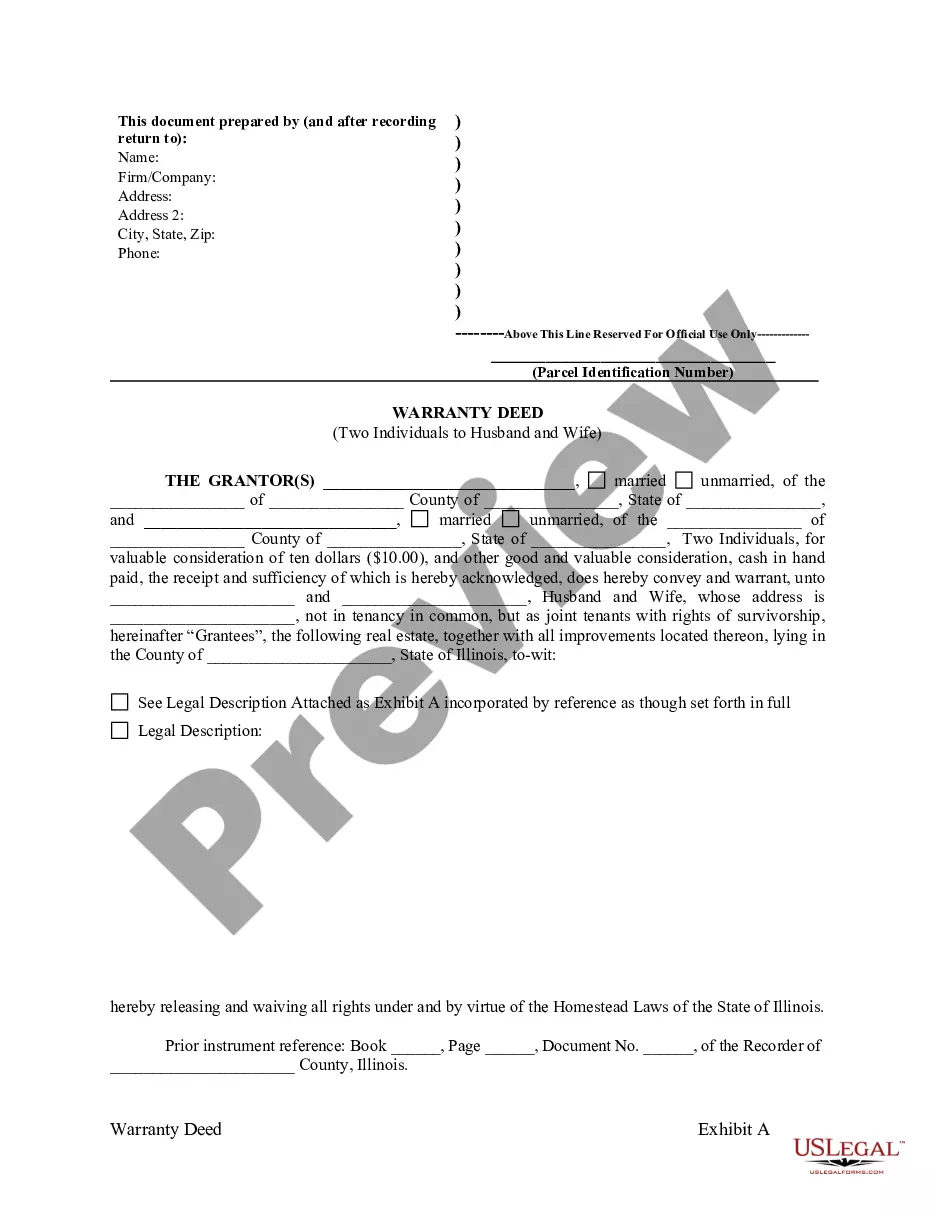

Illinois Warranty Deed from two Individuals to Husband and Wife

Description Two Husband Wife

How to fill out Illinois Warranty Deed From Two Individuals To Husband And Wife?

Looking for Illinois Warranty Deed from two Individuals to Husband and Wife templates and filling out them might be a problem. To save time, costs and energy, use US Legal Forms and choose the right template specifically for your state within a couple of clicks. Our legal professionals draft every document, so you simply need to fill them out. It truly is that simple.

Log in to your account and return to the form's web page and save the sample. Your downloaded templates are kept in My Forms and therefore are available at all times for further use later. If you haven’t subscribed yet, you should register.

Have a look at our comprehensive guidelines on how to get your Illinois Warranty Deed from two Individuals to Husband and Wife form in a couple of minutes:

- To get an qualified sample, check its applicability for your state.

