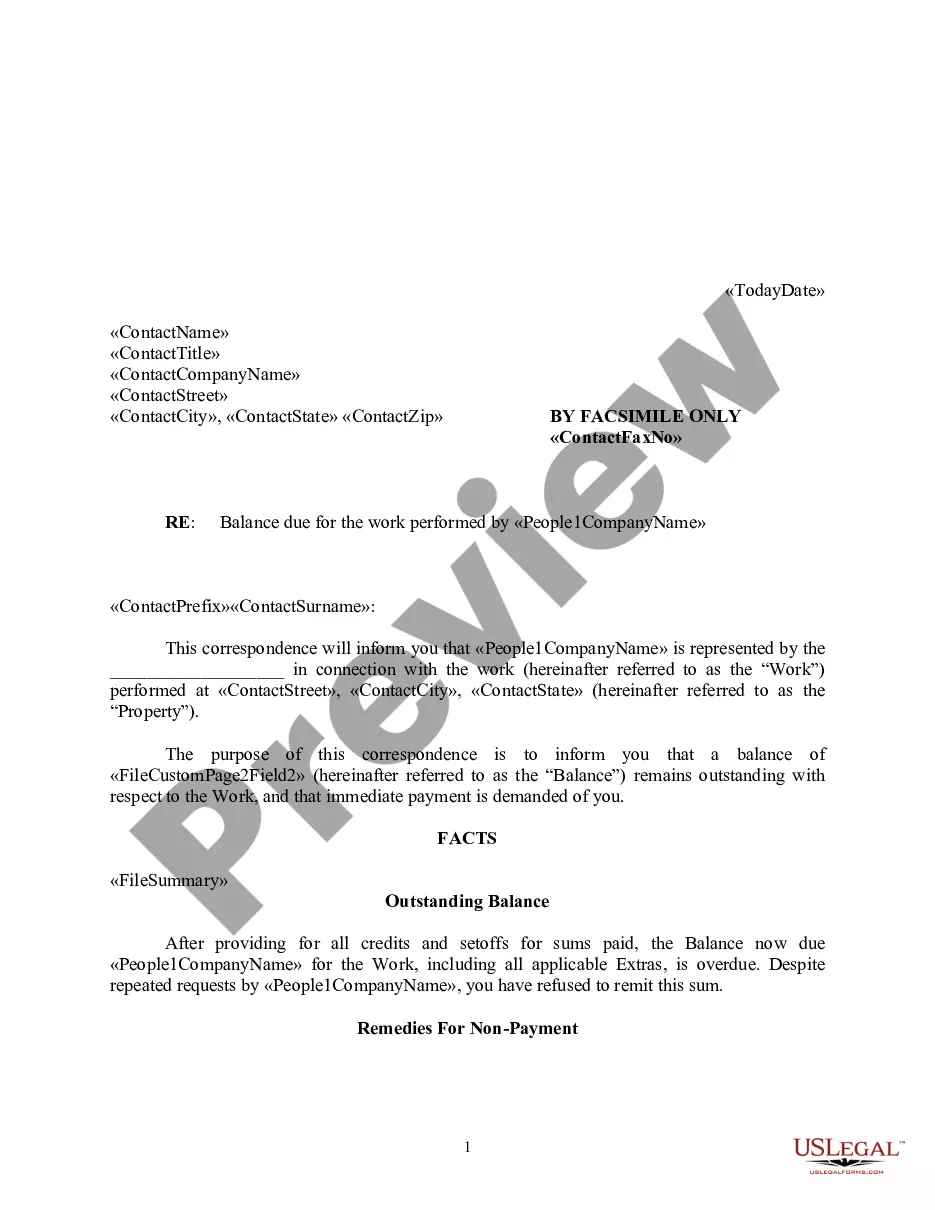

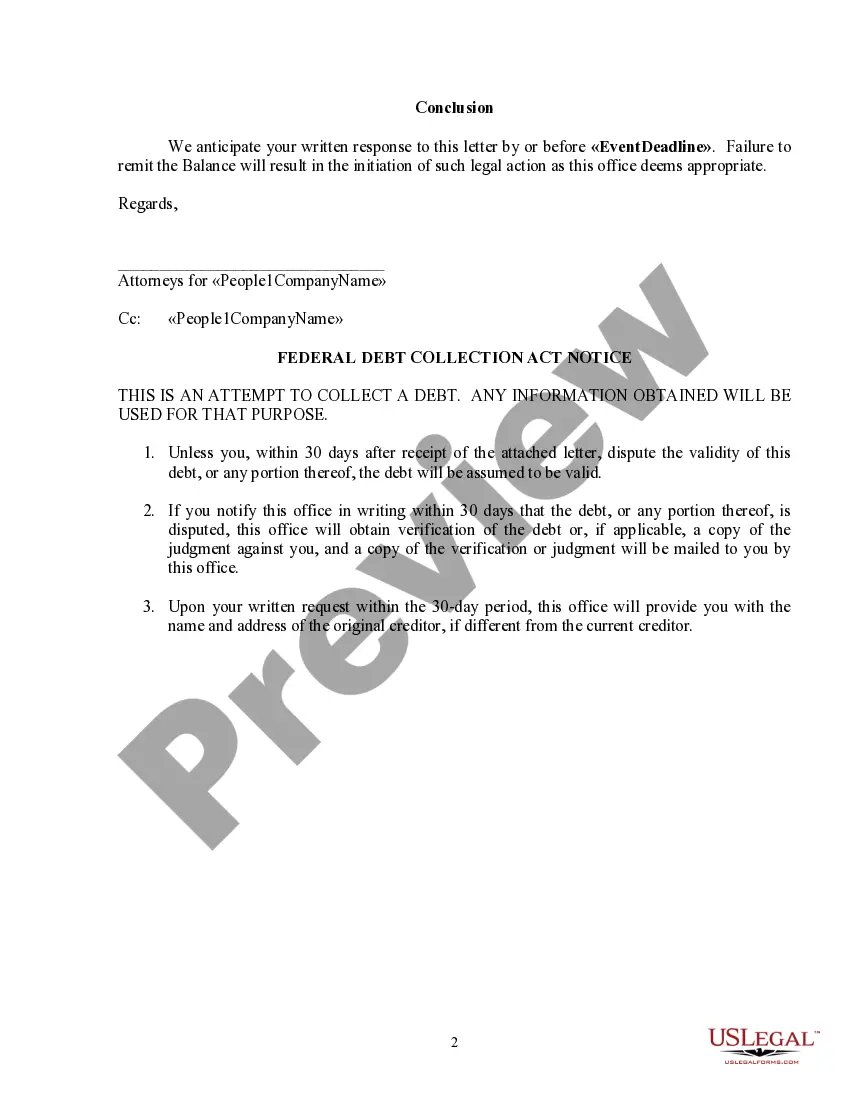

Illinois Collection Letter - Consumer Debtor

Description Il Collection Letter

How to fill out Illinois Collection Template?

Looking for Illinois Collection Letter - Consumer Debtor sample and completing them could be a problem. To save time, costs and effort, use US Legal Forms and find the appropriate sample specifically for your state within a few clicks. Our legal professionals draft each and every document, so you simply need to fill them out. It is really that simple.

Log in to your account and come back to the form's web page and save the document. All of your downloaded examples are kept in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you should sign up.

Check out our comprehensive guidelines concerning how to get your Illinois Collection Letter - Consumer Debtor sample in a couple of minutes:

- To get an qualified sample, check its validity for your state.

- Have a look at the sample making use of the Preview function (if it’s available).

- If there's a description, read it to know the important points.

- Click Buy Now if you identified what you're searching for.

- Choose your plan on the pricing page and create your account.

- Select you want to pay by a card or by PayPal.

- Save the file in the favored format.

Now you can print out the Illinois Collection Letter - Consumer Debtor template or fill it out using any online editor. No need to worry about making typos because your sample may be applied and sent, and published as many times as you want. Try out US Legal Forms and get access to more than 85,000 state-specific legal and tax documents.

Illinois Collection Document Form popularity

Il Collection Debtor Other Form Names

Illinois Consumer Uslegal FAQ

