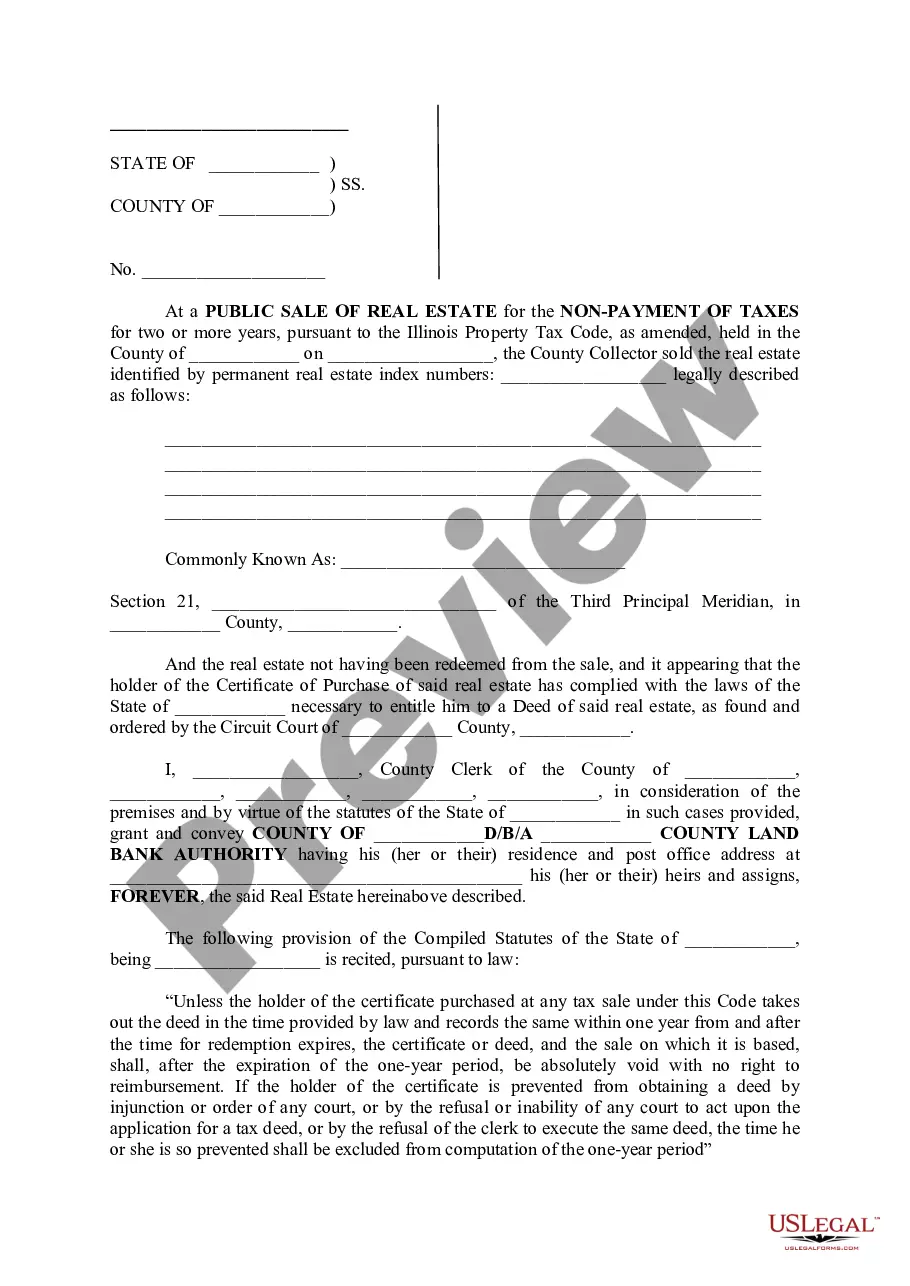

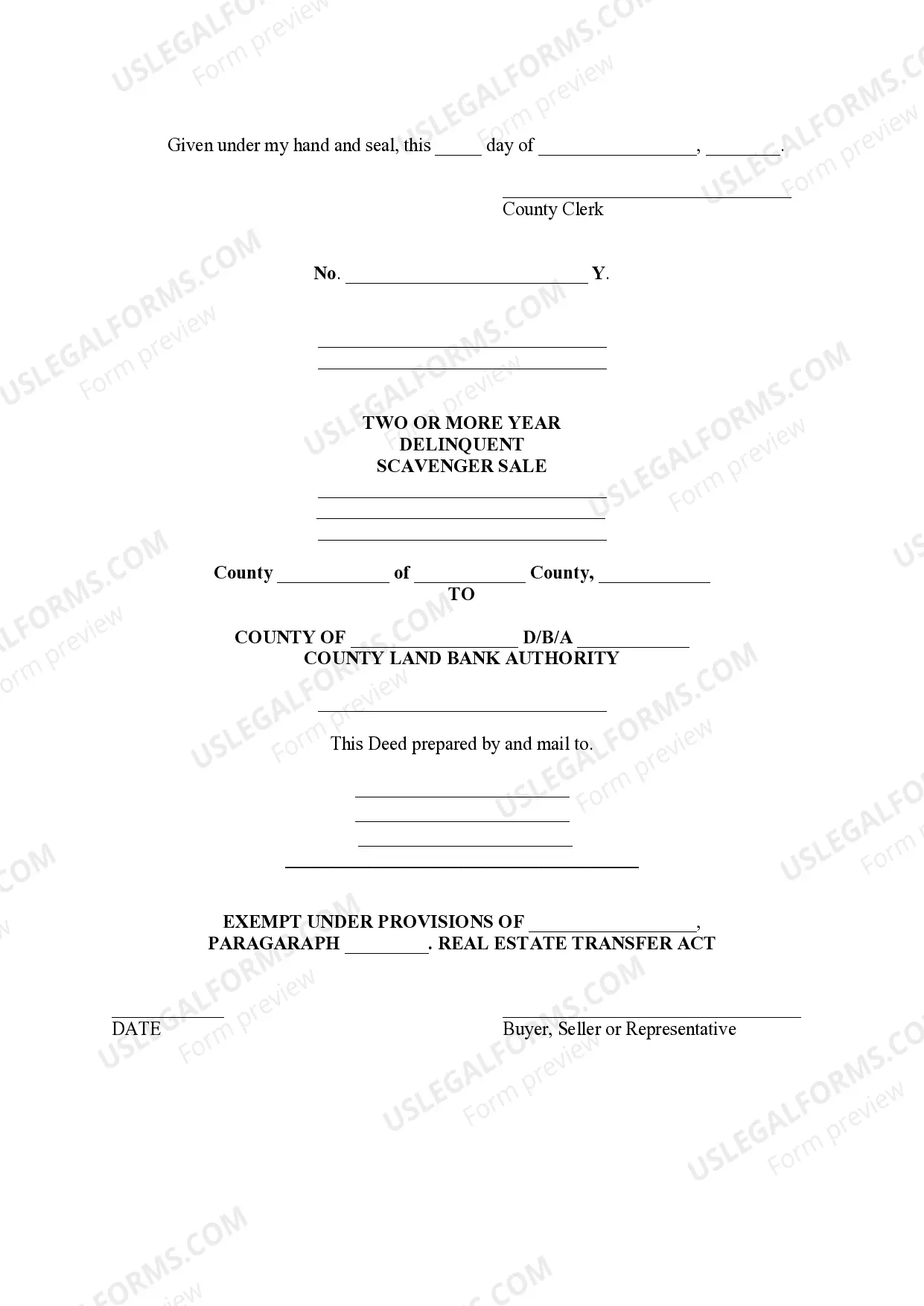

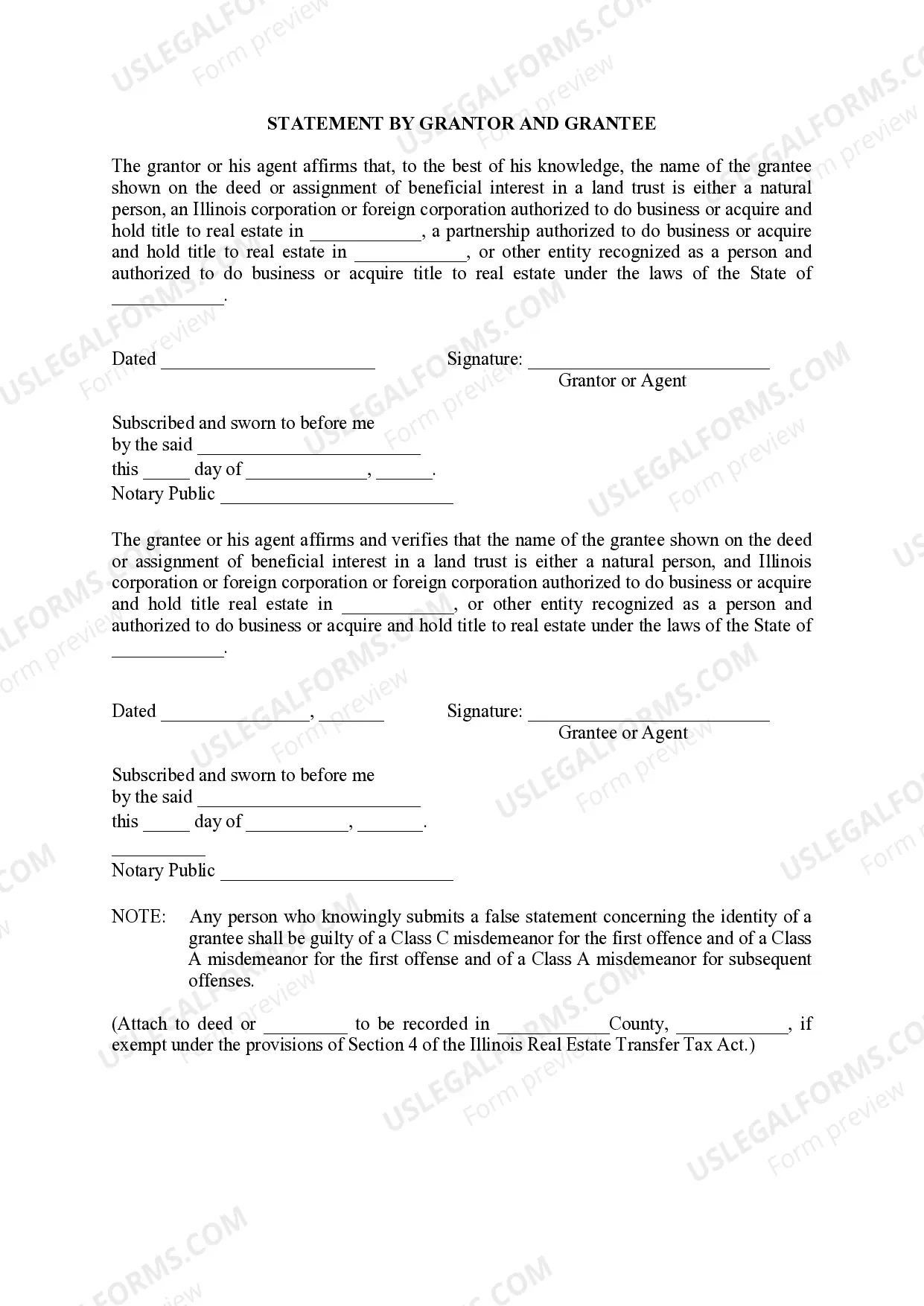

Illinois Public Sale of Real Estate for the Non - Payment of Taxes

Description

How to fill out Illinois Public Sale Of Real Estate For The Non - Payment Of Taxes?

Utilize US Legal Forms to secure a printable Illinois Public Sale of Real Property for the Lack of Tax Payment.

Our legally acceptable forms are composed and frequently revised by proficient attorneys.

We possess the largest collection of forms online, providing affordable and precise templates for individuals, legal experts, and small to medium-sized businesses.

Ensure to inspect the form by reading the description and utilizing the Preview option. Click Buy Now if it is the document you require. Set up your account and transact via PayPal or card|credit card. Download the form to your device and feel free to reuse it multiple times. Utilize the Search function if you wish to discover another document template. US Legal Forms provides a multitude of legal and tax templates and packages for both business and personal requirements, including Illinois Public Sale of Real Property for the Lack of Tax Payment. Over three million users have already successfully utilized our platform. Select your subscription plan and access high-quality forms in just a few clicks.

