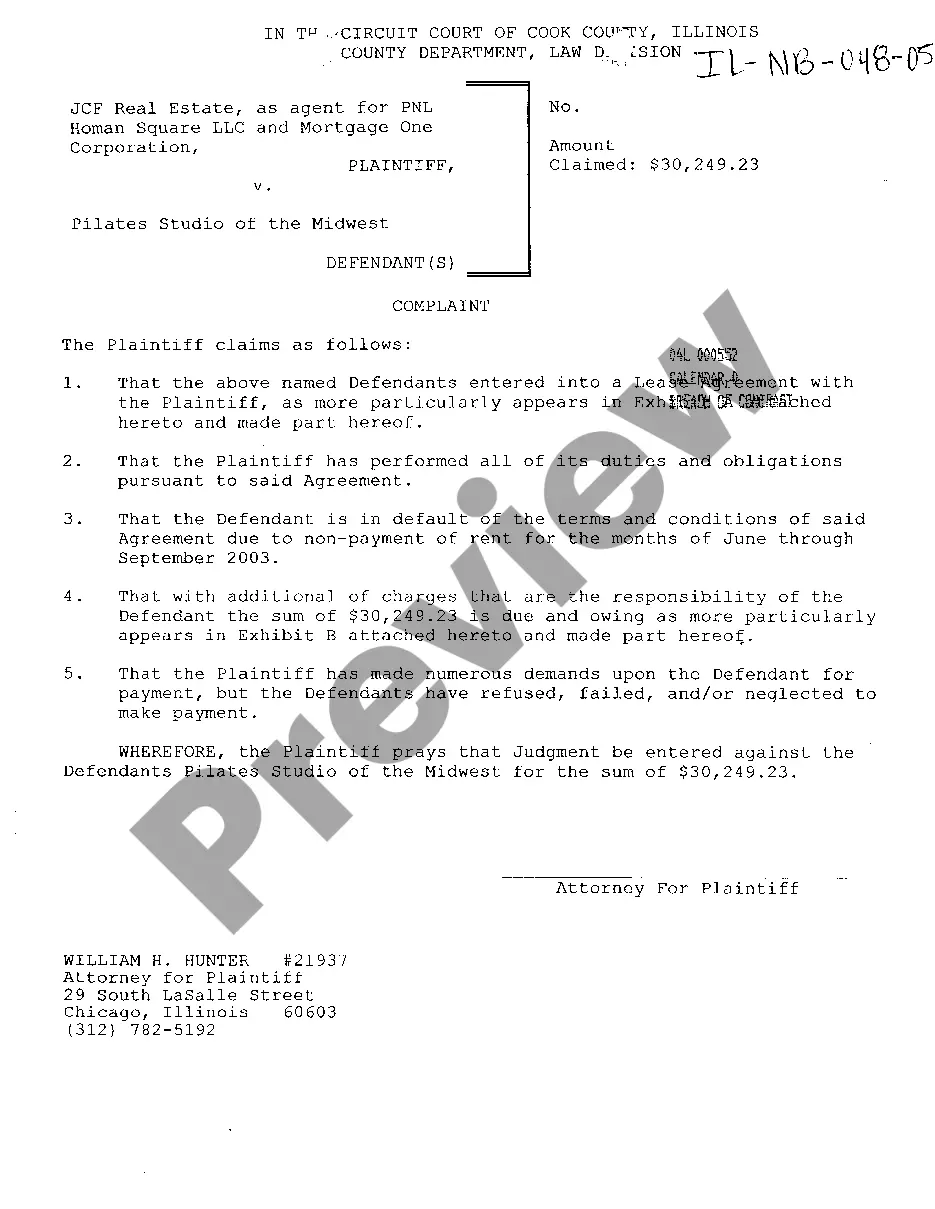

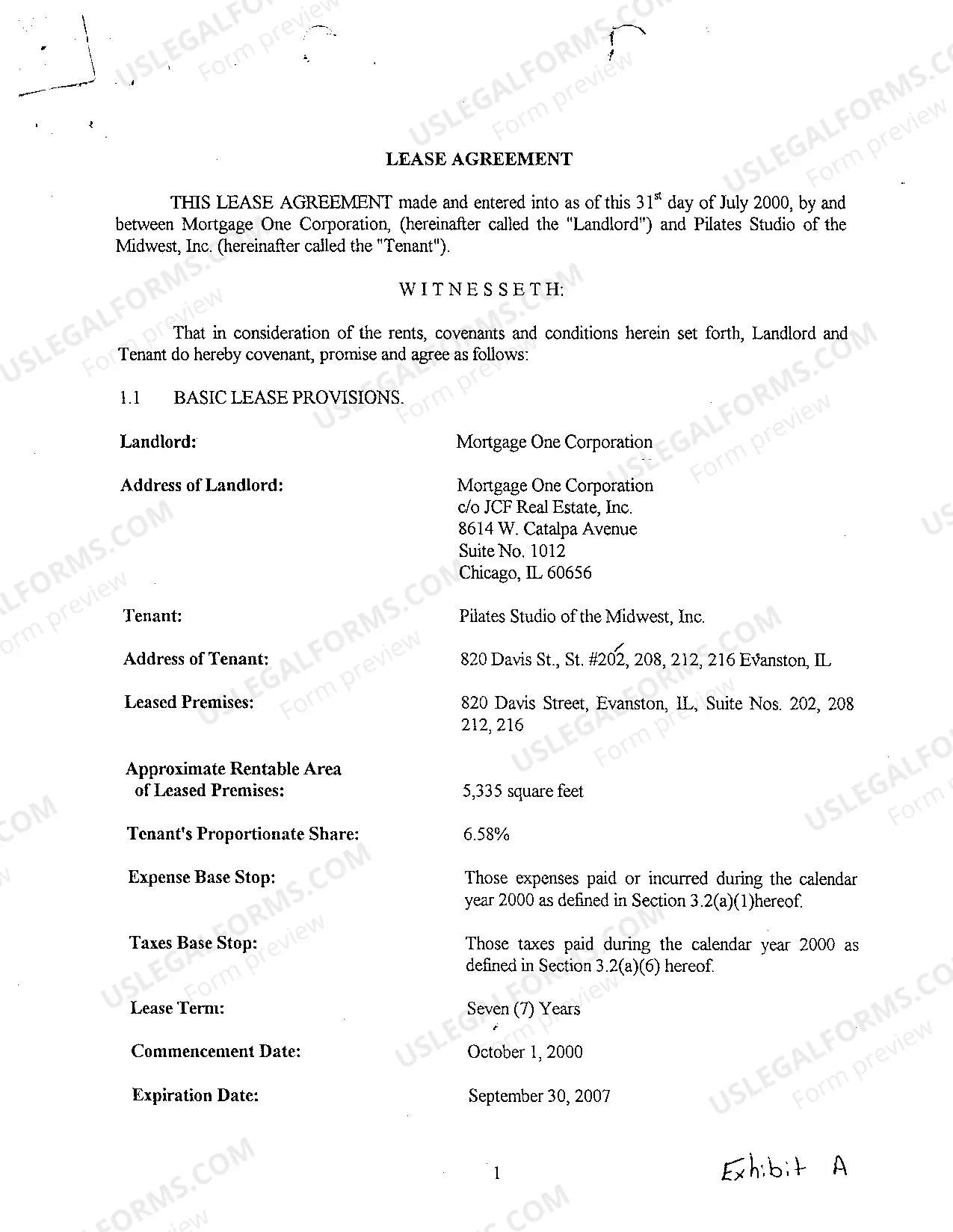

