Illinois Assumed Business Name Application Filing Instructions for Lake County

Description Illinois Assumed Business Name

How to fill out Illinois Assumed Business Name Application Filing Instructions For Lake County?

In search of Illinois Assumed Business Name Application Filing Instructions for Lake County forms and filling out them can be quite a problem. To save time, costs and energy, use US Legal Forms and find the appropriate example specifically for your state within a couple of clicks. Our legal professionals draft every document, so you just have to fill them out. It is really so easy.

Log in to your account and come back to the form's web page and download the document. All your downloaded templates are stored in My Forms and they are available always for further use later. If you haven’t subscribed yet, you have to sign up.

Check out our detailed recommendations concerning how to get your Illinois Assumed Business Name Application Filing Instructions for Lake County template in a few minutes:

- To get an qualified sample, check out its applicability for your state.

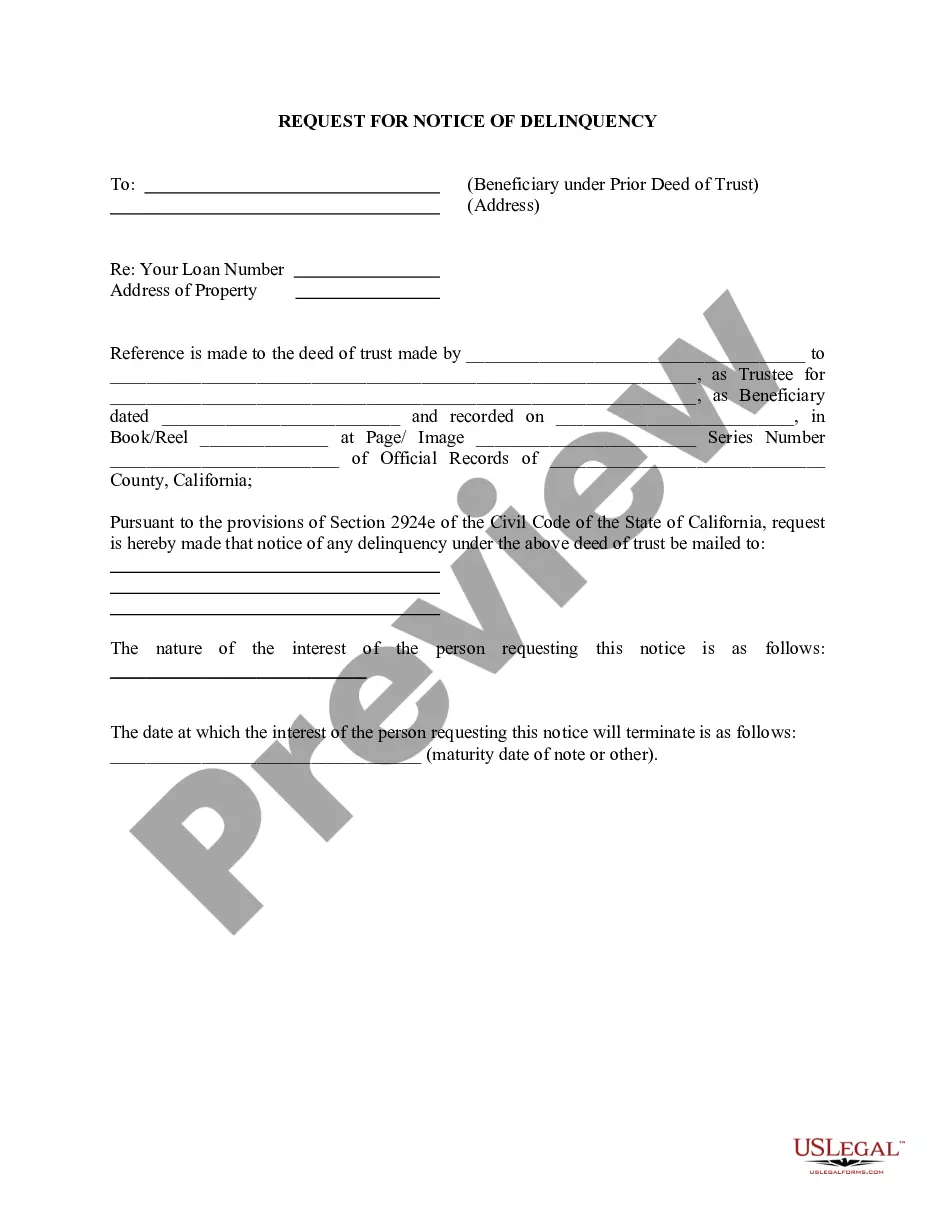

