Illinois Notice To Heirs and Legatees-Will admitted is a legal document that is issued by the probate court in the state of Illinois. It informs the named beneficiaries of a will that the will has been admitted into probate and that they are entitled to their inheritance. There are two types of Illinois Notice To Heirs and Legatees-Will admitted. The first type is the Notice of Will Admitted, which is issued when the will is admitted into probate and the second type is the Notice of Petition to Admit Will to Probate, which is issued when a petition is filed to admit the will to probate. Both notices provide the same information, but the Notice of Petition to Admit Will to Probate provides more specific information about the petition and the process of probate.

Illinois Notice To Heirs and Legatees-Will admitted

Description

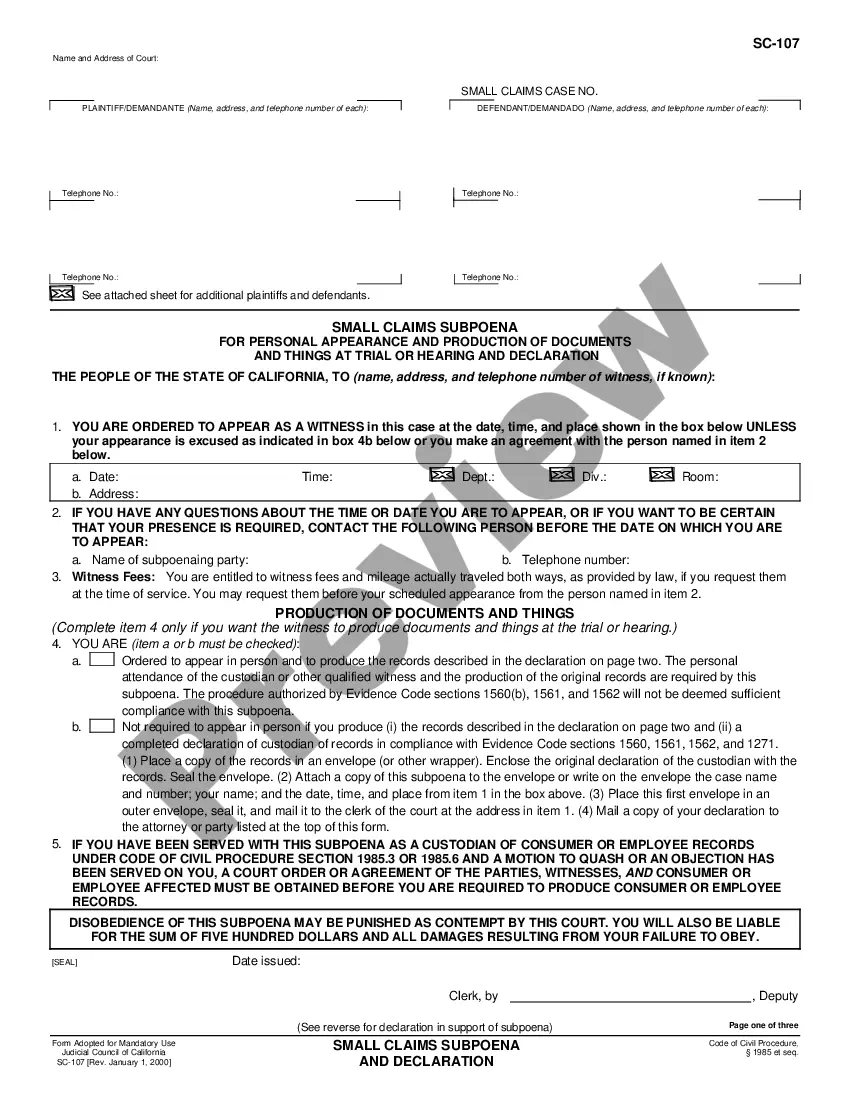

How to fill out Illinois Notice To Heirs And Legatees-Will Admitted?

US Legal Forms is the most simple and affordable way to find suitable formal templates. It’s the most extensive online library of business and individual legal documentation drafted and verified by lawyers. Here, you can find printable and fillable templates that comply with national and local laws - just like your Illinois Notice To Heirs and Legatees-Will admitted.

Getting your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Illinois Notice To Heirs and Legatees-Will admitted if you are using US Legal Forms for the first time:

- Read the form description or preview the document to guarantee you’ve found the one meeting your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you like most.

