Illinois Transfer on Death Instrument Revocation

Description Transfer On Death Instrument Illinois

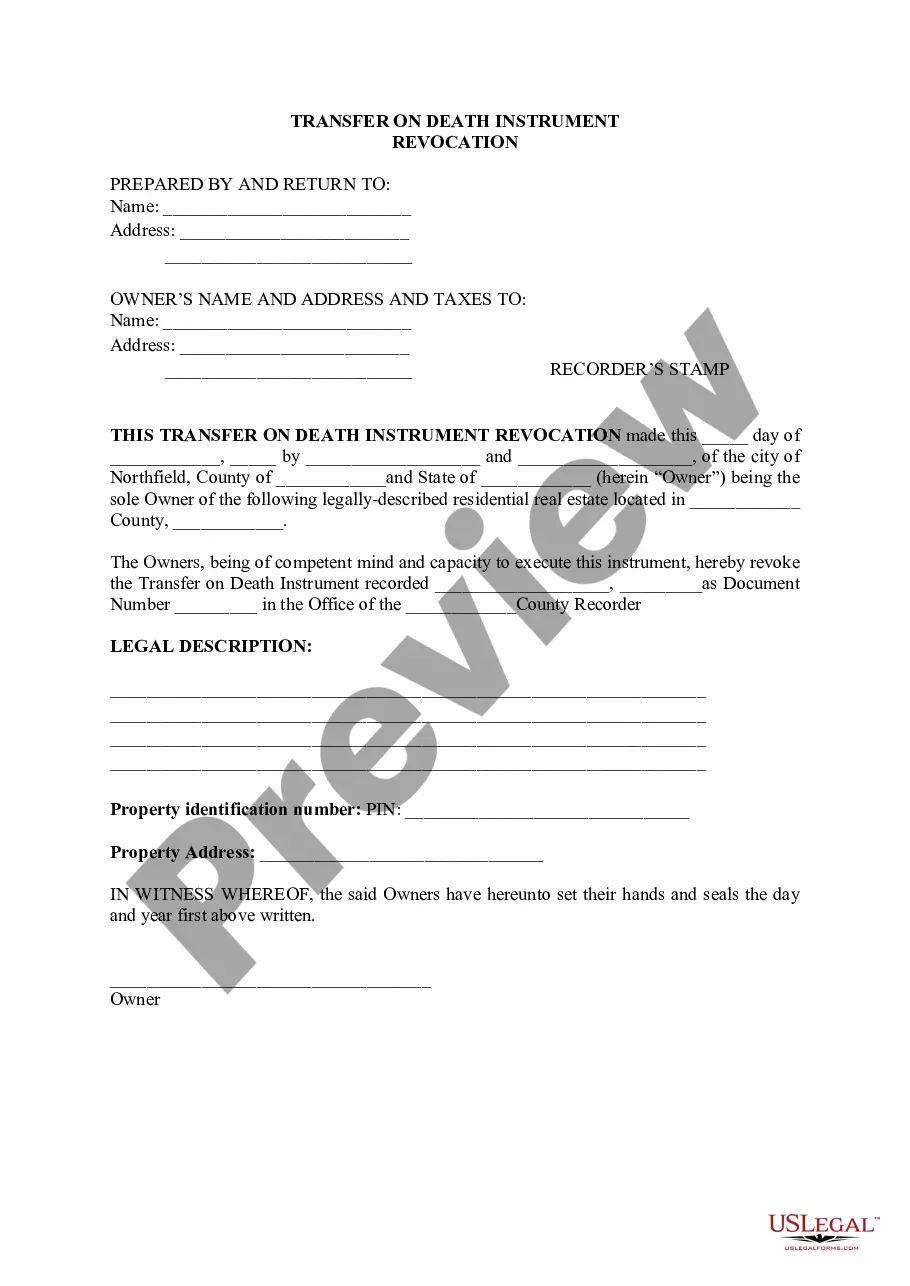

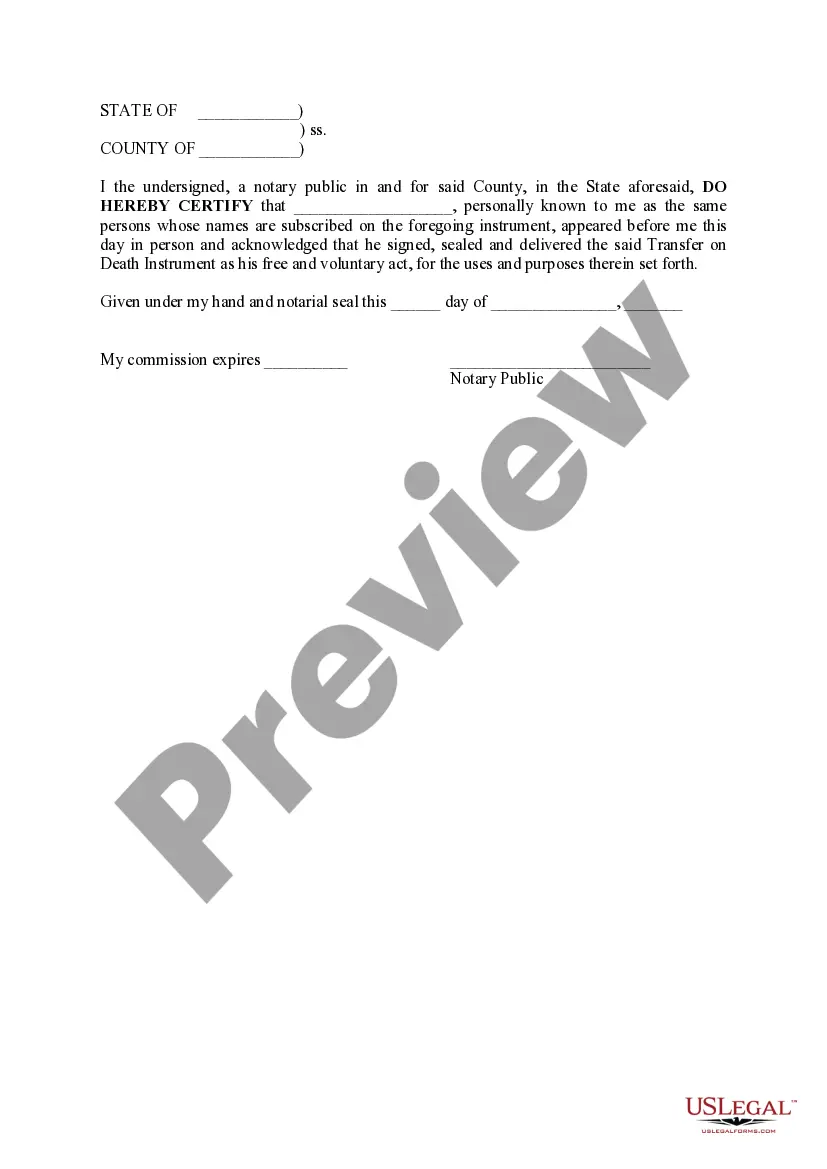

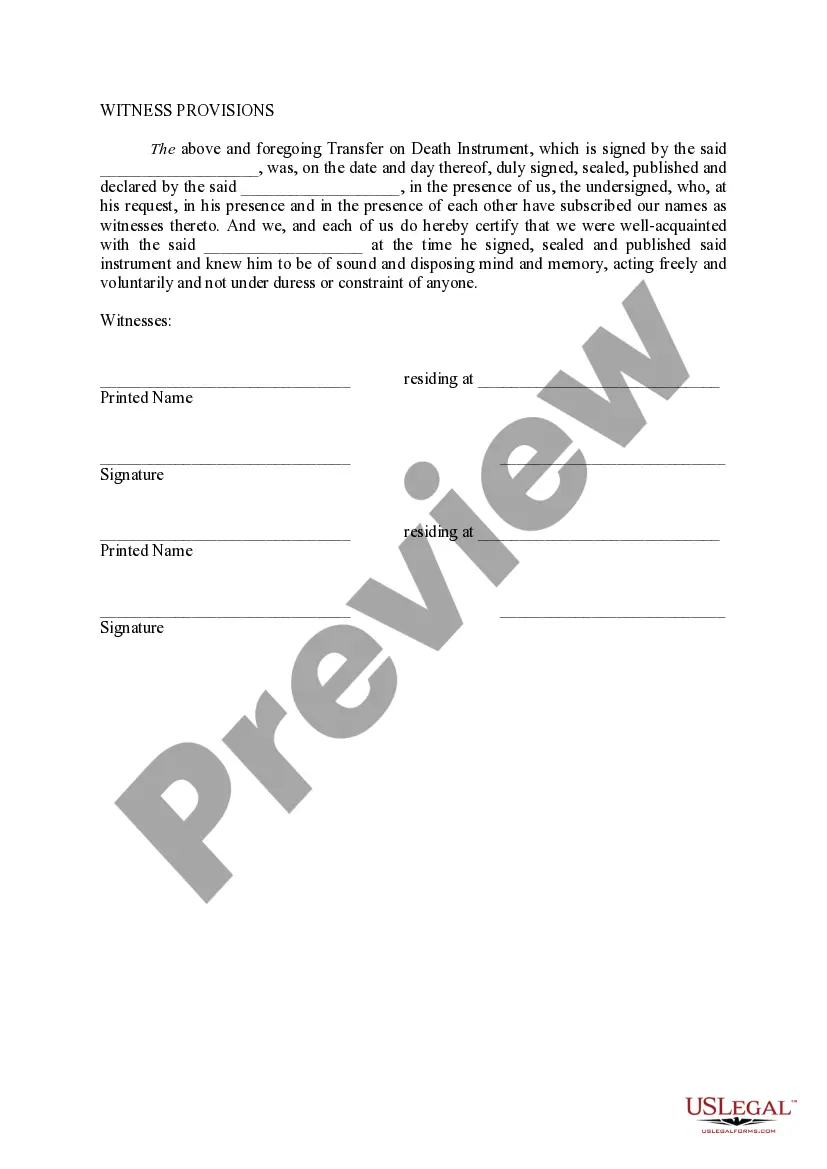

