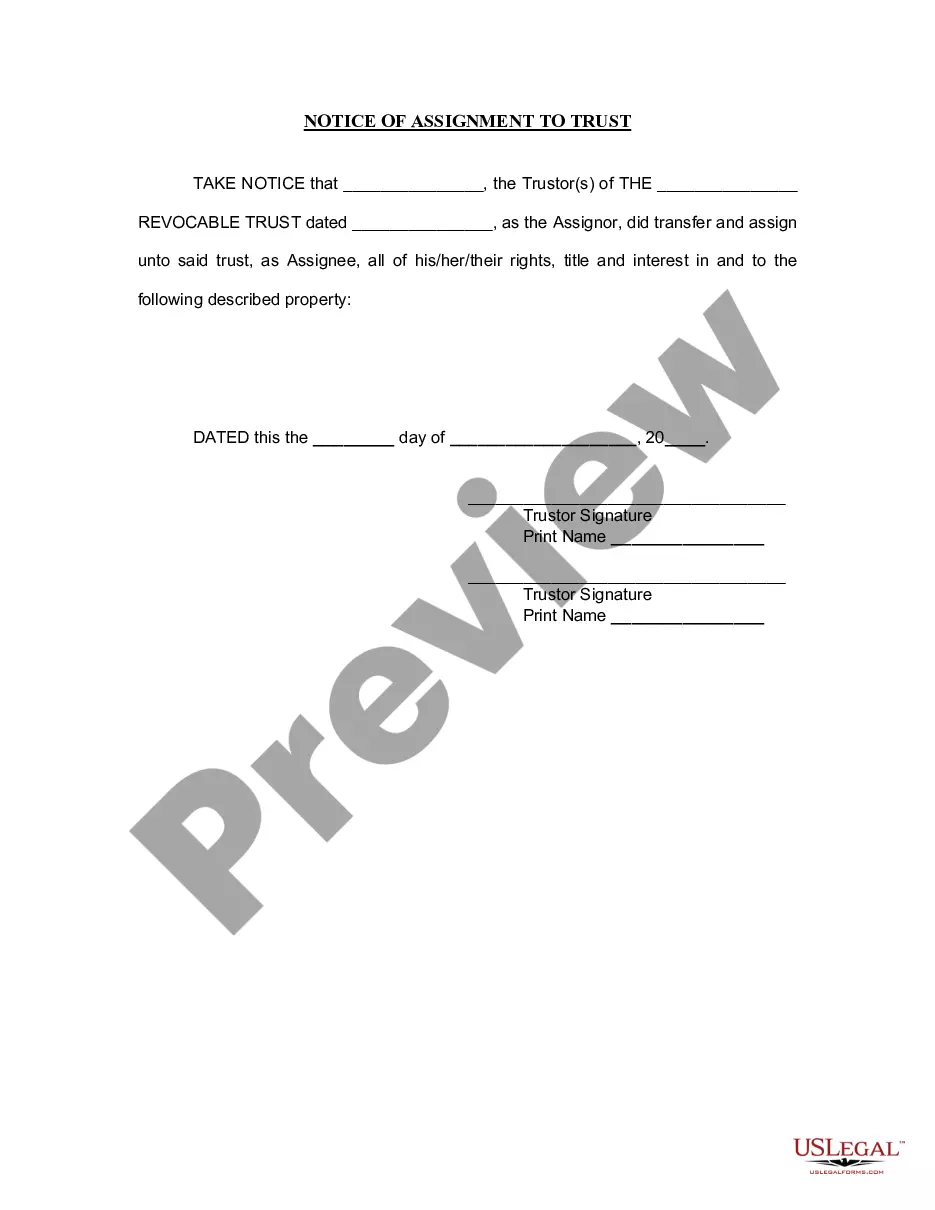

Illinois Notice of Assignment to Living Trust

Description Illinois Living Trust Sample

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Illinois Notice Of Assignment To Living Trust?

Trying to find Illinois Notice of Assignment to Living Trust sample and completing them can be quite a challenge. To save time, costs and energy, use US Legal Forms and find the correct example specially for your state within a couple of clicks. Our legal professionals draft each and every document, so you just need to fill them out. It really is so simple.

Log in to your account and come back to the form's web page and save the sample. All your saved templates are kept in My Forms and they are available always for further use later. If you haven’t subscribed yet, you need to register.

Look at our thorough guidelines on how to get the Illinois Notice of Assignment to Living Trust template in a few minutes:

- To get an eligible sample, check its applicability for your state.

- Take a look at the form utilizing the Preview function (if it’s available).

- If there's a description, read it to learn the specifics.

- Click Buy Now if you identified what you're looking for.

- Choose your plan on the pricing page and create your account.

- Select you wish to pay by way of a card or by PayPal.

- Save the form in the preferred file format.

You can print the Illinois Notice of Assignment to Living Trust form or fill it out using any web-based editor. Don’t concern yourself with making typos because your form can be utilized and sent, and printed out as many times as you want. Check out US Legal Forms and access to around 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

To transfer real estate (also called real property) into your living trust, you must prepare and sign a new deed, transferring ownership. You can usually fill out a new deed yourself.

A trust can be contested for many of the same reasons as a will, including lack of testamentary capacity, undue influence, or lack of requisite formalities. The beneficiaries may also challenge the trustee's actions as violating the terms and purpose of the trust.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

Of the trust's existence, the beneficiary's right to request a copy of the trust agreement and right to an account (within 90 days of the trust becoming irrevocable or a change in trusteeship) when a trust becomes irrevocable (within 90 days of the event) appointment of a new trustee (within 90 days of acceptance)

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Updating a beneficiary designation: It supersedes your Will or Trust. The beneficiary designation is a legally binding document that supersedes your Will or Trust; neither will override the person you have named as your beneficiary in a life insurance policy, annuity or retirement account.

Unlike a will, the contents of a living trust are not a matter of public record. Like most court records, probate files are open to the public.

Does a Beneficiary Have the Right to See the Trust? The California Probate Law section 16061.7 provides for the beneficiaries right to see the trust. Trustees should furnish beneficiaries and heirs with copies of the trust document.