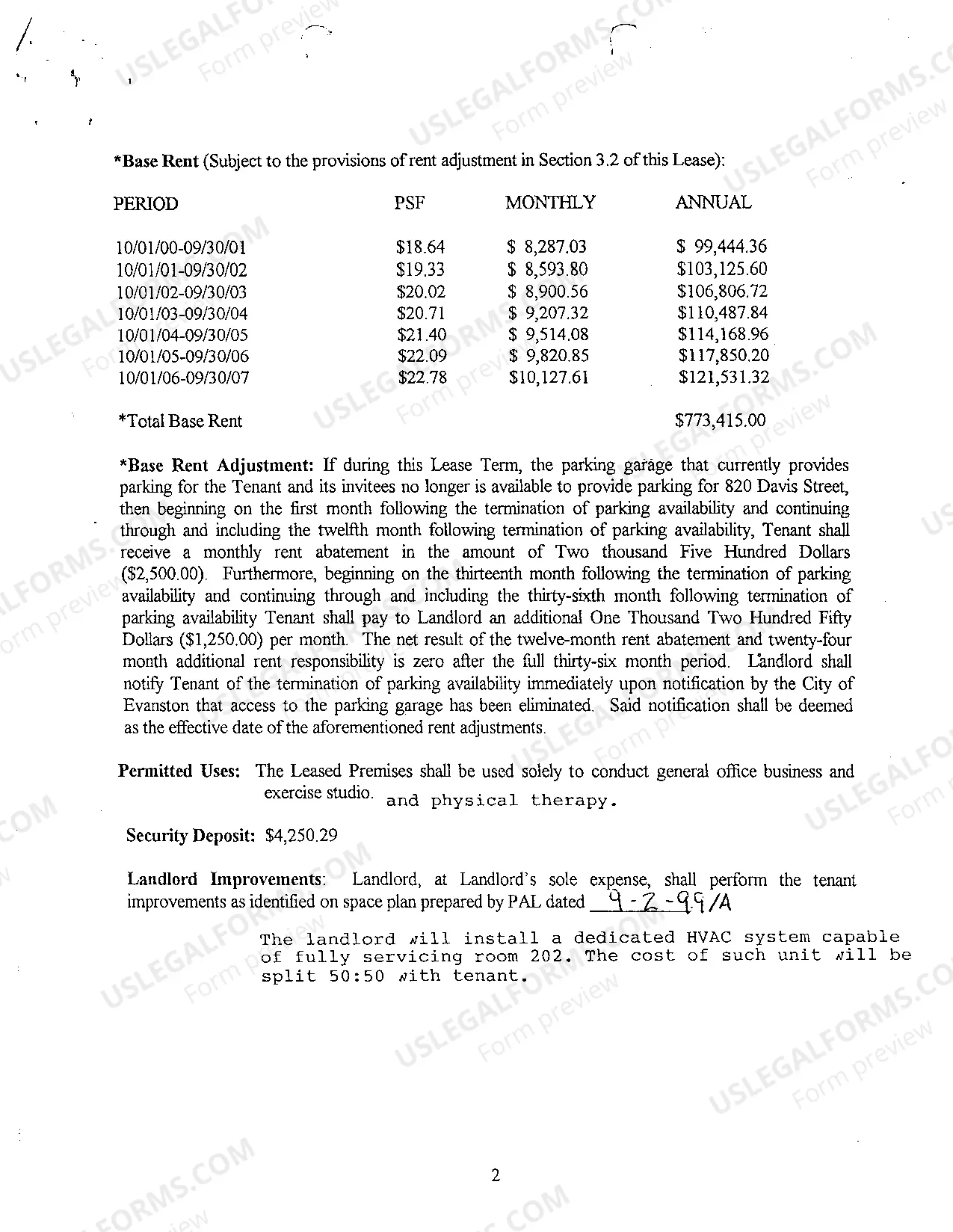

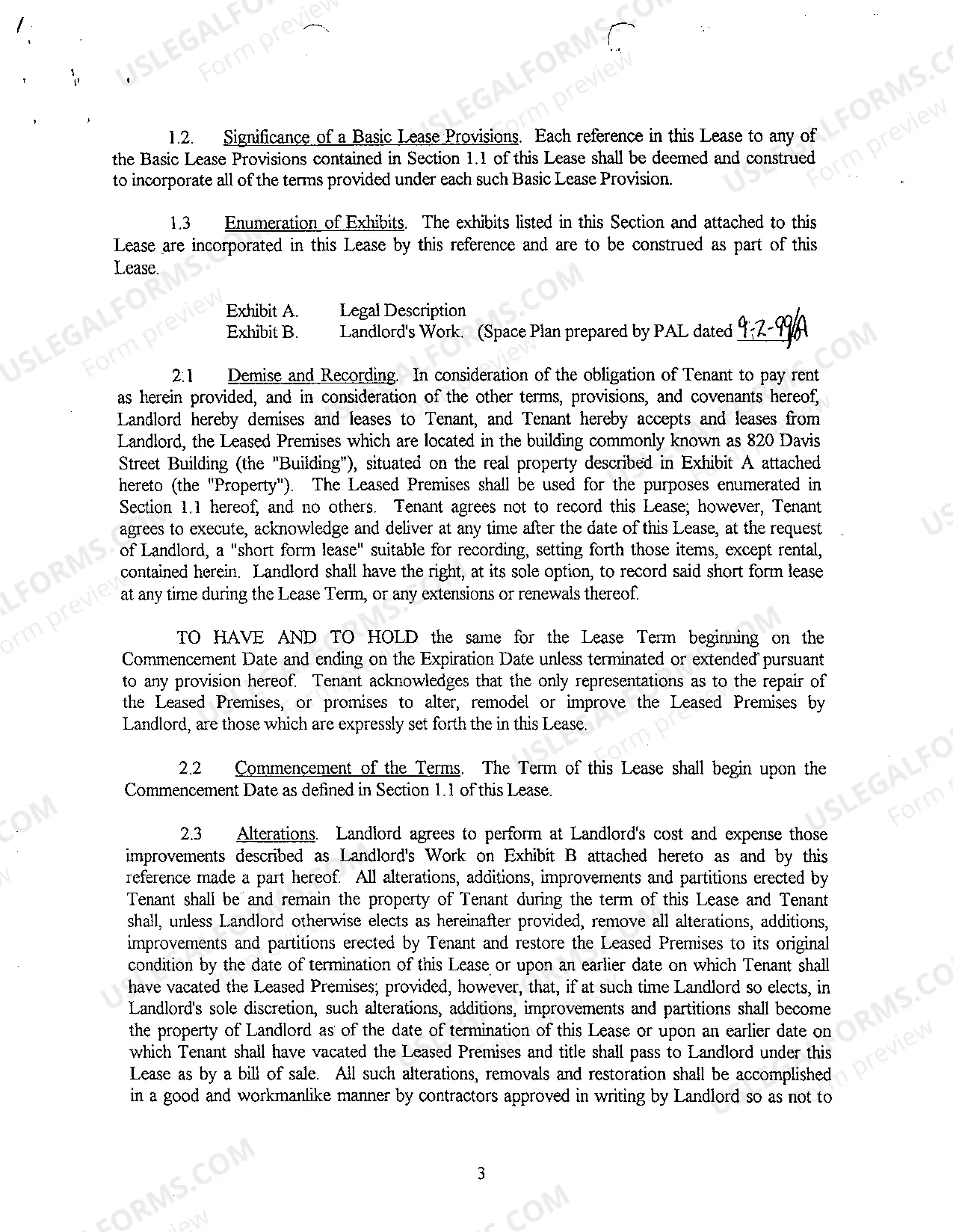

Illinois Complaint Alleging Nonpayment of Rent on Commercial Lease

Description

How to fill out Illinois Complaint Alleging Nonpayment Of Rent On Commercial Lease?