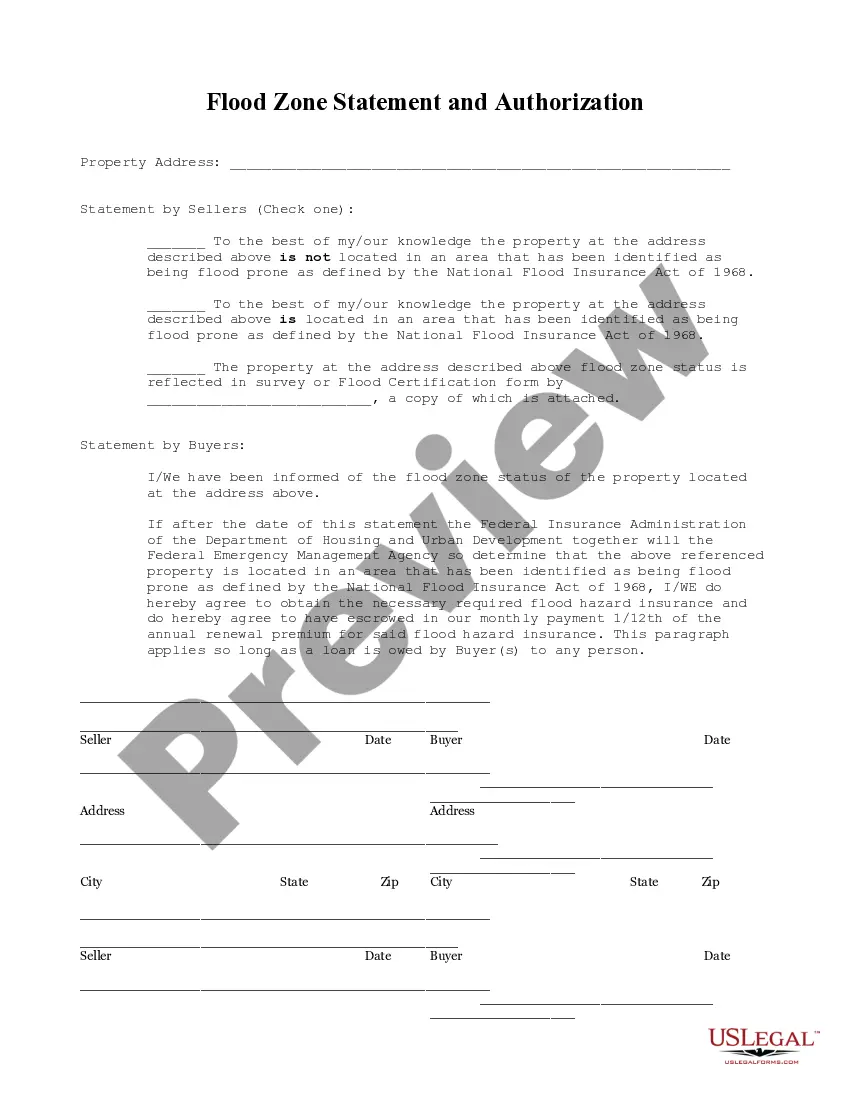

How to fill out Illinois Transfer Death?

