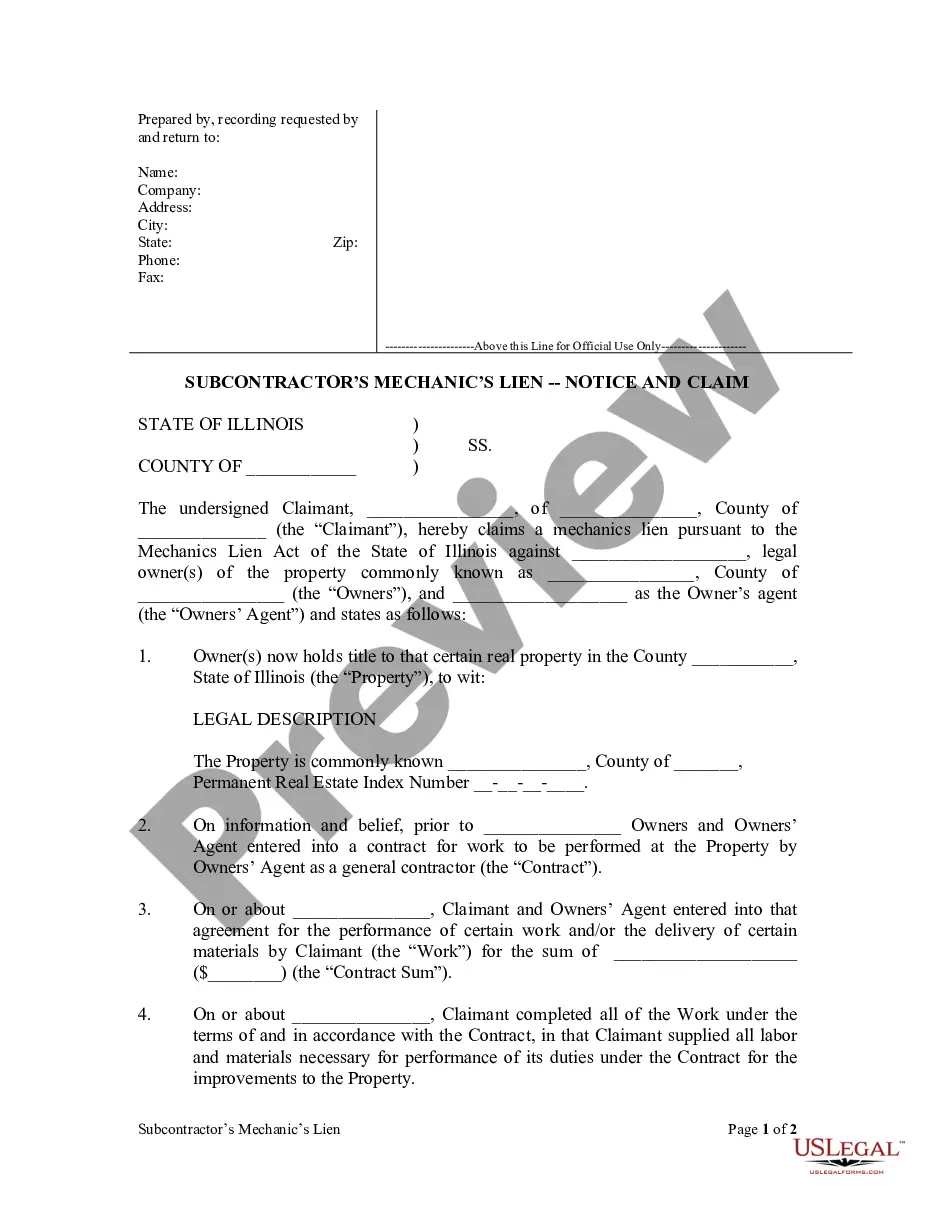

Illinois Subcontractor's Lien - Notice of Claim - Mechanic Liens - Individual

Description Lien Individual Form Buy

How to fill out Lien Notice Template?

In search of Illinois Subcontractor's Lien - Notice of Claim - Mechanic Liens - Individual forms and filling out them could be a problem. In order to save time, costs and energy, use US Legal Forms and find the right example specially for your state in just a few clicks. Our lawyers draft each and every document, so you just need to fill them out. It truly is so easy.