In Illinois, the Statute of Limitations on debt ranges from 5 years to 10 years. Some debt collection agencies buy old debts, out the Statute of Limitation period for pennies on the dollar from the original creditor in order to collect what they can.

Even though debts still exist after seven years, having them fall off your credit report can be beneficial to your credit score.Note that only negative information disappears from your credit report after seven years. Open positive accounts will stay on your credit report indefinitely.

In Illinois, the Statute of Limitations on debt ranges from 5 years to 10 years. Some debt collection agencies buy old debts, out the Statute of Limitation period for pennies on the dollar from the original creditor in order to collect what they can.

The statute of limitations in Illinois is five years for open accounts for debt collections and oral contracts and ten years for written contracts. The good news is that the debts are time-barred and you can't be sued for them.

There is no statute of limitations on how long a creditor can attempt to collect an unpaid debt, but there is a deadline for when they can still use litigation to receive a court judgment against the debtor.

How Long Can a Debt Collector Pursue an Old Debt? Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

Although there's no debtor's prison, it's possible to wind up in jail in a collection case. But, not because you owe money, or can't pay it. Jail can only happen if you're able to pay, and refuse to, or if you miss a court-ordered court date.

We contract with collection agencies to help us collect the amount of tax, penalty, and interest that you owe.

There is no statute of limitations on how long a creditor can attempt to collect an unpaid debt, but there is a deadline for when they can still use litigation to receive a court judgment against the debtor.Creditors can request methods of enforcing the court order, such as wage garnishment.