- Documents are organized into state-specific categories.

- Many forms can be previewed before downloading.

- To acquire templates, users are required to maintain a subscription and to Log In to their account.

- Select Download adjacent to any form you desire and locate it in My documents.

- For those without a subscription, adhere to the following steps to swiftly locate and download Illinois Public Sale of Real Property for the Lack of Tax Payment.

- Verify that you possess the correct form for the appropriate state.

Form popularity

FAQ

Property taxes are real estate taxes calculated by local governments and paid by homeowners.You will never be free from property taxes while you own your home, but there are a few simple tricks you can use to lower your property tax bill.

Even if your property taxes are sold, you remain the property owner subject to the discussion below. You must redeem, or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax sale. If you do not, the tax buyer can ask the court for a tax deed .

If after the said 36 months you still fail to pay your annual RPT, and the maximum interest of 72 percent had accrued on top of it, then per Section 258: real property subject to such tax may be levied upon through the issuance of a warrant on or before, or simultaneously with, the institution of the civil action for

If you fall behind in making the property tax payments for your home, you might end up losing the place. The taxing authority could sell your home, perhaps through a foreclosure process, to satisfy the debt. Or the taxing authority might sell the tax lien that it holds, and the purchaser might be able to foreclose.

At the sale, the purchaser effectively buys the existing tax lien and gets a certificate, which acts as evidence of the purchaser's interest in the property. If you don't redeem the home after the sale within the allotted time (see below), the purchaser can petition the court for a tax deed to your home.

This process is called redeeming the property. Under Illinois law, the redemption period is typically two years and six months, although the time frame might be different depending on your particular circumstances.

When homeowners fail to pay their property taxes, some tax jurisdictions choose to hold tax deed home sales to make back the money they are owed. Interested buyers can register to participate as a bidder on these homes in a tax deed auction.