- Create an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Illinois Notice To Heirs and Legatees-Will admitted and save it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding official documentation. Try it out!

Form popularity

FAQ

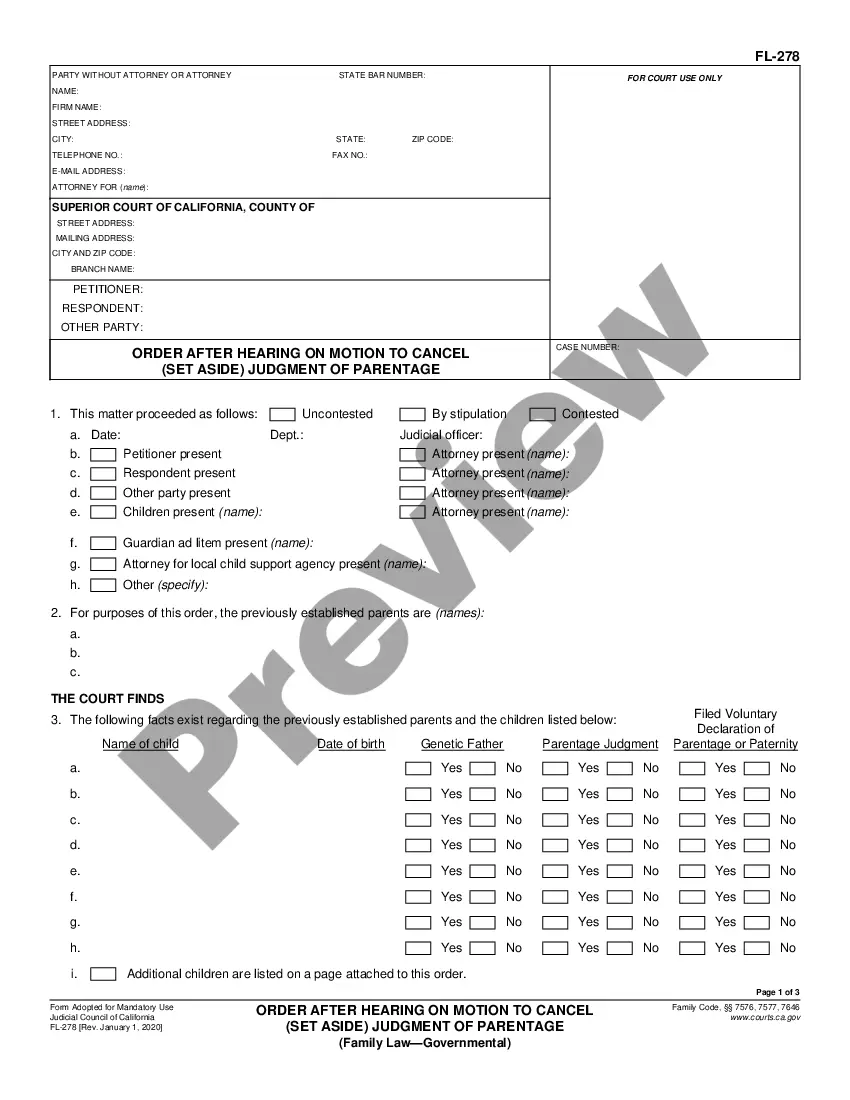

The Illinois Probate Act states in Article XV that the surviving spouse of a recently deceased person is entitled to an award from that person's estate in an amount the court finds reasonable to support the living of the surviving spouse for a period of 9 months after the decedent's death.

Every estate does not have to go through probate. Probate is the legal process to make sure that a deceased person's debts and taxes are paid. In Illinois, a lawyer is required for probate unless the estate is valued at or less than $100,000 and does not have real estate.

