Illinois Waiver of Homestead Exemption

Description

Where statutes specify the manner in which a homestead may be

released or waived in a particular jurisdiction, such statutes must

be strictly followed.

How to fill out Illinois Waiver Of Homestead Exemption?

Use US Legal Forms to get a printable Illinois Waiver of Homestead Exemption. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms library on the web and offers affordable and accurate samples for consumers and legal professionals, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the tips below to easily find and download Illinois Waiver of Homestead Exemption:

- Check out to ensure that you have the right template with regards to the state it is needed in.

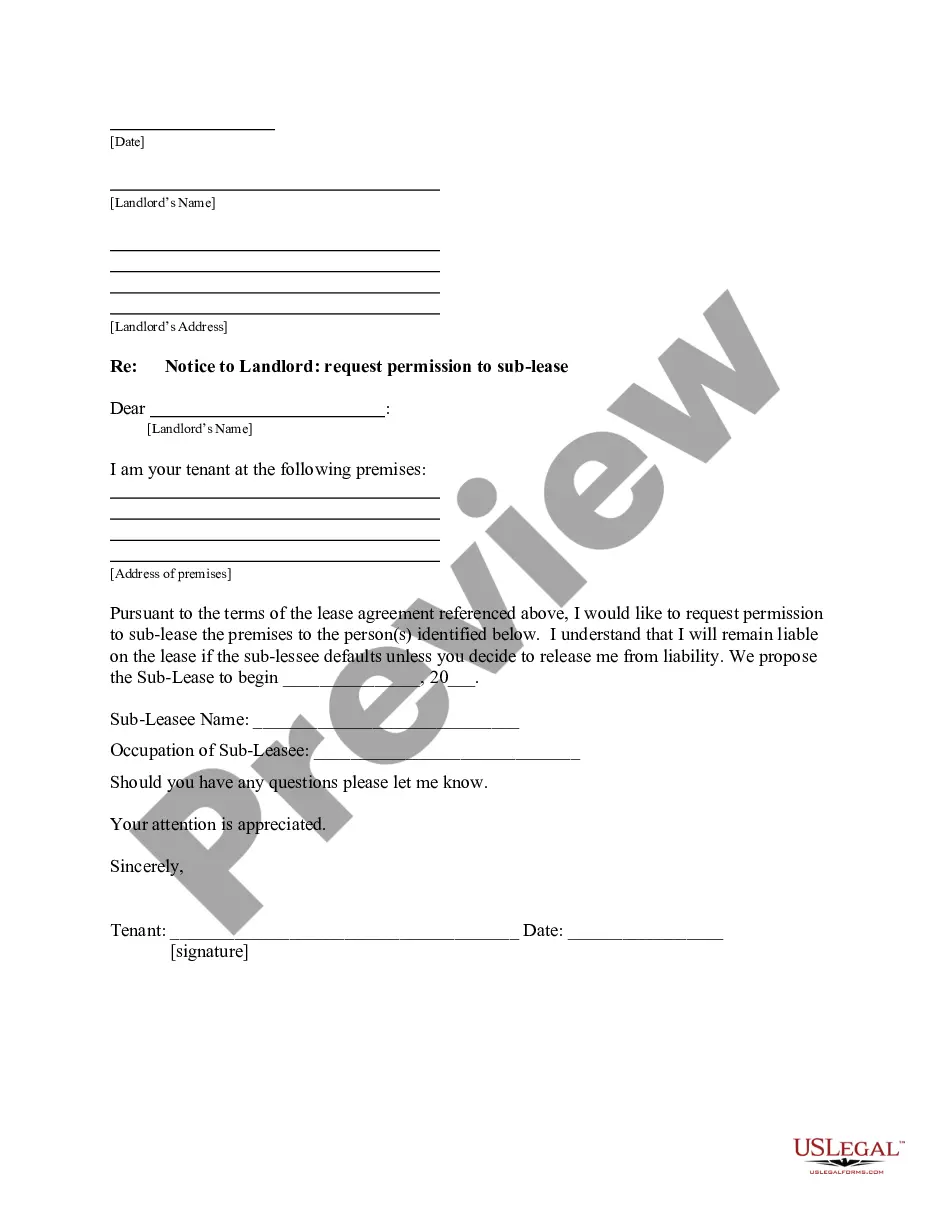

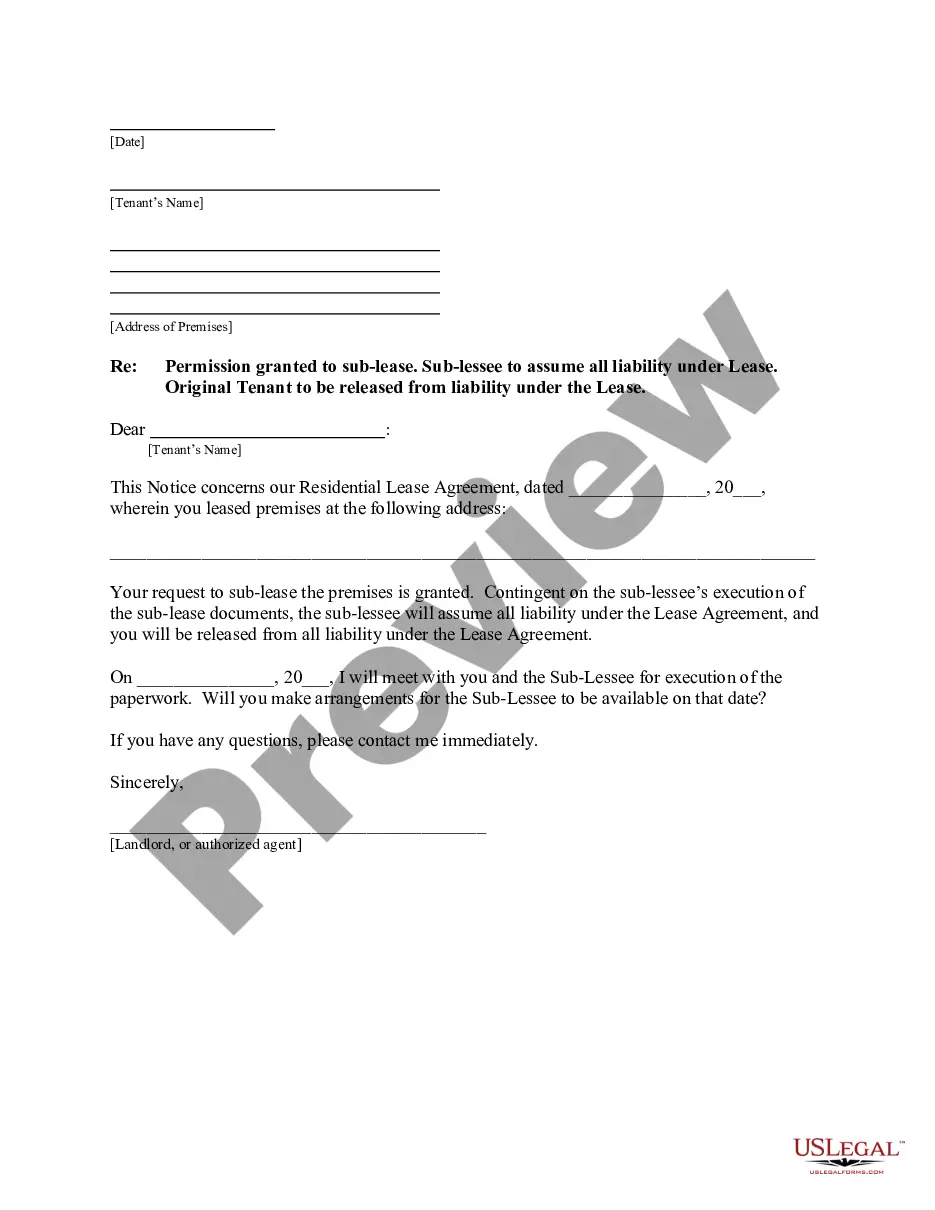

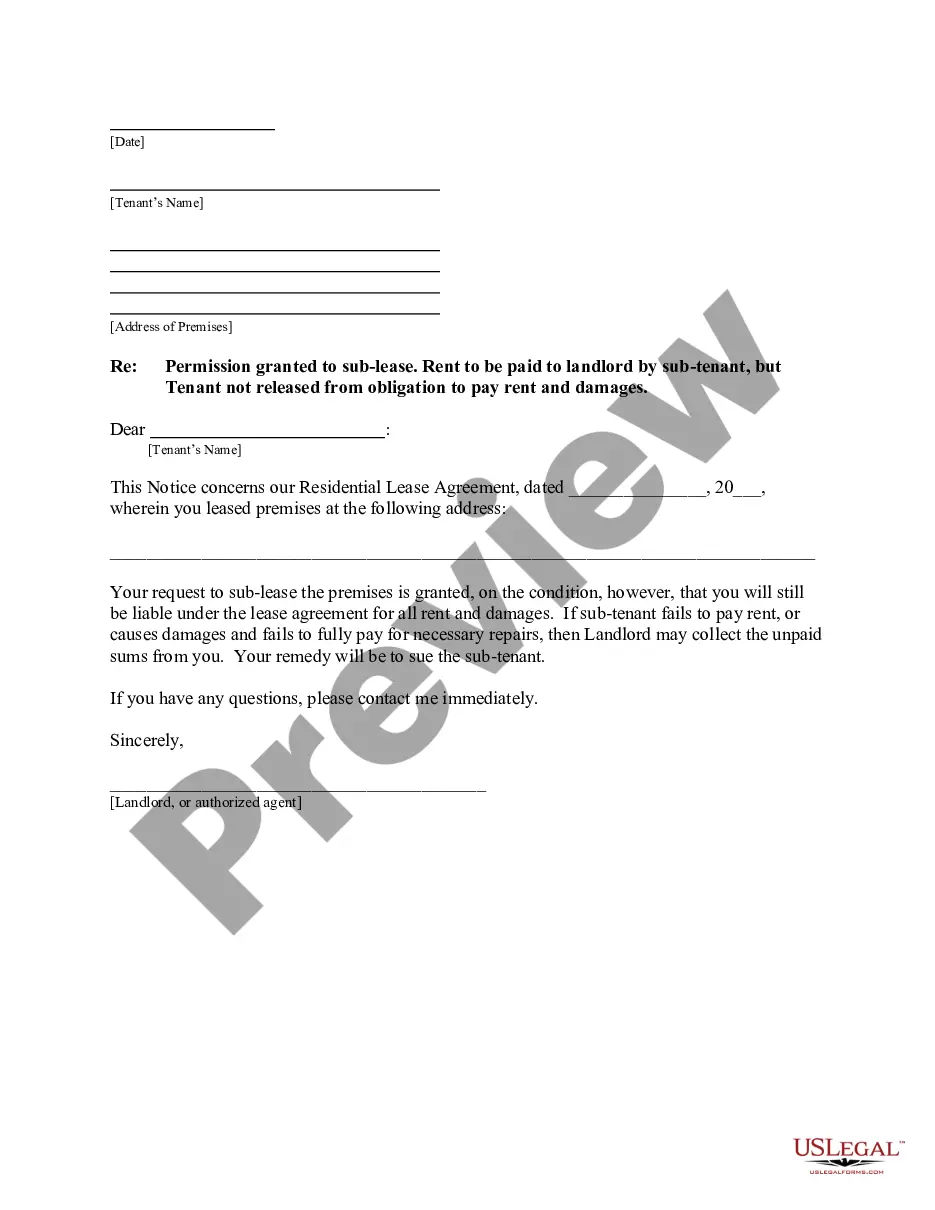

- Review the document by looking through the description and by using the Preview feature.

