Illinois Dissolution Package to Dissolve Limited Liability Company LLC

Description Closing An Llc In Illinois

How to fill out Letter From Secretary Of State Illinois?

In search of Illinois Dissolution Package to Dissolve Limited Liability Company LLC forms and filling out them can be quite a challenge. In order to save time, costs and effort, use US Legal Forms and find the appropriate template specifically for your state in just a few clicks. Our legal professionals draw up all documents, so you just have to fill them out. It truly is that simple.

Log in to your account and return to the form's web page and save the sample. All of your downloaded examples are stored in My Forms and therefore are accessible all the time for further use later. If you haven’t subscribed yet, you should register.

Have a look at our thorough recommendations concerning how to get the Illinois Dissolution Package to Dissolve Limited Liability Company LLC form in a couple of minutes:

- To get an qualified form, check its validity for your state.

- Have a look at the example making use of the Preview function (if it’s offered).

- If there's a description, go through it to learn the specifics.

- Click on Buy Now button if you found what you're trying to find.

- Choose your plan on the pricing page and create your account.

- Pick how you want to pay by a card or by PayPal.

- Save the file in the preferred file format.

Now you can print out the Illinois Dissolution Package to Dissolve Limited Liability Company LLC form or fill it out making use of any web-based editor. No need to worry about making typos because your sample may be utilized and sent away, and printed as often as you want. Try out US Legal Forms and access to more than 85,000 state-specific legal and tax files.