Use US Legal Forms to obtain a printable Illinois Transfer on Death Instrument Revocation. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms catalogue on the web and offers reasonably priced and accurate templates for customers and lawyers, and SMBs. The templates are grouped into state-based categories and a number of them can be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

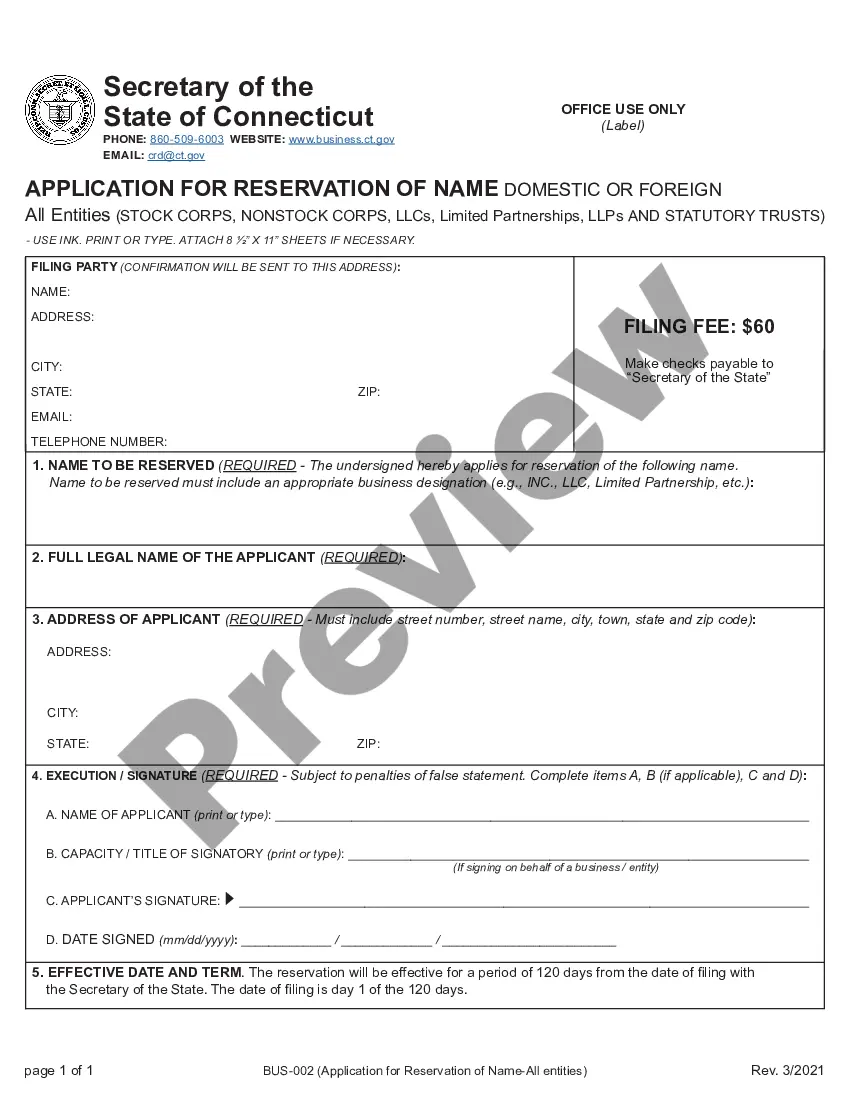

For those who don’t have a subscription, follow the following guidelines to easily find and download Illinois Transfer on Death Instrument Revocation:

- Check to make sure you get the correct form in relation to the state it is needed in.

- Review the document by reading the description and using the Preview feature.

