Illinois Notice of Default and Foreclosure Sale

Description

How to fill out Illinois Notice Of Default And Foreclosure Sale?

Utilize US Legal Forms to obtain a printable Illinois Notice of Default and Foreclosure Sale. Our legal forms are accepted in court and are created and frequently refreshed by qualified attorneys.

We offer the most extensive library of Forms available online, providing cost-efficient and precise examples for individuals, legal professionals, and small to medium-sized businesses.

The documents are categorized based on state requirements, and several can be viewed prior to downloading.

US Legal Forms offers a vast array of legal and tax templates and packages for both business and personal requirements, including the Illinois Notice of Default and Foreclosure Sale. Over three million users have successfully benefited from our platform. Select your subscription plan to access high-quality documents in just a few clicks.

- To access templates, users must subscribe and Log In to their account.

- Select Download next to any form desired and find it in My documents.

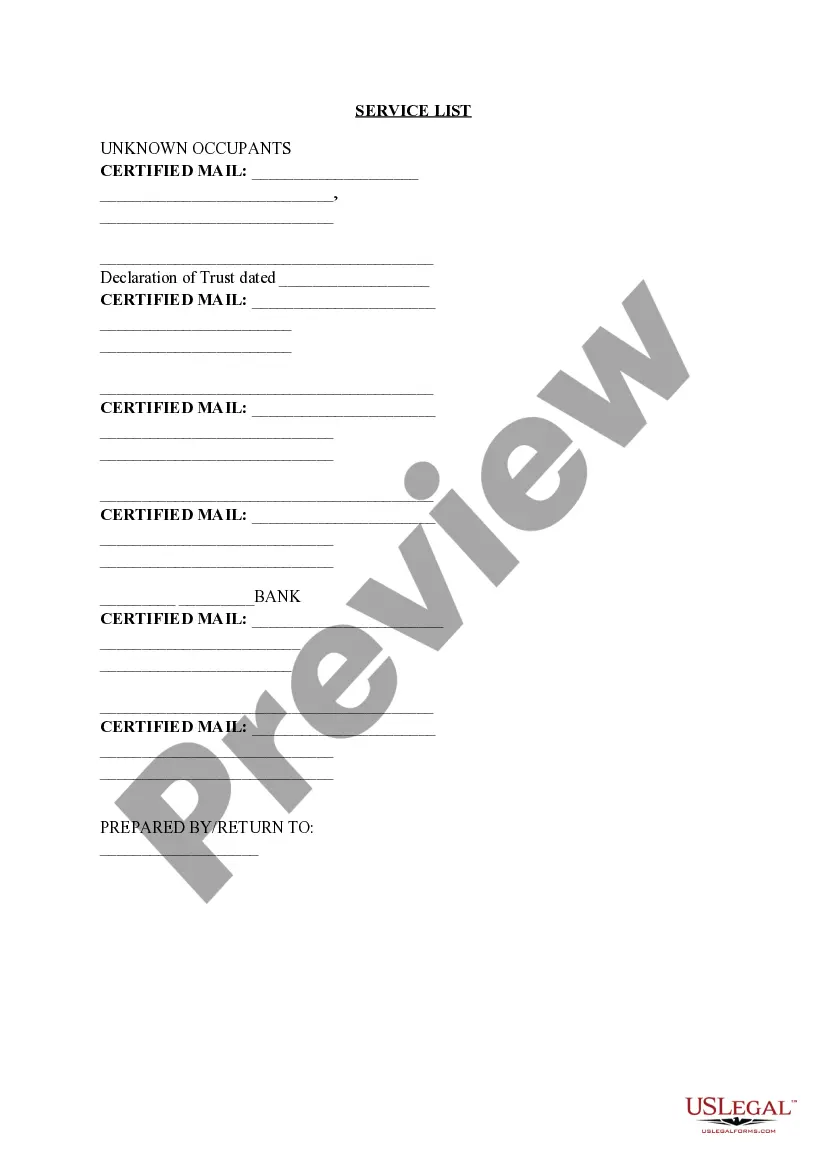

- For users without a subscription, follow these steps to quickly locate and download the Illinois Notice of Default and Foreclosure Sale.

- Ensure you select the correct template for your needed state.

- Examine the form by reviewing the description and utilizing the Preview function.

- Press Buy Now if it’s the template you require.

- Create your account and complete payment via PayPal or credit card.

- Download the template onto your device and feel free to use it repeatedly.

