An Illinois Affidavit for Non Wage Garnishment is a form provided by the Illinois Department of Employment Security (IDES) to employers in order to prevent wage garnishment for certain types of debt. This form is used to certify that the employee does not have any wages or other assets that can be subject to garnishment. It is important to note that the form must be completed in full for a garnishment to be prevented. There are two types of Illinois Affidavit for Non Wage Garnishment. The first is the Affidavit of Exemption for Debts Owed to Illinois Agencies, which must be filed with the IDES in order to prevent garnishment of wages or other assets by any Illinois state agency. The second is the Affidavit of Exemption for Debts Owed to Private Creditors, which must be filed with the IDES to prevent garnishment of wages or other assets by any private creditor.

Illinois affidavit For Non Wage Garnishment

Description

How to fill out Illinois Affidavit For Non Wage Garnishment?

Handling legal documents necessitates focus, precision, and utilizing well-prepared templates. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Illinois affidavit for Non Wage Garnishment template from our collection, you can be confident it adheres to federal and state regulations.

Interacting with our service is simple and quick. To acquire the necessary paperwork, all you need is an account with an active subscription. Here’s a concise guide to obtain your Illinois affidavit for Non Wage Garnishment in just minutes.

All documents are designed for multiple uses, like the Illinois affidavit for Non Wage Garnishment that you see on this page. If you need them again, you can fill them out without additional payment - simply go to the My documents tab in your profile and complete your document whenever required. Try US Legal Forms and get your business and personal paperwork done swiftly and in full legal compliance!

- Be sure to carefully review the form content and its alignment with general and legal standards by previewing it or examining its description.

- Look for an alternative official template if the one you initially opened does not suit your circumstances or state laws (the tab for that is located on the top corner of the page).

- Log in to your account and download the Illinois affidavit for Non Wage Garnishment in your desired format. If this is your first experience with our service, click Buy now to continue.

- Create an account, select your subscription plan, and complete payment via credit card or PayPal.

- Choose the format in which you want to receive your document and click Download. Print the template or upload it to a professional PDF editor for submission without paper.

Form popularity

FAQ

STEP 1: Fill out the Certification in Objection to. STEP 2: Fill out the Wage Garnishment. STEP 3: Fill out the Certification of Service. The Certification of Service tells the court how you.STEP 4: Where to file.STEP 5: Check your completed forms.STEP 6: Mail or deliver your package of. STEP 7: You will get a court date.

Non-wage garnishment is the judgment creditor's attachment, after judgment, of the judgment debtor's property, other than wages, which is in the possession, custody or control of third parties. Example: A creditor files a non-wage garnishment to attach funds your client has deposited in the local bank.

If you are objecting to the wage attachment, you need to complete a Defendant/Debtor's Objection to Wage Attachment form and file it with the clerk of court. File the objection on or before the objection date listed on the creditor's Notice and Motion to Attach Wages.

The written objection should include: the case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. a detailed explanation of your reasons for challenging the garnishment. a request for a hearing if the court has not already set a hearing date.

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.

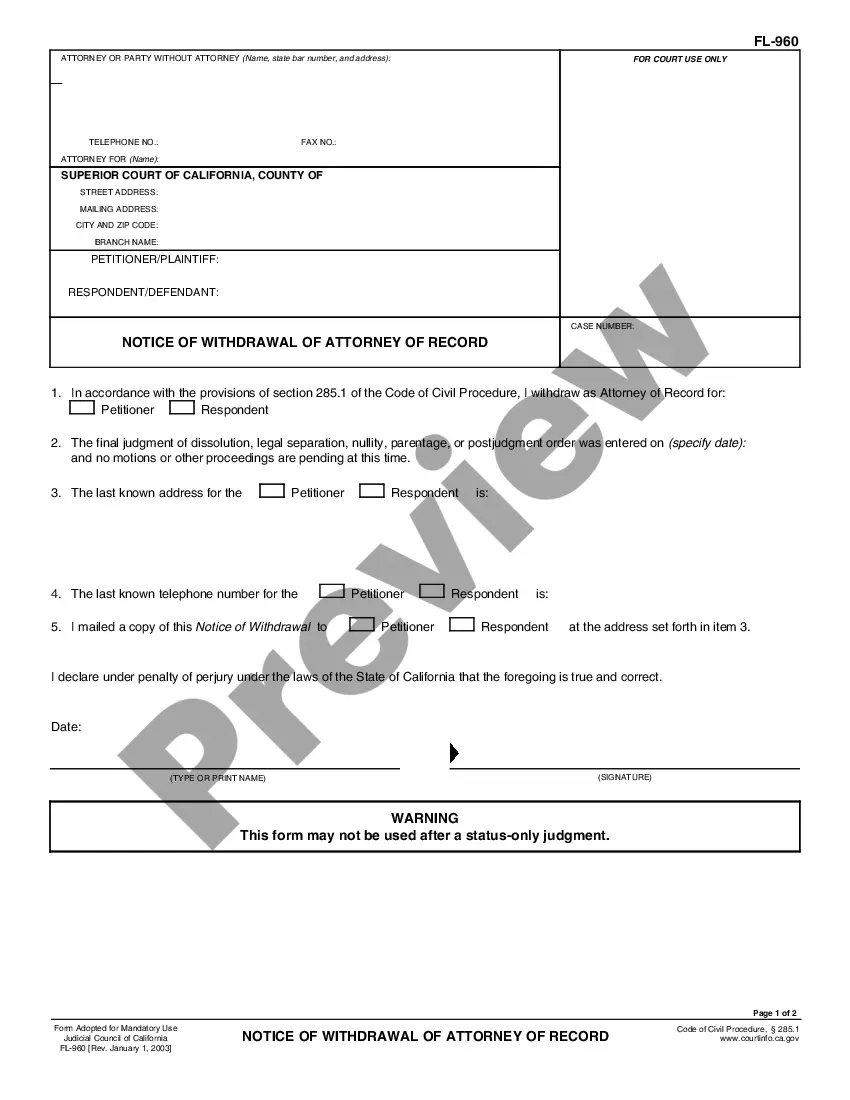

The document is called a Wage Deduction Affidavit. The creditor states their belief that the debtor's employer owes the creditor wages. In that affidavit, the creditor must certify that, before filing the affidavit, he mailed a wage deduction notice, explained below, to the debtor at the debtor's last known address.

For the most part, there are only two ways to stop wage garnishments in Illinois. First, you can pay off the judgment. You may be able to pay the judgment in a lump sum, or you may have to wait for the garnishment to run its course. The second way to stop a garnishment is by filing bankruptcy.

Many creditors are reluctant to settle debts once they have a garnishment. However, an attorney can help you negotiate the best settlement by offering a lump sum amount or payment terms. A third way to stop a wage garnishment includes becoming current with your debt obligations.