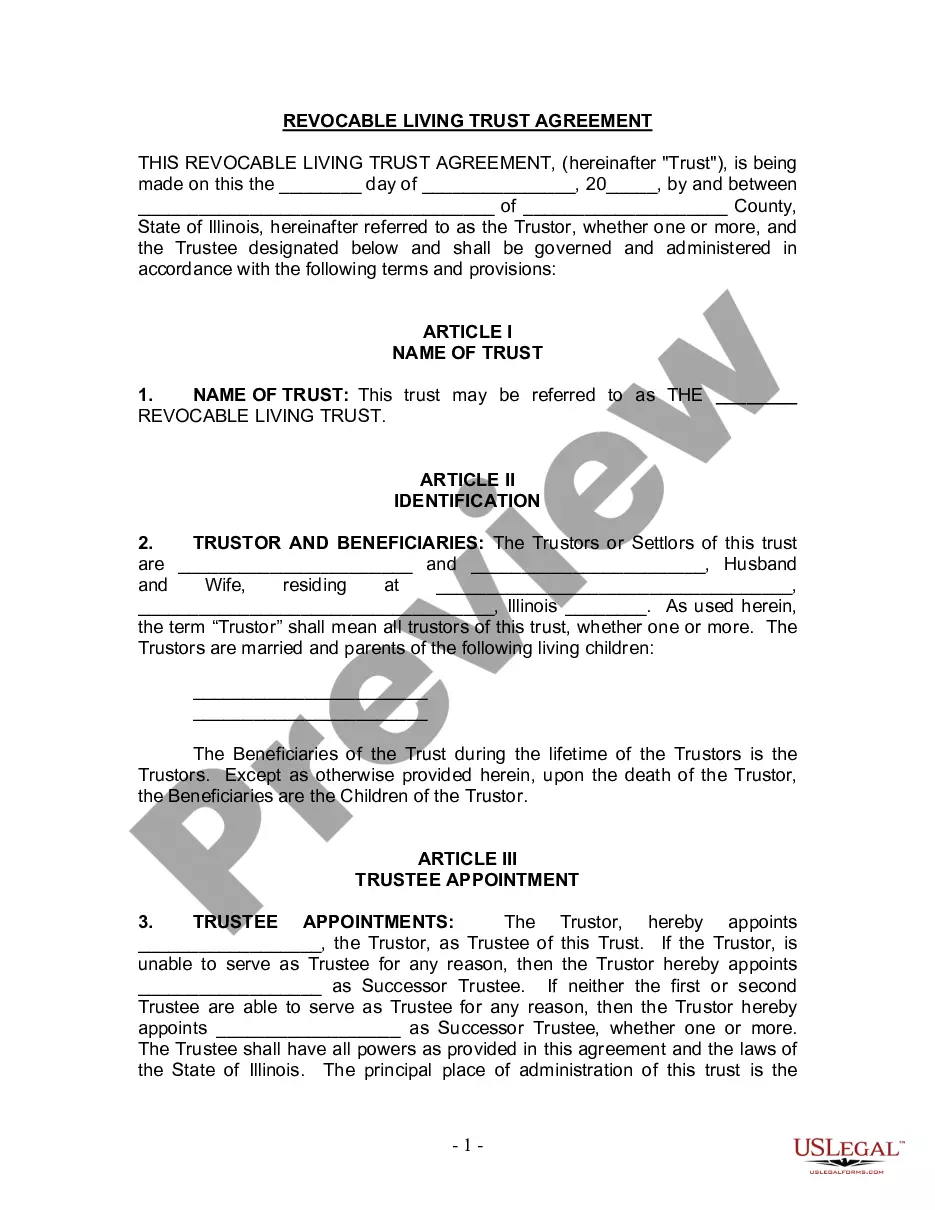

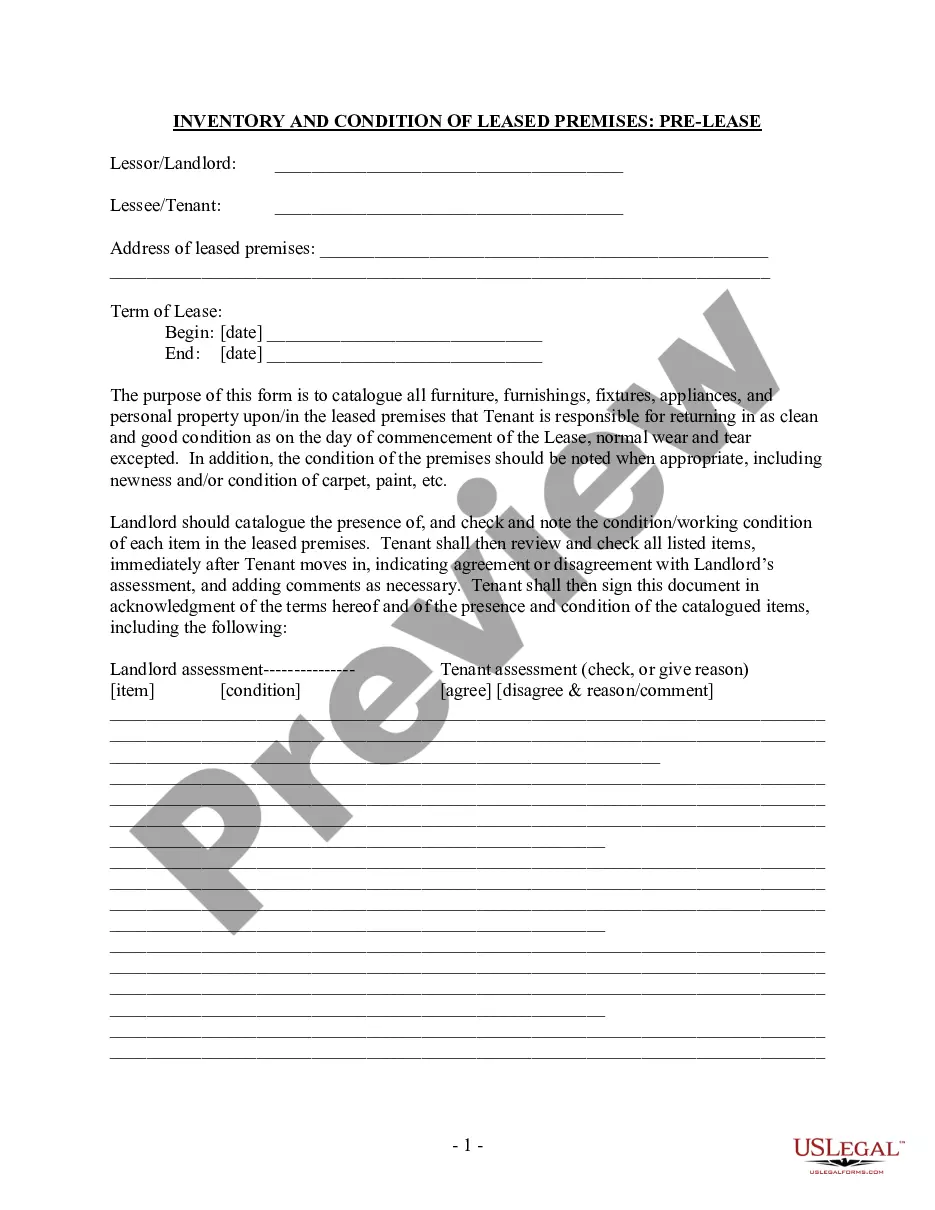

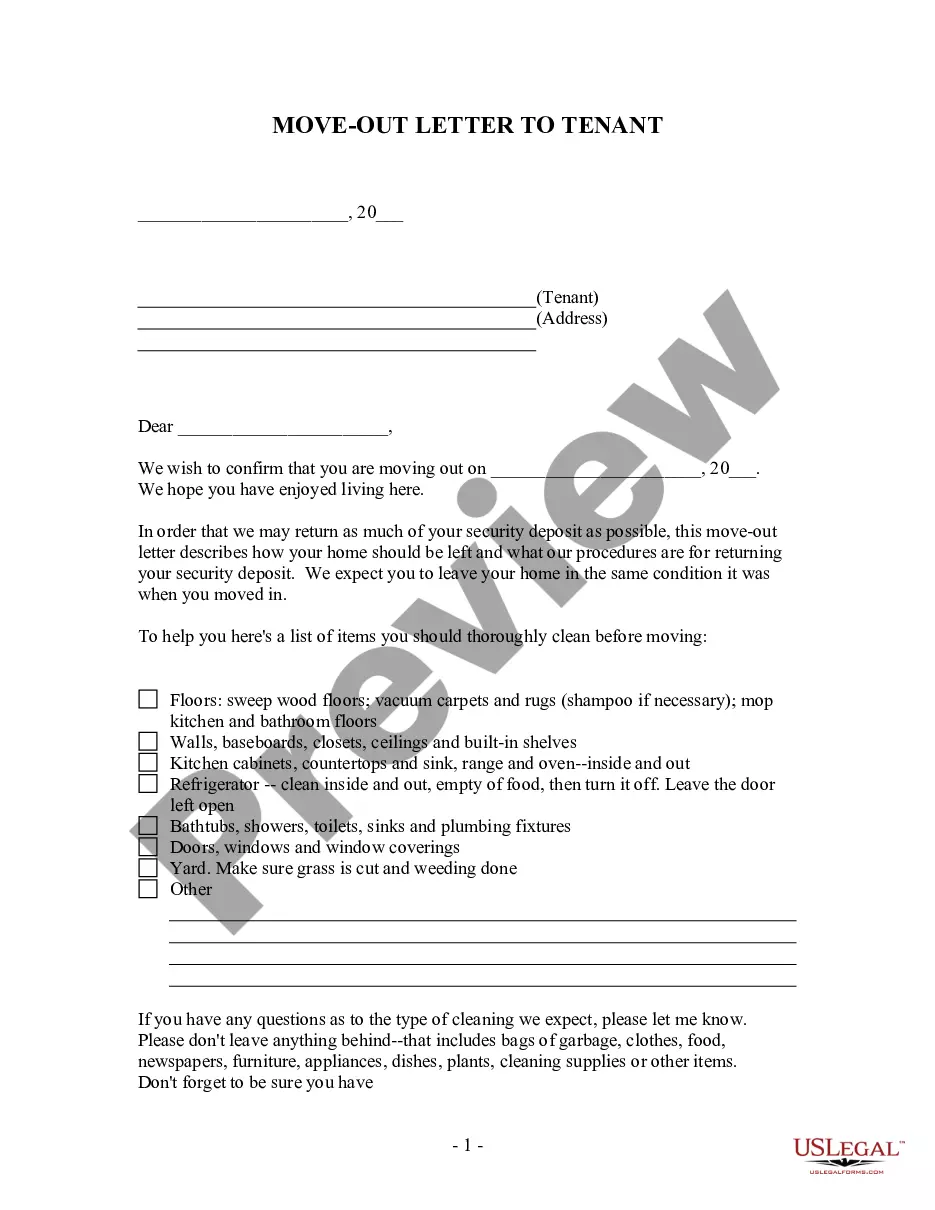

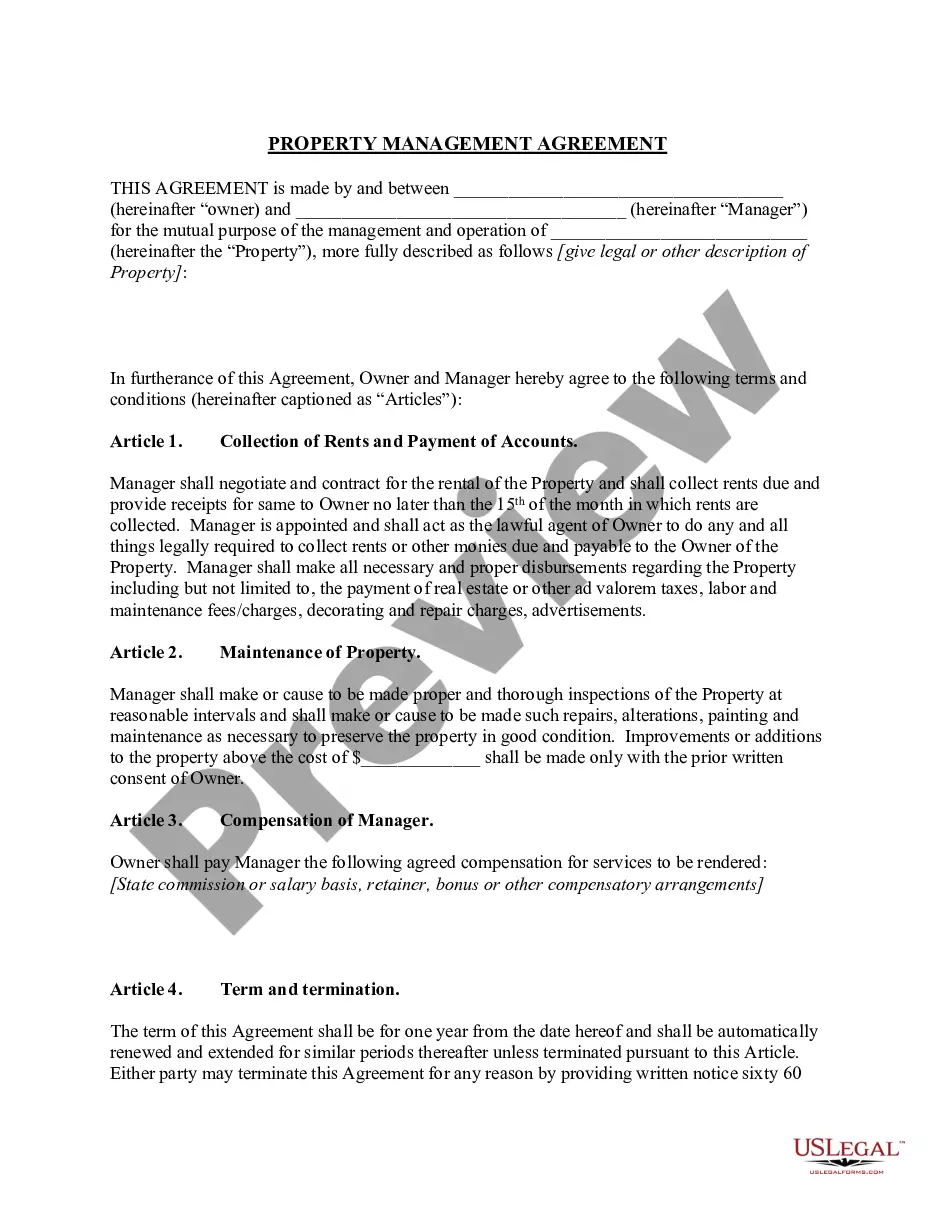

Illinois Living Trust for Husband and Wife with Minor and or Adult Children

Description Trust Adult Children

How to fill out Trust Minor Adult?

Looking for Illinois Living Trust for Husband and Wife with Minor and or Adult Children forms and filling out them might be a problem. To save time, costs and effort, use US Legal Forms and find the correct example specially for your state within a few clicks. Our attorneys draft all documents, so you simply need to fill them out. It truly is that simple.

Log in to your account and return to the form's web page and download the document. Your downloaded samples are stored in My Forms and they are accessible all the time for further use later. If you haven’t subscribed yet, you should register.