Form popularity

FAQ

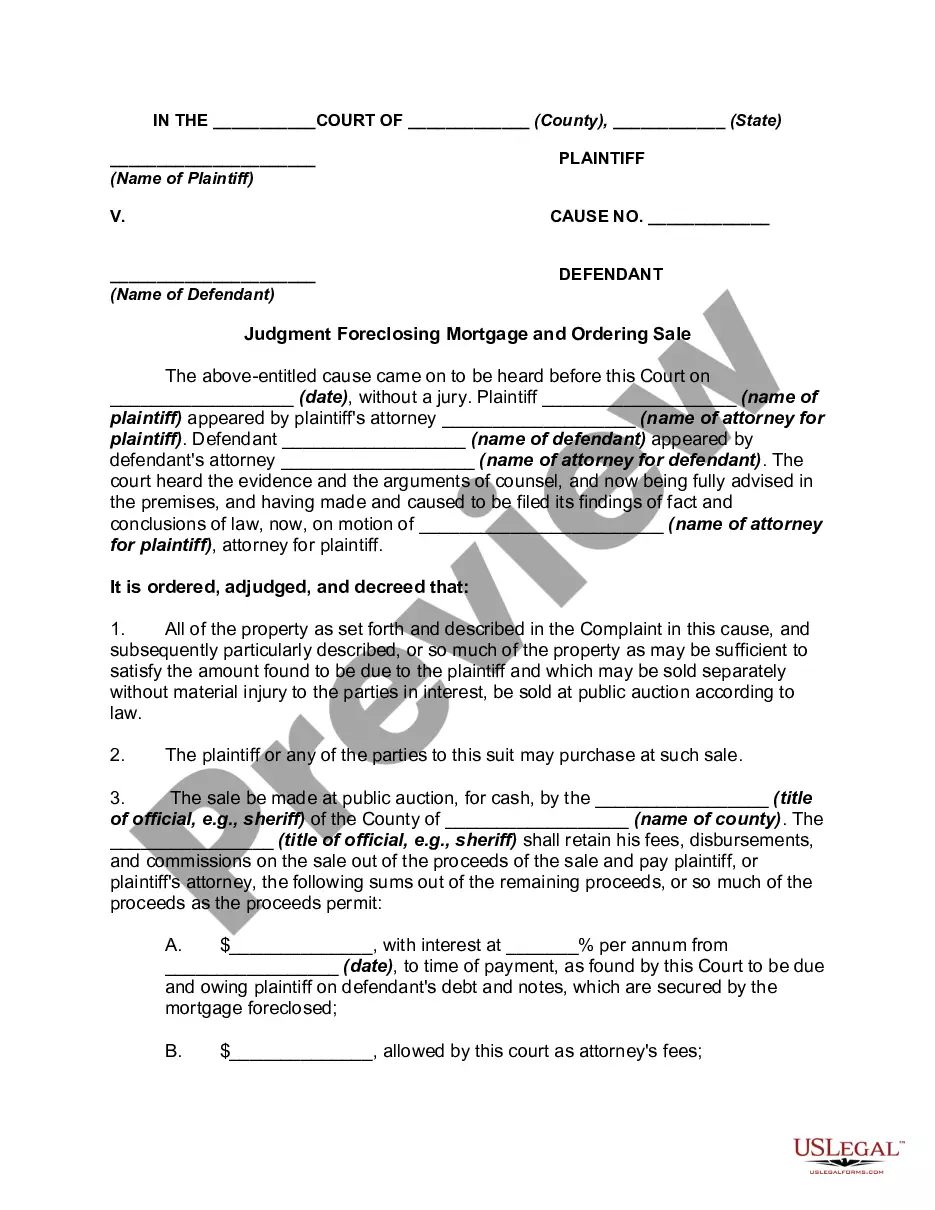

Foreclosure proceedings begin with a complaint filed by the lender. The borrower is served a copy of the complaint and a summons, along with a notice of his or her rights during foreclosure. In most cases, the borrower has 30 days to file a response. Failure to respond will result in a default judgment for the lender.

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

When You Have to Leave After an Illinois Foreclosure Sale The foreclosed homeowner can remain in the home for 30 days after the court confirms the sale.

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.

If a borrower falls behind on his mortgage payments, the mortgage lender might file a notice of default, which is an official public notice that the borrower is in arrears. It is one of the initial steps in the foreclosure process.

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.