- Click Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search field if you need to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Illinois Transfer on Death Instrument Revocation. Over three million users have used our service successfully. Select your subscription plan and get high-quality forms in a few clicks.

Instrument Of Transfer Sample Form popularity

Instrument Of Transfer Other Form Names

Transfer Death Instrument FAQ

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

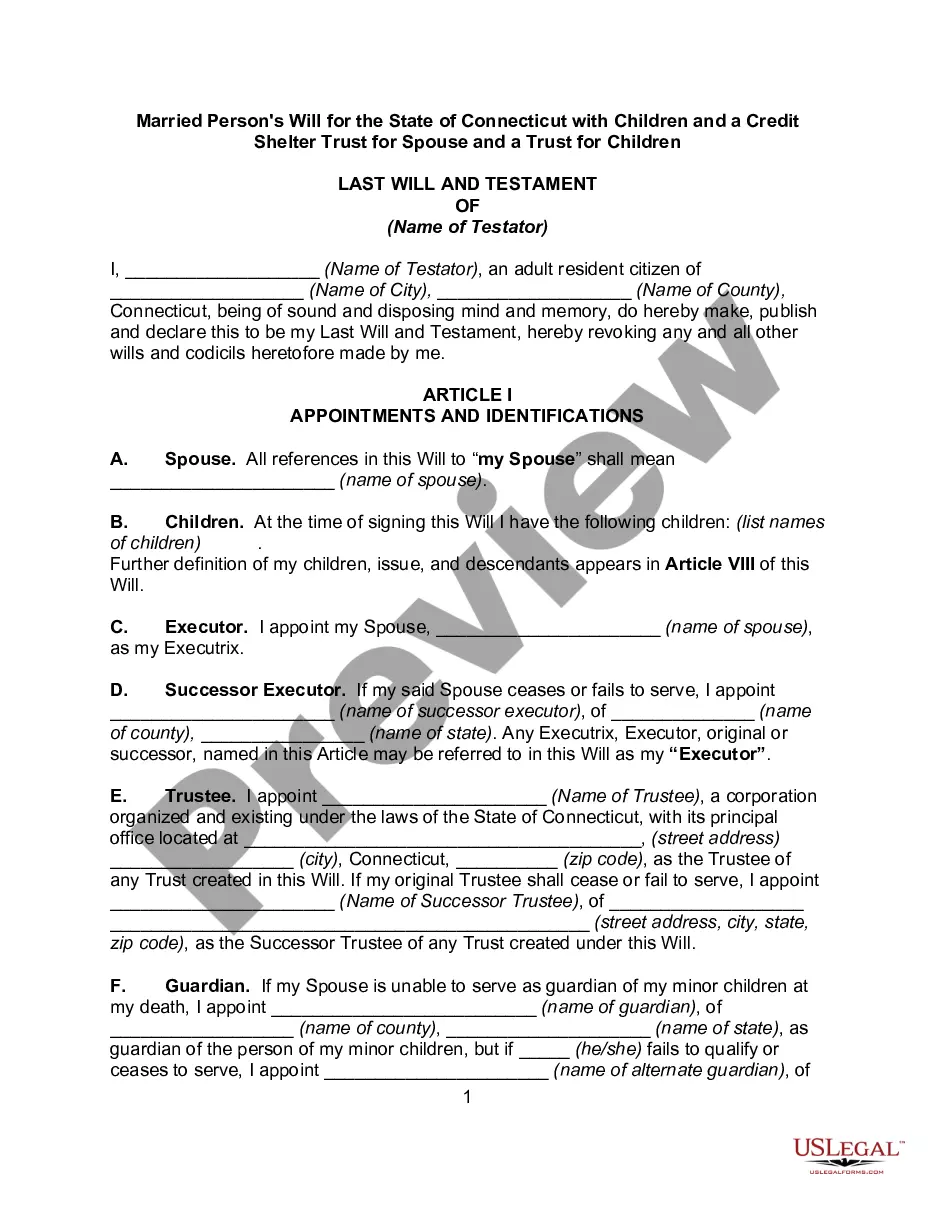

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

The Illinois TOD deed form form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

A transfer on death deed (TOD) lets a property owner pass land or real estate to a designated beneficiary outside of the probate process. A transfer on death deed can be a helpful estate planning tool but it is not permitted in every state.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.