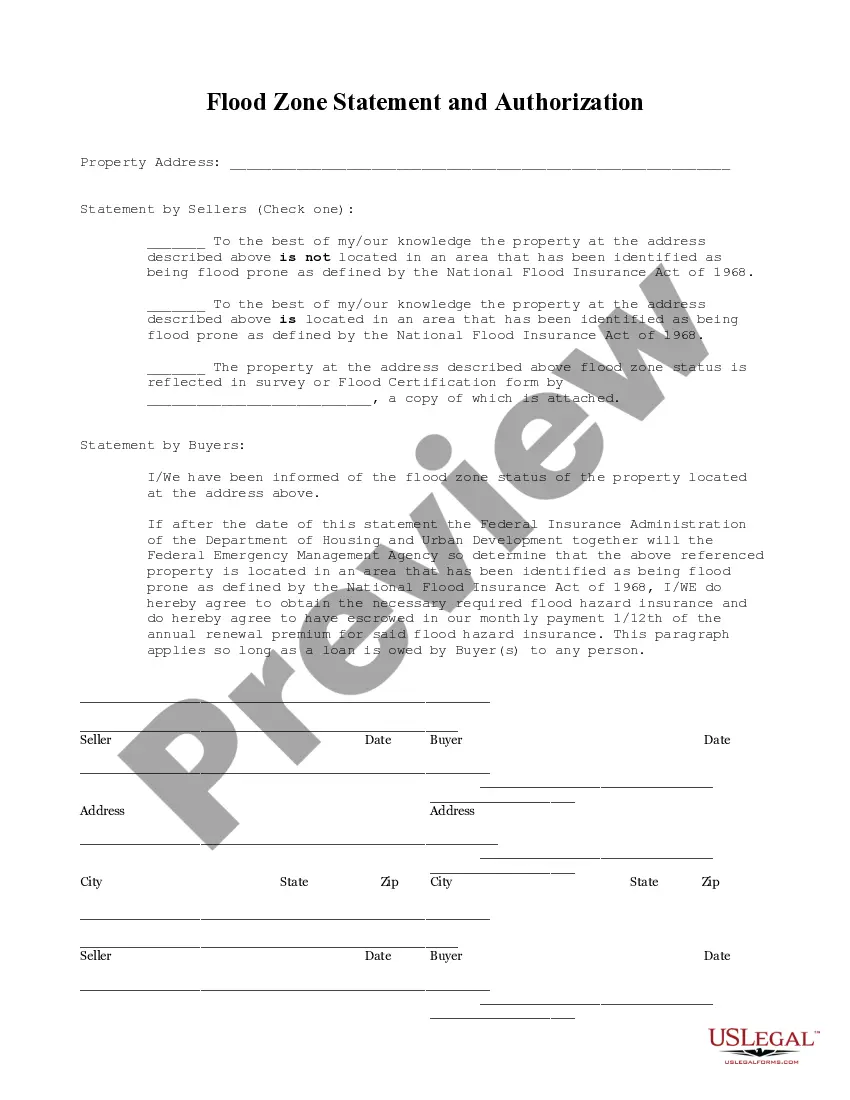

Illinois Flood Zone Statement and Authorization

Description

How to fill out Illinois Flood Zone Statement And Authorization?

Searching for the Illinois Flood Zone Statement and Authorization template and completing it could be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our legal experts prepare every document, allowing you to merely fill them in. It's incredibly straightforward.

Select your payment plan on the pricing page and create an account. Choose your payment method, be it a credit card or PayPal. Save the form in your desired format. You can now print the Illinois Flood Zone Statement and Authorization form or complete it using any online editor. Don't worry about typos, as your template can be reused and printed multiple times as needed. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's page to download the document.

- All your downloaded templates are stored in My documents and are always available for future use.

- If you haven't registered yet, you'll need to create an account.

- Review our detailed guidelines on how to obtain your Illinois Flood Zone Statement and Authorization form within minutes.

- To obtain a verified example, ensure its relevance for your state.

- Examine the sample using the Preview feature (if available).

- If there’s a description, read it to grasp the specifics.

- Click on the Buy Now button if you've found what you need.

Form popularity

FAQ

Summary: Proximity to a flood zone lowers property values. By law, a property is considered in a flood zone if any part of the structure falls within a floodplain, an area that is adjacent to a stream or river that experiences periodic flooding.

Evidence of flood insurance Completed and executed NFIP Flood Insurance Application PLUS a copy of the Borrower's premium check or agent's paid receipt.

Areas in flood zone A have a 1 percent chance of flooding per year and a 25 percent chance of flooding at least once during a 30-year mortgage. Since there haven't been detailed hydraulic analysis in these areas, the base flood elevation and depths have not been determined.

Use the Comments area of Section D, on the back of the certificate, to provide datum, elevation, or other relevant information not specified on the front. Complete Section E if the building is located in Zone AO or Zone A (without BFE). Otherwise, complete Section C instead.

If you live in a high-risk area for flooding and are purchasing flood insurance through the National Flood Insurance Program (NFIP), you will almost certainly be required to provide an elevation certificate to complete your purchase.

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

The BFE is the elevation that floodwaters are estimated to have a 1% chance of reaching or exceeding in any given year. The higher your lowest floor is above the BFE, the lower the risk of flooding. Lower risk typically means lower flood insurance premiums.

If you live in a high-risk area for flooding and are purchasing flood insurance through the National Flood Insurance Program (NFIP), you will almost certainly be required to provide an elevation certificate to complete your purchase.

The best way to find flood insurance without a Flood Elevation Certificate is to consult a licensed flood insurance agent to see if they work with any companies that don't rely on a certificate to price out flood risk.