Illinois Notification of Cancellation or Dissolution of Business for Cook County

Description

How to fill out Illinois Notification Of Cancellation Or Dissolution Of Business For Cook County?

Looking for Illinois Notification of Cancellation or Dissolution of Business for Cook County templates and filling out them can be quite a problem. To save time, costs and energy, use US Legal Forms and find the appropriate template specially for your state within a few clicks. Our lawyers draft all documents, so you simply need to fill them out. It really is that easy.

Log in to your account and return to the form's web page and save the sample. Your downloaded templates are stored in My Forms and they are accessible all the time for further use later. If you haven’t subscribed yet, you have to sign up.

Have a look at our comprehensive instructions regarding how to get your Illinois Notification of Cancellation or Dissolution of Business for Cook County form in a few minutes:

- To get an entitled example, check out its applicability for your state.

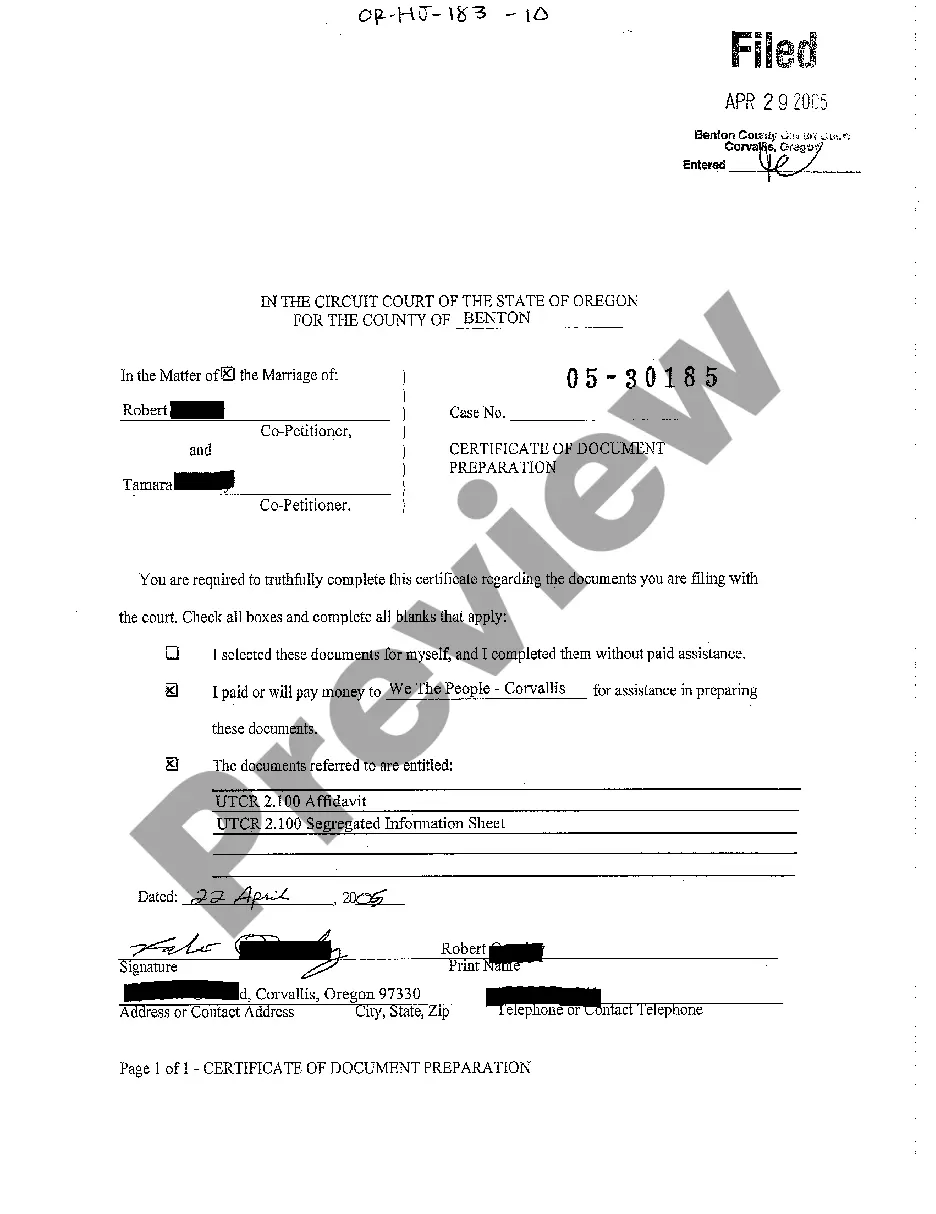

