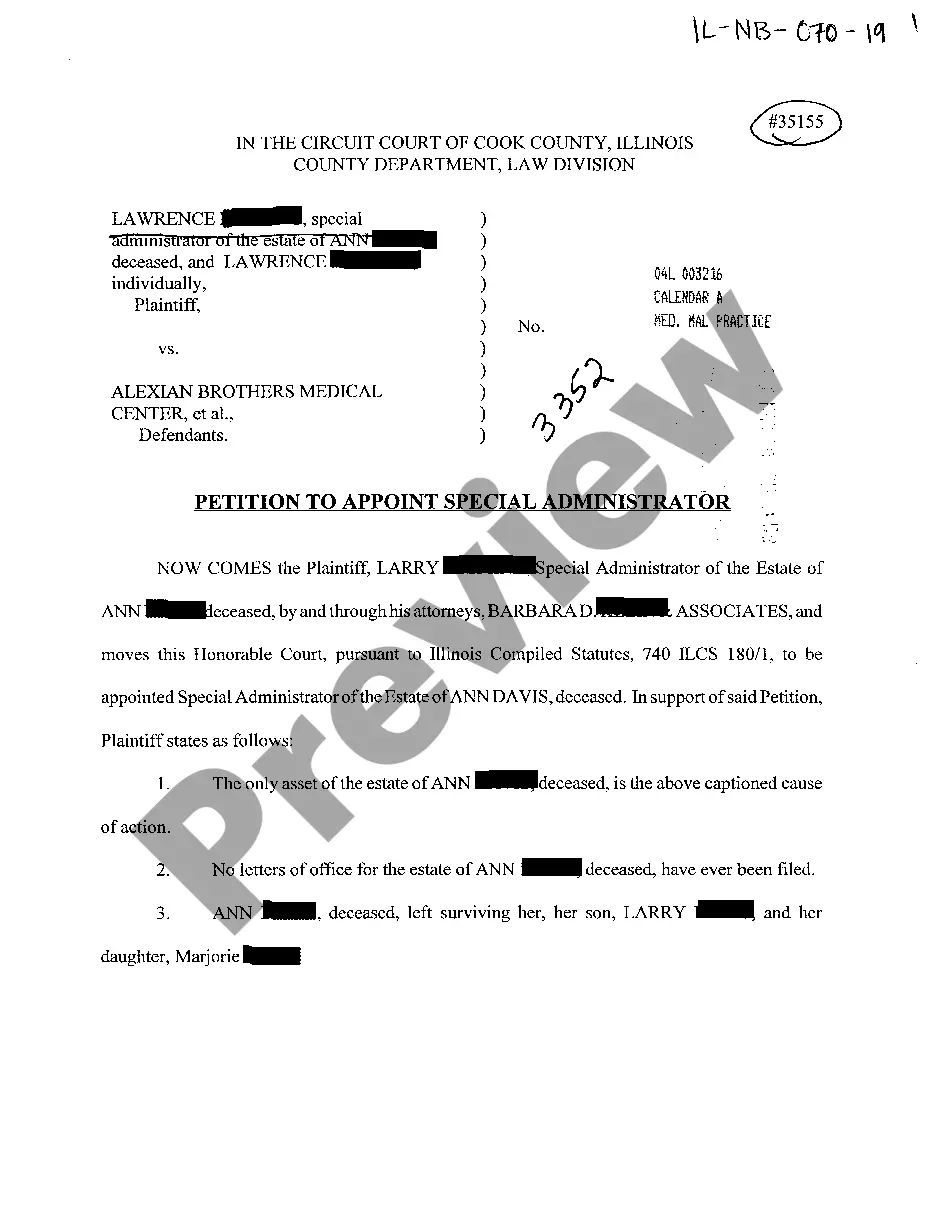

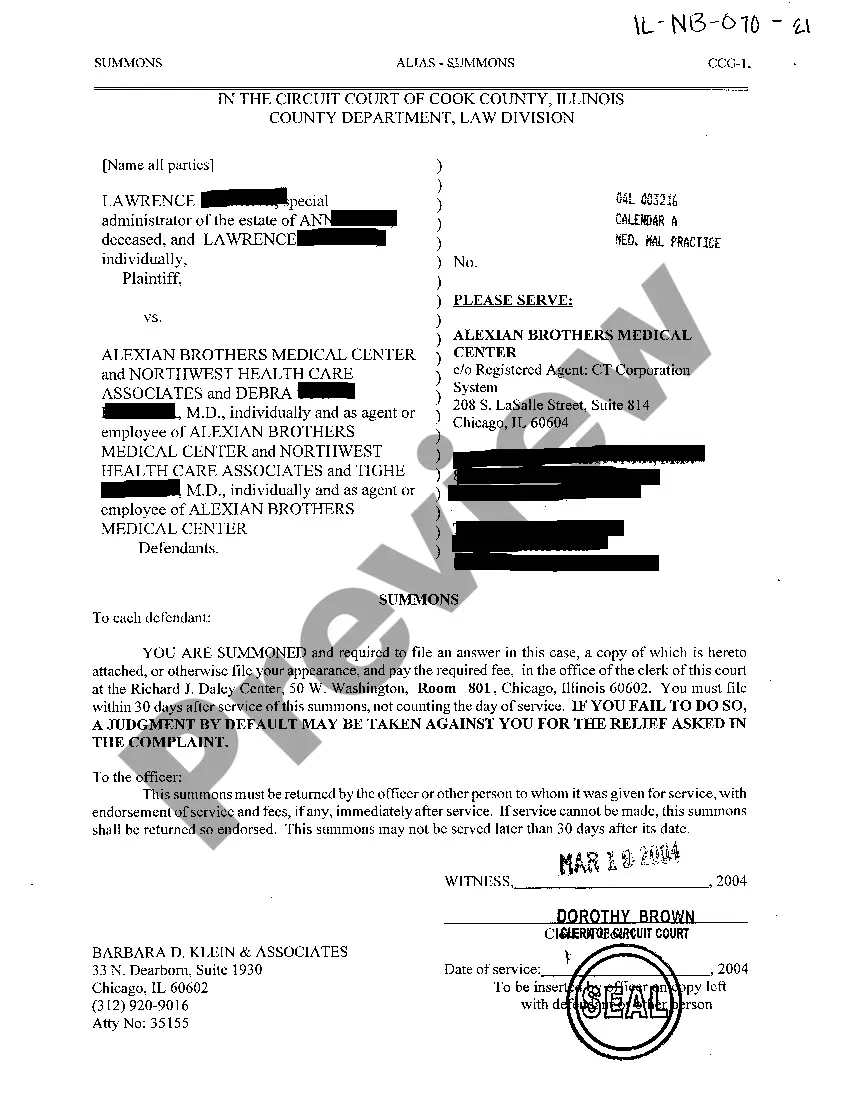

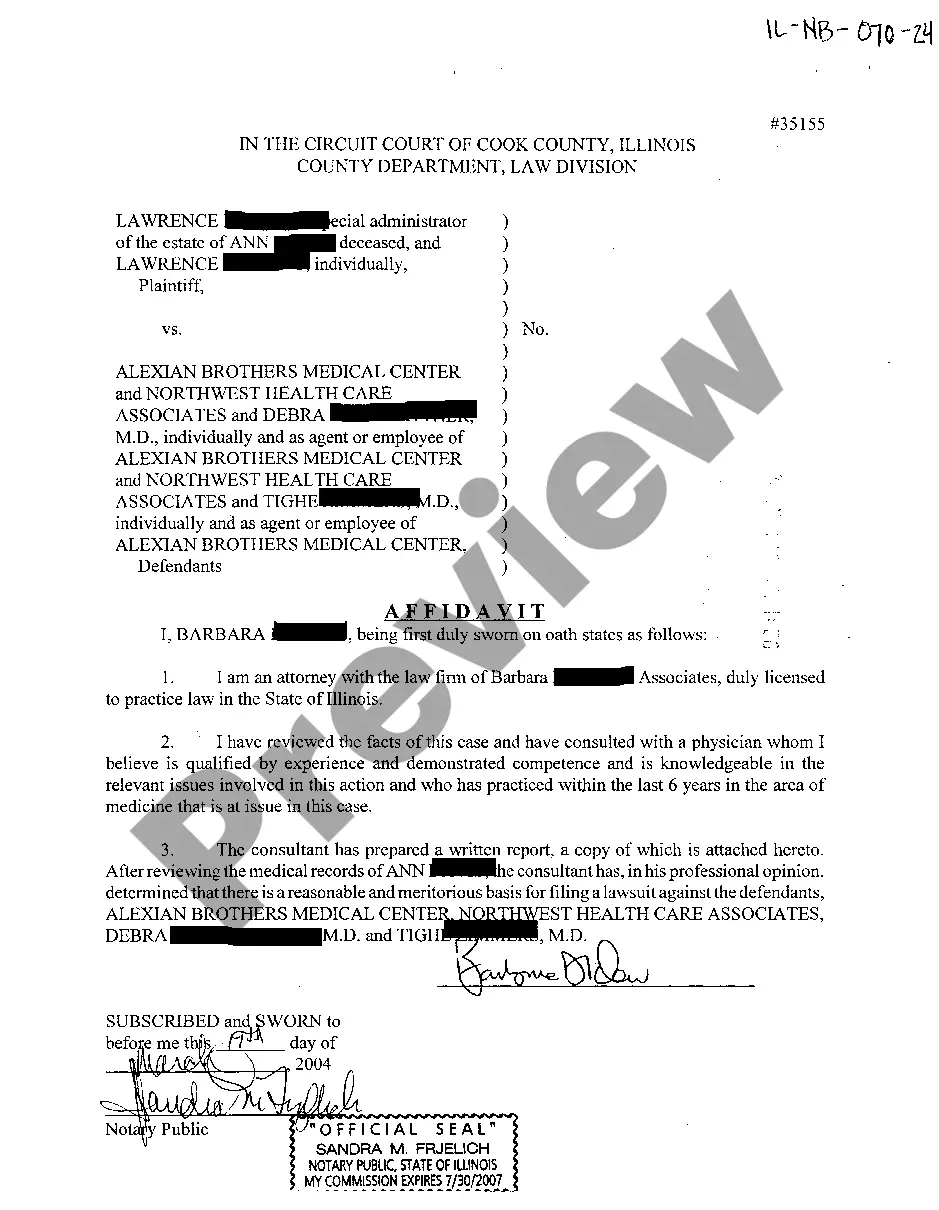

Illinois Petition to Appoint Special Administrator

Description

How to fill out Illinois Petition To Appoint Special Administrator?

Locating Illinois Petition to Appoint Special Administrator templates and completing them can be difficult.

To conserve time, expenses, and effort, utilize US Legal Forms to discover the appropriate example specifically for your state in just a few clicks.

Our attorneys draft all documents, so you only need to complete them. It’s truly that simple.

You can print the Illinois Petition to Appoint Special Administrator template or complete it using any online editor. Don’t worry about making mistakes since your template can be used and submitted, and printed out as many times as you wish. Explore US Legal Forms and gain access to around 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the document.

- All of your downloaded samples are stored in My documents and are always available for future use.

- If you haven’t subscribed yet, you should register.

