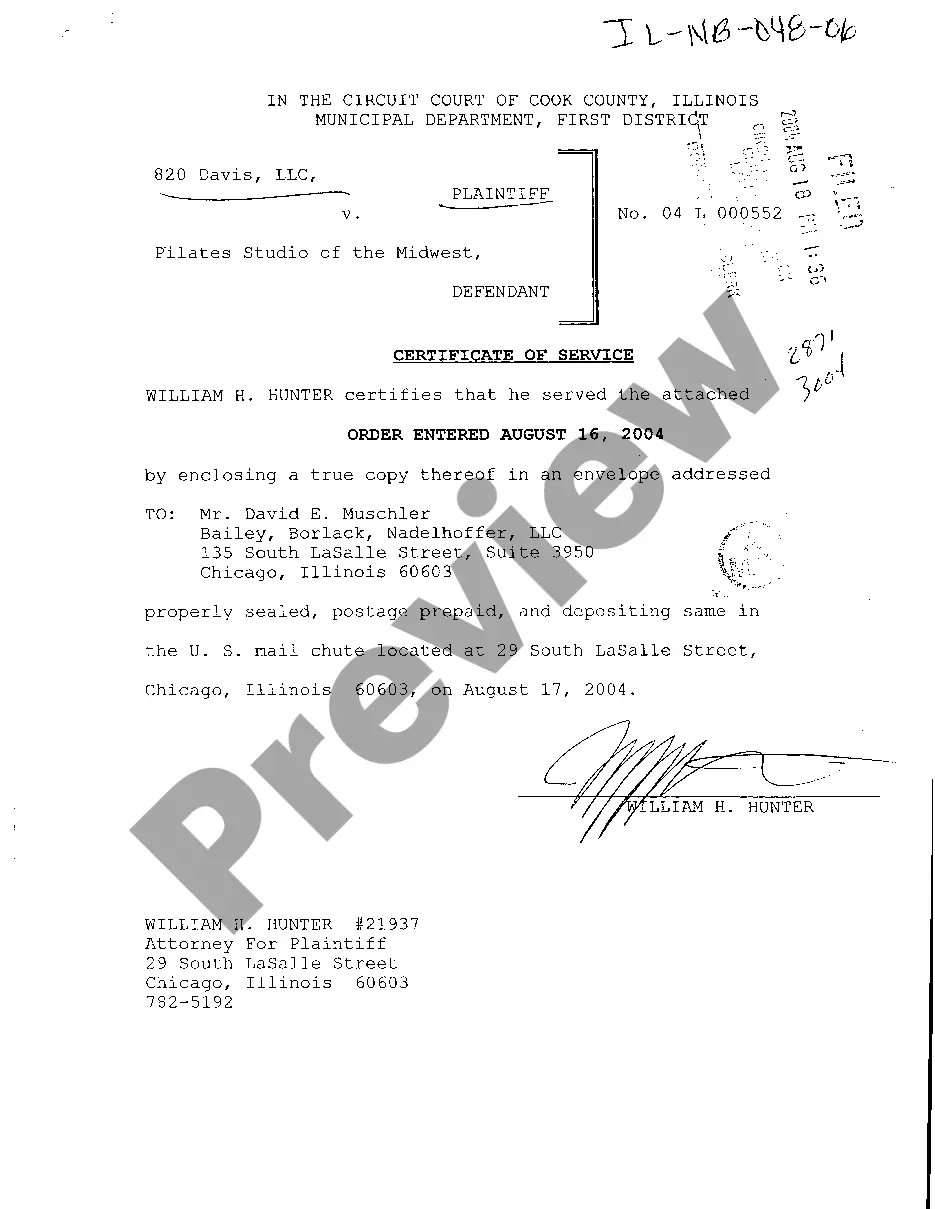

Illinois Certificate Of Service

Description Illinois Certificate Service

How to fill out Illinois Certificate Of Service?

Trying to find Illinois Certificate Of Service templates and filling out them can be quite a problem. To save time, costs and effort, use US Legal Forms and find the correct sample specifically for your state in just a couple of clicks. Our lawyers draw up every document, so you just need to fill them out. It truly is that easy.

Log in to your account and come back to the form's page and download the document. All your saved samples are stored in My Forms and they are available all the time for further use later. If you haven’t subscribed yet, you should sign up.

Check out our comprehensive guidelines regarding how to get the Illinois Certificate Of Service sample in a few minutes:

- To get an entitled form, check its validity for your state.

- Take a look at the sample utilizing the Preview function (if it’s accessible).

- If there's a description, go through it to know the details.

- Click on Buy Now button if you identified what you're seeking.

- Choose your plan on the pricing page and create your account.

- Choose you wish to pay out by a credit card or by PayPal.

- Download the file in the preferred format.

Now you can print the Illinois Certificate Of Service form or fill it out utilizing any online editor. Don’t worry about making typos because your template may be applied and sent, and printed out as often as you want. Try out US Legal Forms and access to around 85,000 state-specific legal and tax documents.

Illinois Certificate Of Service Form popularity

Certificate Of Good Standing Illinois Other Form Names

Service Nb Forms FAQ

Generally the information included on an Illinois Certificate of Good Standing is implied to be valid for 60-90 days but it really depends on the nature of the business for which the Illinois Good Standing Certificate is being used.

Register electronically using MyTax Illinois. Complete and mail Form REG-1, Illinois Business Registration Application. Visit a regional office.

Illinois businesses are not legally required to obtain a certificate of good standing. However, your business may choose to get one if you decide to do business outside of Illinois or get a business bank account.

Obtain a Certificate of Good Standing Payment may be made by Visa, MasterCard, Discover or American Express. For corporations only, you also may purchase a Certificate of Good Standing by calling 217-782-6875.

A non-governmental firm called "IL Certificate Service" is contacting Illinois businesses in an attempt to collect an $87 fee for a form entitled a "Certificate of Status".It is recommended that business organizations in Illinois ignore this solicitation and do NOT reply to the solicitation.

A certificate of good standing is a document that says your company is legally registered with your state. The document is proof that you're authorized to do business there and that you follow all state requirements, like submitting required documents and paying taxes and other fees.

How Do I Obtain an LLC Illinois State ID Number? First, you start by forming an LLC in Illinois. This requires the filing of the Articles of Organization through the Illinois Secretary of State. You must also obtain a taxpayer identification from the Illinois Department of Revenue and certificate of registration.

A Certificate of Good Standing is a document issued by the Illinois Secretary of State showing the official existence of registered business entities like a Limited Liability Company (LLC), Corporation, LP, LLP, or Not-for-Profit that is authorized to do business in Illinois.

A Certificate of Good Standing is a document issued by the Illinois Secretary of State showing the official existence of registered business entities like a Limited Liability Company (LLC), Corporation, LP, LLP, or Not-for-Profit that is authorized to do business in Illinois.Applying for a business loan.