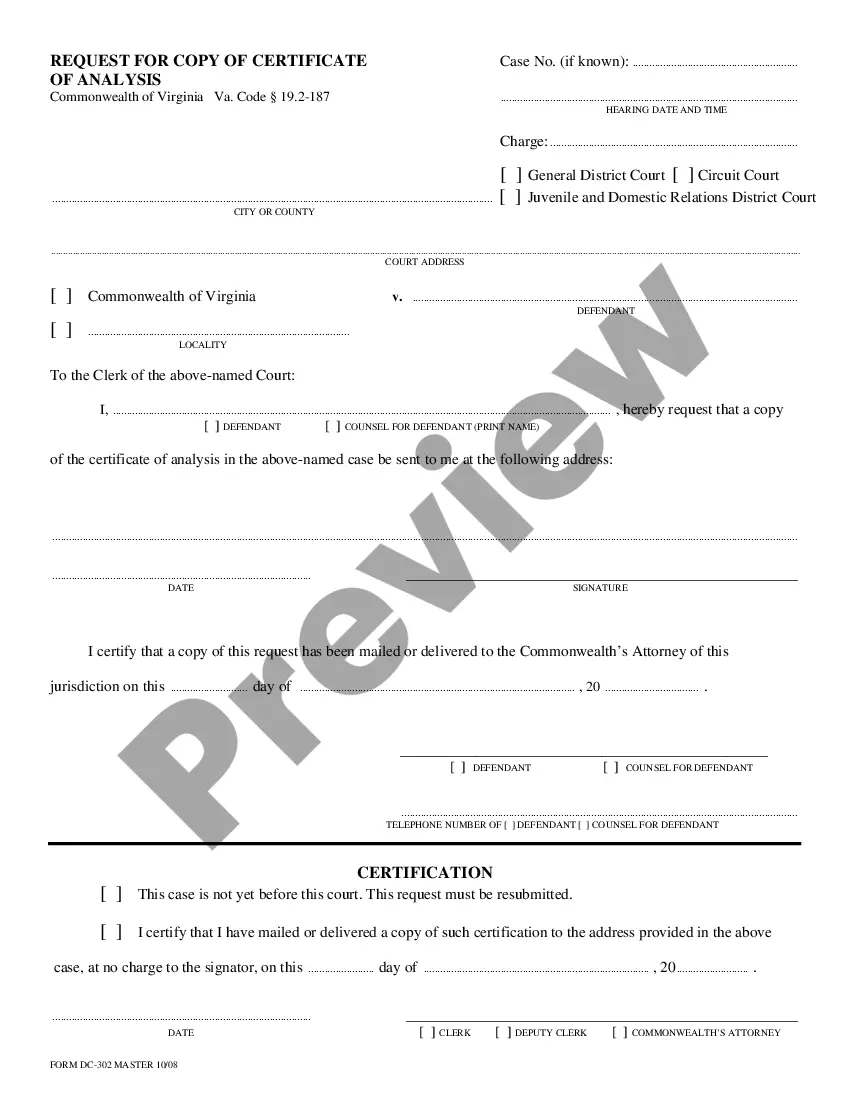

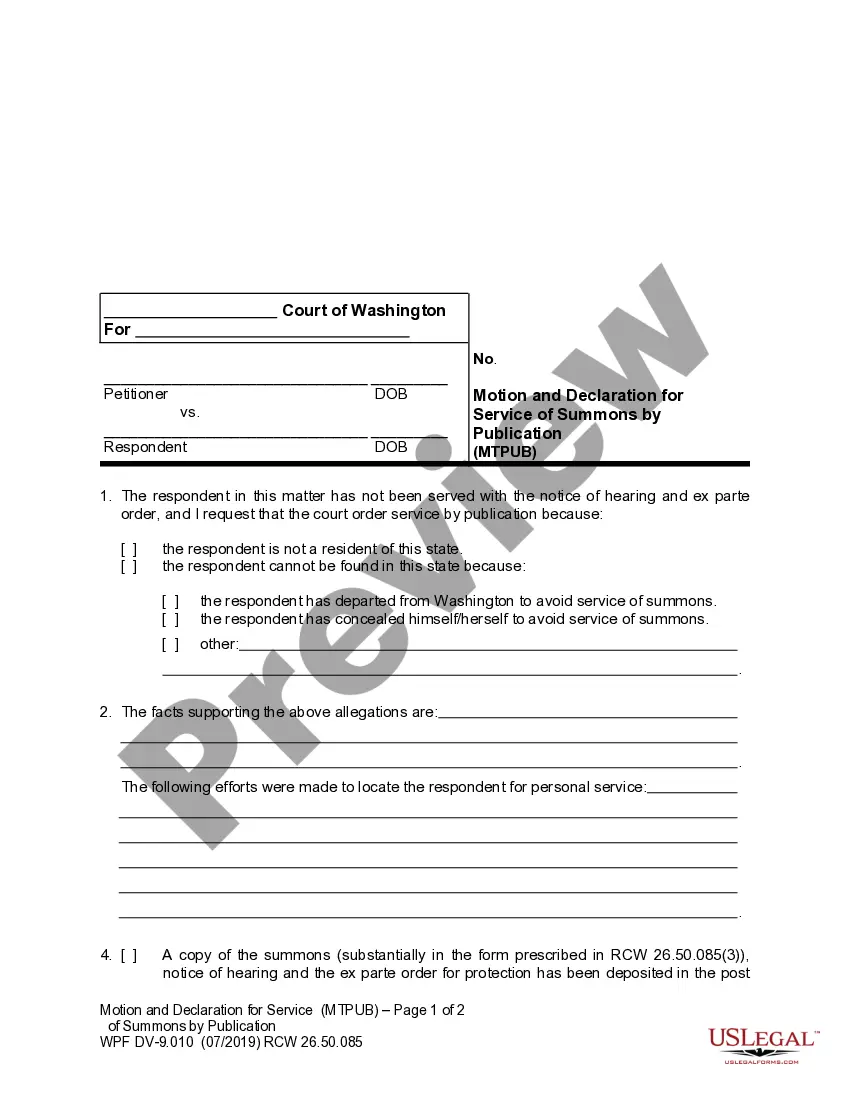

- Check out the example utilizing the Preview function (if it’s offered).

- If there's a description, read through it to understand the details.

- Click Buy Now if you identified what you're seeking.

- Choose your plan on the pricing page and make your account.

- Choose you wish to pay out with a card or by PayPal.

- Save the form in the favored format.

Now you can print out the Illinois Notification of Cancellation or Dissolution of Business for Cook County form or fill it out making use of any online editor. Don’t worry about making typos because your form may be utilized and sent away, and printed out as many times as you would like. Try out US Legal Forms and access to more than 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock.

File final tax returns and terminate your EIN. File the required dissolution documents. Settle any remaining tax liabilities and other debts. Sell any remaining inventory, property, and other assets. Cancel any remaining insurance policies, licenses, or permits.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Step 1 Obtain the Form. The Assumed Business Name form is available from the County Clerk's office. Step 2 Fill out the Form. Information that is commonly requested includes: Step 3 Legal Notice Publication. Step 4 Submit Application.

Step 1: Hold a Board Meeting and Seek Shareholder Approval. Step 2: File a Certificate of Dissolution with the Secretary of State. Step 3: Notify the Internal Revenue Service and Other Taxing Authorities. Step 4: Formal Notice of Dissolution. Step 5: Settle Claims with Creditors.

File final tax returns and terminate your EIN. File the required dissolution documents. Settle any remaining tax liabilities and other debts. Sell any remaining inventory, property, and other assets. Cancel any remaining insurance policies, licenses, or permits.

File the Articles of Dissolution with the Illinois Secretary of State. Fulfill all tax obligations with the state of Illinois, as well as with the IRS. Cancel any relevant licenses and permits, along with closing your business bank account. Notify customers, vendors, and creditors of your dissolution.