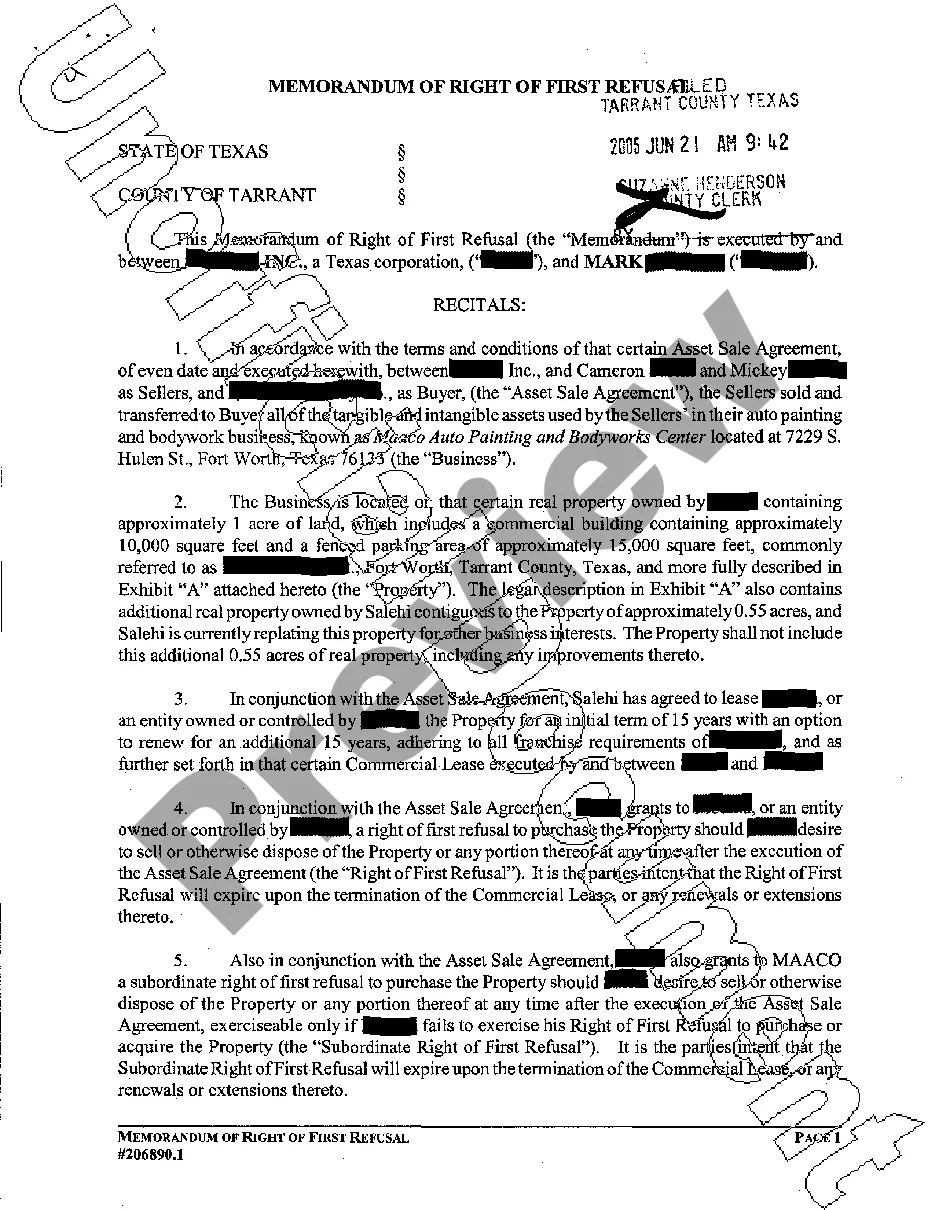

This statement of the decedent's intent is commonly known as that person's "Will." Under Illinois law, it is required that any person who possesses the Will of a decedent file it with the Clerk of the Circuit Court of the county in which that individual resided within 30 days after the death of the testator is known to

Things that aren't part of the deceased person's estate don't have to be handled in settling their estate. Probate is just one way to settle an estate when someone dies. And it's not always required. Illinois law allows a different and simplified procedure for handling small estates.

Three Tips to Avoid Probate in Illinois Create a Living Trust. The simplest way to avoid probate is to create a living trust instead of a last will.Hold Property Jointly. Another effective way to keep your real estate assets out of probate is to hold your property jointly.Name Beneficiaries on Your Accounts.

?If the address of an heir or legatee is unknown, the executor is required to publish notice to the heirs and legatees in a local newspaper once a week for three weeks, beginning within 14 days of the entry of the order admitting the will to probate. ?The executor must also publish notice to any unknown creditors.

No probate will be necessary to transfer the property, although of course it will take some paperwork to show that title to the property is held solely by the surviving owner.

Probate is typically necessary in Illinois when the decedent owns any real estate or more than $100,000.00 of non-real-estate assets outside of a trust.