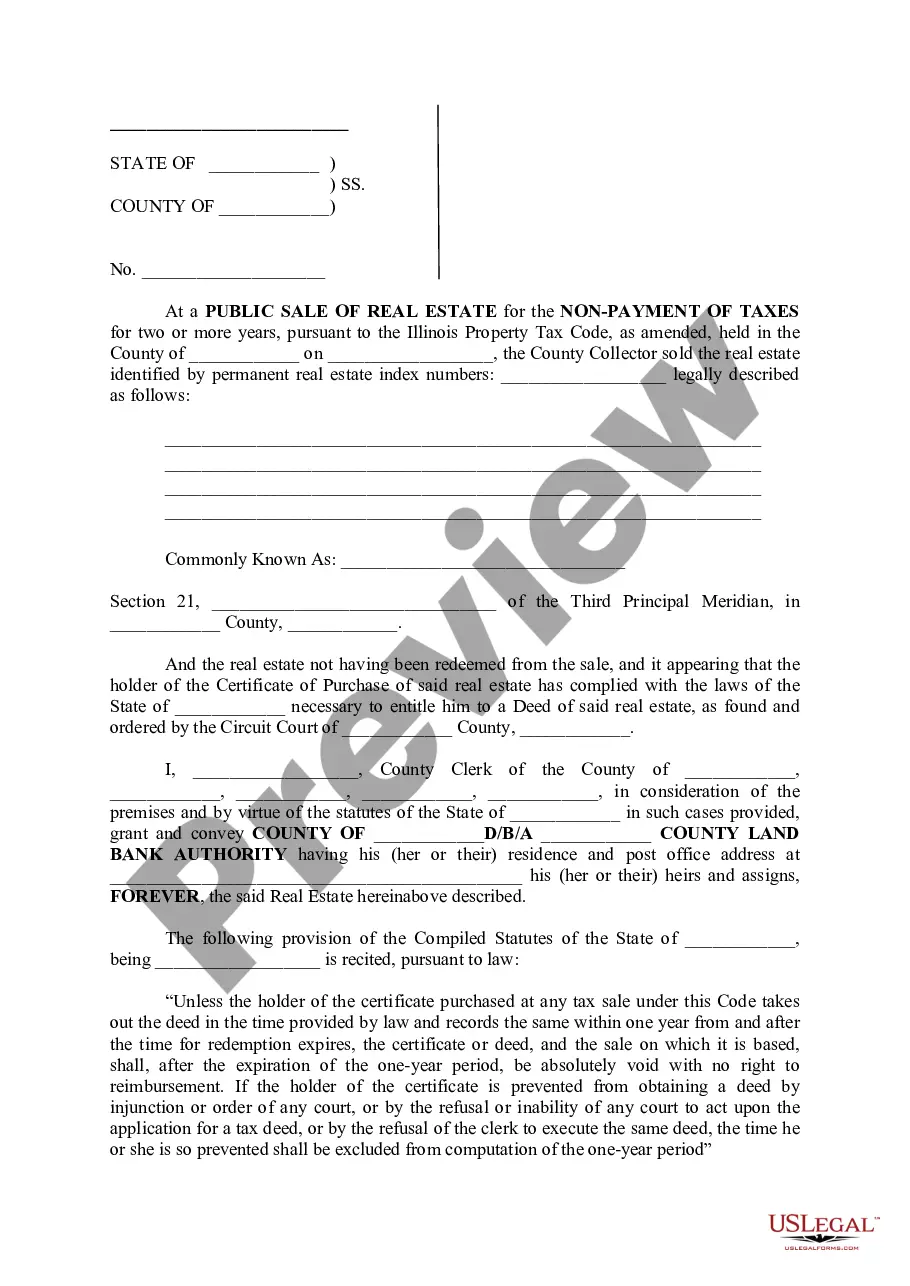

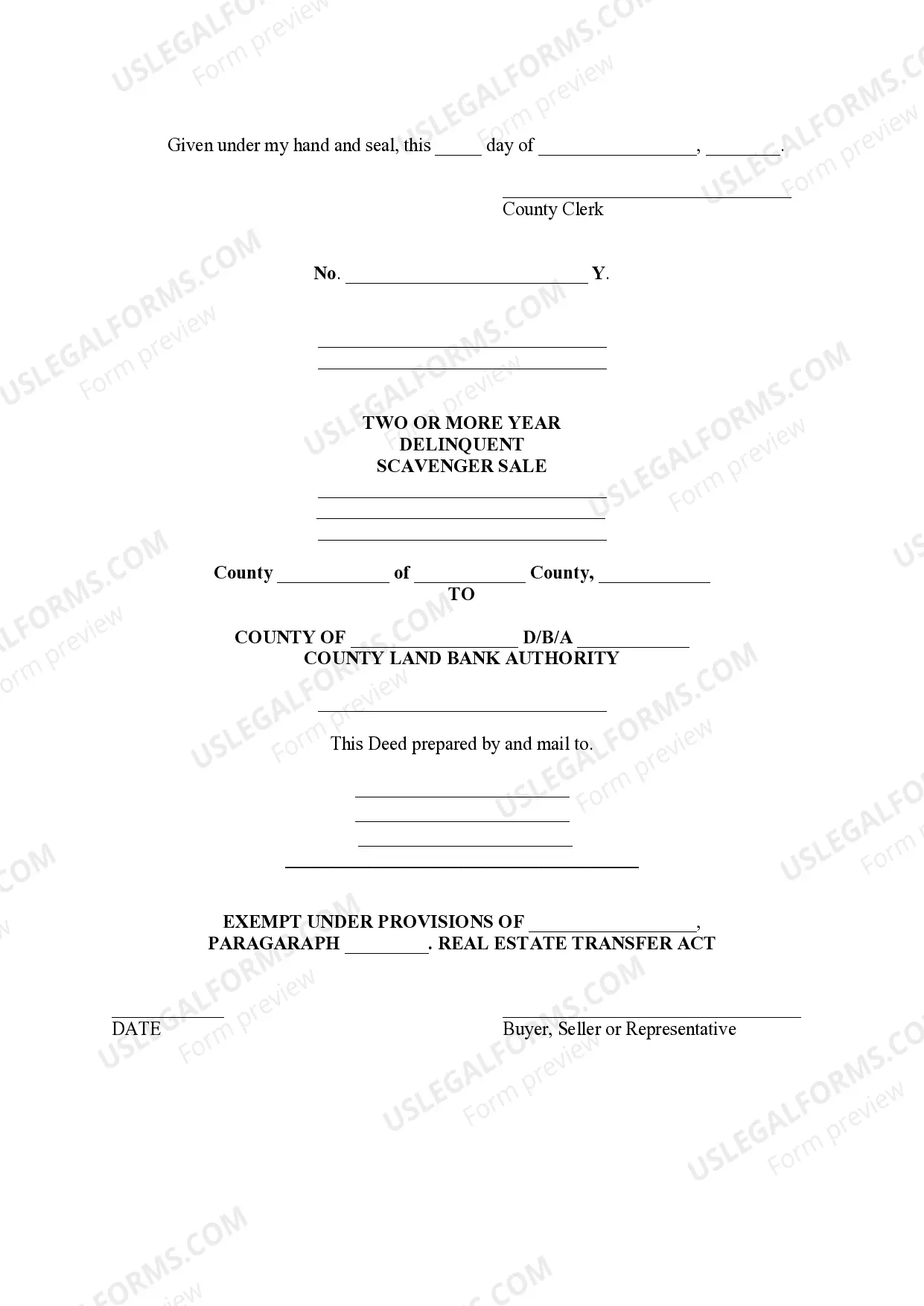

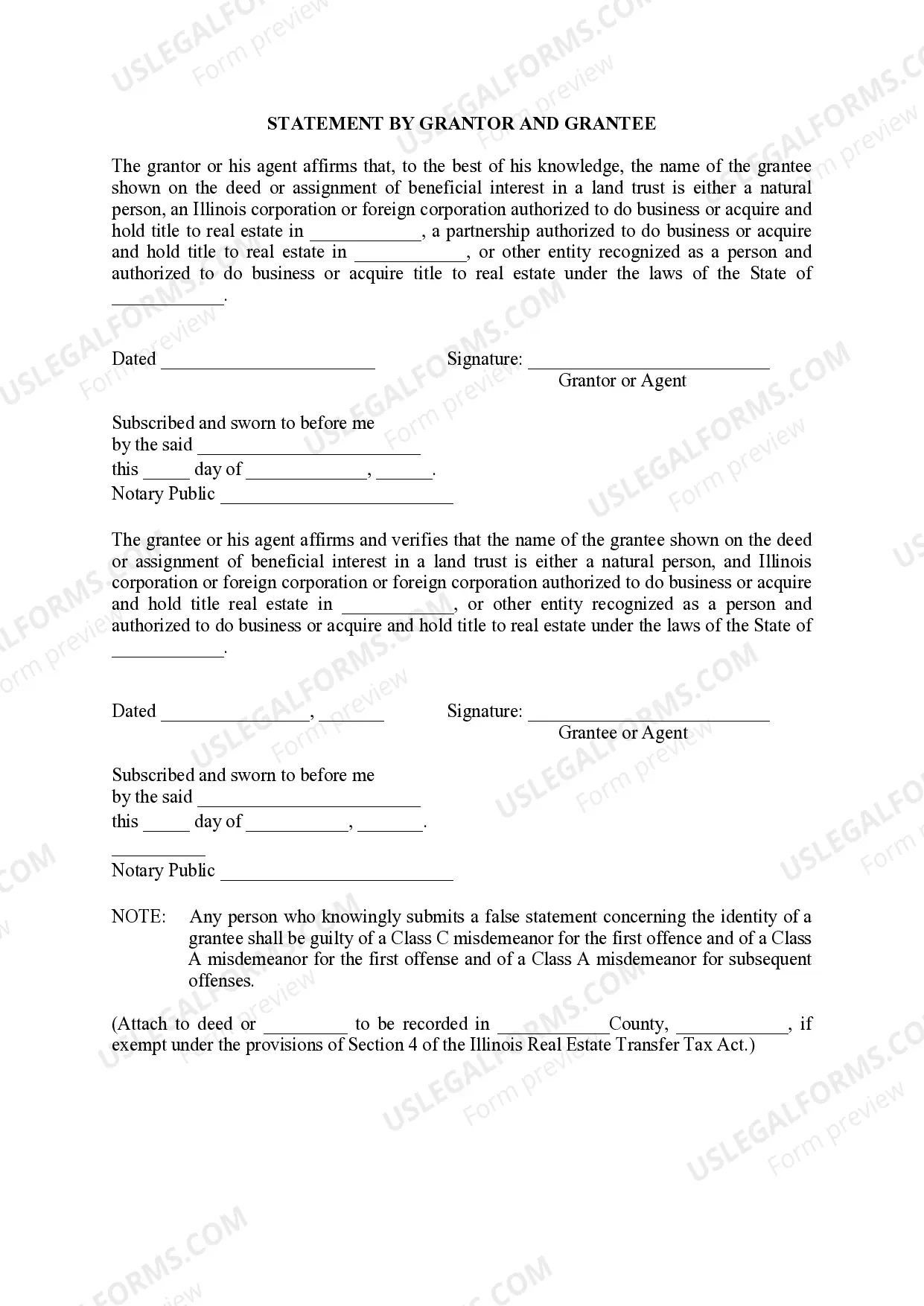

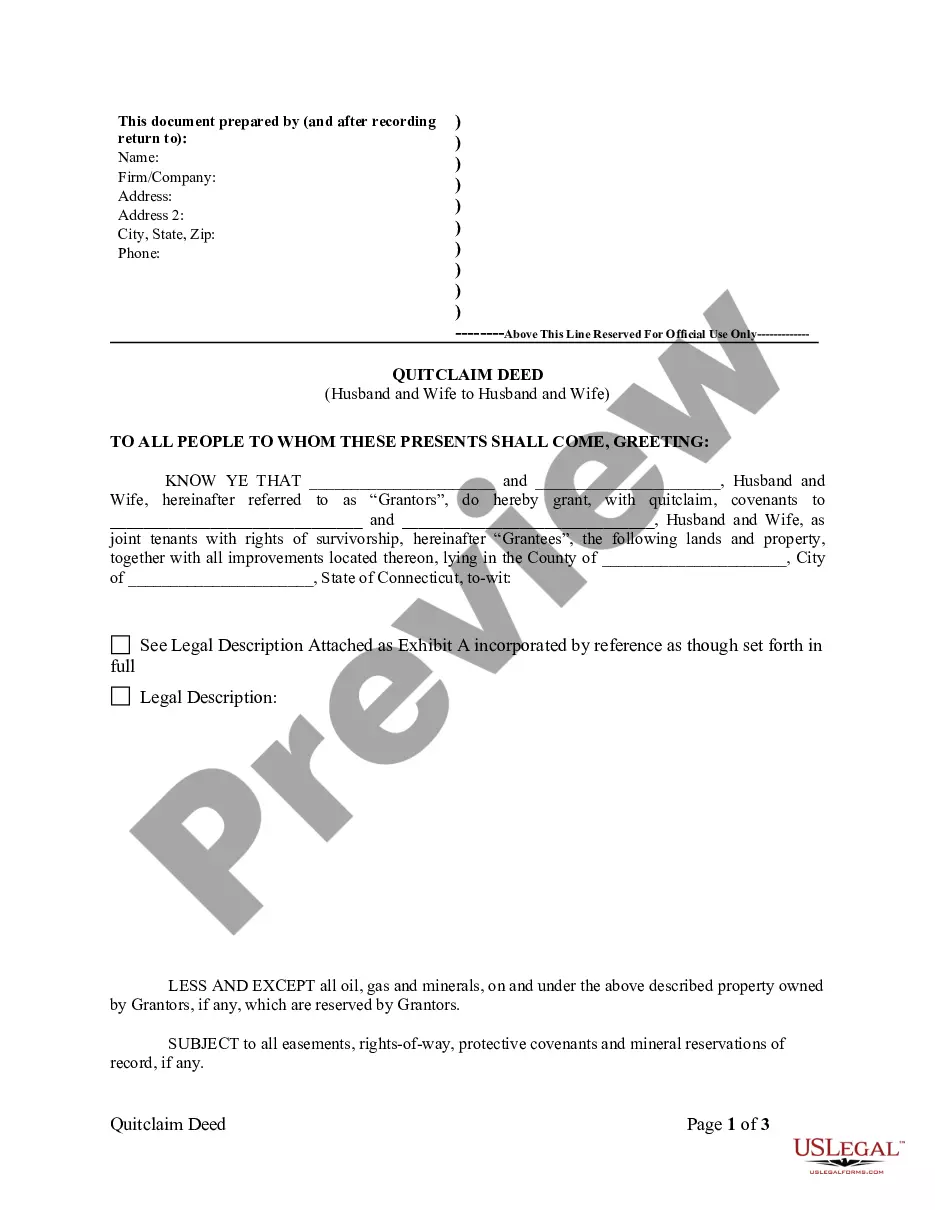

Illinois Public Sale of Real Estate for the Non - Payment of Taxes

Description

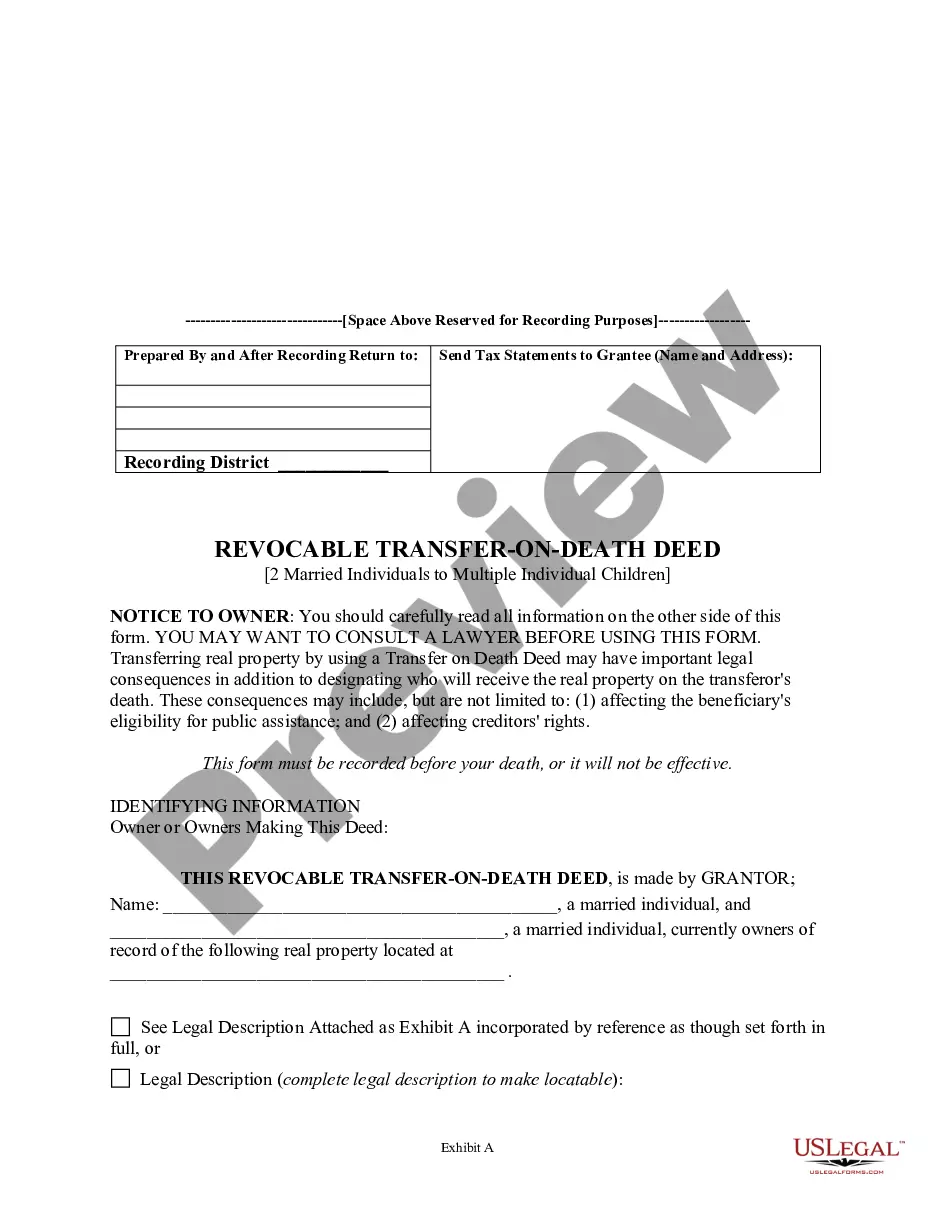

How to fill out Illinois Public Sale Of Real Estate For The Non - Payment Of Taxes?

Use US Legal Forms to obtain a printable Illinois Public Sale of Real Estate for the Non – Payment of Taxes. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue on the web and offers reasonably priced and accurate templates for customers and legal professionals, and SMBs. The