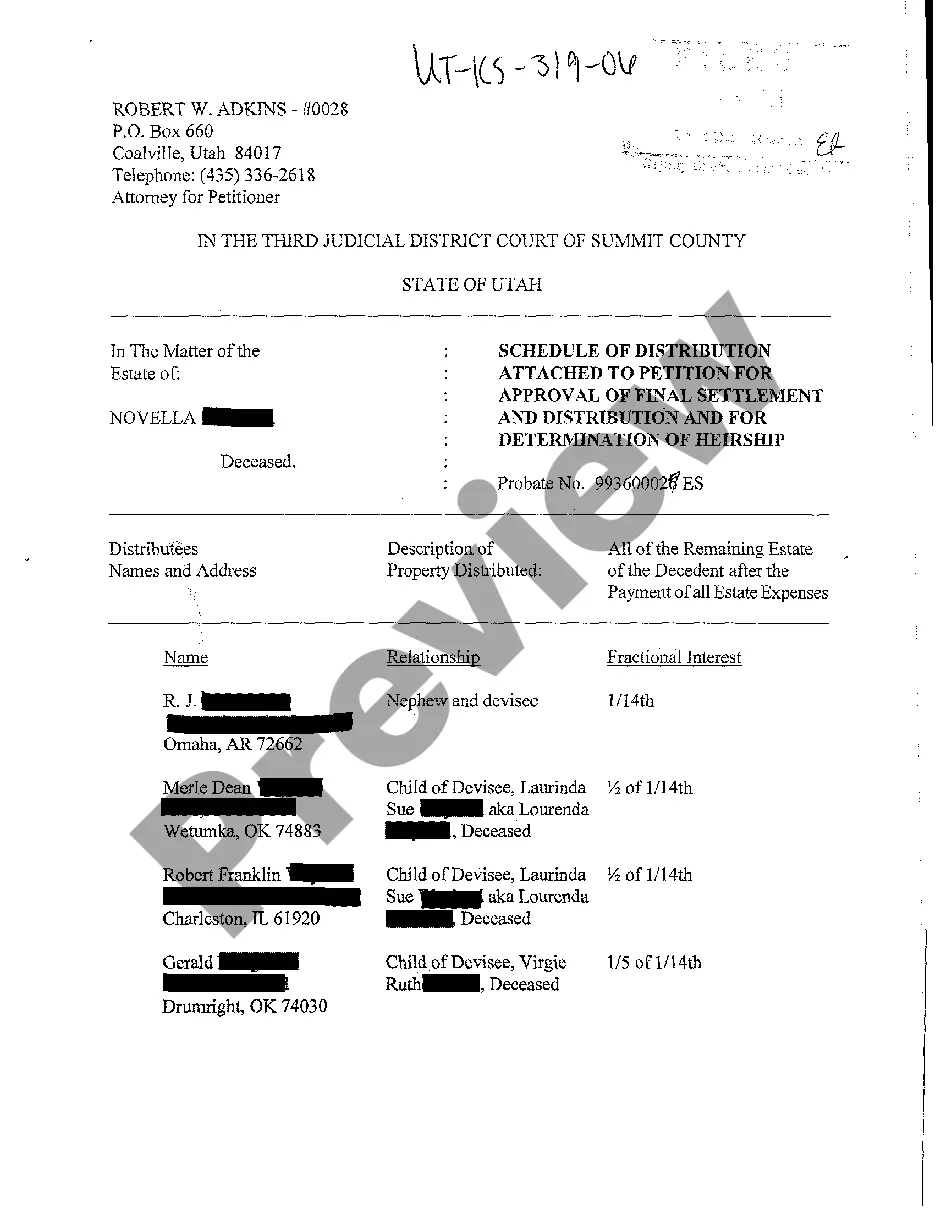

An Illinois Order Converting To Independent Administration For The Purpose Of Closing Estate is a court order issued by a probate court in the State of Illinois which allows for the closure of an estate of a deceased individual without the need for continued court supervision. This type of order allows an independent administrator to manage the estate and make decisions regarding the distribution of the deceased’s assets. The order is typically issued when the deceased's will has been fully executed and all debts and taxes have been paid. The two types of Illinois Order Converting To Independent Administration For The Purpose Of Closing Estate are: 1. Supervised Independent Administration: In this type of order, the probate court will oversee the administration of the estate. 2. Unsupervised Independent Administration: This type of order allows the independent administrator to manage the estate without the need for court supervision. It is important to note that the terms of the Illinois Order Converting To Independent Administration For The Purpose Of Closing Estate will vary depending on the particular estate and the wishes of the deceased.

An Illinois Order Converting To Independent Administration For The Purpose Of Closing Estate is a court order issued by a probate court in the State of Illinois which allows for the closure of an estate of a deceased individual without the need for continued court supervision. This type of order allows an independent administrator to manage the estate and make decisions regarding the distribution of the deceased’s assets. The order is typically issued when the deceased's will has been fully executed and all debts and taxes have been paid. The two types of Illinois Order Converting To Independent Administration For The Purpose Of Closing Estate are: 1. Supervised Independent Administration: In this type of order, the probate court will oversee the administration of the estate. 2. Unsupervised Independent Administration: This type of order allows the independent administrator to manage the estate without the need for court supervision. It is important to note that the terms of the Illinois Order Converting To Independent Administration For The Purpose Of Closing Estate will vary depending on the particular estate and the wishes of the deceased.