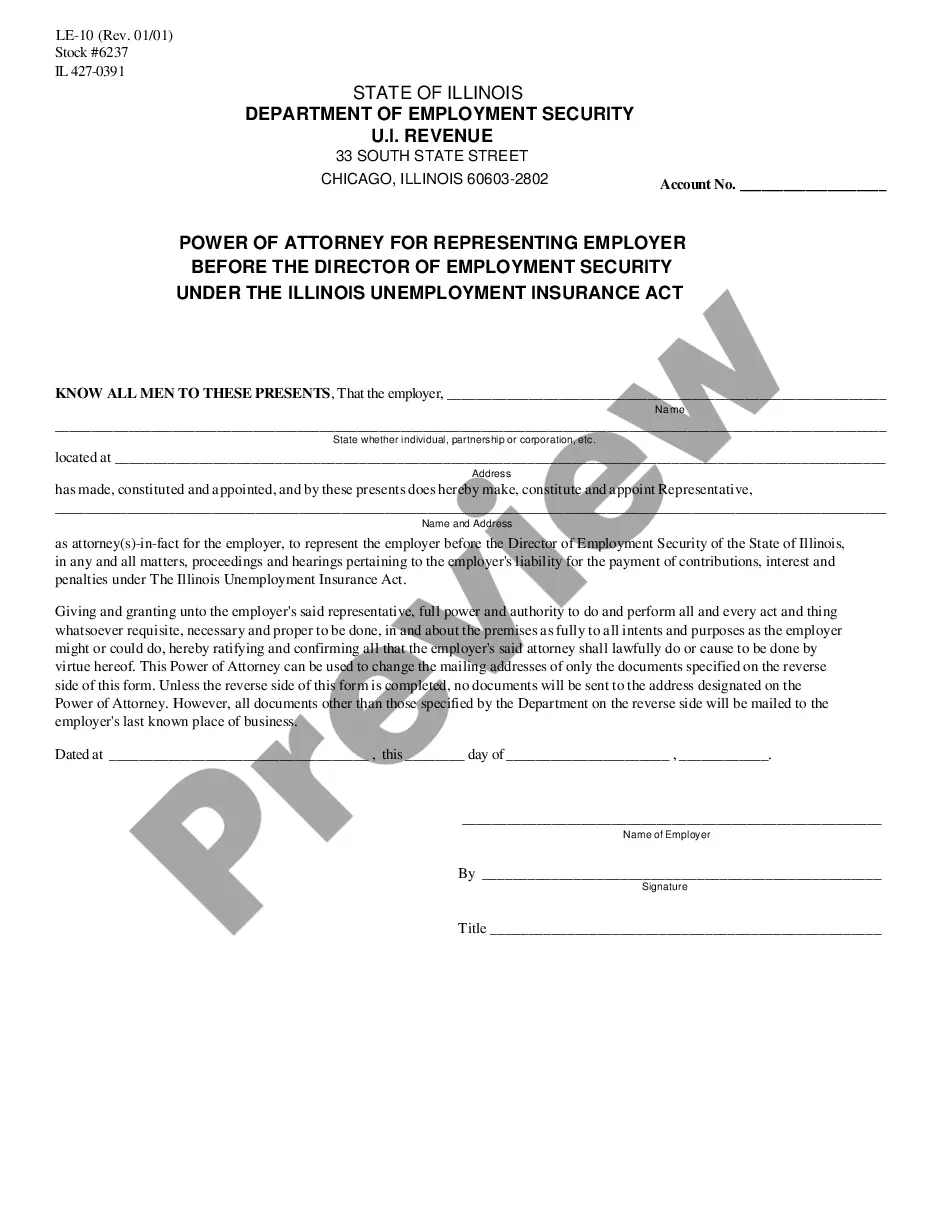

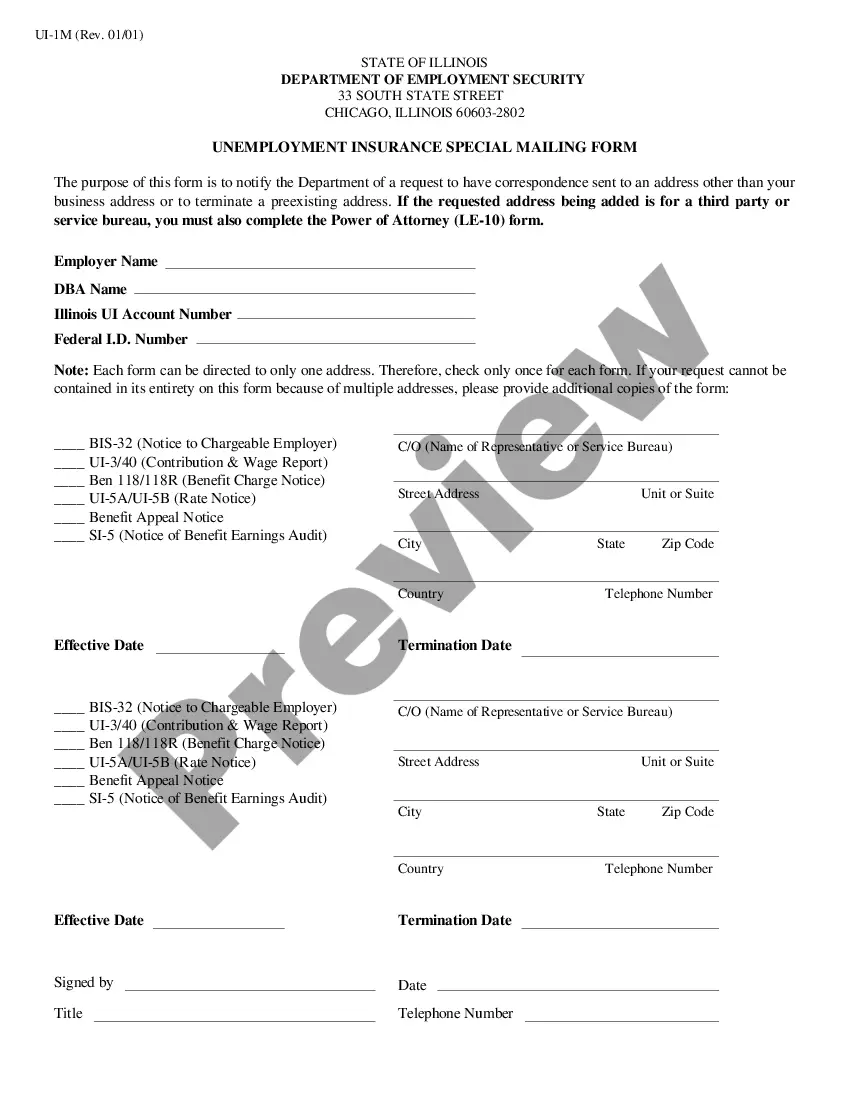

Power of Attorney and designation of representative for UI filing and correspondence

Power of Attorney for Representing Employer Before the Director of Employment Security Under the Illinois

Description Power Of Attorney Form Illinois

How to fill out Power Of Attorney For Representing Employer Before The Director Of Employment Security Under The Illinois?