Check out our comprehensive guidelines on how to get the Illinois Living Trust for Husband and Wife with Minor and or Adult Children form in a few minutes:

- To get an eligible sample, check out its validity for your state.

- Take a look at the sample utilizing the Preview function (if it’s offered).

- If there's a description, go through it to understand the specifics.

- Click on Buy Now button if you identified what you're trying to find.

- Select your plan on the pricing page and create an account.

- Select you wish to pay out by a credit card or by PayPal.

- Download the file in the favored format.

You can print the Illinois Living Trust for Husband and Wife with Minor and or Adult Children template or fill it out making use of any web-based editor. No need to concern yourself with making typos because your form can be employed and sent away, and published as often as you wish. Check out US Legal Forms and access to above 85,000 state-specific legal and tax documents.

Trust Minor Children Form popularity

Il Living Trust Revocable Other Form Names

Illinois Living Minor FAQ

Basic revocable living Trusts may be included in a flat-fee estate planning package costing between $2,500 and $6,000. Revocable living Trusts help you bypass the costly and public probate process and can evolve into testamentary Trusts that allow you to control your assets long after you have departed this world.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

The national average cost for a living trust for an individual is $1,100-1,500 USD. The national average cost for a living trust for a married couple is $1,700-2,500 USD. Part of the reason for this range in prices is the range of services that are available from various estate planning attorneys.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

How Much Does a Living Trust Cost in California? A common question that people ask when they're considering if a living trust is right for their family is how much it costs. On average, a living trust costs between $1000 and $5000 to put together.

Single and Joint Revocable Living Trusts Trusts can be both single and joint.Joint trusts are particularly useful in community property states, such as Arizona, California, Nevada, Idaho, New Mexico, Louisiana, Texas, Washington, and Wisconsin.

Married couples should consider whether they live in a community property or a separate property state before deciding what type of trust to create. For many married couples, a basic joint living trust will meet their needs. Each person can act as both a grantor and a trustee of the trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Figure out which type of trust you need. Single people only have the option of a single trust. Take stock of your property. Pick a trustee. Create a trust document. Sign the trust document in the presence of a notary. Lastly, you'll need to fund your trust by moving your property into it.