- Press Buy Now if it’s the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Illinois Waiver of Homestead Exemption. Over three million users have already used our service successfully. Choose your subscription plan and obtain high-quality forms in a few clicks.

Form popularity

FAQ

Under the Illinois exemption system, a homeowner can exempt up to $15,000 of equity in a home or other property covered by the homestead exemption. The Illinois homestead exemption requires that you be a legal owner of record to claim the exemption. Your name must be listed on the deed to the property.

(US) a house and adjoining land designated by the owner as his fixed residence and exempt under the homestead laws from seizure and forced sale for debts.

The Illinois Homestead Exemption Amount Under the Illinois exemption system, a homeowner can exempt up to $15,000 of equity in a home or other property covered by the homestead exemption. The Illinois homestead exemption requires that you be a legal owner of record to claim the exemption.

You will qualify for the property tax credit if: your principal residence during the year preceding the tax year at issue was in Illinois, and. you owned the residence, and. you paid property tax on your principal residence (excluding any applicable exemptions, late fees, and other charges).

Homeowner exemptions The homeowner (or homestead) exemption allows you to take $10,000 off of your EAV. The $10,000 reduction is the same for every home, no matter its market value or EAV. So if a property's EAV is $50,000, its tax value would be $40,000.

This annual exemption is available for property that is occupied as a residence by a person 65 years of age or older who is liable for paying real estate taxes on the property and is an owner of record of the property or has a legal or equitable interest therein as evidenced by a written instrument, except for a

WAG 07-02-04-a 1) Homestead property is exempt, and is the property that is owned and occupied by the person as their home. It includes any surrounding property that is not separated from the home by someone else's property.