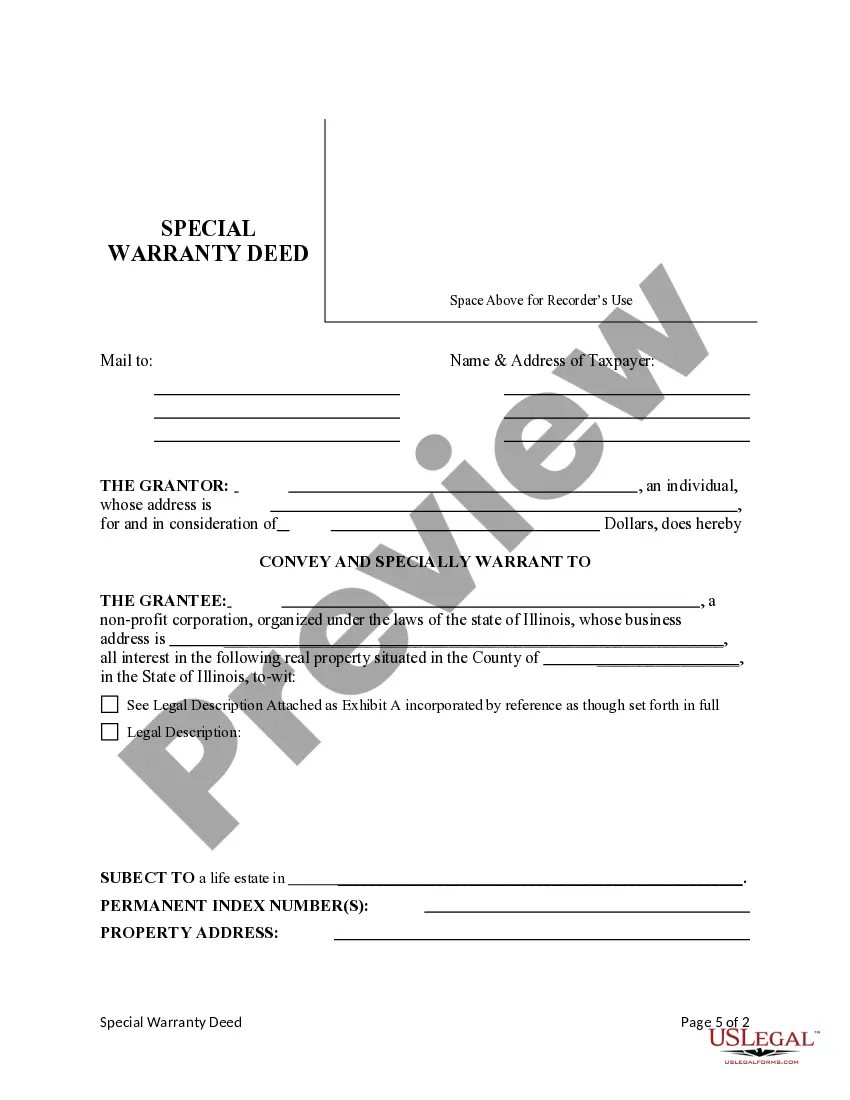

This form is a Special Warranty Deed where the Grantor is an individual and the Grantee is a non-profit corporation. Grantor conveys and specially warrants the described property to the Grantee subject to a reserved life estate. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved LIfe Estate

Description

How to fill out Illinois Special Warranty Deed From An Individual Grantor To Non-Profit Corporation As Grantee With Reserved LIfe Estate?

Searching for Illinois Special Warranty Deed from an Individual Grantor to a Non-Profit Corporation as the Grantee with Reserved Life Estate templates and completing them may prove to be difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate example specifically for your state in just a few clicks.

Our attorneys prepare all documents, so you only need to complete them. It's truly that easy.

Select your plan on the pricing page and set up your account. Choose whether you prefer to pay with a card or through PayPal. Save the file in your desired format. You can now print the Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate form or complete it using any online editor. There's no need to worry about typographical errors, as your template can be used and submitted, and printed as many times as necessary. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the template.

- Your saved templates are stored in My documents and can be accessed at any time for future use.

- If you haven’t registered yet, you should create an account.

- Review our detailed guidelines on how to obtain your Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate form in just minutes.

- To find a suitable example, confirm its eligibility for your state.

- Examine the sample using the Preview feature (if available).

- If there's a description, read it to understand the key details.

- Click on the Buy Now button if you found what you're searching for.

