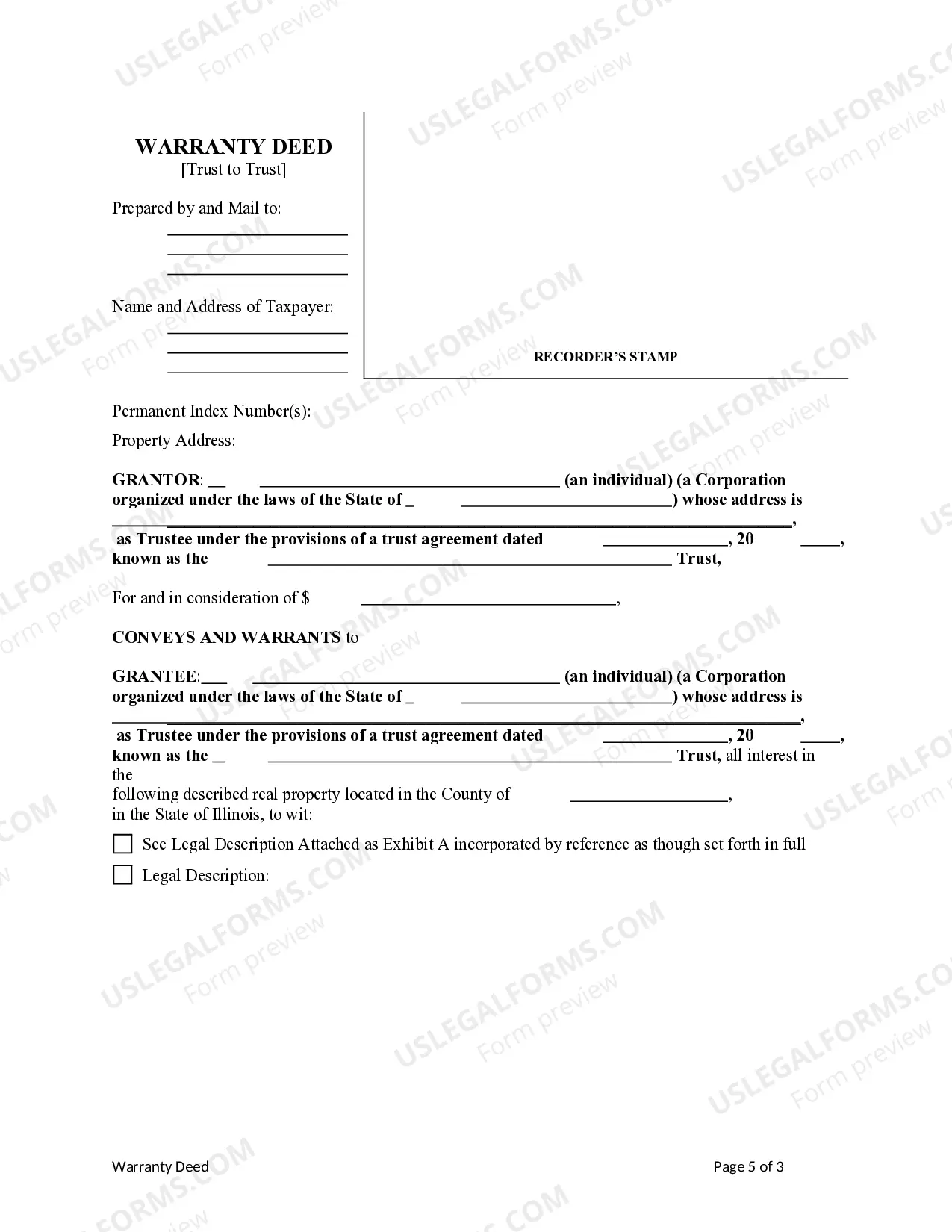

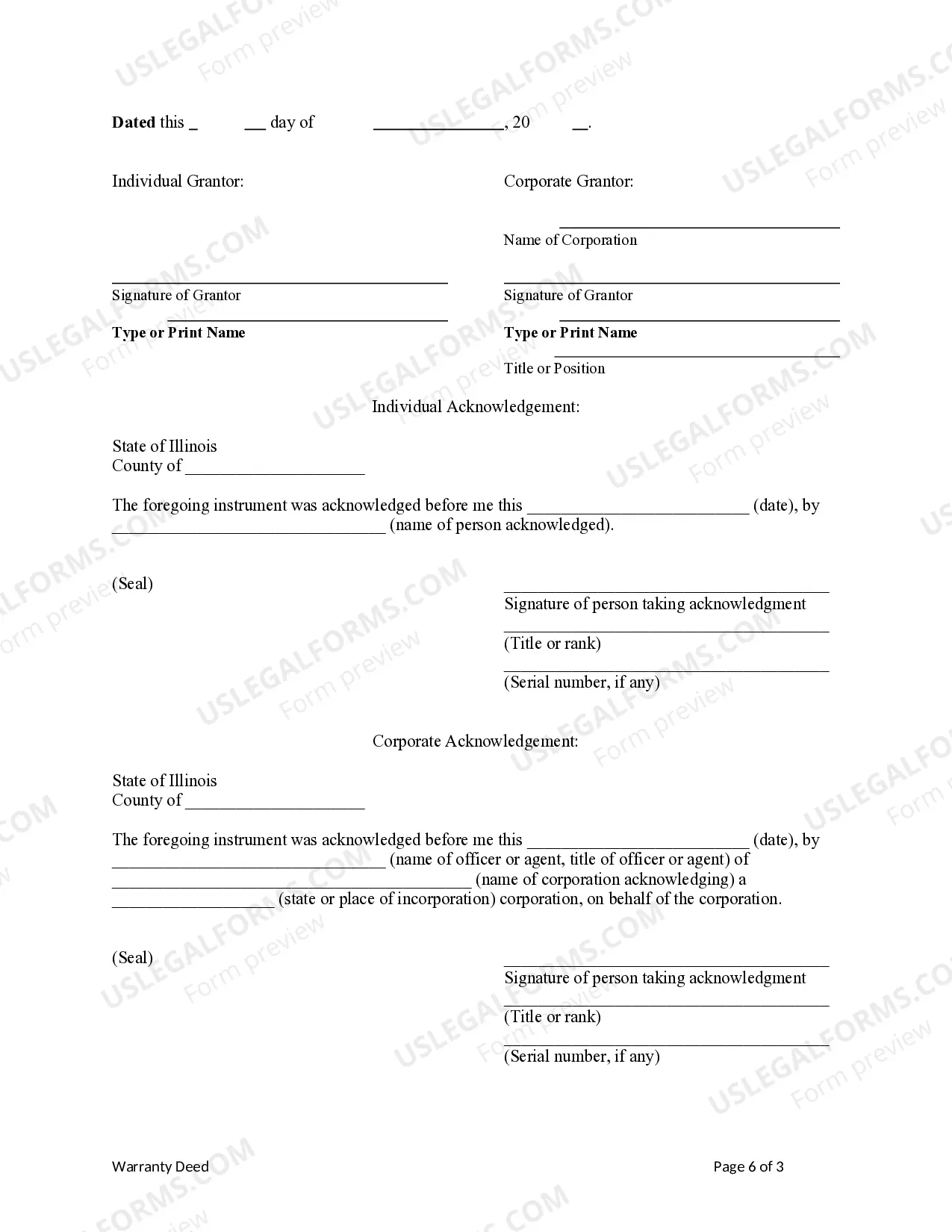

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is also a Trust. Grantor conveys and warrants the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Illinois Warranty Deed from a Trust to a Trust

Description

How to fill out Illinois Warranty Deed From A Trust To A Trust?

Locating Illinois Warranty Deed from a Trust to a Trust templates and completing them may pose a challenge.

To conserve significant time, expenses, and effort, utilize US Legal Forms to find the appropriate template specifically for your state with just a few clicks.

Our legal experts prepare all documents, so you merely need to complete them. It really is that straightforward.

You can print the Illinois Warranty Deed from a Trust to a Trust template or complete it using any online editor. Don’t worry about typographical errors, as your template can be utilized and submitted multiple times. Try out US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the template.

- Your downloaded documents are stored in My documents and are accessible at any time for future use.

- If you haven't registered yet, you must sign up.

- Review our comprehensive instructions for obtaining your Illinois Warranty Deed from a Trust to a Trust template in just a few minutes.

- To find a suitable sample, verify its relevance for your state.

- Examine the form using the Preview feature (if available).

- If there’s a description, read it to grasp the details.

- Click on the Buy Now button if you found what you're looking for.

- Select your plan on the pricing page and create your account.

- Choose to pay with a card or PayPal.

- Download the form in your preferred file format.

Form popularity

FAQ

A property is likely to be conveyed with a trustee's deed when the property is being sold by a trustee to satisfy debts or obligations of the trust. This typically occurs during foreclosure situations or when the trust's purpose has been fulfilled. Using an Illinois Warranty Deed from a Trust to a Trust can help clarify ownership and rights during such transactions.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

A trustee deed offers no such warranties about the title.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Warranty Deed Vs Deed of Trust. Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another.As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.