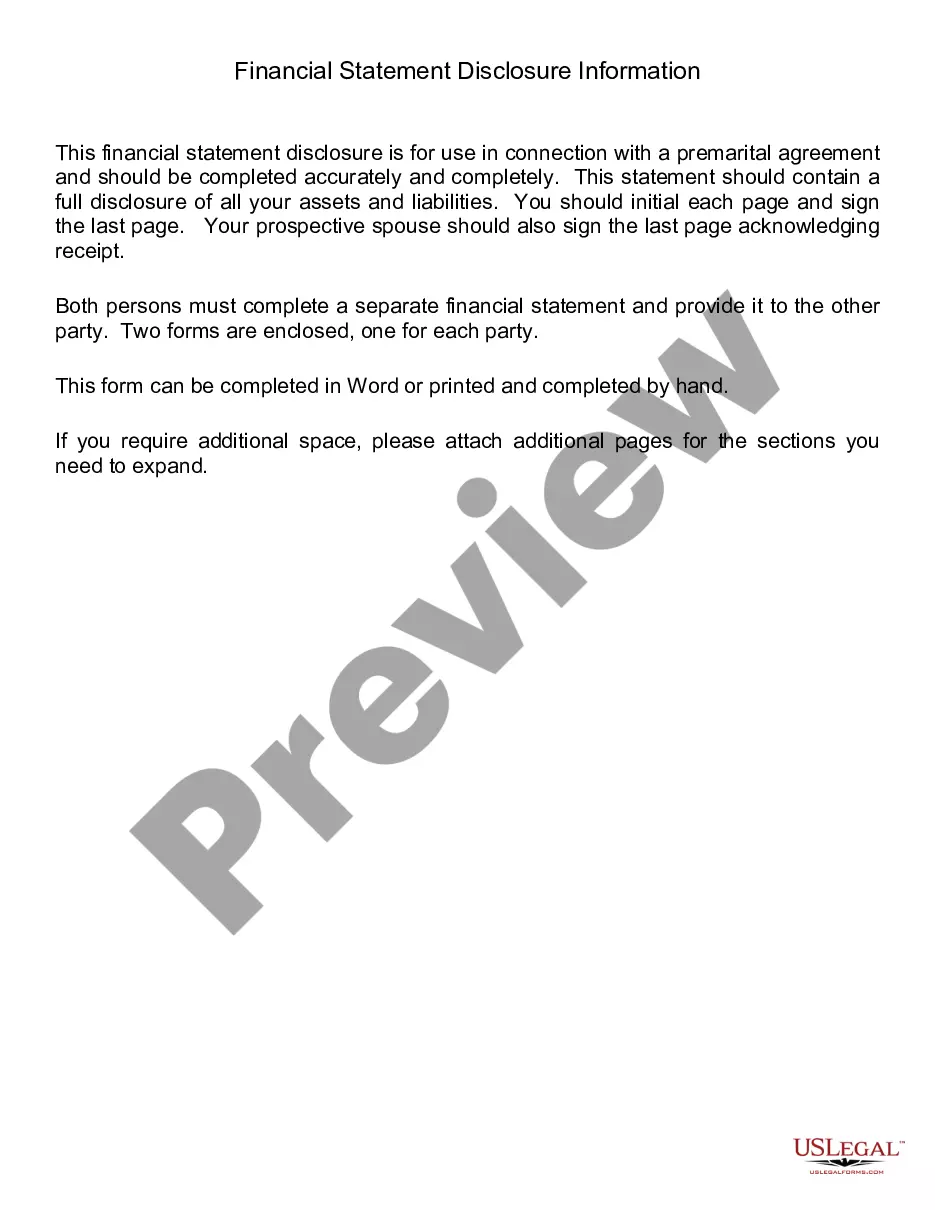

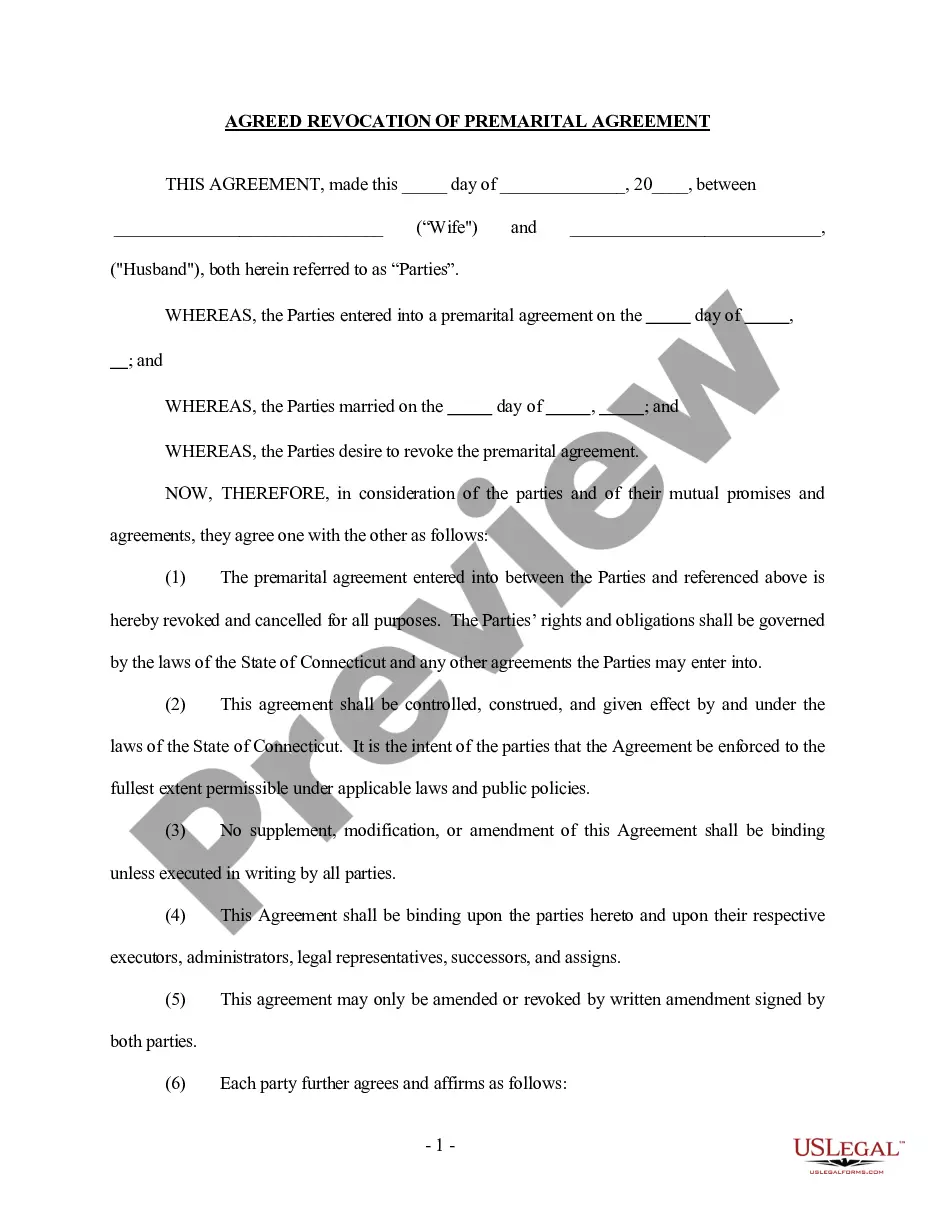

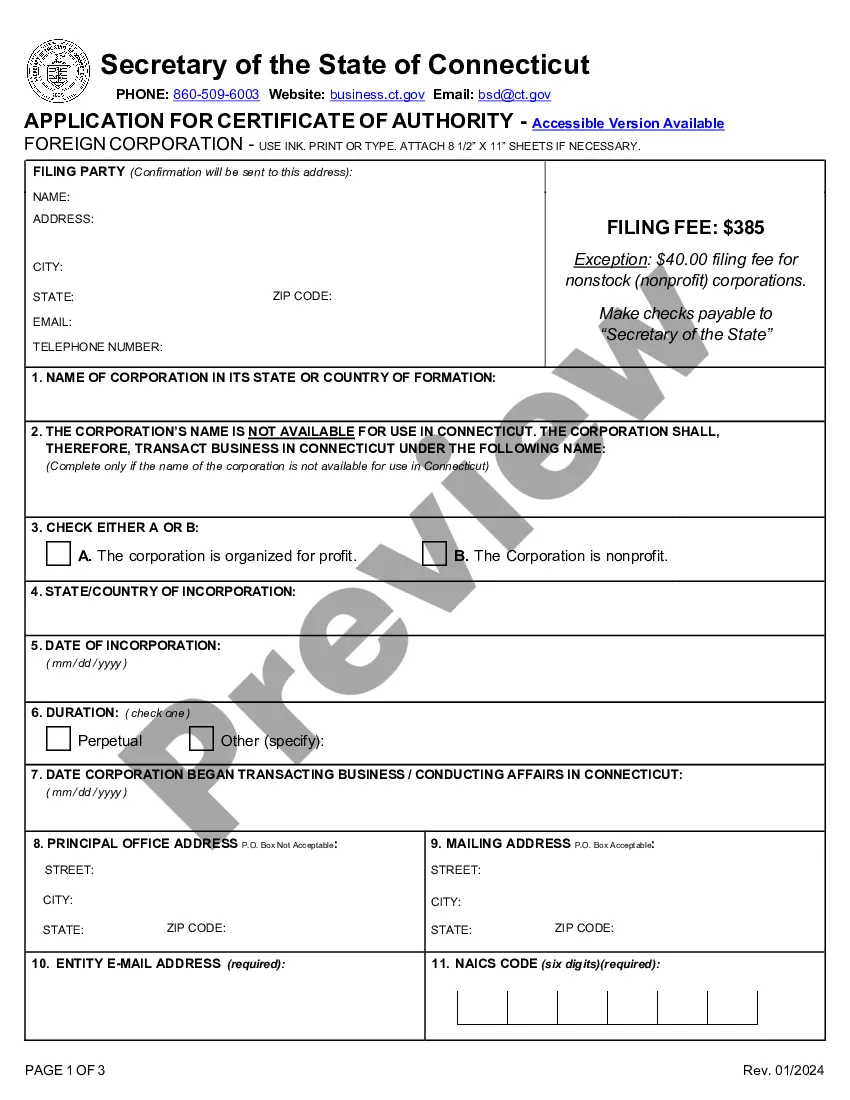

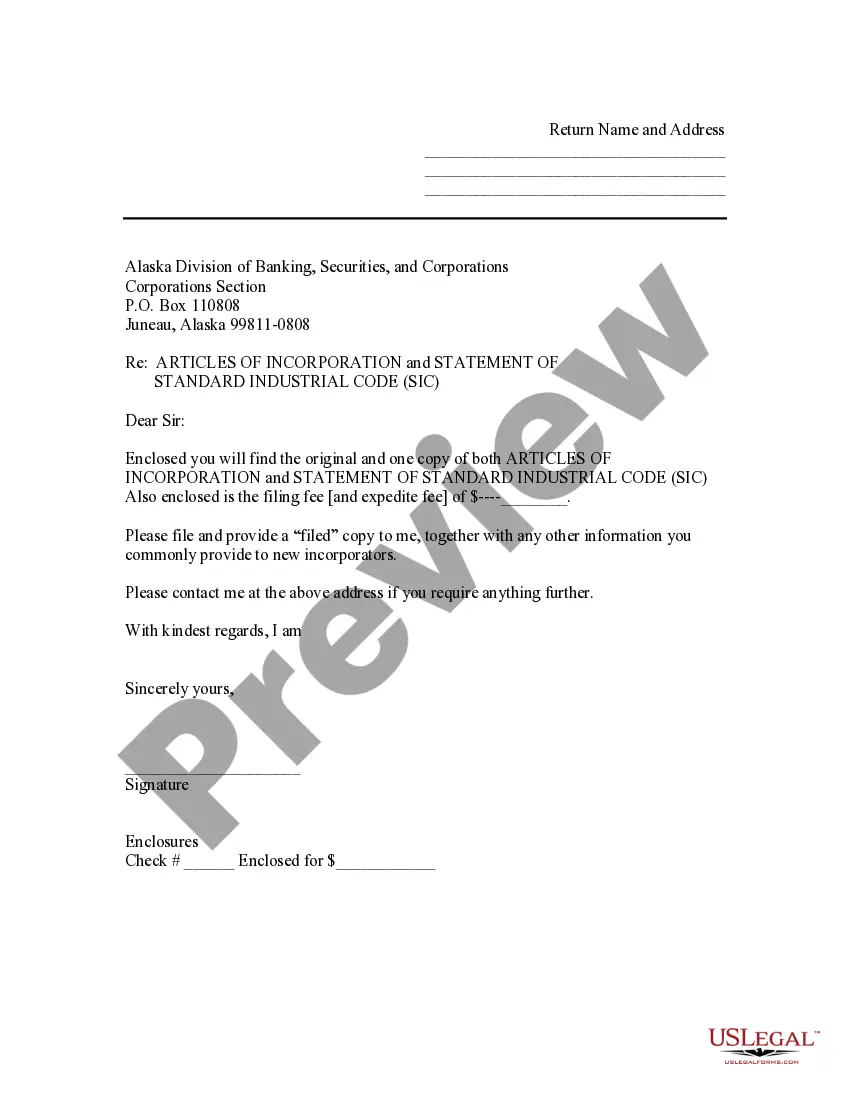

Searching for Power of Attorney for Representing Employer Before the Director of Employment Security Under the Illinois templates and filling out them might be a challenge. To save time, costs and energy, use US Legal Forms and find the right sample specially for your state in just a few clicks. Our lawyers draft each and every document, so you just need to fill them out. It is really so simple.

Log in to your account and come back to the form's web page and download the sample. All of your saved examples are stored in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you need to sign up.

Look at our thorough recommendations concerning how to get your Power of Attorney for Representing Employer Before the Director of Employment Security Under the Illinois sample in a few minutes:

- To get an entitled form, check its validity for your state.