Log in to your account and return to the form's page and save the document. Your downloaded examples are stored in My Forms and therefore are available always for further use later. If you haven’t subscribed yet, you have to register.

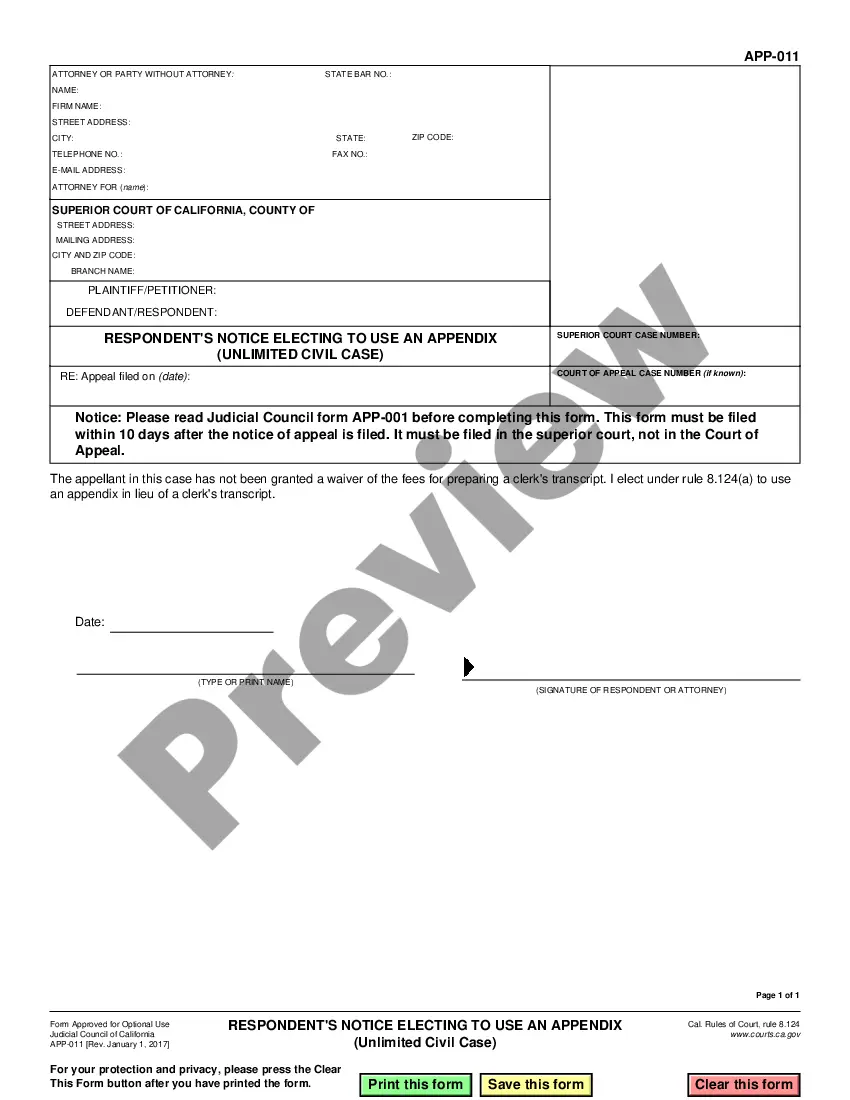

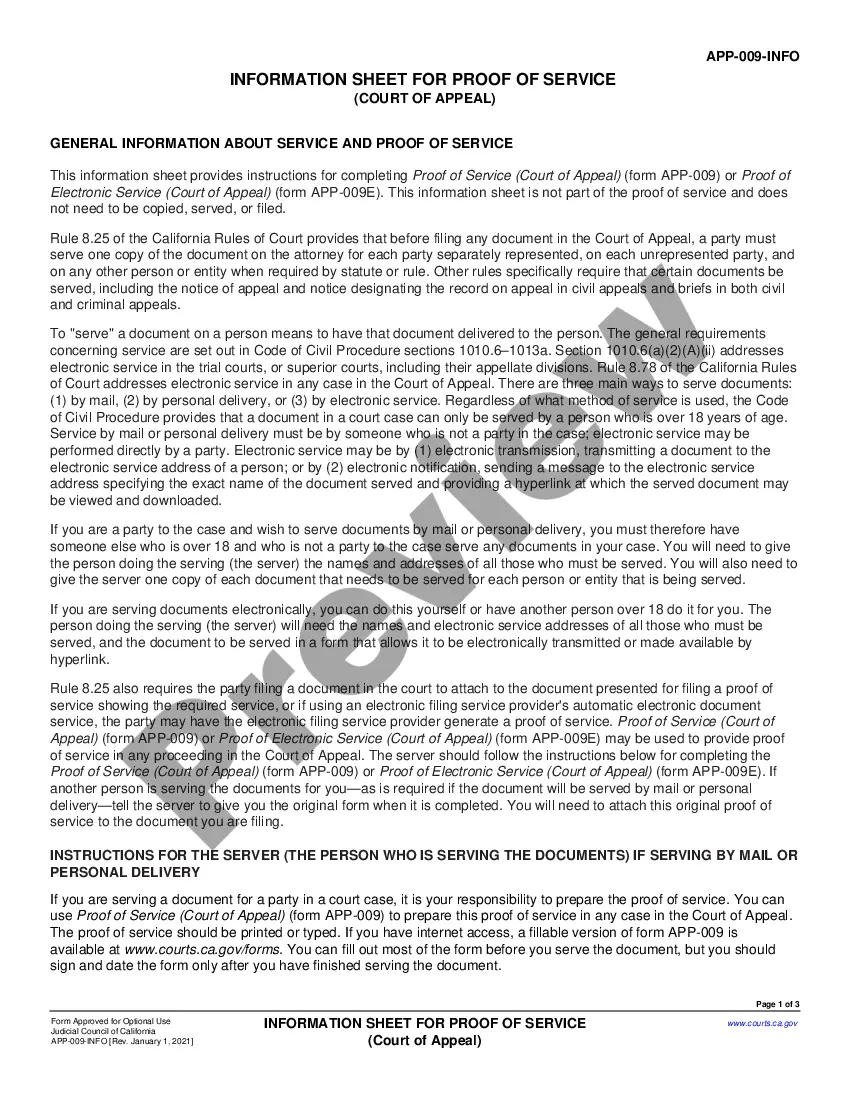

Check out our comprehensive guidelines on how to get the Illinois Subcontractor's Lien - Notice of Claim - Mechanic Liens - Individual template in a few minutes:

- To get an qualified sample, check out its applicability for your state.

- Have a look at the sample utilizing the Preview function (if it’s offered).

- If there's a description, read through it to learn the details.

- Click on Buy Now button if you found what you're trying to find.

- Select your plan on the pricing page and create an account.

- Select you want to pay out by a credit card or by PayPal.

- Download the form in the preferred format.

Now you can print the Illinois Subcontractor's Lien - Notice of Claim - Mechanic Liens - Individual form or fill it out using any online editor. Don’t concern yourself with making typos because your sample can be applied and sent, and printed out as many times as you want. Check out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Lien Individual Form Contract Form popularity