Form popularity

FAQ

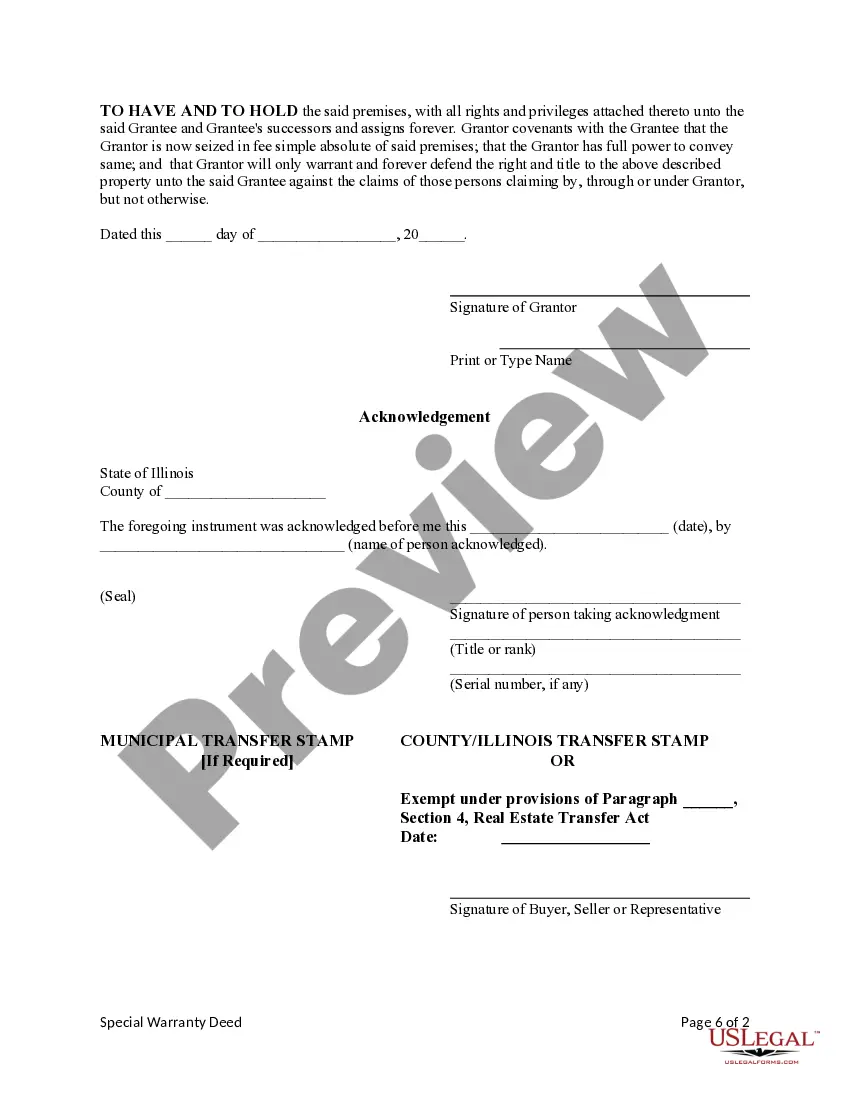

Absolutely, when a corporation transfers ownership of property, the deed must be signed by an authorized representative of the corporation. This ensures the transfer is legally valid and binding. If you are drafting an Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate, make certain that the signatory has the proper authority and all necessary documentation to support the transfer.

Yes, in most cases, the grantor is indeed the same as the owner of the property. When executing an Illinois Special Warranty Deed from an Individual Grantor to a Non-Profit Corporation as Grantee with Reserved Life Estate, the grantor transfers property ownership to the grantee. This distinction is crucial during transactions. If you’re unsure about owner status, our user-friendly tools can guide you to the right legal documentation.

In the context of an Illinois Special Warranty Deed from an Individual Grantor to a Non-Profit Corporation as Grantee with Reserved Life Estate, the grantor is the person transferring the property. The grantee is the non-profit corporation that receives the property. Understanding the roles of grantor and grantee is essential for a seamless transaction. When you use our platform, you can ensure your documents reflect these crucial roles accurately.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.A quitclaim deed requires trust on the part of the person receiving the deed, because the person transferring it, also known as the grantor, isn't guaranteeing they actually own the property.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

Recording - A quit claim deed in Illinois is to be filed with the appropriate County Recorder's Office along with the appropriate fees (if they haven't already been paid). Signing - Before being filed with the County Recorder's Office, a quit claim deed must be signed by the Grantor in the presence of a Notary Public.

One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

Discuss the terms of the deed with the new owners. Hire a real estate attorney to prepare the deed. Review the deed. Sign the deed in front of a notary public, with witnesses present. File the deed on public record.

In Illinois, a special warranty deed transfers title in fee simple to the grantee with warranties and covenants of title that are limited to only the acts of the grantor or that result from the acts of the grantor and is the form of deed customarily used in commercial real estate transactions.