- Take a look at the form making use of the Preview function (if it’s accessible).

- If there's a description, read it to understand the specifics.

- Click Buy Now if you identified what you're searching for.

- Select your plan on the pricing page and make your account.

- Pick how you would like to pay with a card or by PayPal.

- Download the form in the preferred file format.

Now you can print out the Power of Attorney for Representing Employer Before the Director of Employment Security Under the Illinois form or fill it out making use of any web-based editor. Don’t worry about making typos because your sample can be used and sent away, and published as many times as you would like. Try out US Legal Forms and get access to around 85,000 state-specific legal and tax files.

Power Of Attorney In Illinois Form popularity

Le 10 Illinois Other Form Names

FAQ

Unemployment Benefits for Railroad Employees. Instructions for Completing Claim for unemployment Benefits (Form (UI-3)

The minimum contribution rate for 2019 is 0.475% (0% plus the 0.475% Fund Building Rate). The maximum contribution rate for 2019 is 6.875% (6.400% plus the 0.475% Fund Building Rate).

Illinois Unemployment Claims customer service phone number is 1-800-244-5631. Live customer service representatives from Illinois Unemployment Claims are available from am to 5pm Monday-Friday, Saturday-Sunday closed. For individuals who have been scheduled for an Appeal hearing you need to dial 1-800-244-5631.

The percentage that an employer pays is dependent on the number employees who claim and receive unemployment benefits from the State of Illinois as a result of being terminated from your business. As the amount of the benefits increase the employer's variable rate will also increase..

The Illinois unemployment-taxable wage base is to be $12,960 for 2021, up from $12,740 for 2020, the state department of Employment Security said Nov. 30.

If you have questions about Unemployment Insurance, please call our Customer Service Center at 800-244-5631. Individuals with a hearing impairment who would like to speak with someone in the Claimant Services Center should dial 711 for the Illinois Relay System.

Step 1: Collect your 1040 tax forms for the 2019 tax year. NOTE: If you do not upload your tax form on the day that you file, then you are required do so within 21 days of the date of filing. Step 2: File a PUA Claim. Step 3: Review your claim before submitting it.

Filing Reports - The Employer's Contribution and Wage Report, IDES Form UI-3/40, must be filed quarterly by each employer subject to the Illinois Unemployment Insurance Act.Change in Status - Check this box to indicate that you no longer have workers in Illinois and want your account terminated.

Within 7-10 days of filing your claim, you will receive a blank debit card and a UI Finding in the mail. The UI Finding will tell you whether you are monetarily eligible for benefits, meaning you have earned sufficient wages in your base period.