Trying to find Illinois Complaint Alleging Nonpayment of Rent on Commercial Lease templates and filling out them might be a problem. To save lots of time, costs and energy, use US Legal Forms and find the correct example specially for your state within a few clicks. Our attorneys draft every document, so you just have to fill them out. It truly is so easy.

Log in to your account and come back to the form's web page and download the sample. All your downloaded samples are saved in My Forms and therefore are accessible at all times for further use later. If you haven’t subscribed yet, you should register.

Look at our detailed instructions concerning how to get the Illinois Complaint Alleging Nonpayment of Rent on Commercial Lease sample in a few minutes:

- To get an eligible sample, check its applicability for your state.

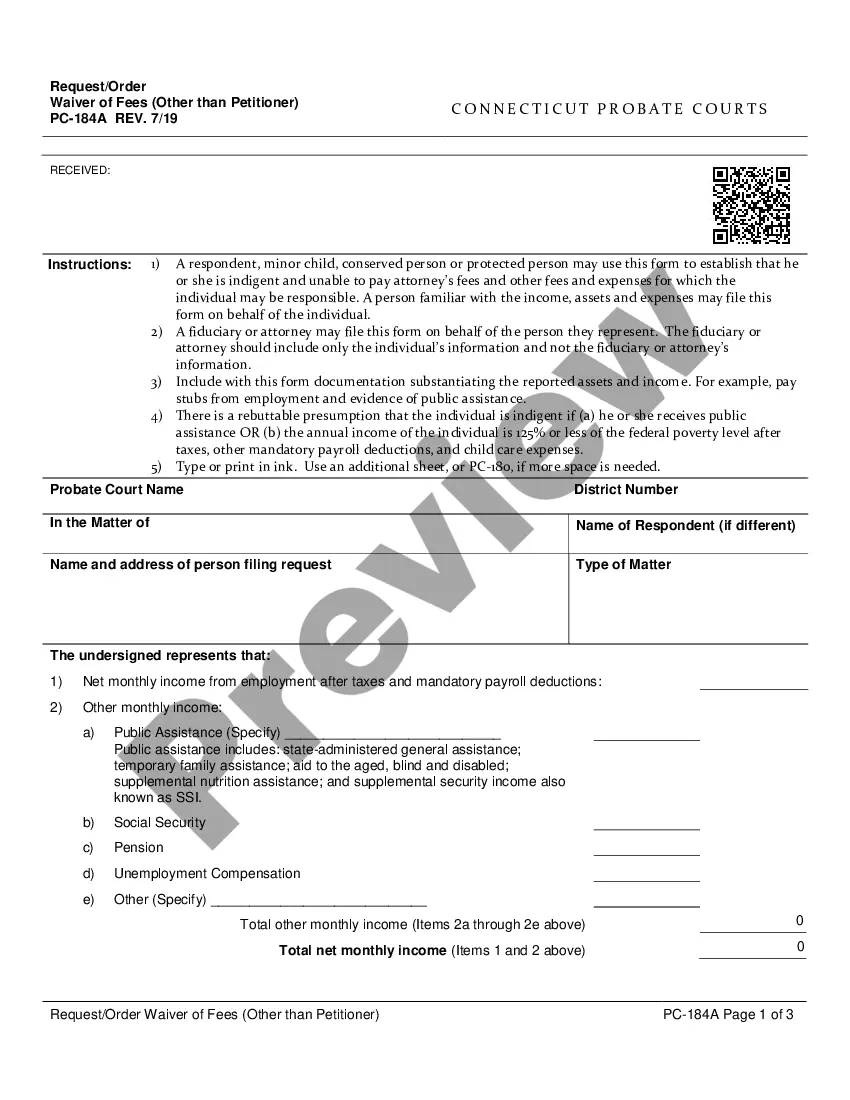

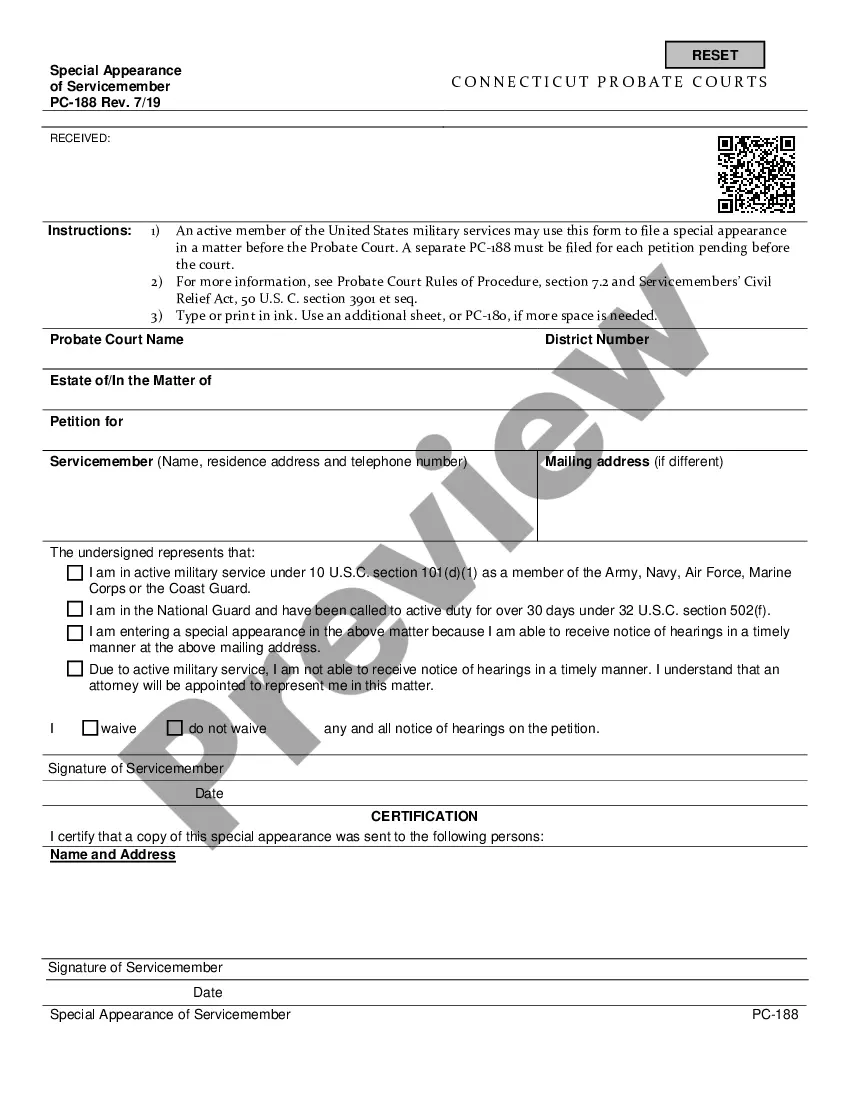

