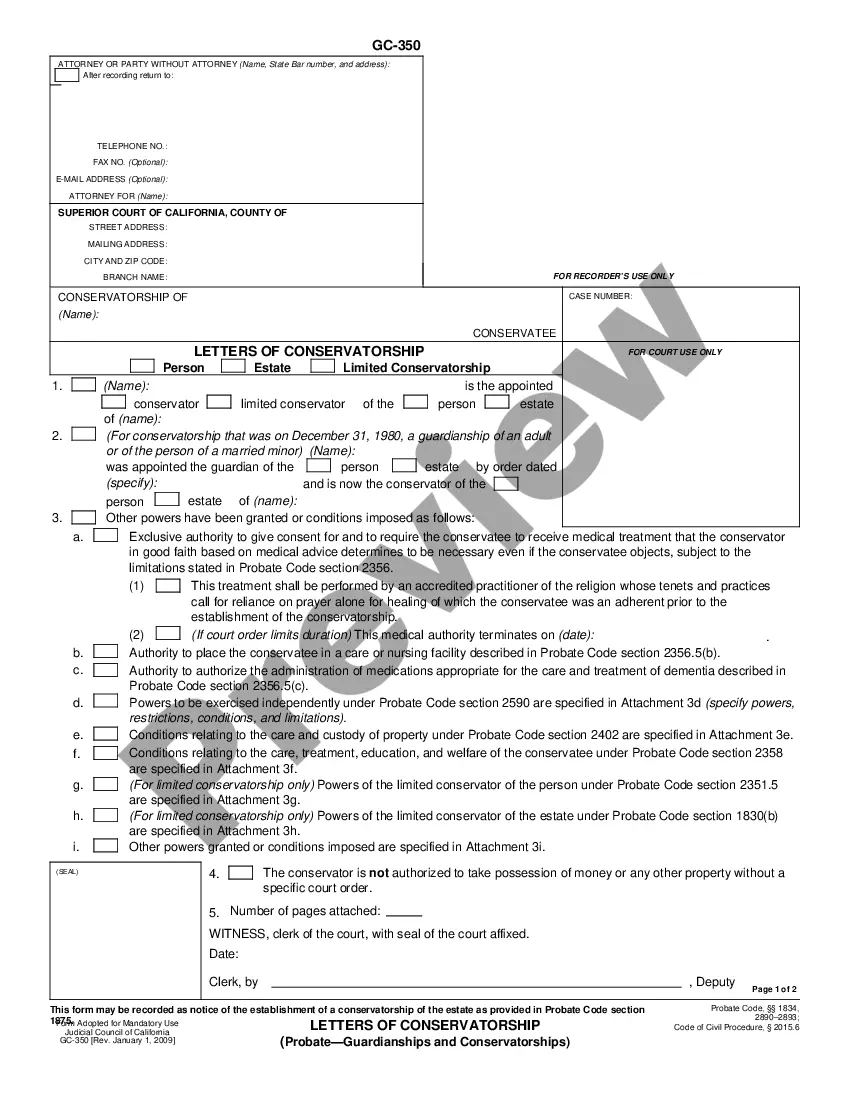

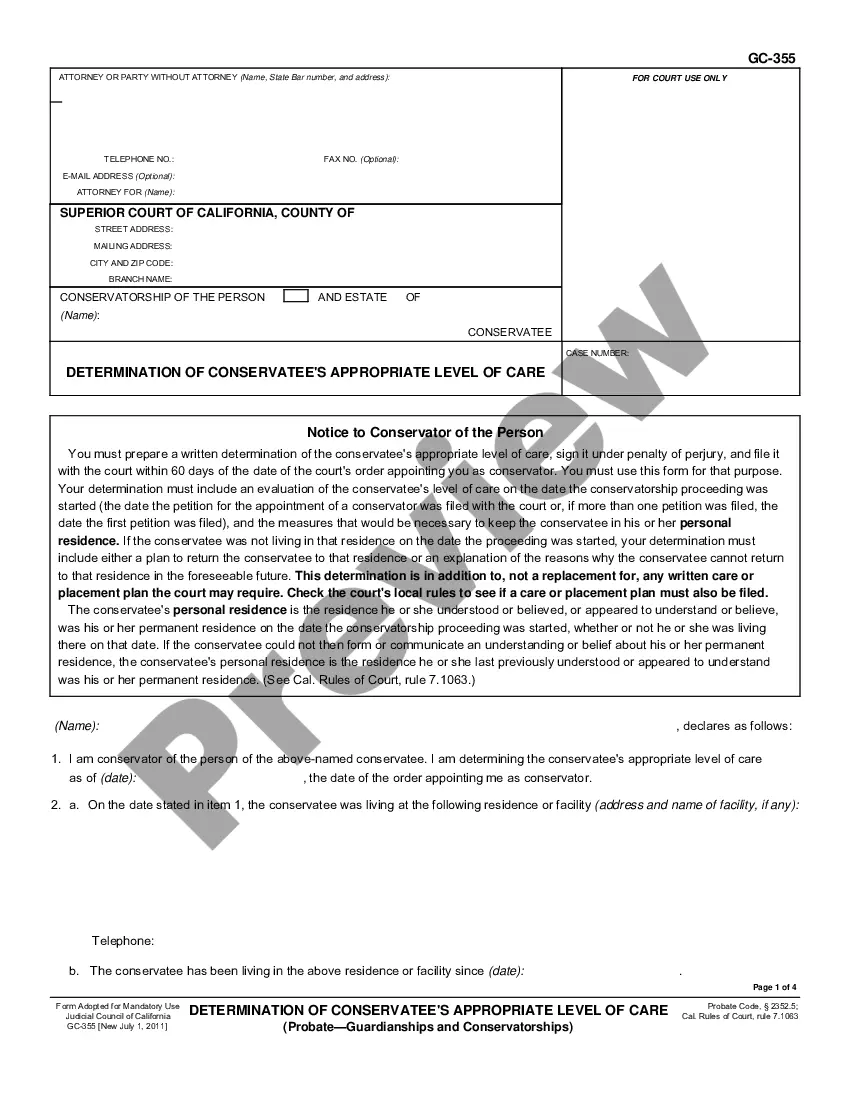

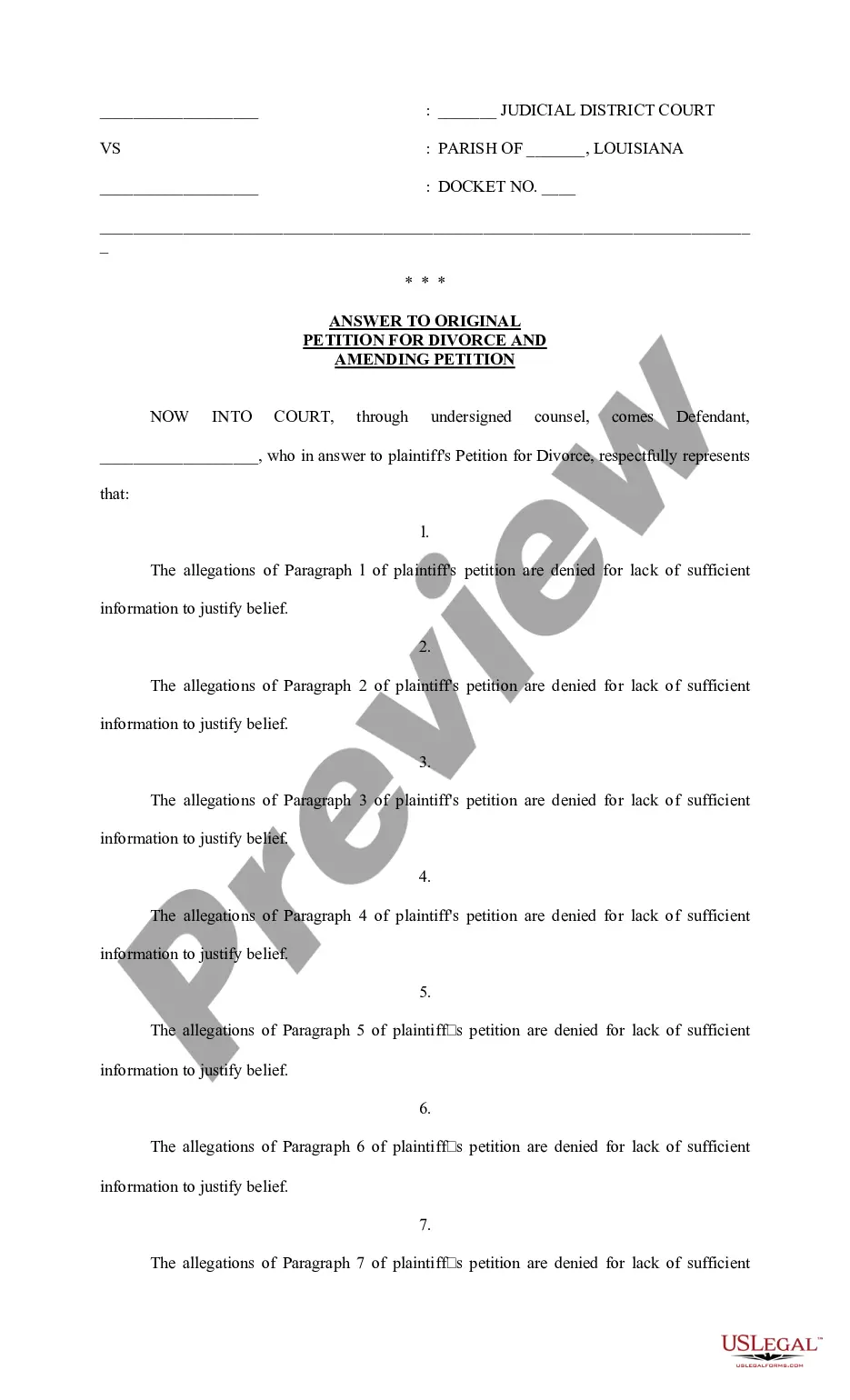

The Illinois Bond Of Legal Representative No Surety is a type of surety bond that is required by the state of Illinois. It is required for individuals who are acting as a legal representative on behalf of another person or entity. The bond is issued by a surety, usually an insurance company, to guarantee that the legal representative will comply with all applicable laws, regulations, and court orders. The bond also serves as a form of protection for the person or entity for whom the legal representative is acting. There are two types of Illinois Bond Of Legal Representative No Surety: the Special Administrator Bond and the Executor Bond. The Special Administrator Bond is a bond that is required for an individual who is appointed as a Special Administrator or Guardian of the Estate. The Executor Bond is a bond that is required for an individual who is appointed as an Executor or Administrator of an Estate. Both bonds provide a guarantee that the legal representative will perform their duties in accordance with the law and that any funds entrusted to them will be managed responsibly.

Illinois Bond Of Legal Representative No Surety

Description

How to fill out Illinois Bond Of Legal Representative No Surety?

