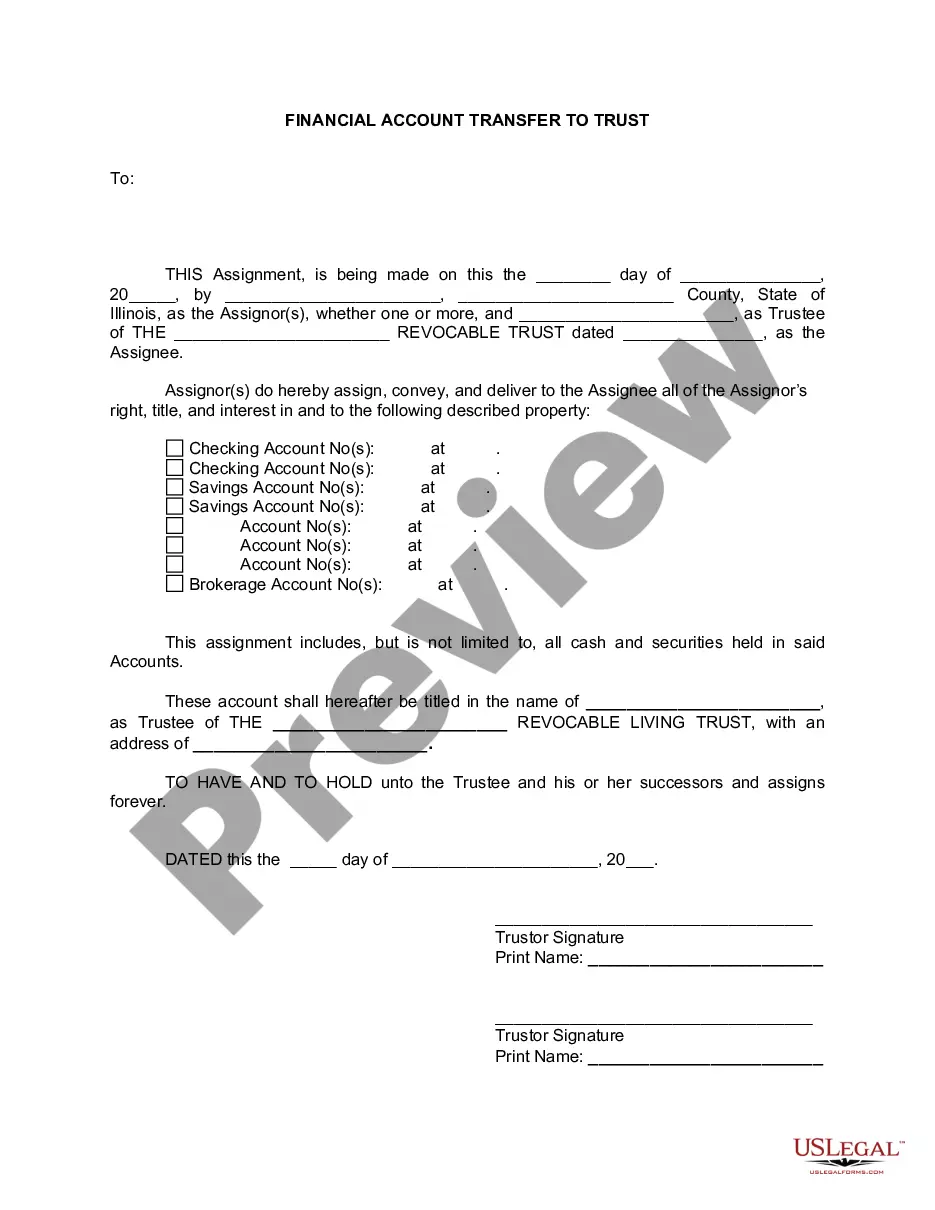

Illinois Financial Account Transfer to Living Trust

Description

How to fill out Illinois Financial Account Transfer To Living Trust?

