Illinois Use Agreement

Description

How to fill out Illinois Use Agreement?

Use US Legal Forms to obtain a printable Illinois Use Agreement. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library on the internet and provides cost-effective and accurate samples for customers and legal professionals, and SMBs. The templates are categorized into state-based categories and many of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to quickly find and download Illinois Use Agreement:

- Check to ensure that you get the right form with regards to the state it is needed in.

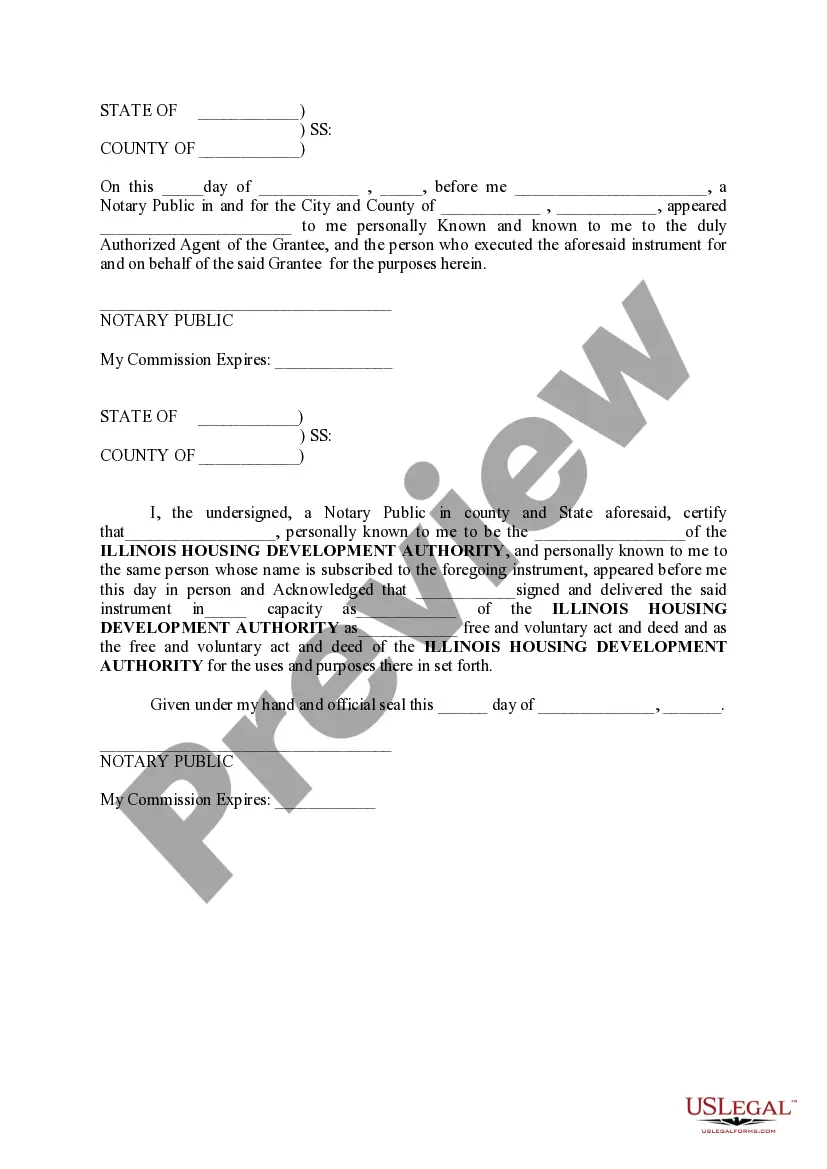

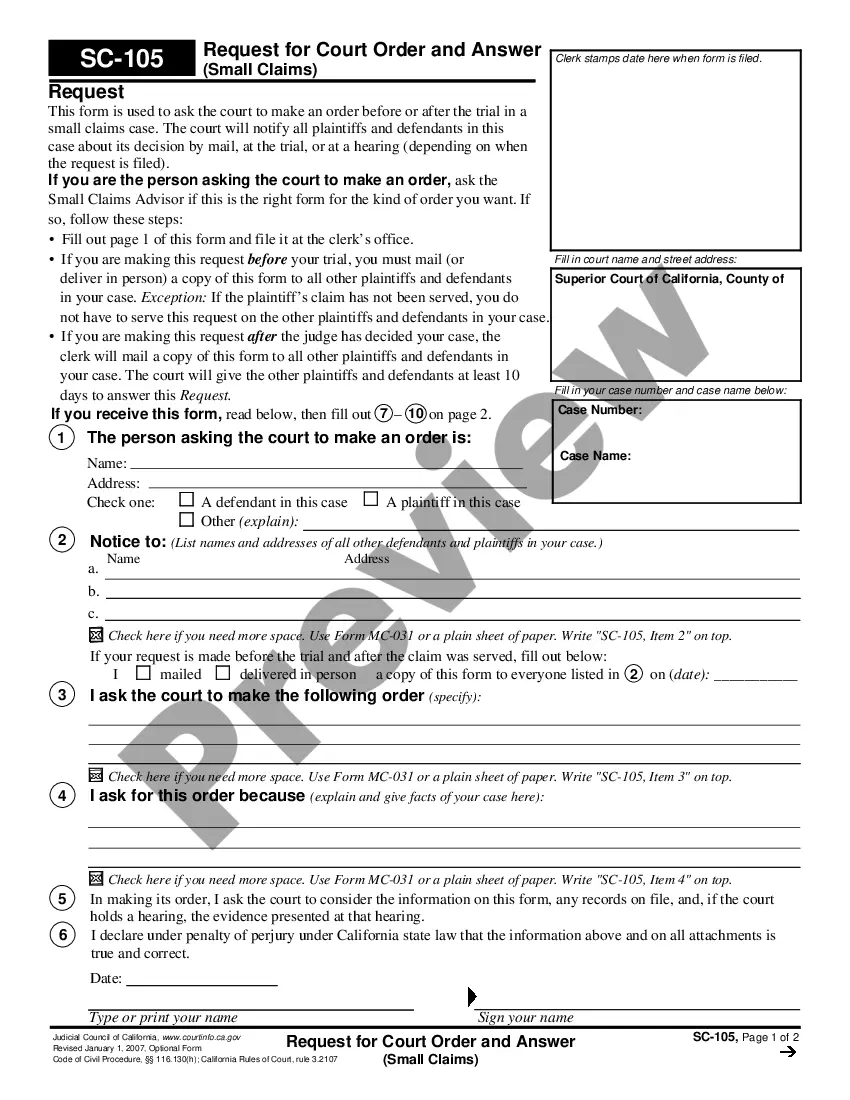

- Review the document by looking through the description and by using the Preview feature.

- Press Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Use the Search engine if you need to get another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Illinois Use Agreement. More than three million users already have used our platform successfully. Choose your subscription plan and obtain high-quality forms in just a few clicks.

Form popularity

FAQ

The state sales tax rate in Illinois is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 11.000%. Illinois has recent rate changes (Wed Jul 01 2020).

File online - File online at MyTax Illinois. You can remit your payment through their online system. File by mail - You can use Form ST-1 and file and pay through the mail. AutoFile - Let TaxJar file your sales tax for you.

Find your Gross Sales in Illinois this number is at the top of your TaxJar Illinois state report. Enter your Gross Sales on your Illinois form ST-1 on line 1 Total Receipts under Step 2: Taxable Receipts. The Illinois filing system will automatically round this number to the closest dollar amount.

