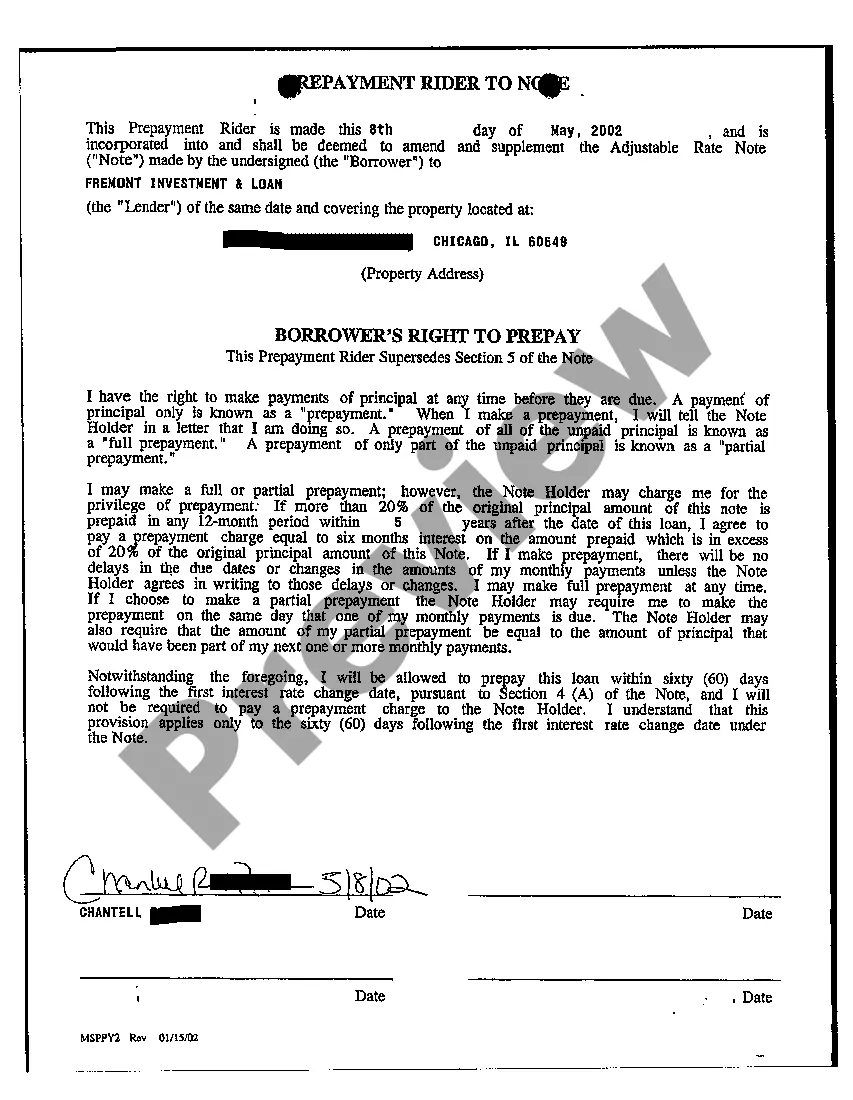

Illinois Exhibit A Adjustable Rate Note

Description

How to fill out Illinois Exhibit A Adjustable Rate Note?

Looking for Illinois Exhibit A Adjustable Rate Note forms and completing them might be a problem. To save time, costs and energy, use US Legal Forms and choose the right sample specially for your state in a few clicks. Our legal professionals draw up every document, so you simply need to fill them out. It is really that easy.

Log in to your account and return to the form's web page and save the document. Your downloaded examples are kept in My Forms and they are accessible all the time for further use later. If you haven’t subscribed yet, you need to register.

Have a look at our comprehensive recommendations regarding how to get the Illinois Exhibit A Adjustable Rate Note template in a couple of minutes:

- To get an qualified example, check its applicability for your state.

- Have a look at the form making use of the Preview function (if it’s accessible).

- If there's a description, read through it to know the details.

- Click Buy Now if you identified what you're searching for.

- Select your plan on the pricing page and create an account.

- Pick how you wish to pay by way of a card or by PayPal.

- Save the form in the favored format.