- Review our thorough guidelines on how to acquire your Illinois Petition to Appoint Special Administrator form in just a few minutes.

- To obtain a valid example, verify its applicability for your state.

- Examine the form using the Preview option (if it’s available).

- If there's a description, read it to understand the specifics.

- Click Buy Now if you've found what you're looking for.

Form popularity

FAQ

An administrator is appointed as personal representative where the decedent died intes- tate (without a will).A special administrator is appointed where immediate action is required with regard to the estate but no permanent personal representative has yet been appointed. Prob 8540(a).

The difference between executor and administrator of estate in comes down to how the person came to be in charge of the estate. Someone who is appointed through the will of the person who died is called executor. Someone who is appointed because of any other reason is called administrator.

How is an Administrator of an estate appointed? Letters of Administration can be made by the Supreme Court where a person dies without leaving a Will or without an executor. Once granted, the appointed person will be the Administrator of the estate, just like an Executor appointed in a Will.

A Special administrator is a court-appointed person who administrates a court-defined part of an estate during probate.A special administrator can also oversee an entire estate, albeit for a limited time (in case of emergency).

The appointment of a special administrator is a special, temporary situation where a person is appointed to do the limited tasks of checking into a decedent's assets, accounting the assets, marshaling the assets, protecting the assets, and/or acting as a real party in interest in lawsuits involving the estate.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

An administrator can be appointed by: the board of directors of a company taking a majority decision. the shareholders of a company at a general meeting. a qualifying floating charge holder meaning a debenture holder, usually a bank.

If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative. If the decedent dies intestate i.e., without a Will an Administrator is appointed as the personal representative.