Illinois' sales tax rate is 6.25 percent on general merchandise and 1 percent on qualifying foods, drugs, and medical appliances. The tax rate may be higher in some areas because some local jurisdictions are allowed to impose their own taxes.

Calculating Total Cost. Multiply the cost of an item or service by the sales tax in order to find out the total cost. The equation looks like this: Item or service cost x sales tax (in decimal form) = total sales tax. Add the total sales tax to the Item or service cost to get your total cost.

A sales tax is what the state calls tax collected by a merchant in-state. Use tax is what the state calls a tax collected and remitted by what they deem a "remote seller" (i.e. someone who has sales tax in the state but isn't based there.)

Use Tax is a sales tax that you, as the purchaser, owe on items that you buy for use in Illinois. If the seller does not collect at least 6.25 percent sales tax, you must pay the difference to the Illinois Department of Revenue.Click here for more Use Tax information.

File online - File online at MyTax Illinois. You can remit your payment through their online system. File by mail - You can use Form ST-1 and file and pay through the mail. AutoFile - Let TaxJar file your sales tax for you.

The basic rule for collecting sales tax from online sales is: If your business has a physical presence, or nexus, in a state, you must collect applicable sales taxes from online customers in that state. If you do not have a physical presence, you generally do not have to collect sales tax for online sales.