You can print the Illinois Exhibit A Adjustable Rate Note form or fill it out utilizing any online editor. No need to worry about making typos because your template may be applied and sent, and printed out as often as you want. Check out US Legal Forms and access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

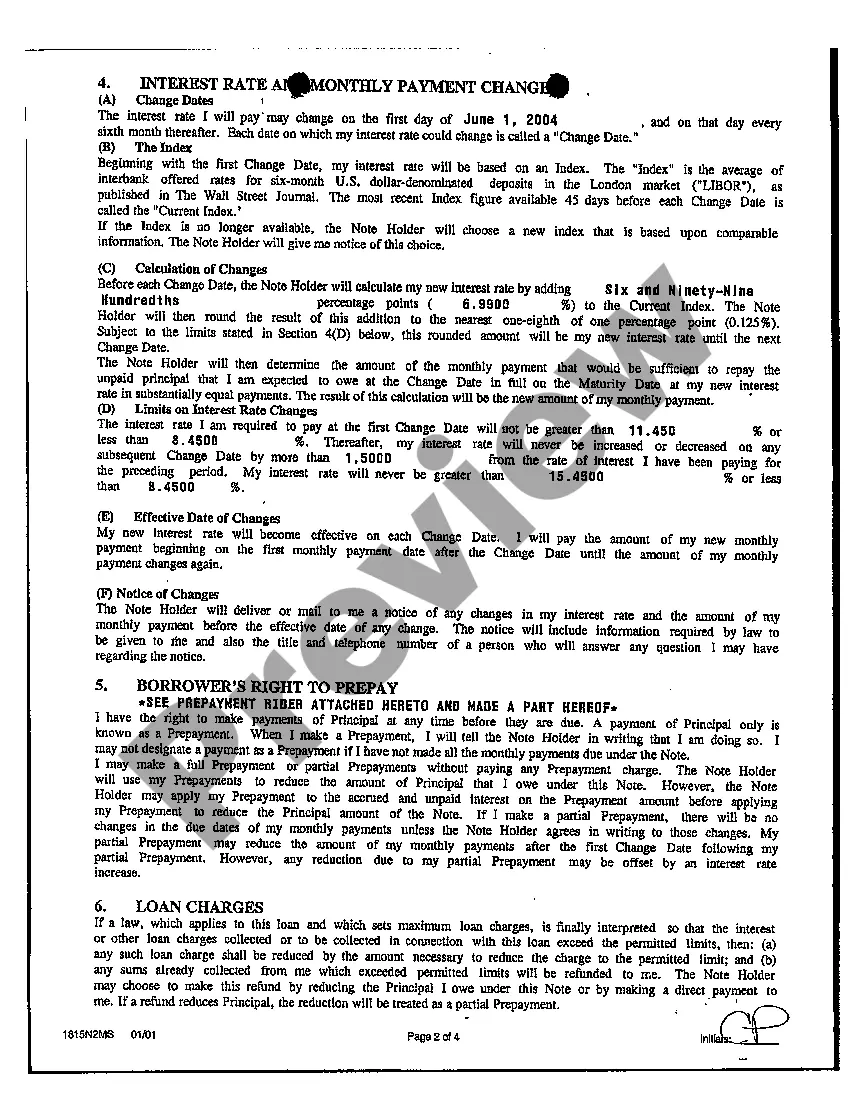

An ARM has four components: (1) an index, (2) a margin, (3) an interest rate cap structure, and (4) an initial interest rate period. When the initial interest rate period has expired, the new interest rate is calculated by adding a margin to the index.