- Have a look at the sample utilizing the Preview function (if it’s available).

- If there's a description, go through it to know the important points.

- Click on Buy Now button if you found what you're trying to find.

- Choose your plan on the pricing page and create an account.

- Choose you wish to pay by way of a card or by PayPal.

- Save the file in the preferred format.

Now you can print out the Illinois Warranty Deed from two Individuals to Husband and Wife form or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your form can be employed and sent away, and published as often as you want. Try out US Legal Forms and get access to more than 85,000 state-specific legal and tax files.

Deed Two Wife Form popularity

Warranty Deed Individuals Other Form Names

Il Warranty Deed Form FAQ

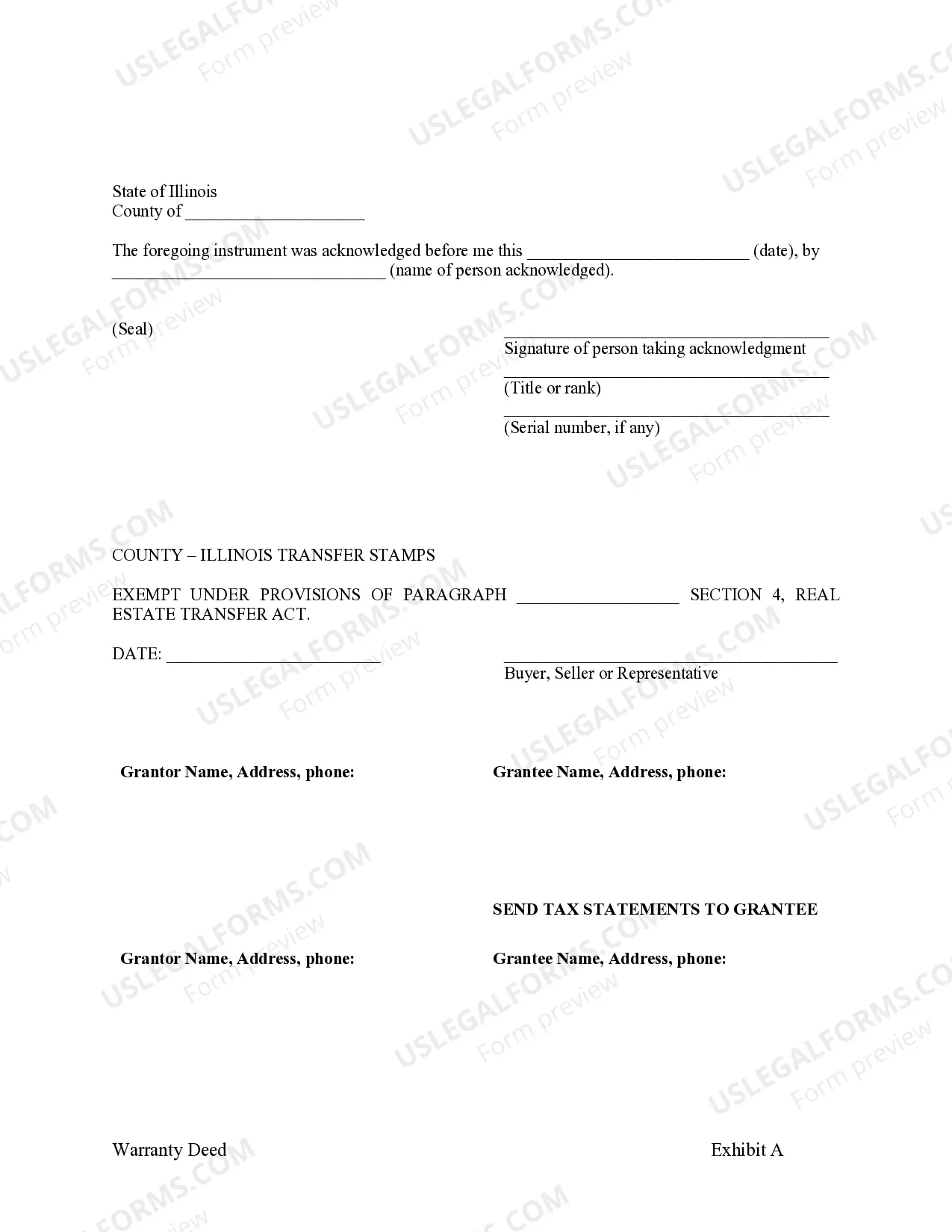

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.

The simplest way to add a spouse to a deed is through a quitclaim deed. This type of deed transfers whatever ownership rights you have so that you and your spouse now become joint owners. No title search or complex transaction is necessary. The deed will list you as the grantor and you and your spouse as grantees.