Lien Individual Form Statement Other Form Names

Lien Individual Form FAQ

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

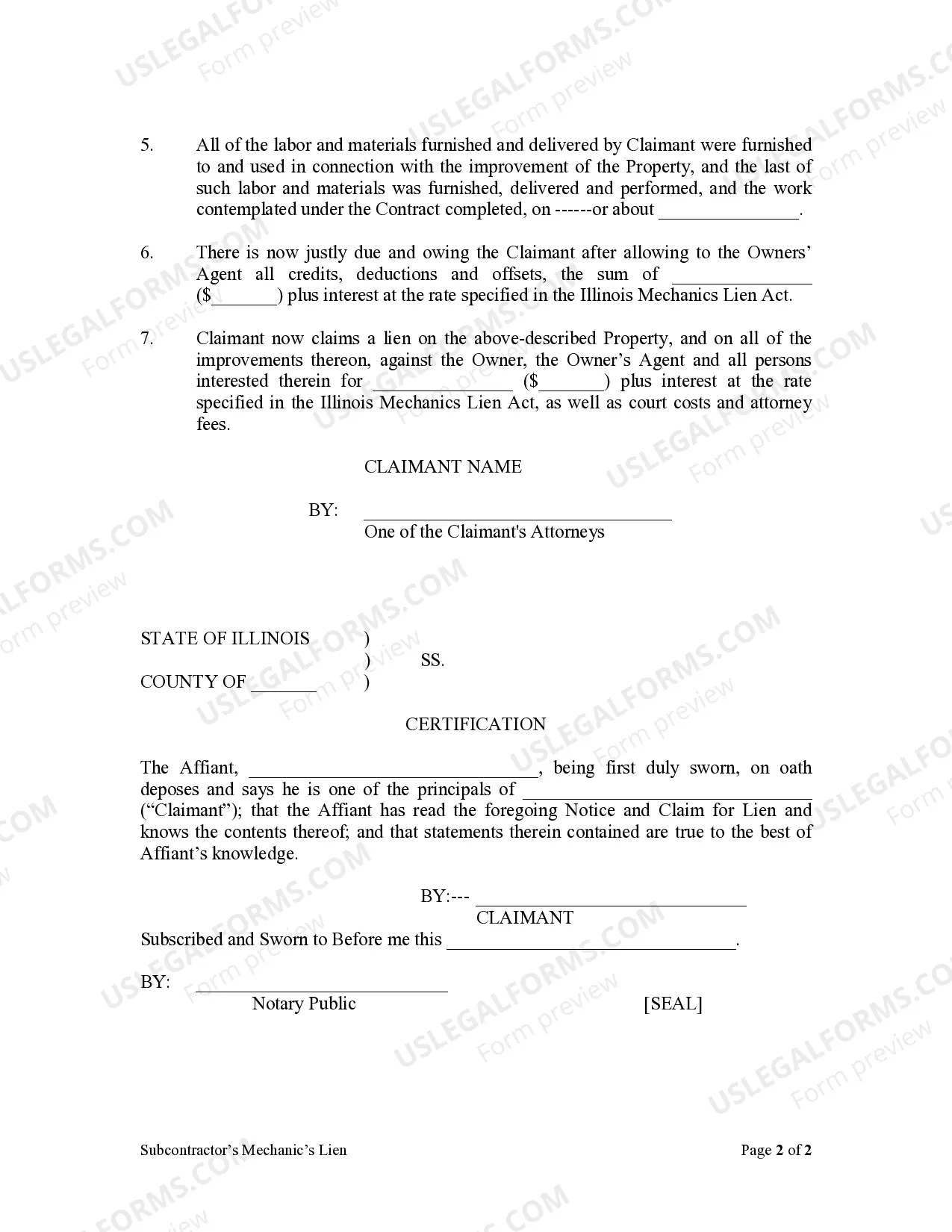

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

The deadline for contractors and subcontractors to file their statement of mechanic's lien is four months (not 120 days) from the last date of work (exclusive of warranty work or other work performed free of charge), or from the last date that materials were supplied to the project.

WHAT MUST I DO BEFORE I FILE MY LIEN? Usually there is at least one notice that you must mail before you can file your lien. These notices are sometimes called notices of intent to file lien. Illinois Document Preparation fee of $165 includes all required notices of intent.

If you're claiming a lien on real property, it must be filed in the recorder's office of the county where the property is located. Expect to pay a filing fee between $25 and $50 depending on the location where you file.

Mechanic's liens create a cloud on title, meaning that they appear in public property records. Liens are sometimes said to travel with the land, meaning that anyone who buys your house would take the property subject to the contractor's lien (or, more likely, demand that you pay it off first).

Even though these states may permit project participants to secure lien rights and claim a mechanics lien even without a written contract, it is generally best practice to have a signed written contract for work provided.

In order to enforce a lien, the contractor, subcontractor or supplier must file a lawsuit. The deadline to file a lawsuit is two years from the last date work was performed or materials were supplied. A recorded lien is valid for these two years, but a failure to sue within that time frame voids the lien.

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.