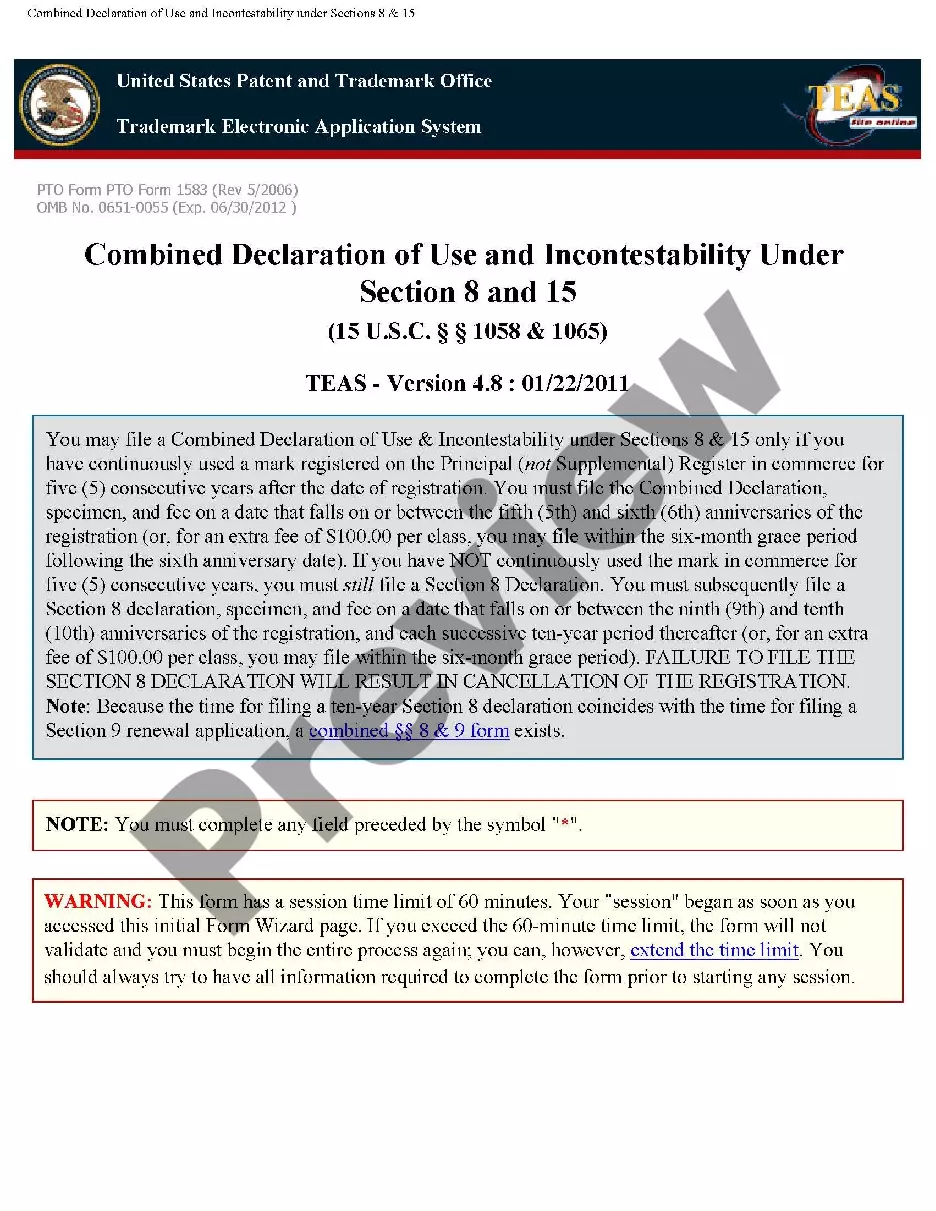

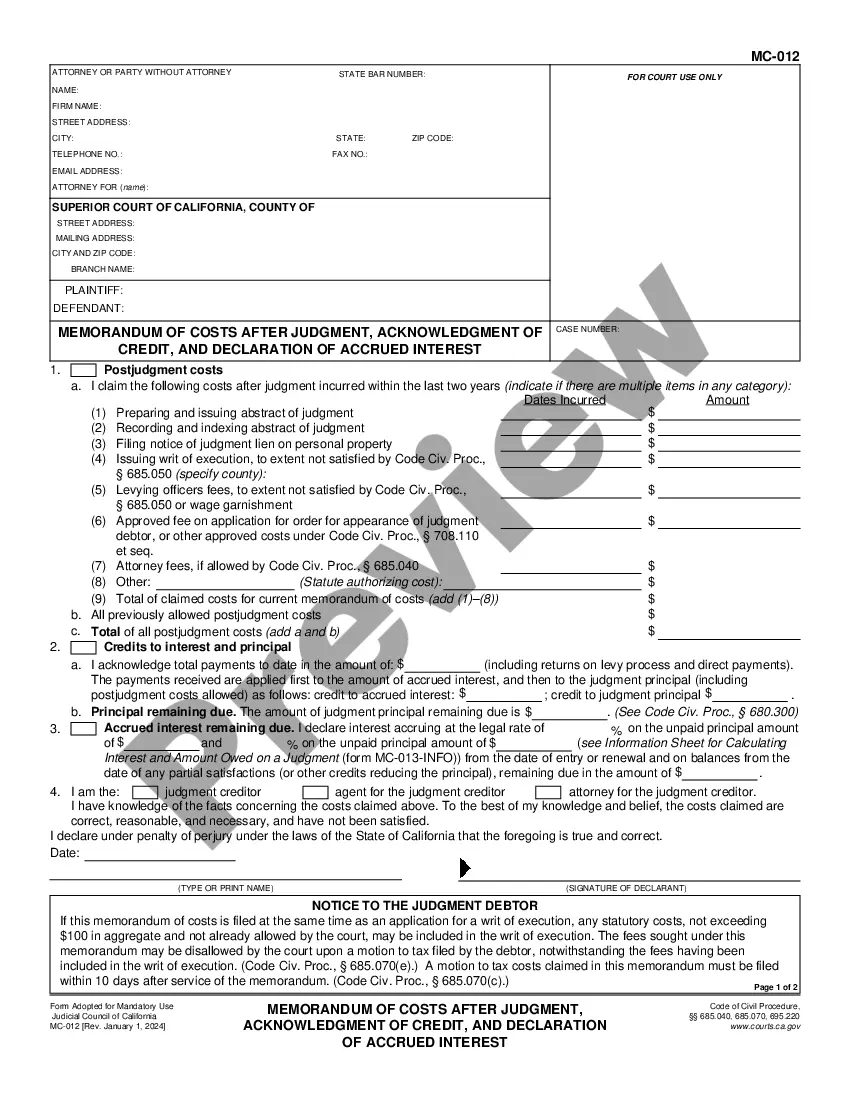

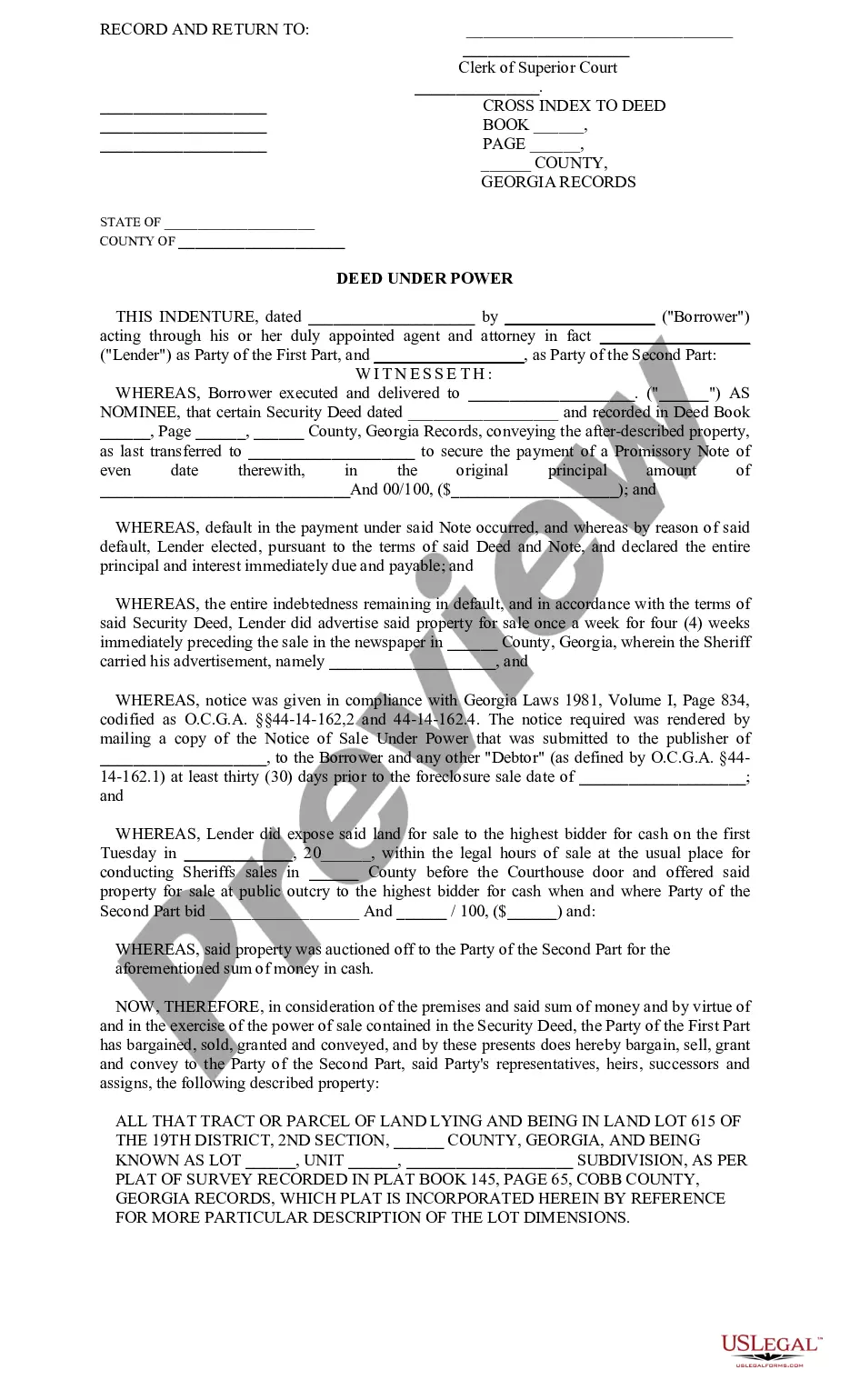

- Look at the form making use of the Preview function (if it’s available).

- If there's a description, read through it to understand the important points.

- Click Buy Now if you found what you're searching for.

- Pick your plan on the pricing page and create your account.

- Pick how you would like to pay with a credit card or by PayPal.

- Save the file in the preferred file format.

You can print out the Illinois Assumed Business Name Application Filing Instructions for Lake County form or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your template can be utilized and sent away, and published as many times as you want. Check out US Legal Forms and access to around 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Step 1 Obtain the Form. The Assumed Business Name form is available from the County Clerk's office. Step 2 Fill out the Form. Information that is commonly requested includes: Step 3 Legal Notice Publication. Step 4 Submit Application.