One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

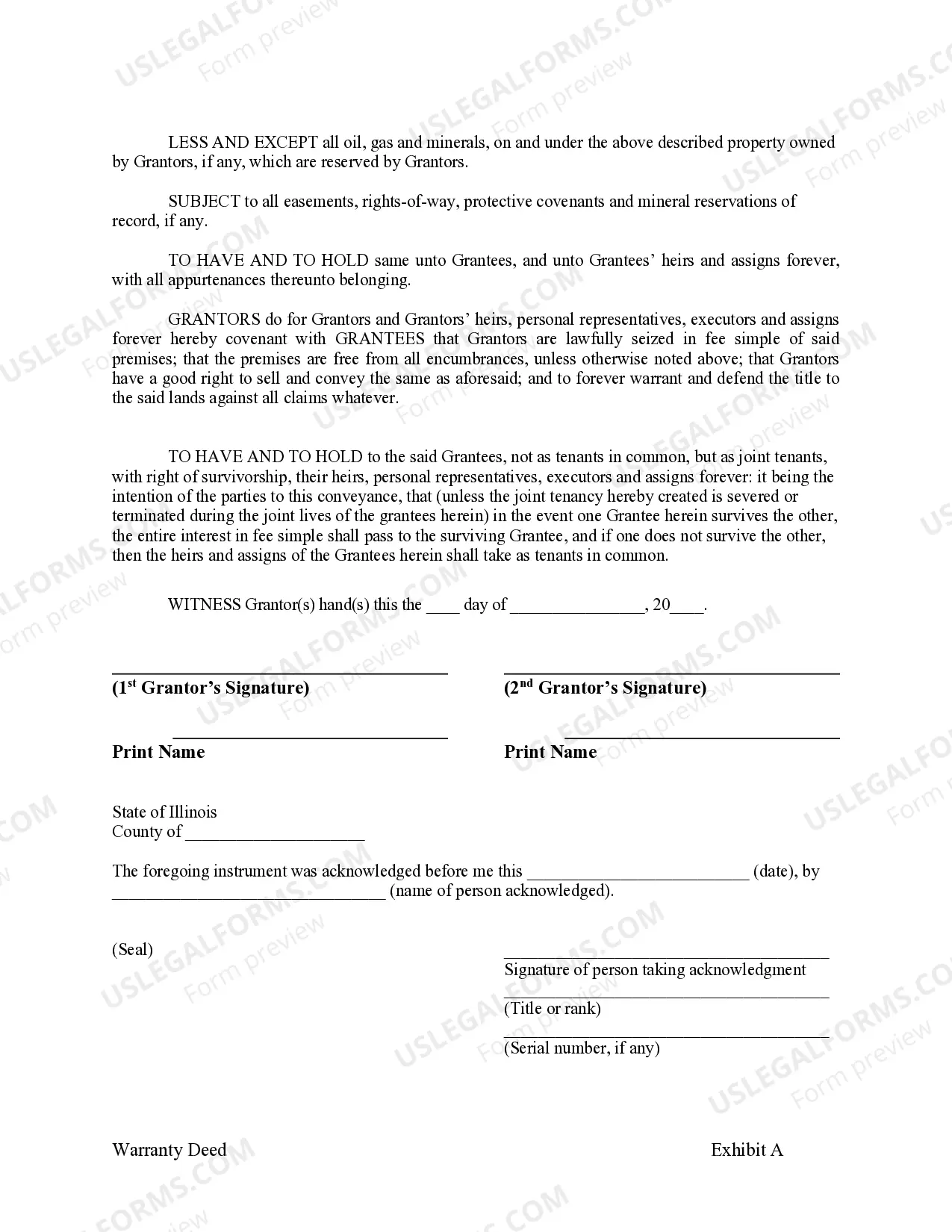

What Is the Difference Between a Warranty Deed & a Survivorship Deed?A warranty deed is the most comprehensive and provides the most guarantees. Survivorship isn't so much a deed as a title. It's a way to co-own property where, upon the death of one owner, ownership automatically passes to the survivor.

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

Each party has a full ownership interest in the property. The property will pass instantly to the survivor upon the death of the other without probate. Conveyance by one party without the other breaks the joint tenancy. Seller warrants that he/she has good title and will warrant and defend title.

The dangers of joint tenancy include the following: Danger #1: Only delays probate. When either joint tenant dies, the survivor usually a spouse or child immediately becomes the owner of the entire property. But when the survivor dies, the property still must go through probate.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.