How much time and resources do you usually spend on drafting formal documentation? There’s a better option to get such forms than hiring legal experts or spending hours browsing the web for a suitable blank. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Illinois Bond Of Legal Representative No Surety.

To obtain and complete a suitable Illinois Bond Of Legal Representative No Surety blank, follow these simple steps:

- Examine the form content to ensure it meets your state laws. To do so, read the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your needs, find another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Illinois Bond Of Legal Representative No Surety. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely safe for that.

- Download your Illinois Bond Of Legal Representative No Surety on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents that you safely keep in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trusted web solutions. Sign up for us now!

Form popularity

FAQ

A personal representative bond, also known as an estate bond, protects the estate and the estate's beneficiaries from financial loss due to malfeasance, fraud, or any other breach of fiduciary responsibilities by the personal representative.

Illinois law requires Notaries to purchase and maintain a surety bond for the duration of their 4-year commission.

Surety Bond Requirements in IL You must have a proper surety bond in place if you are an appraisal management company (AMC), motor vehicle dealer, plumbing contractor, roofing contractor, or residential mortgage broker. Most Illinois surety bonds have a fixed liability amount, while some vary.

A personal representative bond guarantees the performance of specific duties. The personal representative must identify all heirs and creditors, identify and collect the deceased's assets and appraise them, pay all debts and taxes, then distribute the remaining assets to the heirs.

A probate bond is required in most probate estates in Illinois, except for those where the will specifies that no bond is required. The yearly cost of a bond tends to be about 0.5% of the estate's assets, though there are many factors that can increase or decrease the amount charged by a bonding company.

A probate bond is a type of court bond issued on the performance of an executor of the estate of a recently deceased person. It essentially acts as a guarantee that the executor of an estate will act ing to state laws and the terms of the trust or will of the deceased.

A personal representative surety bond is a type of probate bond that protects the estate and the estate's beneficiaries from financial loss in the event the personal representative commits fraud, irresponsibility, or wrongdoing. The bond ensures the personal representative will fulfill their duties.

The DC personal representative bond penalty (surety bond amount) is set by the Court genarally in an amount not exceeding the probable maximum value of the personal and D.C. real property of the estate at any time during administration.