Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration is a process by which the court reviews the final accounting of a decedent's assets in an estate. The court reviews the accounting to ensure that the estate has been properly administered and that the assets have been properly distributed. The court must approve the accounting before the estate can be closed. There are two types of Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration: (1) full and public administration and (2) limited and private administration. In full and public administration, the court reviews the accounting and all interested parties must be given notice of the hearing. In limited and private administration, the court reviews the accounting but only those parties with an immediate interest in the estate are given notice of the hearing.

Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration

Description

How to fill out Illinois Receipt And Approval On Closing Of Decedents Estate In Independent Administration?

How much time and resources do you often spend on drafting formal documentation? There’s a greater way to get such forms than hiring legal specialists or wasting hours searching the web for a suitable blank. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration.

To obtain and complete an appropriate Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration blank, follow these easy steps:

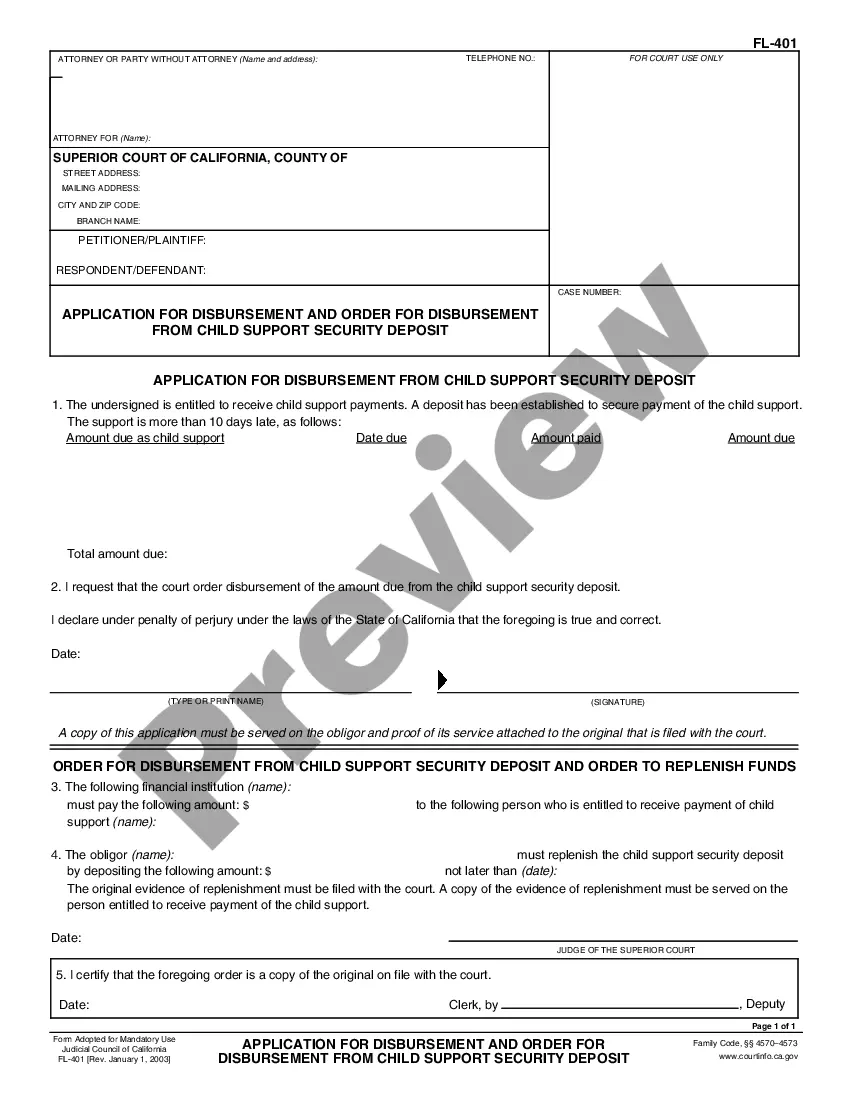

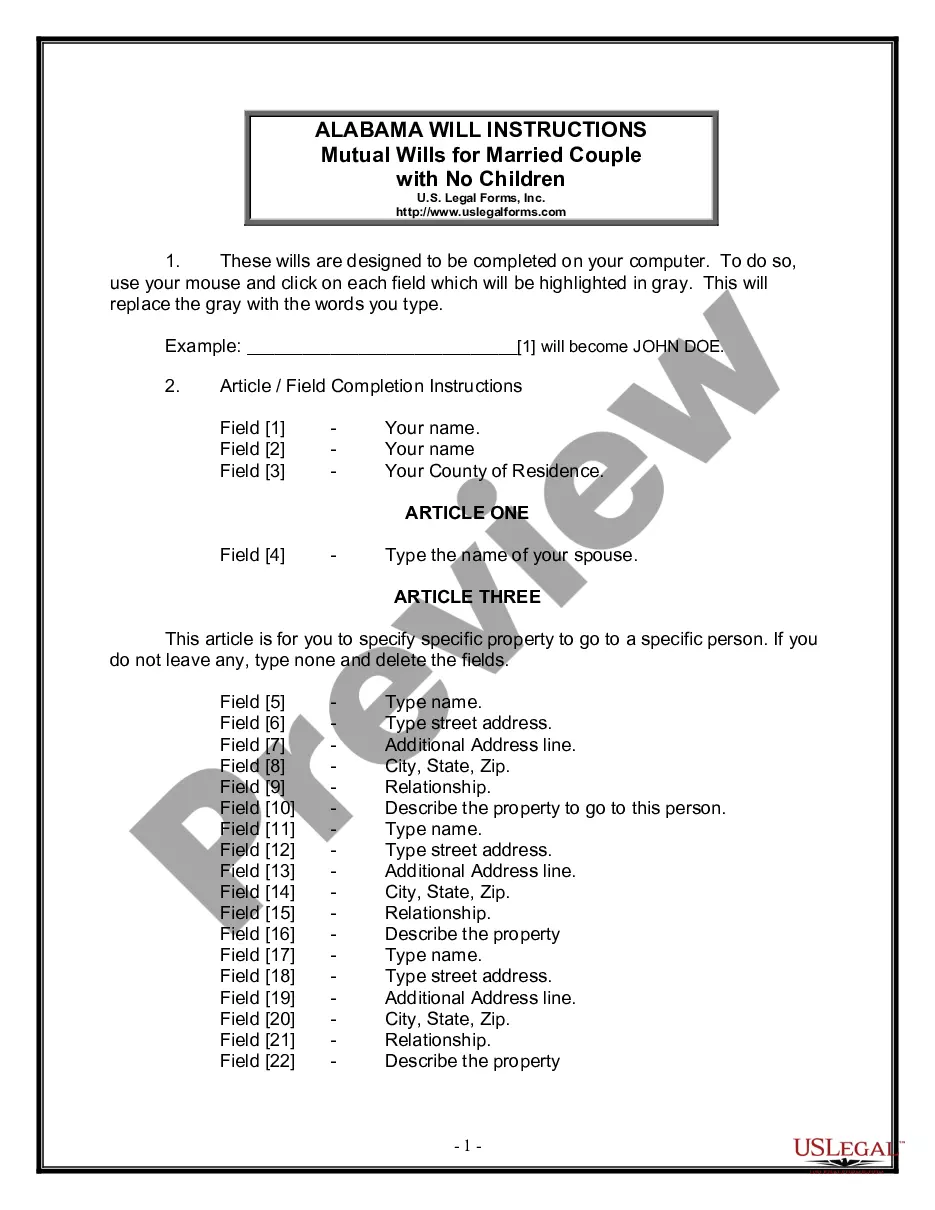

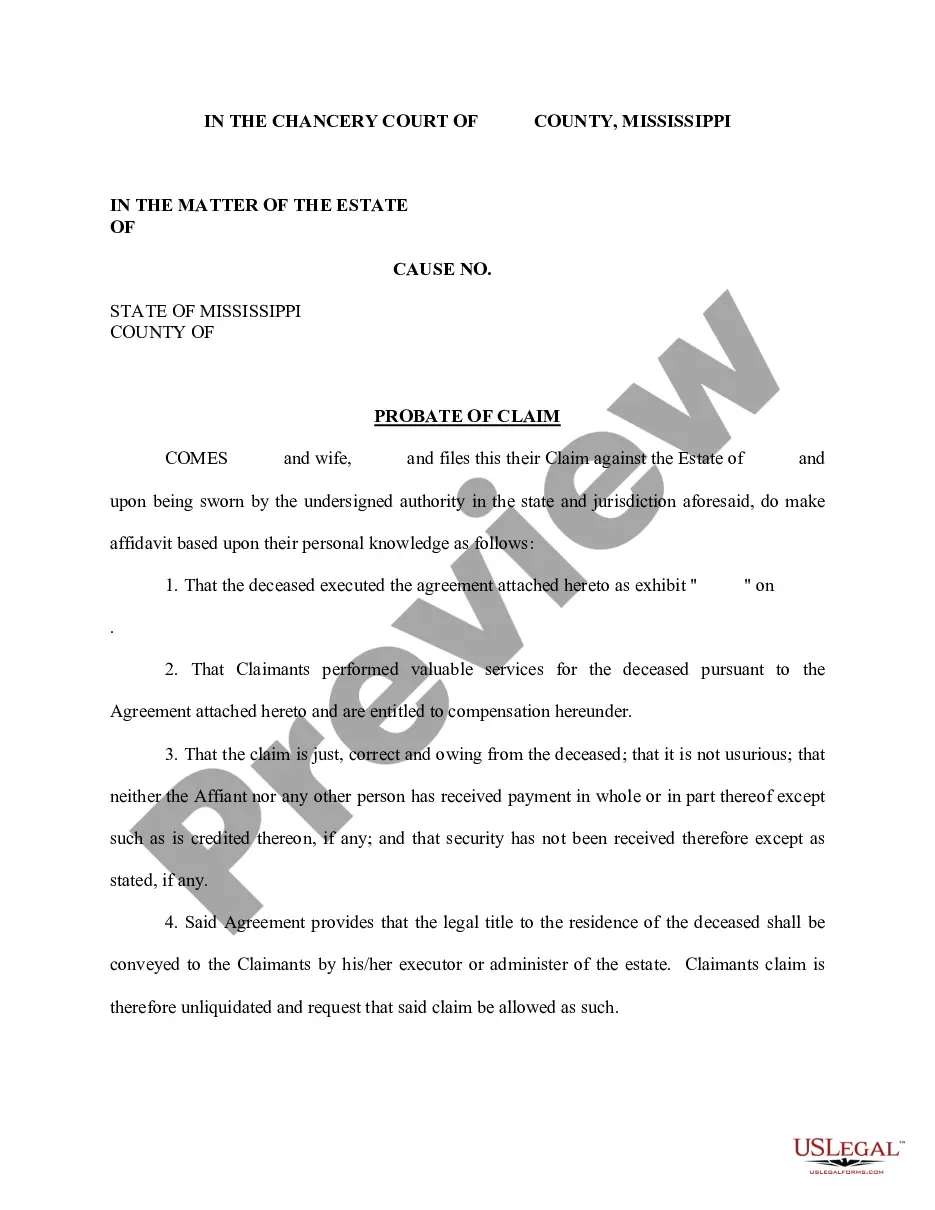

- Look through the form content to make sure it meets your state requirements. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your requirements, find another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your Illinois Receipt and approval On Closing Of Decedents Estate In Independent administration on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously downloaded documents that you securely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most trustworthy web services. Join us today!

Form popularity

FAQ

Broadly speaking, independent administration means that the executor or administrator will not have to obtain court orders or file estate papers in court during probate, unless specifically ordered to do so ? generally, because an interested person asks the court to become involved, or because the decedent's will

For example, an independent administrator can pay debts, sell assets, and transfer title to estate property without court permission. The independent administrator must, in most Illinois probate courts, retain an Illinois probate attorney to represent them in the administration process.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

What is the Difference Between an Executor and an Administrator in Illinois? An Executor is the individual named in a Will to serve as the representative of the Estate. An Administrator is an interested party to an estate who petitions the Probate Court to serve as the Estate representative in the absence of a Will.

If a person dies leaving a valid will, and the will names a person who is to execute the will and administer the estate, this person is called an executor. However, when the person in charge of administering the estate is not named in a will, that person is called an administrator.

This means that the executor or administrator will not have to obtain court orders or file estate documents in court during probate. The estate will be administered without court supervision, unless an interested person asks the court to become involved.

Closing of an Illinois Probate Estate The executor must file a final accounting with the court showing how estate assets were handled. The accounting will list the assets, possible income the estate generated, the amount paid for any debts or other expenses, and the distributions made to beneficiaries.

On average, probate in Illinois takes no less than twelve months. The probate process must allow time for creditors to be notified, filing of required income tax returns, and the resolution of any disputes. Creditors must file any claims against the estate within six months of notification.