Illinois Addition of Owners to Business for Lake County

Description

How to fill out Illinois Addition Of Owners To Business For Lake County?

Searching for the Illinois Addition of Owners to a Business for Lake County example and completing it can be a significant challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the suitable template tailored for your state in merely a few clicks. Our attorneys prepare every document, so you only need to complete them.

It truly is that simple.

Choose your plan on the pricing page and create an account. Decide if you prefer to pay via card or PayPal. Save the file in the desired file format. Now you can print the Illinois Addition of Owners to Business for Lake County form or complete it using any online editor. Don’t fret about making errors since your template can be used, submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the example.

- All your downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, consider signing up.

- Review our detailed instructions on how to obtain your Illinois Addition of Owners to Business for Lake County template in just a few minutes.

- To acquire a valid form, verify its applicability for your state.

- Examine the specimen using the Preview option (if available).

- If there’s a description, read it to grasp the particulars.

- Click Buy Now if you found what you were looking for.

Form popularity

FAQ

Electronically through MyTax Illinois, by calling us at 217-785-3707, or. at one of our offices.

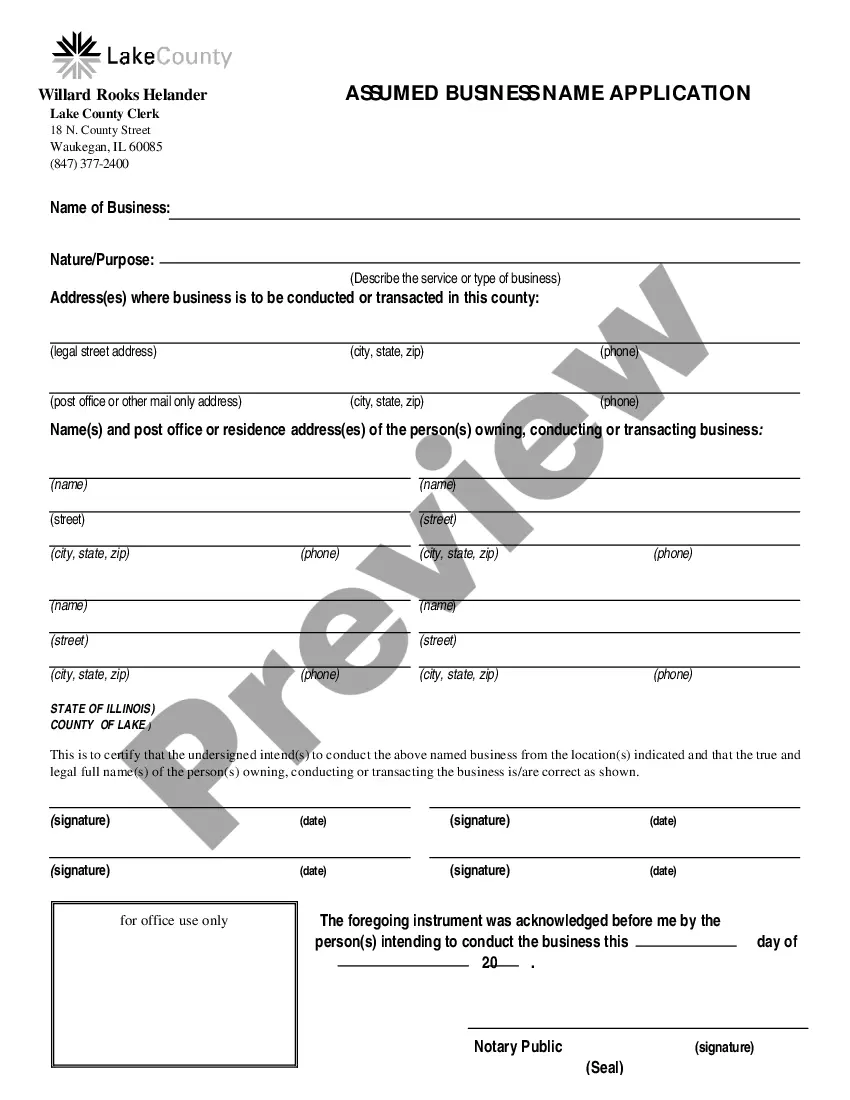

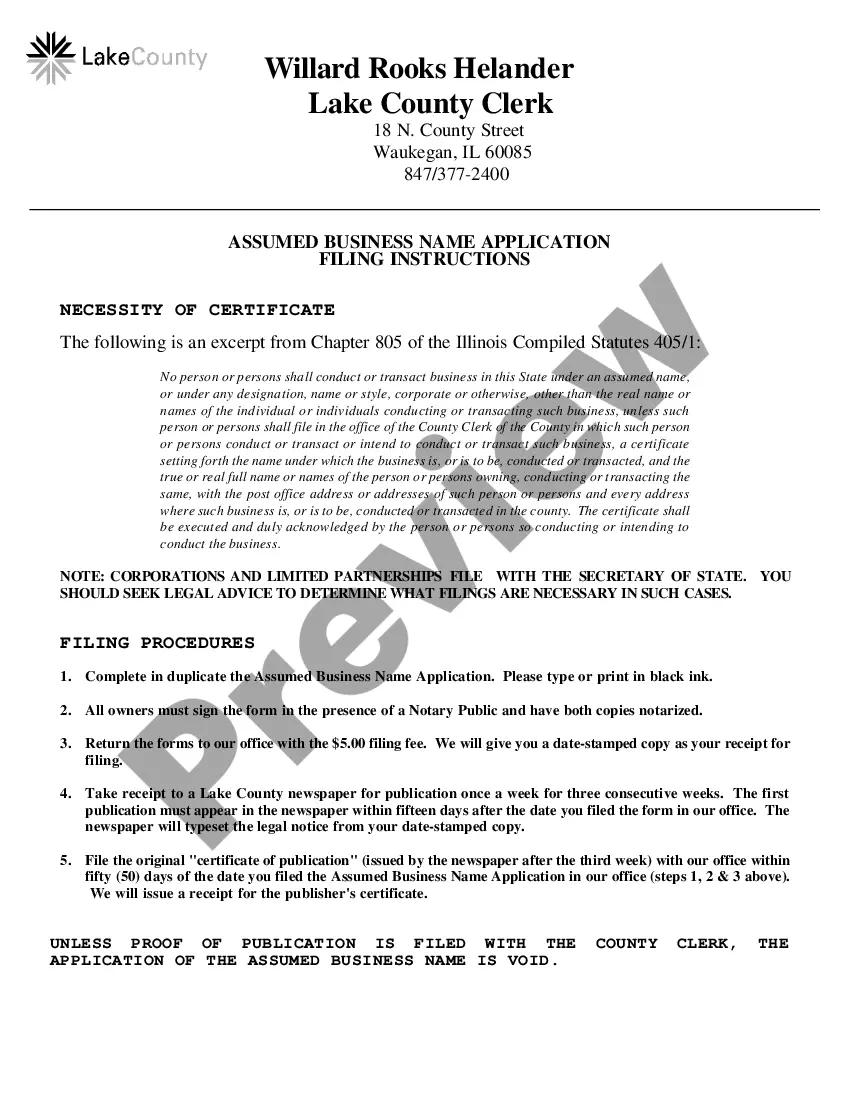

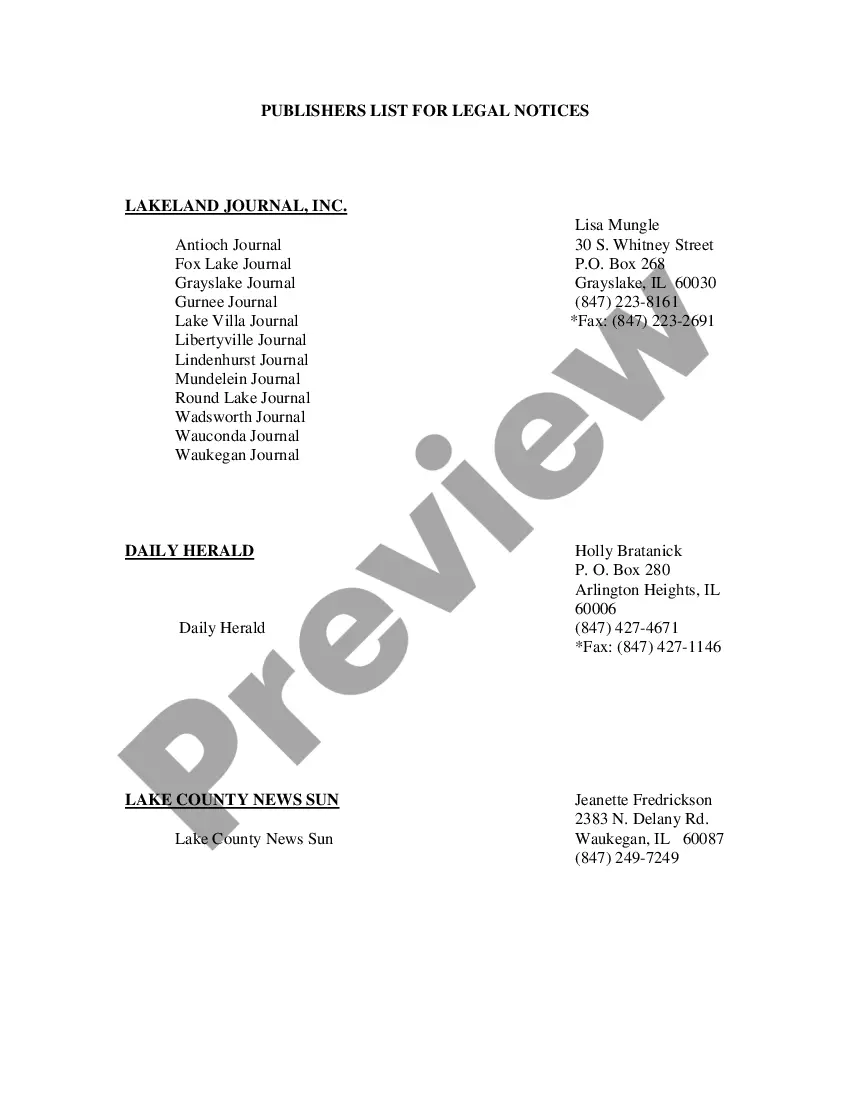

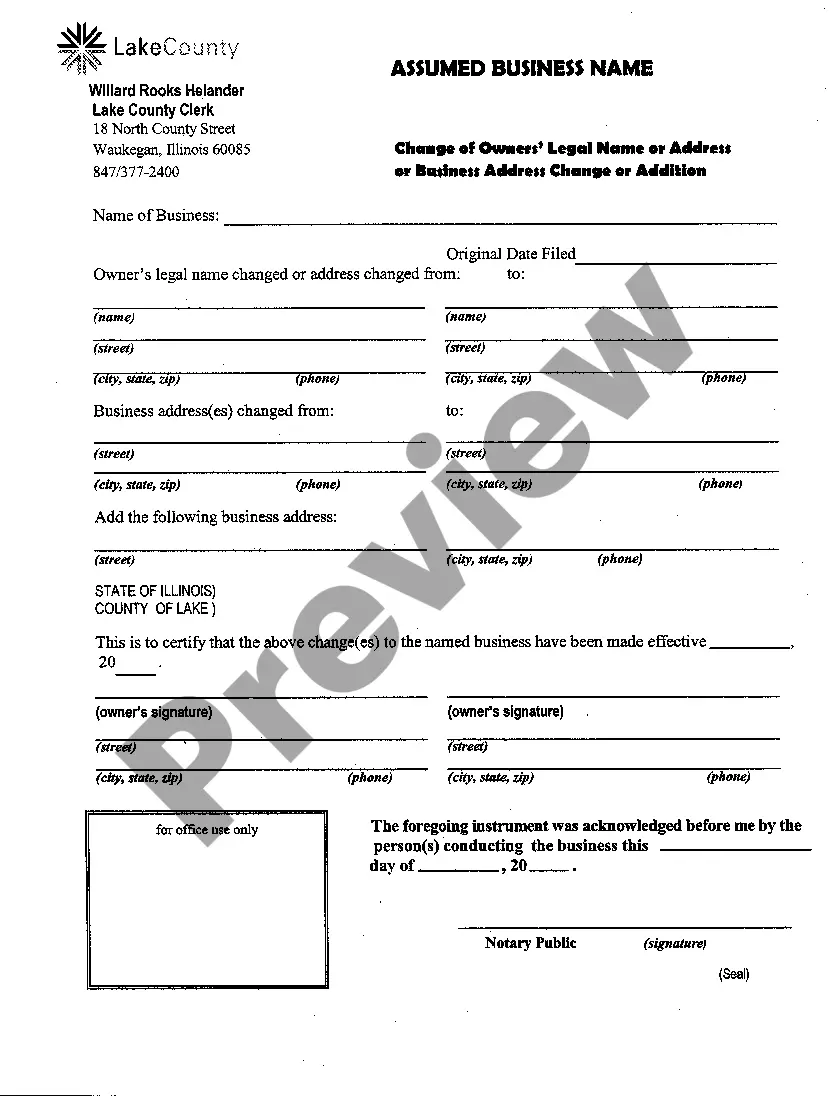

Lake County does not issue general permits or licenses to operate a business. Contact the city or village in which the business is located for local licensing requirements. You may print the following Assumed Business Name Application as well as filing instructions and a publisher's list for legal notices.

Choose a Corporate Name. File Articles of Incorporation. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Directors and Hold First Board Meeting. File Annual Report. Obtain an EIN.

Top 5 Tips on Registering a Business in Illinois Forming an LLC costs $500 and a $250 annual fee. The fee for a corporation varies, but is usually $125 to start and $100 annually.

Option 1: File Online With the Cook County Clerk. Option 2: File the Assumed Business Name Application by Mail or In-Person. Cost: $50 Filing Fee. Filing Address: Cook County Clerk. Vital Statistics P.O. Box 641070. Chicago IL, 60664-1070. Note: Hard copy forms must be notarized.

Step 1 Obtain the Form. The Assumed Business Name form is available from the County Clerk's office. Step 2 Fill out the Form. Information that is commonly requested includes: Step 3 Legal Notice Publication. Step 4 Submit Application.

Electronically register through MyTax Illinois (approximately one to two days to process); complete and mail Form REG-1, Illinois Business Registration Application, to us at the address on the form (Form REG-1 is available on our web site as a fill-in and savable form. visit one of our offices.

Under Illinois law, all businesses are required to register alternative trade names by filing for a DBA if the business seeks to operate under a different name than the name used when it was formed. In the case of a sole proprietorship, any name different than the owner's legal name requires registration.

Illinois Department Of Revenue (IDOR) In Illinois, most business are required to be registered and/or licensed by the IDOR. If you plan to hire employees, buy or sell products wholesale or retail, or manufacture goods, you must register with the IDOR.