Illinois Complex Will with Credit Shelter Marital Trust for Large Estates

Description Marital Trust

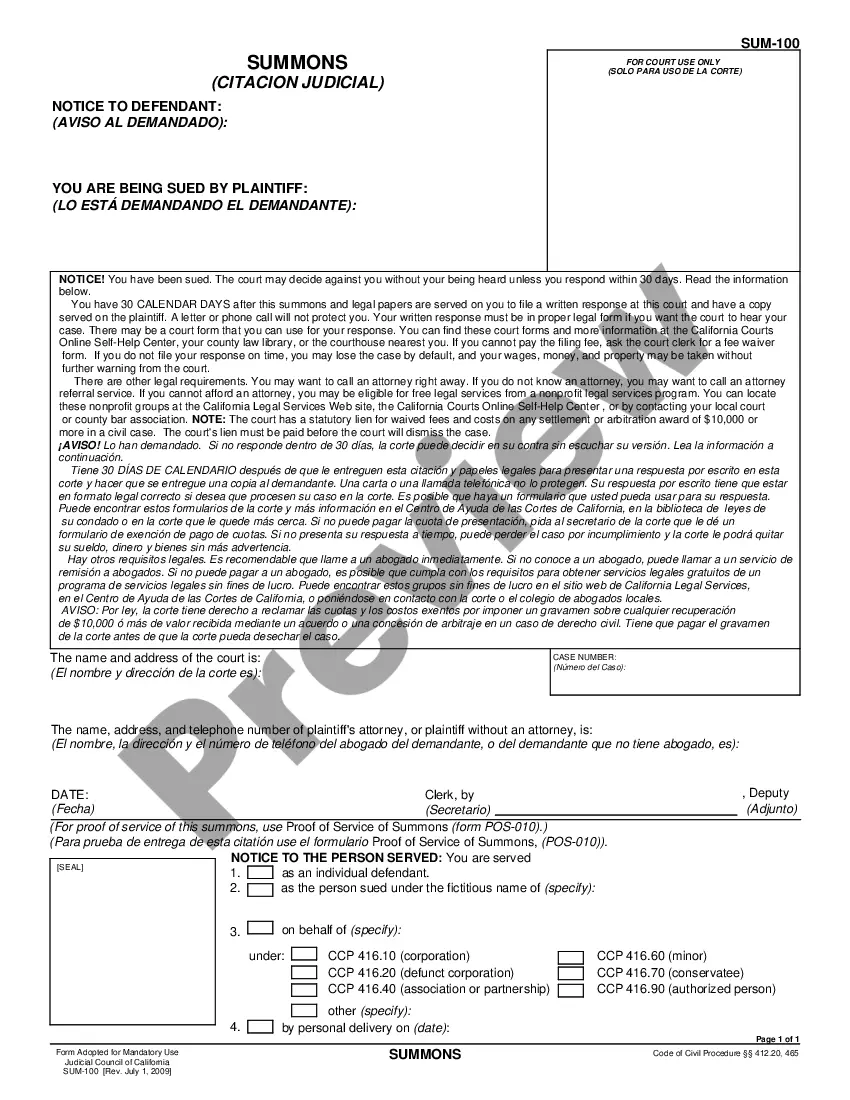

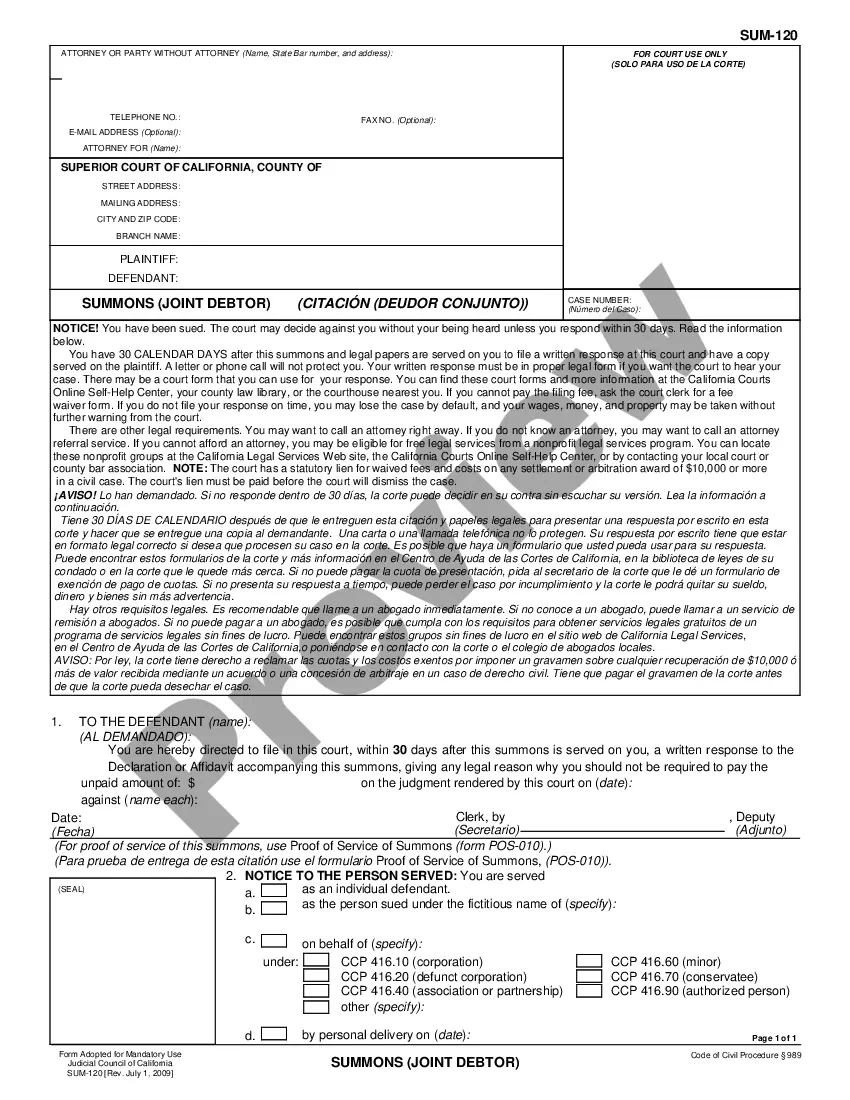

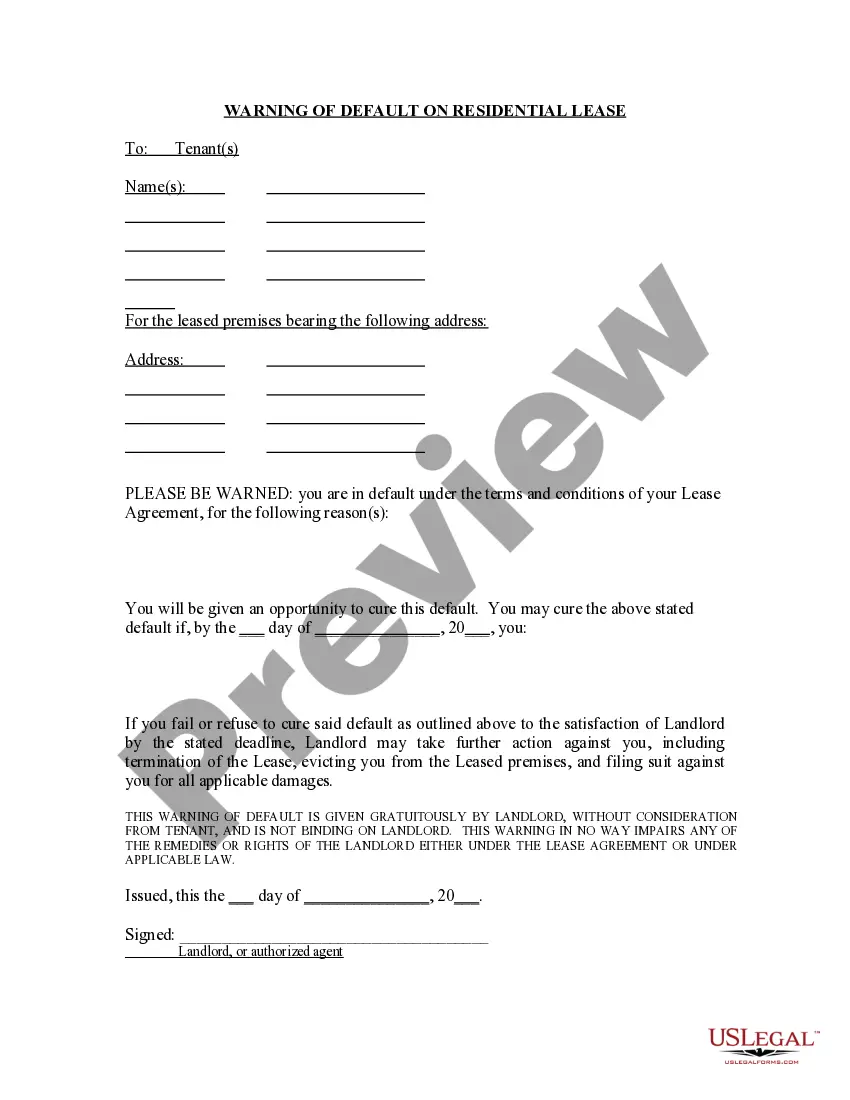

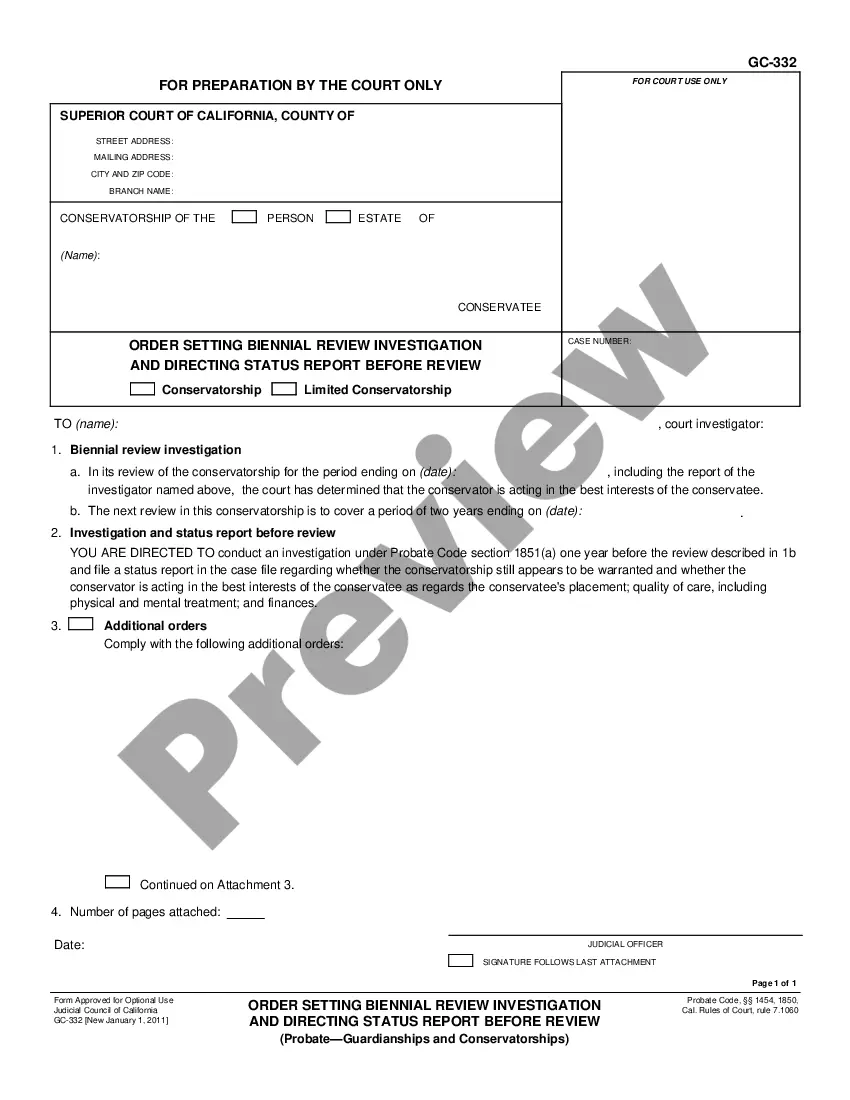

How to fill out Illinois Complex Will With Credit Shelter Marital Trust For Large Estates?

In search of Illinois Complex Will with Credit Shelter Marital Trust for Large Estates sample and completing them might be a challenge. To save time, costs and effort, use US Legal Forms and find the right sample specially for your state within a couple of clicks. Our attorneys draw up each and every document, so you just have to fill them out. It is really that simple.

Log in to your account and come back to the form's page and save the sample. Your downloaded examples are stored in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you need to register.

Check out our comprehensive recommendations on how to get the Illinois Complex Will with Credit Shelter Marital Trust for Large Estates form in a couple of minutes:

- To get an entitled form, check out its validity for your state.

- Take a look at the form making use of the Preview option (if it’s accessible).

- If there's a description, read through it to know the important points.

