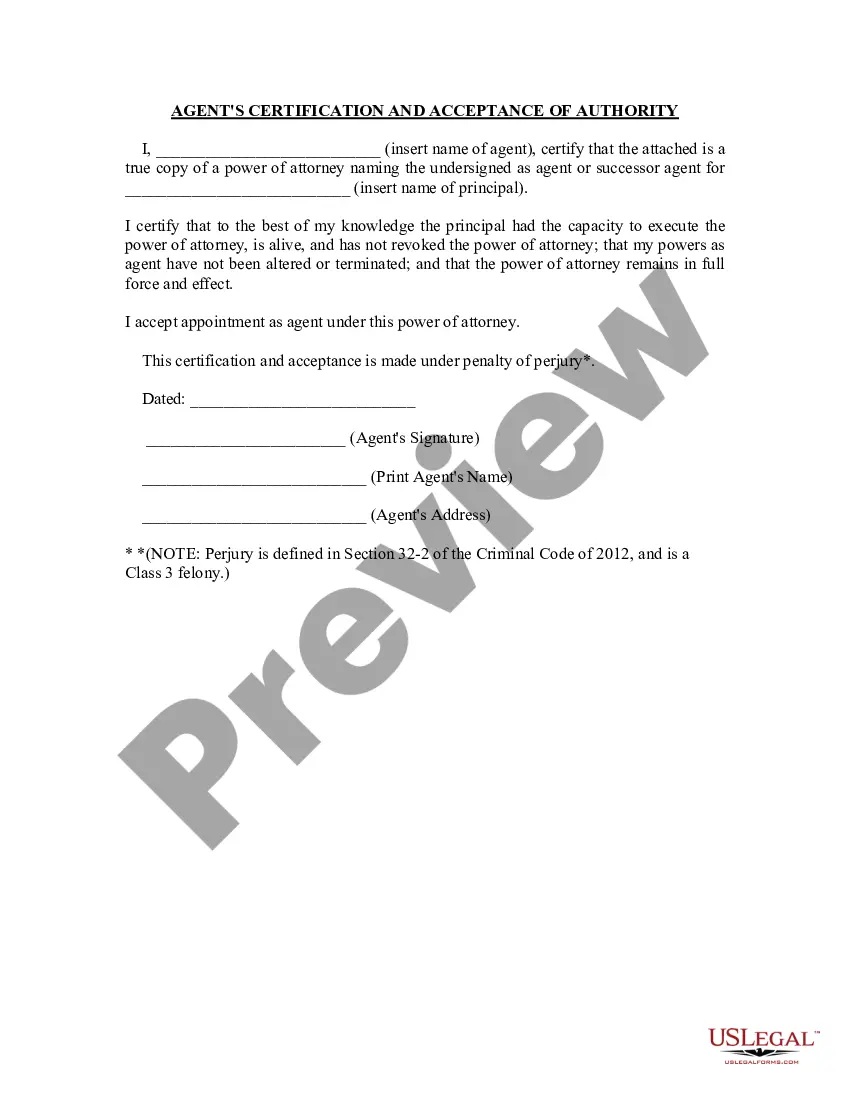

Illinois Agent's Certification and Acceptance of Authority

Description Agent Authority

How to fill out Power Under Certify?

Trying to find Illinois Agent's Certification and Acceptance of Authority forms and filling out them can be a challenge. In order to save time, costs and energy, use US Legal Forms and choose the right template specially for your state in a couple of clicks. Our legal professionals draw up every document, so you simply need to fill them out. It is really that easy.

Log in to your account and come back to the form's page and save the sample. All your saved examples are stored in My Forms and therefore are accessible always for further use later. If you haven’t subscribed yet, you need to sign up.

