Illinois Bond-Surety is a type of surety bond required by the state of Illinois to protect the public from any financial loss due to the failure of a contractor or other business to perform the duties outlined in a contract. There are three types of Illinois Bond-Surety: Performance Bond, Payment Bond, and Bid Bond. A Performance Bond guarantees that a contractor will complete the project according to the terms of the contract. A Payment Bond guarantees that all subcontractors, laborers, and suppliers will be paid in full as outlined in the contract. A Bid Bond guarantees that the contractor will be able to complete the project per the terms of their bid.

Illinois Bond-Surety

Description

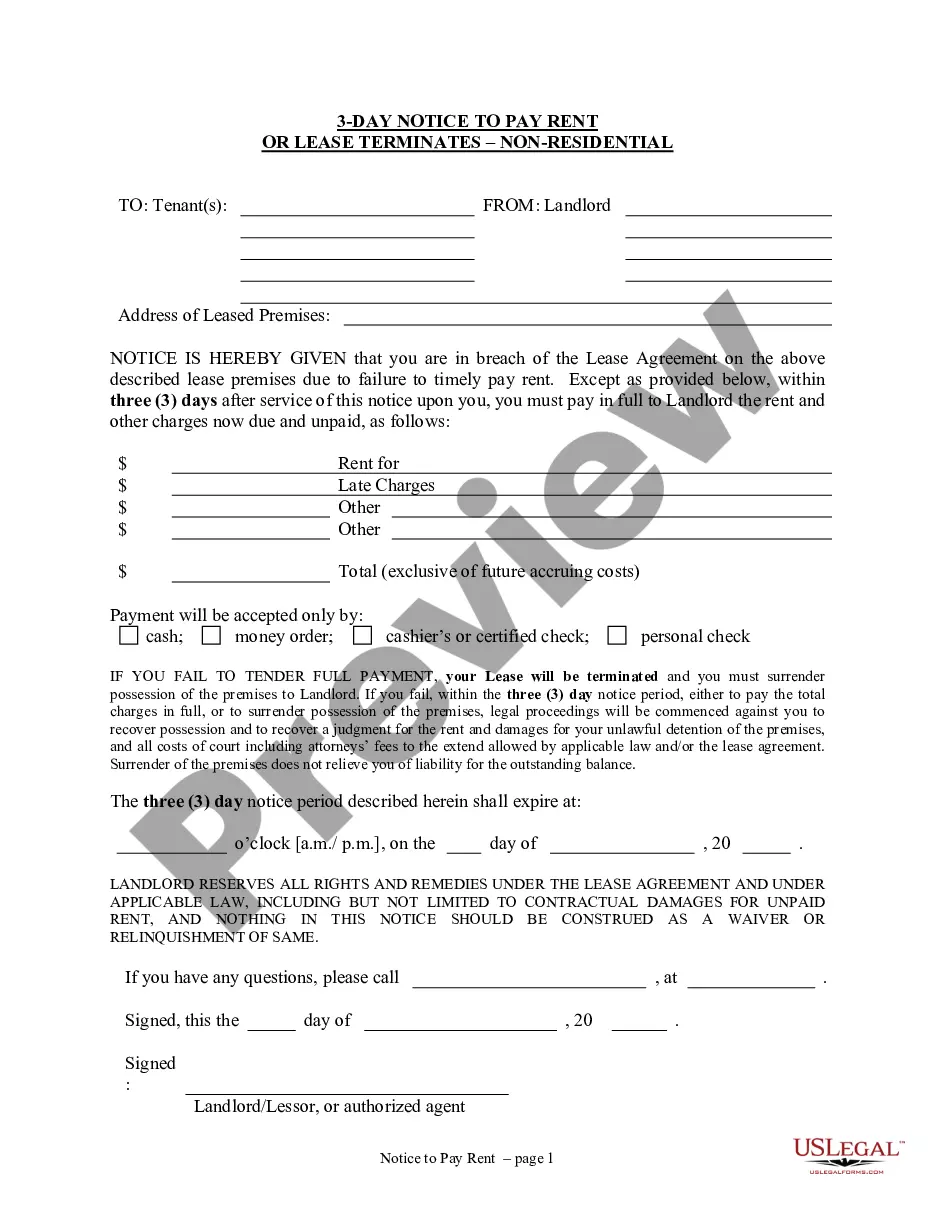

How to fill out Illinois Bond-Surety?

US Legal Forms is the most straightforward and affordable way to find appropriate legal templates. It’s the most extensive online library of business and individual legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your Illinois Bond-Surety.

Obtaining your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Illinois Bond-Surety if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one meeting your needs, or locate another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you like most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your Illinois Bond-Surety and download it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Take advantage of US Legal Forms, your reputable assistant in obtaining the corresponding formal documentation. Give it a try!

Form popularity

FAQ

A probate bond is required in most probate estates in Illinois, except for those where the will specifies that no bond is required. The yearly cost of a bond tends to be about 0.5% of the estate's assets, though there are many factors that can increase or decrease the amount charged by a bonding company.

The first step to getting an Illinois surety bond is to apply for your bond. Not everyone can get approved for a bond, so this is the first step to getting bonded. Most companies all you to apply for your bond online. You can apply for a bond at your local insurance agency, or a specialized surety bond company.

Illinois law requires Notaries to purchase and maintain a surety bond for the duration of their 4-year commission.

Most Popular Surety Bonds in Illinois You'll need to post a $50,000 bond to get your car dealer license from the Illinois Secretary of State. Roofing contractors in Illinois need a $10,000 or $25,000 bond, while plumbers need a $20,000 bond.

Surety Bond Requirements in IL You must have a proper surety bond in place if you are an appraisal management company (AMC), motor vehicle dealer, plumbing contractor, roofing contractor, or residential mortgage broker. Most Illinois surety bonds have a fixed liability amount, while some vary.