- Click on Buy Now button if you identified what you're seeking.

- Choose your plan on the pricing page and make an account.

- Select you wish to pay out with a credit card or by PayPal.

- Download the sample in the favored format.

You can print the Illinois Complex Will with Credit Shelter Marital Trust for Large Estates form or fill it out using any online editor. No need to worry about making typos because your template may be employed and sent away, and printed out as many times as you wish. Try out US Legal Forms and get access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Yes, the surviving spouse may serve as trustee of the credit shelter trust.All of the assets in the credit shelter trust, including any appreciation in value during the surviving spouse's lifetime, pass free of estate tax to the beneficiaries.

The "A Trust" is also commonly referred to as the "Marital Trust," "QTIP Trust," or "Marital Deduction Trust." The "B Trust" is also commonly referred to as the "Bypass Trust," "Credit Shelter Trust," or "Family Trust."

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Assets that have been conveyed into a revocable living trust do get a step-up in basis when they are distributed to the beneficiaries after the passing of the grantor. We should point out the fact that the beneficiaries would be responsible for any future appreciation from a capital gains perspective.

A marital trust starts as a revocable living trust. A surviving spouse can be its trustee.

First, in a standard credit shelter trust, there is no step-up in basis at the death of the surviving spouse.Second, the credit shelter trust is a separate taxpayer and requires its own tax return, Form 1041.

In the case of a marital trust, the IRS subjects the remaining trust assets to federal estate taxes when the surviving spouse passes. However, a couple can take advantage of the federal gift and estate tax exemption. This is the amount that you can pass on to heirs before you'd ever owe an actual estate tax.

Trust B is irrevocable, the surviving spouse cannot change its terms. When one spouse dies the survivor must hire a lawyer or an accountant to determine how to best divide the couple's assets between the deceased spouse's irrevocable trust and the surviving spouse's revocable trust.

You can be trustee of your own living trust. If you are married, your spouse can be trustee with you. Most married couples who own assets together, especially those who have been married for some time, are usually co-trustees.