Looking for Illinois Financial Account Transfer to Living Trust sample and completing them could be a problem. In order to save time, costs and energy, use US Legal Forms and find the appropriate template specially for your state in just a few clicks. Our lawyers draw up each and every document, so you simply need to fill them out. It really is so easy.

Log in to your account and come back to the form's web page and save the document. All of your saved templates are kept in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you should register.

Check out our thorough recommendations concerning how to get the Illinois Financial Account Transfer to Living Trust form in a few minutes:

- To get an qualified sample, check its validity for your state.

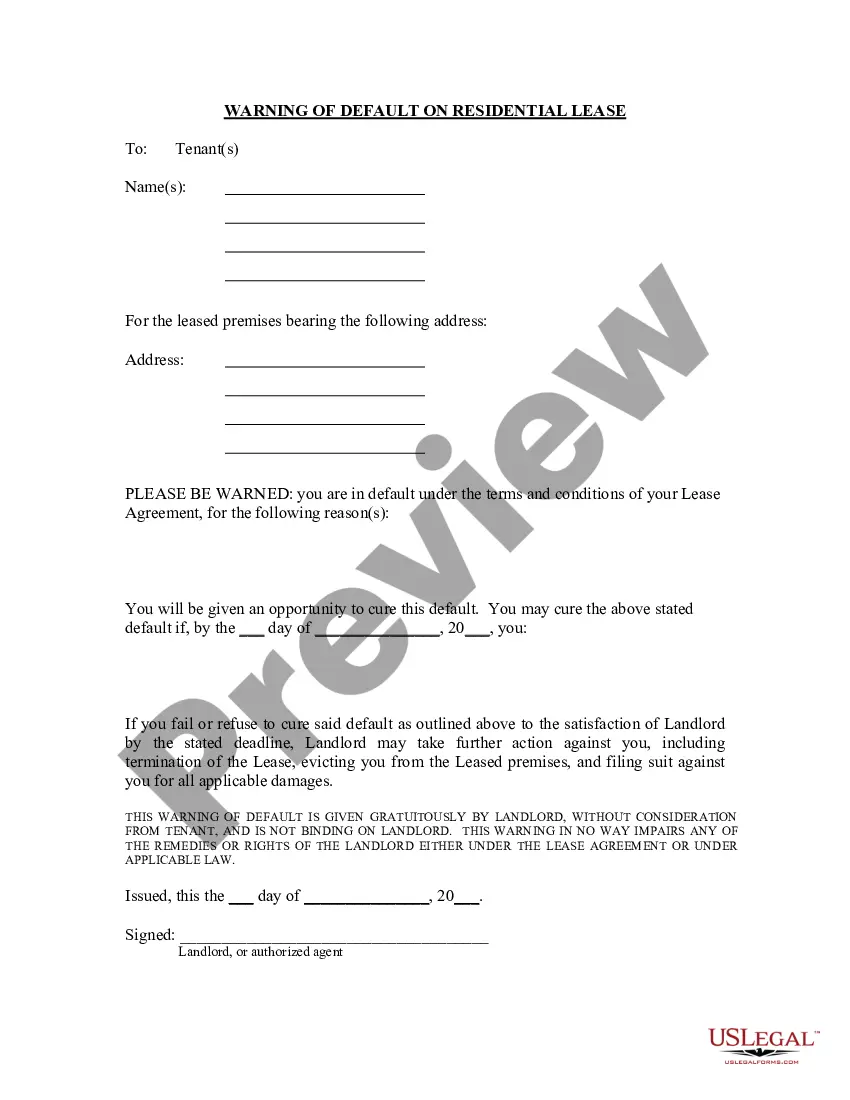

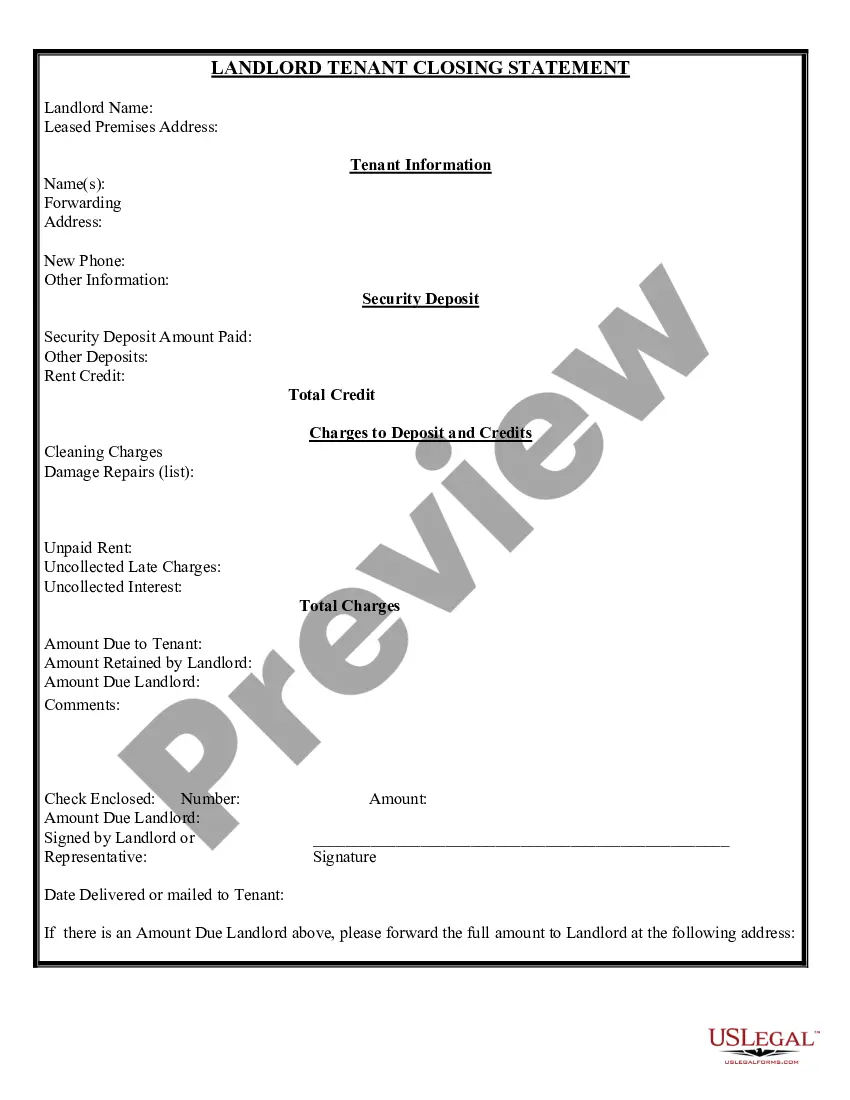

- Look at the sample utilizing the Preview option (if it’s available).

- If there's a description, read it to understand the specifics.

- Click on Buy Now button if you identified what you're searching for.

- Choose your plan on the pricing page and make an account.

- Pick how you wish to pay by a credit card or by PayPal.

- Save the file in the favored file format.

Now you can print the Illinois Financial Account Transfer to Living Trust template or fill it out using any web-based editor. Don’t worry about making typos because your sample may be utilized and sent away, and printed as many times as you want. Check out US Legal Forms and get access to over 85,000 state-specific legal and tax files.

Form popularity

FAQ

You can add property to your living trust at any time. And because you'll also be the trustee, you can always sell or give away property in the trust, or take it out of the living trust and put it back in your name as an individual. A living trust isn't the only way to save money on probate.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

To put checking or savings accounts into the trust, go down to your bank and fill out the institutional paperwork. You don't have to change the name on the checks. When you die, your successor trustee will assume control of the account and distribute the money to your heirs.

Lifetime Gift Tax Exemption The IRS allows you, as of 2014, to give up to $5.34 million in gifts or, after you die, bequests free of estate tax. This means you can put additional money into your irrevocable trust and, as long as you stay below your lifetime limit, it'll be a tax-free transfer.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.