documents are categorized into state-based categories and many of them might be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to quickly find and download Illinois Public Sale of Real Estate for the Non – Payment of Taxes:

- Check out to ensure that you have the correct form in relation to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Hit Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Make use of the Search field if you want to get another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Illinois Public Sale of Real Estate for the Non – Payment of Taxes. Over three million users have already used our platform successfully. Choose your subscription plan and have high-quality forms in just a few clicks.

Form popularity

FAQ

Property taxes are real estate taxes calculated by local governments and paid by homeowners.You will never be free from property taxes while you own your home, but there are a few simple tricks you can use to lower your property tax bill.

Even if your property taxes are sold, you remain the property owner subject to the discussion below. You must redeem, or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax sale. If you do not, the tax buyer can ask the court for a tax deed .

If after the said 36 months you still fail to pay your annual RPT, and the maximum interest of 72 percent had accrued on top of it, then per Section 258: real property subject to such tax may be levied upon through the issuance of a warrant on or before, or simultaneously with, the institution of the civil action for

If you fall behind in making the property tax payments for your home, you might end up losing the place. The taxing authority could sell your home, perhaps through a foreclosure process, to satisfy the debt. Or the taxing authority might sell the tax lien that it holds, and the purchaser might be able to foreclose.

At the sale, the purchaser effectively buys the existing tax lien and gets a certificate, which acts as evidence of the purchaser's interest in the property. If you don't redeem the home after the sale within the allotted time (see below), the purchaser can petition the court for a tax deed to your home.

This process is called redeeming the property. Under Illinois law, the redemption period is typically two years and six months, although the time frame might be different depending on your particular circumstances.

When homeowners fail to pay their property taxes, some tax jurisdictions choose to hold tax deed home sales to make back the money they are owed. Interested buyers can register to participate as a bidder on these homes in a tax deed auction.