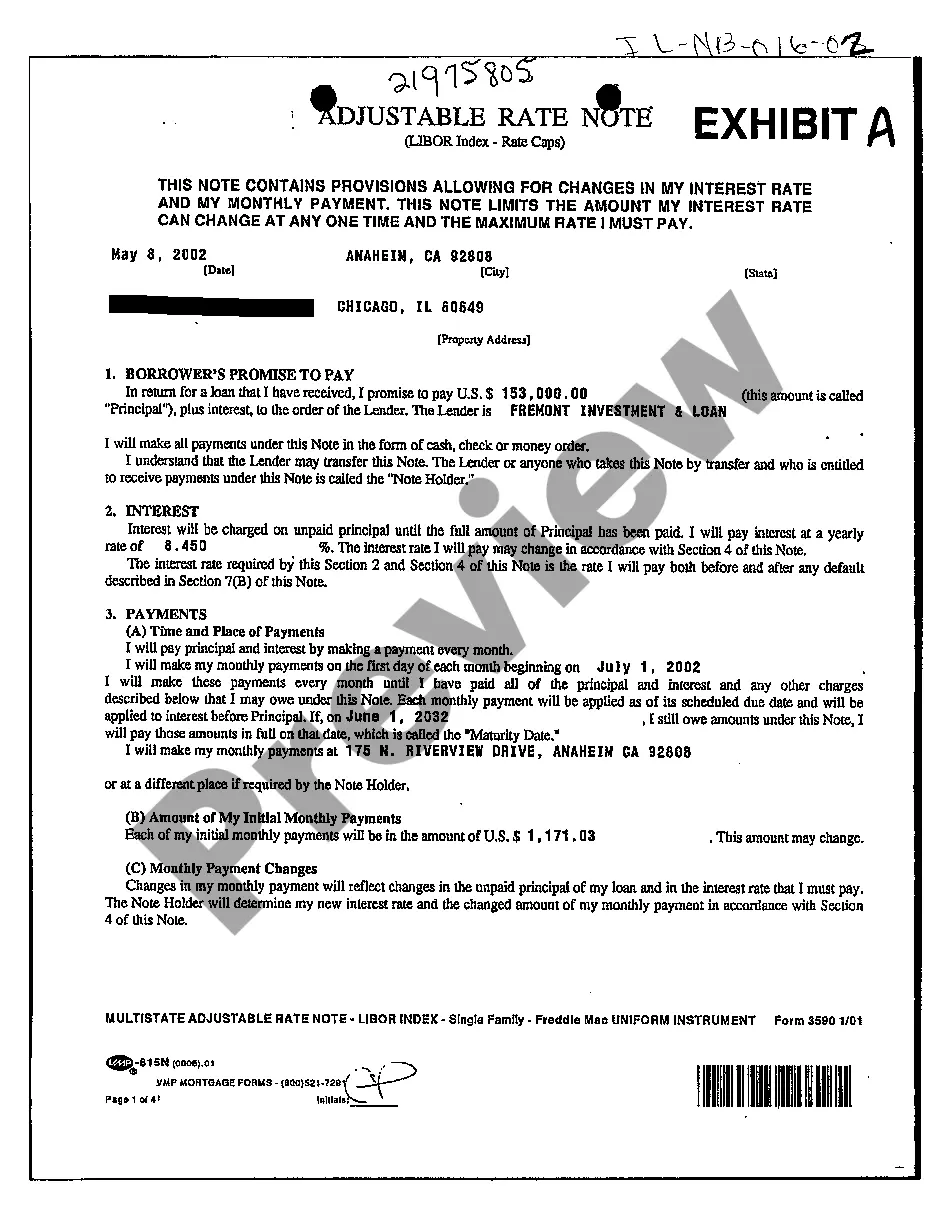

THIS NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN MY INTEREST RATE AND MY MONTHLY PAYMENT. THIS NOTE LIMITS THE AMOUNT MY INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE I MUST PAY.

THIS NOTE PROVIDES FOR A CHANGE IN MY FIXED INTEREST RATE TO AN ADJUSTABLE INTEREST RATE. THIS NOTE LIMITS THE AMOUNT MY ADJUSTABLE INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MINIMUM AND MAXIMUM RATES I MUST PAY. THIS NOTE ALSO CONTAINS THE OPTION TO CONVERT MY ADJUSTABLE INTEREST RATE TO A NEW FIXED RATE.

Divide your interest rate by the number of payments you'll make in the year (interest rates are expressed annually). So, for example, if you're making monthly payments, divide by 12. 2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

Initial cap: Your interest rate can only change by up to 2% the first time it adjusts. Periodic cap: Each change after that is limited to 1% every 6 months. Lifetime cap: Throughout the rest of the loan term, the most the interest rate can increase or decrease is 5% from the fixed rate.

Payment shock. What is the term used to describe a rate adjustment resulting in a new payment amount? recast.

With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time. After this initial period of time, the interest rate resets periodically, at yearly or even monthly intervals.The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin.

With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time. After this initial period of time, the interest rate resets periodically, at yearly or even monthly intervals.The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin.

Index + Margin = Your Interest Rate The index is a benchmark interest rate that reflects general market conditions. The index changes based on the market. Changes in the index, along with your loan's margin, determine the changes to the interest rate for an adjustable-rate mortgage loan.