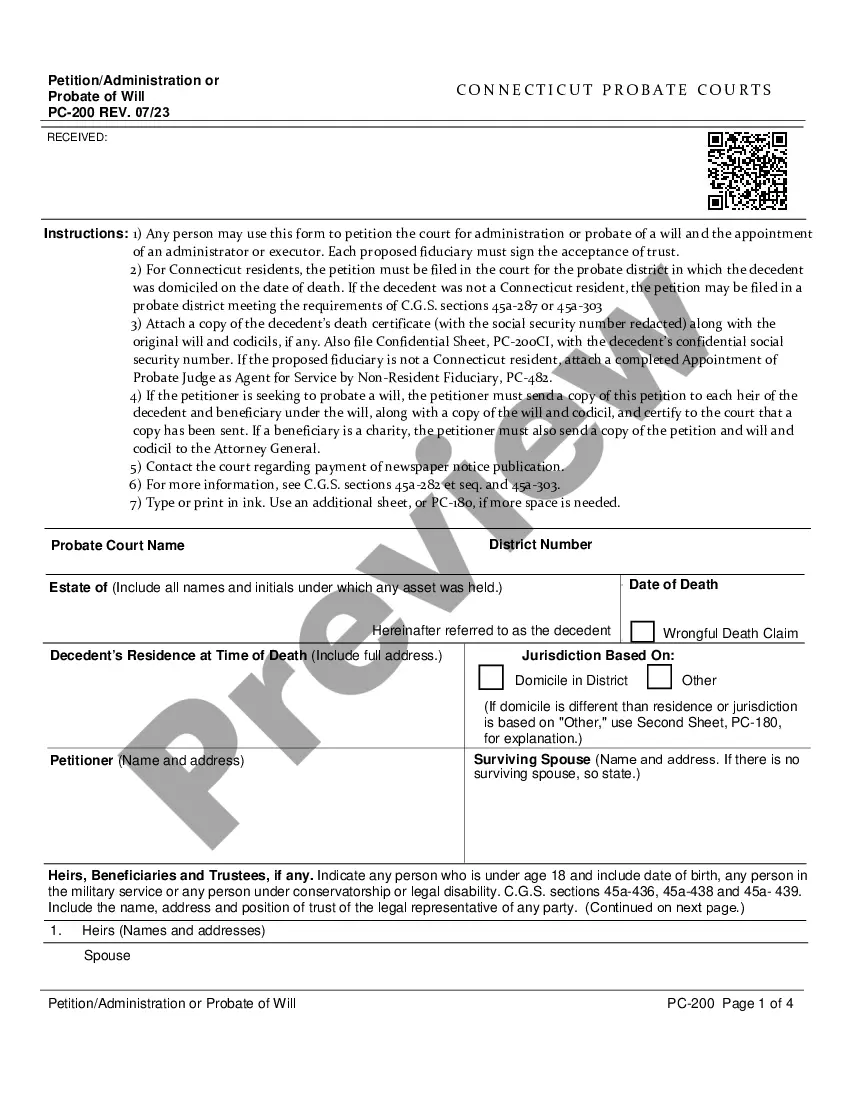

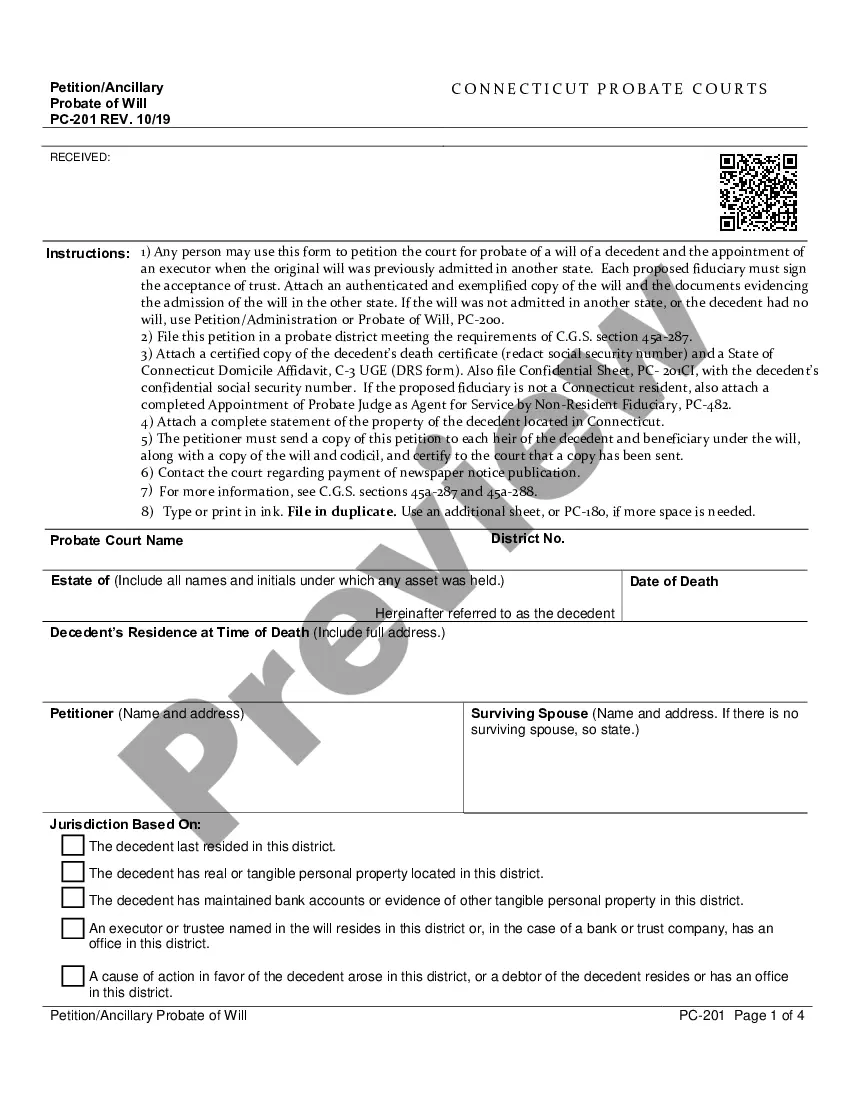

- Take a look at the sample utilizing the Preview option (if it’s available).

- If there's a description, go through it to know the details.

- Click Buy Now if you identified what you're trying to find.

- Select your plan on the pricing page and create your account.

- Choose you wish to pay by a card or by PayPal.

- Save the form in the preferred file format.

You can print out the Illinois Complaint Alleging Nonpayment of Rent on Commercial Lease template or fill it out utilizing any web-based editor. Don’t worry about making typos because your template may be applied and sent away, and printed as many times as you would like. Try out US Legal Forms and get access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