Dissolve Illinois Llc Form popularity

Dissolve Llc In Illinois Other Form Names

Dissociation Vs Dissolution Business Law FAQ

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

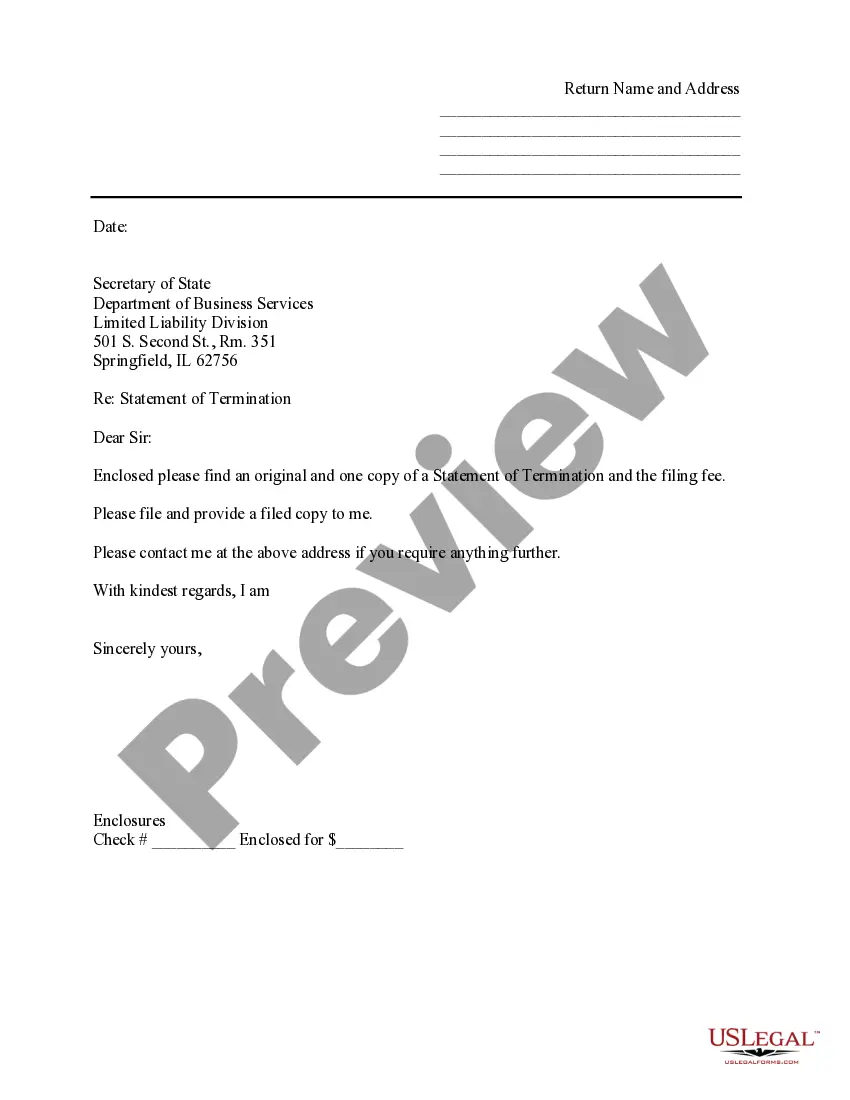

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

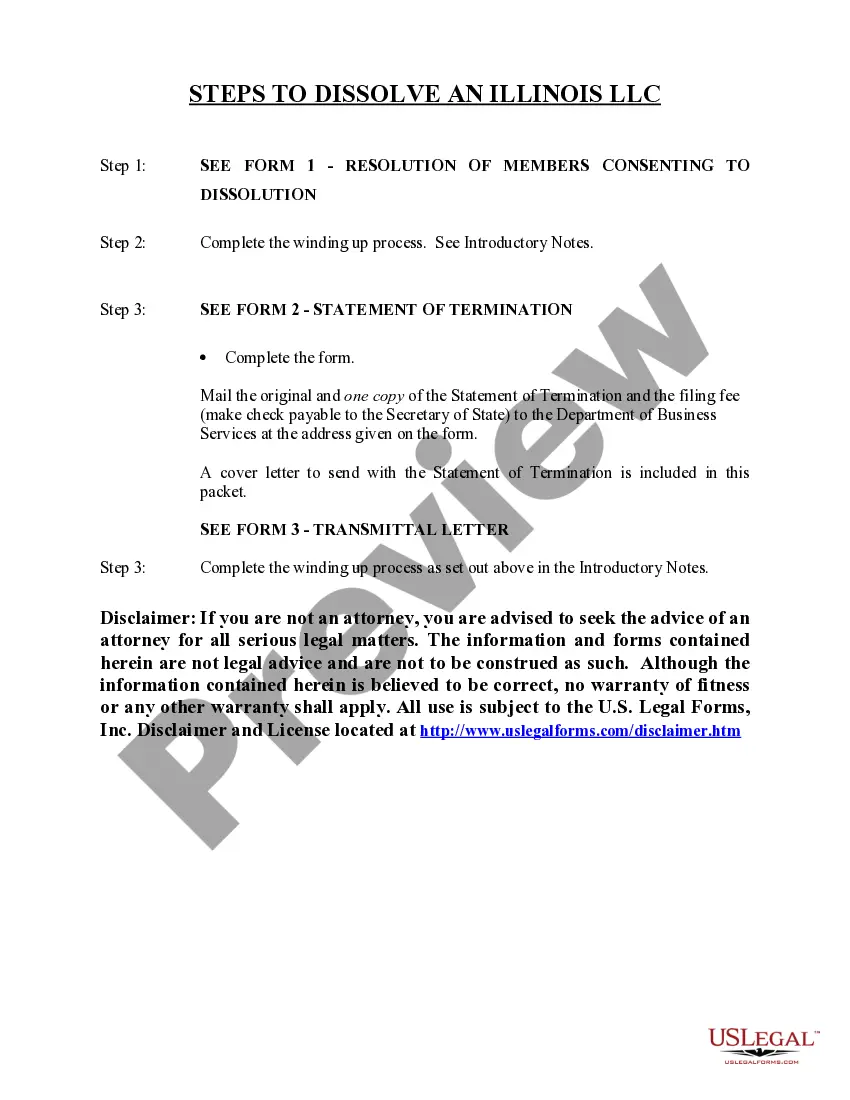

File the Articles of Dissolution with the Illinois Secretary of State. Fulfill all tax obligations with the state of Illinois, as well as with the IRS. Cancel any relevant licenses and permits, along with closing your business bank account. Notify customers, vendors, and creditors of your dissolution.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

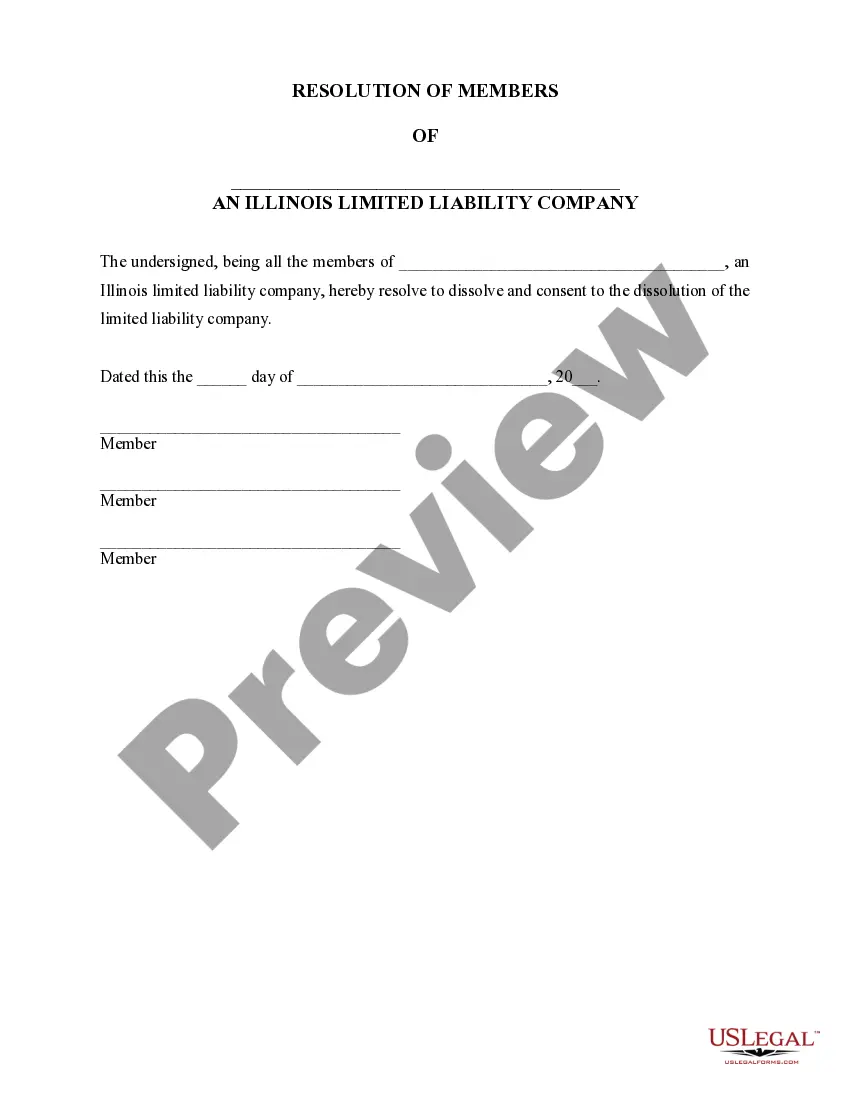

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.