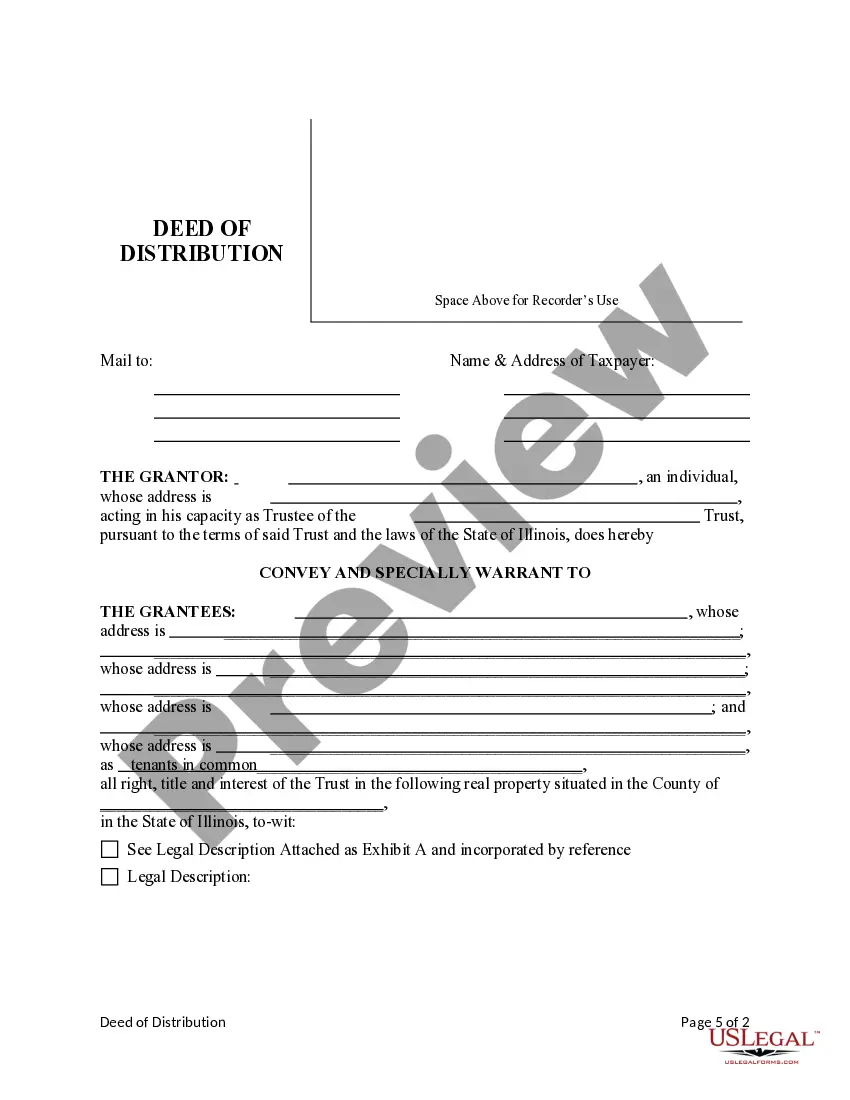

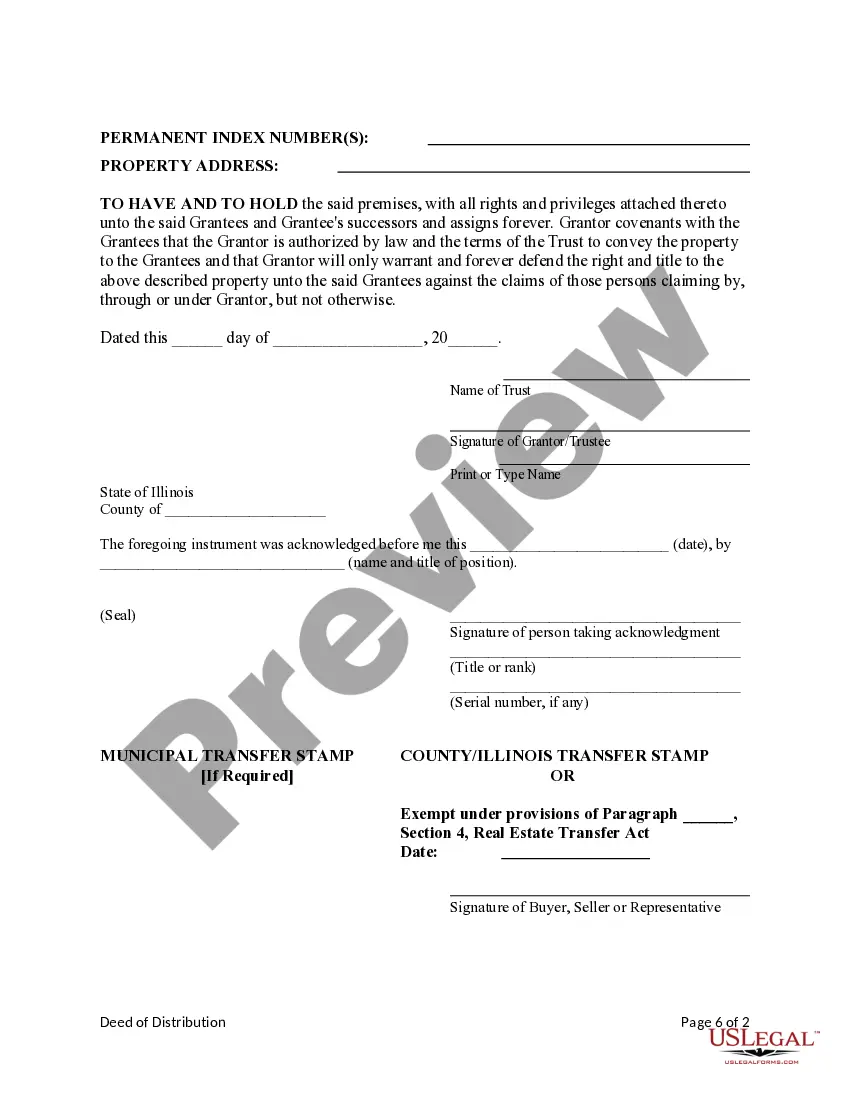

This form is a Deed of Distribution for use by an individual acting as Trustee of a Trust and transferring real property to four individuals. Grantor conveys and specially warrants the described property to the Grantees. This deed complies with all state statutory laws.

Illinois Deed of Distribution from Trust to Four Individuals

Description Trust Property Legal

How to fill out Trust Deed Illinois?

In search of Illinois Deed of Distribution from Trust to Four Individuals templates and completing them could be a problem. In order to save time, costs and energy, use US Legal Forms and find the right sample specially for your state in just a couple of clicks. Our lawyers draw up each and every document, so you simply need to fill them out. It is really so easy.

Log in to your account and return to the form's page and download the document. Your saved examples are saved in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you have to register.

Look at our comprehensive guidelines on how to get your Illinois Deed of Distribution from Trust to Four Individuals sample in a few minutes:

- To get an entitled sample, check out its applicability for your state.

- Check out the form utilizing the Preview function (if it’s offered).

- If there's a description, go through it to learn the specifics.

- Click on Buy Now button if you identified what you're looking for.

- Select your plan on the pricing page and make your account.

- Choose you would like to pay out by way of a credit card or by PayPal.

- Download the file in the favored file format.

You can print the Illinois Deed of Distribution from Trust to Four Individuals form or fill it out using any online editor. Don’t worry about making typos because your template may be utilized and sent, and printed as often as you wish. Try out US Legal Forms and access to around 85,000 state-specific legal and tax documents.

Property Legal Transfer Form popularity

Property Transfer Illinois Other Form Names

Trust Property Document FAQ

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Two documents are needed to transfer California real property from a trust to beneficiaries of the trust; a deed and an 'affidavit of death of trustee. ' An 'affidavit death of trustee' is a declaration, under oath, by the successor trustee.

Distributing assets from an irrevocable trust requires that the assets first be part of the trust's corpus. Tax laws allow trusts to recover the after-tax money locked up in the corpus as tax-free return of principal. Trusts pass this benefit along to their beneficiaries in the form of tax-free distributions.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.