The CARES Act requires landlords to provide a 30-day notice to tenants prior to eviction. This Act covers properties supported by HUD, USDA, and Treasury (Low Income Housing Tax Credit), and properties with federally-backed mortgages (e.g., FHA, Fannie Mae, and Freddie Mac).

Quiet enjoyment is a covenant that promises that you will not do anything to interfere with a tenant's reasonable use and enjoyment of their leased premises, and that you will ensure that a tenant's use and enjoyment of the property will not be disturbed.

The CARES Act provides no direct relief for such tenants. Several executive orders issued by governors and mayors have purported to impose moratoria on evictions that would extend to commercial tenants.

So a tenant is likely to have to give between 3 and 4 months notice if rent is paid monthly, and 3 and 6 months notice if rent is paid quarterly.

Commercial tenants may have the protection of the Landlord and Tenant Act 1954. The Act grants Security of Tenure to tenants who occupy premises for business purposes. The tenancy will continue after the contractual termination date until it is ended in one of the ways specified by the Act.

Relief Program 2: Paycheck Protection Program (PPP)Landlords cannot qualify for a PPP to replace their lost rental income, since that does not qualify as payroll, but that doesn't mean they can't get a PPP.

The Illinois Department of Human Rights - Chicago: (312) 814-6200, TDD: (312) 263-1579; Springfield: (217) 785-5100, TDD: (217) 785-5125; Housing complaints: 1-800-662-3942. For more information, please contact us.

Anyone renting a building, whether for commercial or personal use, has the right to privacy. You are entitled to do anything on the property that you wish, so long as whatever you are doing is legal. The landlord cannot prevent you from operating your business nor from allowing guests or patrons on the property.