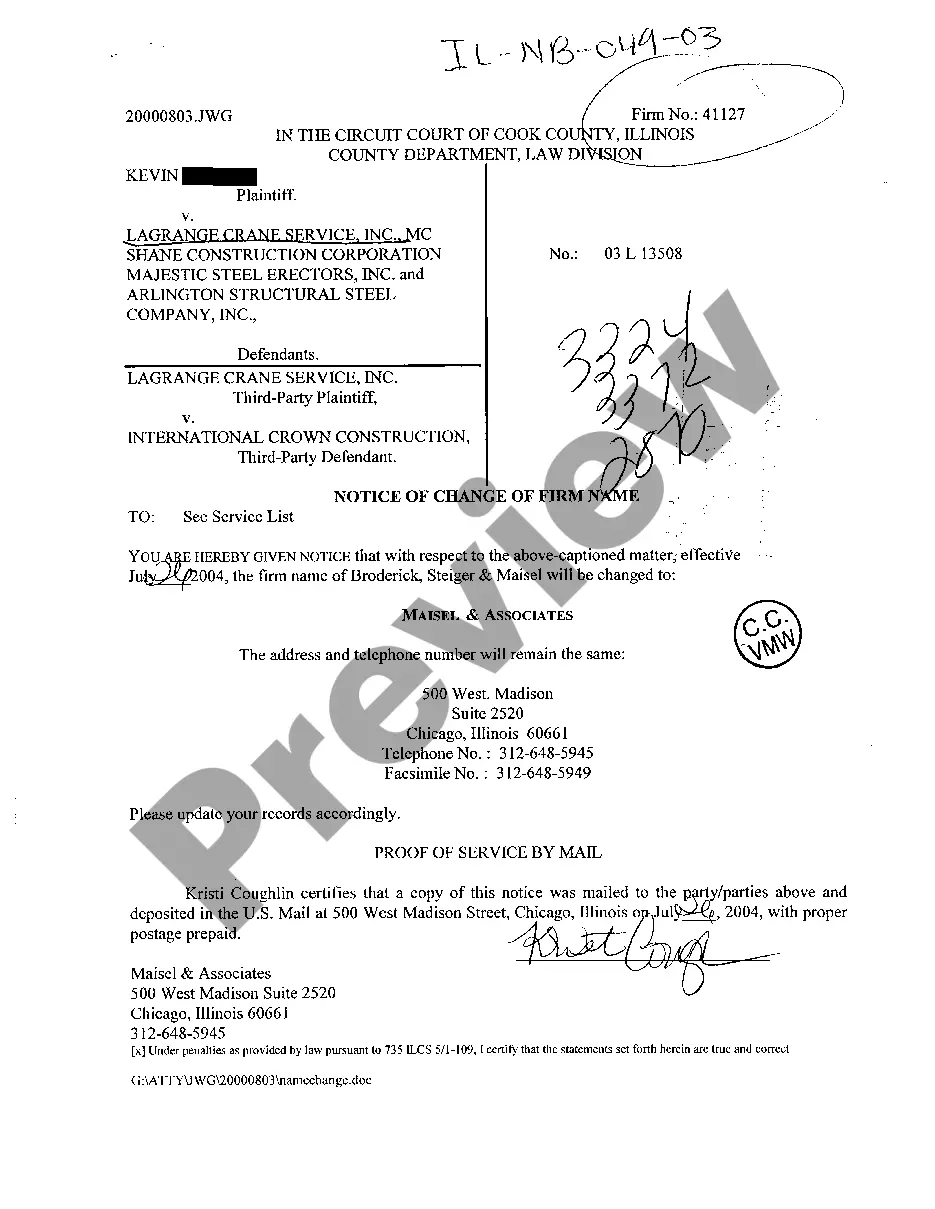

Notice Of Firm Name Change

Description

How to fill out Illinois Notice Of Charge Of Firm Name?

Trying to find Illinois Notice Of Charge Of Firm Name templates and completing them could be a challenge. In order to save time, costs and effort, use US Legal Forms and find the appropriate template specially for your state in a few clicks. Our attorneys draft each and every document, so you simply need to fill them out. It truly is that easy.

Log in to your account and come back to the form's page and download the sample. All of your saved examples are saved in My Forms and therefore are accessible at all times for further use later. If you haven’t subscribed yet, you should sign up.

Have a look at our thorough guidelines on how to get your Illinois Notice Of Charge Of Firm Name form in a few minutes:

- To get an entitled form, check its applicability for your state.

- Take a look at the form using the Preview option (if it’s offered).

- If there's a description, read it to learn the important points.

- Click on Buy Now button if you identified what you're searching for.

- Choose your plan on the pricing page and create your account.

- Pick how you would like to pay out by a credit card or by PayPal.

- Download the file in the favored file format.

You can print out the Illinois Notice Of Charge Of Firm Name template or fill it out utilizing any online editor. No need to concern yourself with making typos because your sample can be utilized and sent away, and printed out as often as you wish. Check out US Legal Forms and access to around 85,000 state-specific legal and tax files.