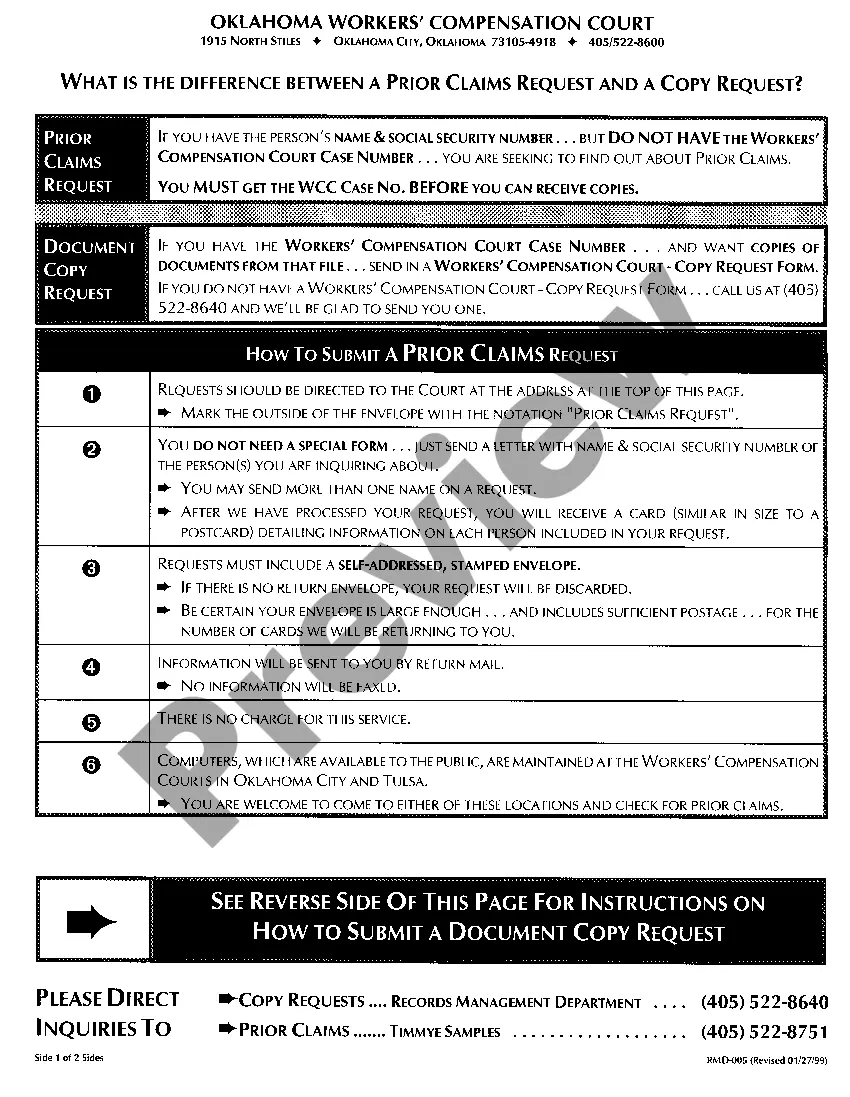

Have a look at our detailed instructions on how to get your Illinois Agent's Certification and Acceptance of Authority template in a few minutes:

- To get an qualified sample, check its validity for your state.

- Check out the example utilizing the Preview function (if it’s accessible).

- If there's a description, read it to know the details.

- Click Buy Now if you identified what you're trying to find.

- Pick your plan on the pricing page and create your account.

- Select you wish to pay out by a credit card or by PayPal.

- Save the sample in the preferred file format.

You can print the Illinois Agent's Certification and Acceptance of Authority template or fill it out utilizing any web-based editor. Don’t concern yourself with making typos because your template may be applied and sent away, and printed as often as you wish. Try out US Legal Forms and access to above 85,000 state-specific legal and tax files.

Agent Insert Certify Form popularity

Agent Authority Document Other Form Names

Agent Authority Blank FAQ

A registered agent is an individual or company who is the central point of contact to receive important legal documents for a business. A registered agent is required by the Illinois Secretary of State when filing for a business entity such as a corporation, Limited Liability Company, and Limited Partnership.

You must be at least 18 years old to be your own registered agent in Illinois. An Illinois street address is required and the agent must be able to accept legal paperwork delivered in person to their home or office. A registered agent can be the owner, an employee, a friend, or a nearby business.

Illinois Department Of Revenue (IDOR) In Illinois, most business are required to be registered and/or licensed by the IDOR. If you plan to hire employees, buy or sell products wholesale or retail, or manufacture goods, you must register with the IDOR.

Illinois state law requires all business entities to designate a registered agent. When you form your company with the Secretary of State, your filing will be rejected without a registered agent.

FAQs About California Registered Agents Yes. All CA LLCs are required to have a Registered Agent. This is mandated by the California Secretary of State.You must assign a Registered Agent when you incorporate your business through paperwork filed with the CA Secretary of State.

Can I Be My Own Registered Agent in Illinois? LLCs and Corporations cannot act as their own registered agents in Illinois. You are required to appoint one. You can hire Illinois Registered Office LLC for only $49 per year.

A registered agent is an individual or company who is the central point of contact to receive important legal documents for a business. A registered agent is required by the Illinois Secretary of State when filing for a business entity such as a corporation, Limited Liability Company, and Limited Partnership.

How much does it cost to form an LLC in Illinois? The Illinois Secretary of State charges $150 to file the Articles of Organization. You can reserve your LLC name with the Illinois Secretary of State for $25.