Under Illinois law, all businesses are required to register alternative trade names by filing for a DBA if the business seeks to operate under a different name than the name used when it was formed. In the case of a sole proprietorship, any name different than the owner's legal name requires registration.

The DBA has to be filled out and notarized with no errors due to the fact that it is recorded with the County. Filing for a DBA allows you to do business under a different name.The name of your business is up to you, but it needs to be properly registered with the state of California.

DBA requirements vary by state, county, city, and business structure, but in general, registering a DBA comes with paperwork and filing fees anywhere from $10 to $100. You'll either go to your county clerk's office to file your paperwork, or you'll do so with your state government.

It is NOT a separate entity. A Sole Proprietor fills out Schedule C as part of your Form 1040. You will also fill out Schedule SE for your employment taxes on your net profit.

Under Illinois law, all businesses are required to register alternative trade names by filing for a DBA if the business seeks to operate under a different name than the name used when it was formed. In the case of a sole proprietorship, any name different than the owner's legal name requires registration.

Option 1: File Online With the Cook County Clerk. Option 2: File the Assumed Business Name Application by Mail or In-Person. Cost: $50 Filing Fee. Filing Address: Cook County Clerk. Vital Statistics P.O. Box 641070. Chicago IL, 60664-1070. Note: Hard copy forms must be notarized.

How much does a DBA cost in Illinois? The cost for a Sole proprietorship or partnership to register their Assumed Name varies by county but expect a filing fee of $20-$50 to the County Clerk and $40-$100 for the publication of the legal notice. This is a one-time cost unless the business changes location.

Lake County does not issue general permits or licenses to operate a business. Contact the city or village in which the business is located for local licensing requirements. You may print the following Assumed Business Name Application as well as filing instructions and a publisher's list for legal notices.