1. Summary of Rights and Obligations under COBRA

2. Termination Letter (General)

3. Checklist for Termination Action

4. Employment Termination Agreement

5. Consent to Release of Employment Information and Release

6. Exit Interview

Illinois Employment or Job Termination Package

Description Employment Job Termination

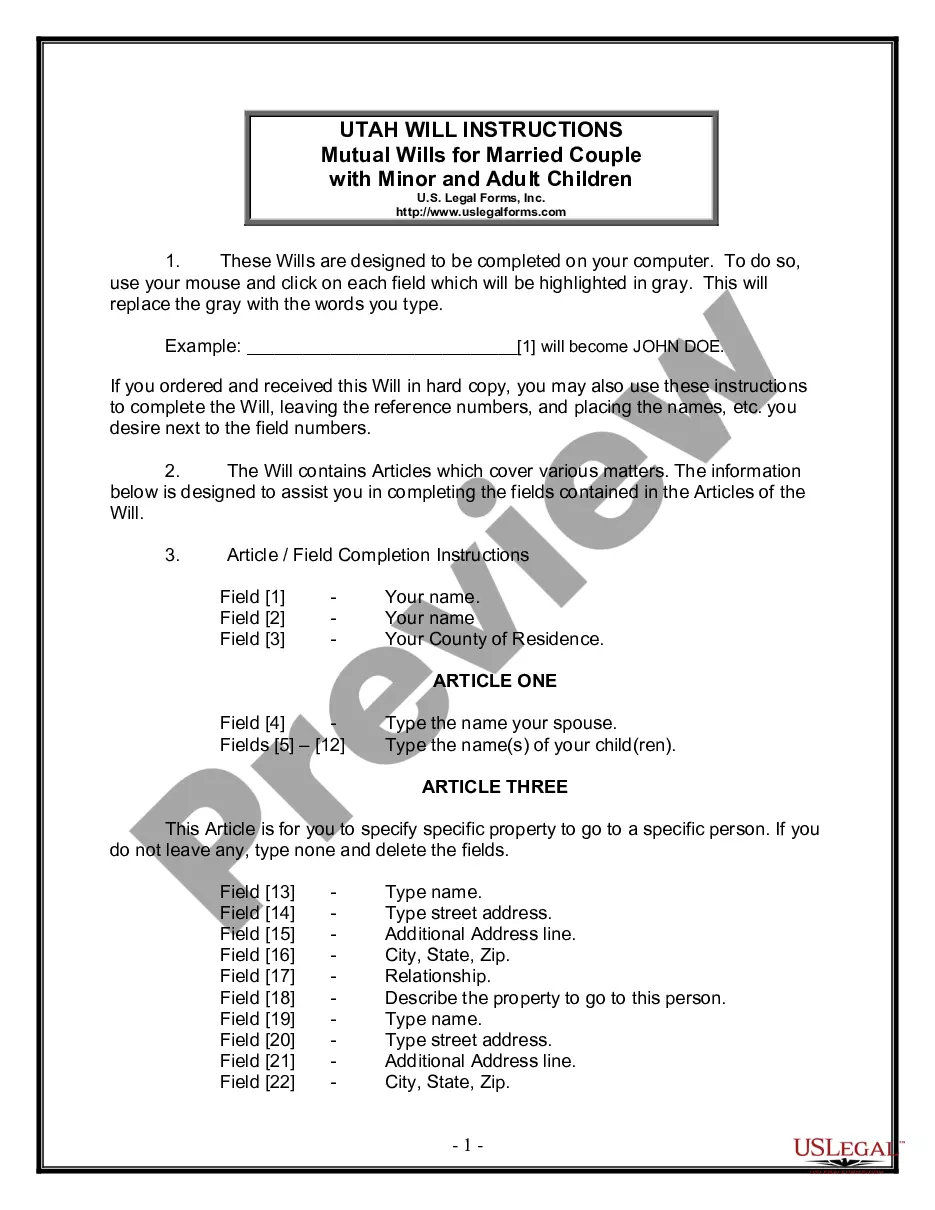

How to fill out Illinois Termination Form?

Looking for Illinois Employment or Job Termination Package sample and completing them can be quite a challenge. To save lots of time, costs and energy, use US Legal Forms and find the appropriate sample specifically for your state in just a couple of clicks. Our lawyers draft every document, so you just have to fill them out. It really is so simple.

Log in to your account and return to the form's page and download the document. All your downloaded templates are stored in My Forms and therefore are available always for further use later. If you haven’t subscribed yet, you should sign up.

Look at our thorough recommendations concerning how to get the Illinois Employment or Job Termination Package form in a few minutes:

- To get an qualified example, check out its validity for your state.

- Take a look at the form utilizing the Preview function (if it’s available).

- If there's a description, go through it to know the specifics.

- Click on Buy Now button if you identified what you're trying to find.

- Pick your plan on the pricing page and create your account.

- Pick how you want to pay out by a credit card or by PayPal.

- Save the sample in the favored file format.

Now you can print out the Illinois Employment or Job Termination Package form or fill it out utilizing any web-based editor. Don’t concern yourself with making typos because your template can be used and sent, and printed as often as you want. Check out US Legal Forms and access to more than 85,000 state-specific legal and tax files.

Employment Termination Form Form popularity

Illinois Termination Other Form Names

Termination Form Packet FAQ

If an employer makes a lump sum severance payment at the time the worker is separated from a job but allocates the severance payment to a week or weeks other than the week in which the payment is made, then the worker's weekly unemployment benefits will be reduced in each claimed week to which the severance payment is

If severance pay does extend the employment relationship, however, unemployment benefits may not be available until the severance ends. For example, if you receive a lump sum amount of severance on your last day of work, you may apply for unemployment.

Under California law, severance pay is not considered wages for unemployment purposes. Instead, it is considered a payment in recognition of your past service. Even if it is paid out in installments, as yours will be, it doesn't count against your unemployment.

You will not be entitled to unemployment benefits if the Illinois Department of Employment Security (IDES) finds that you were fired for misconduct. Misconduct means an employer must show that the actions that led to you being fired were: Willful and deliberate;Harmful to the employer.

In Illinois, you are not required to provide a terminated employee, whether the employee quit or was fired, with a termination letter. The only item you must give an employee at the time of an involuntary termination is a pamphlet from the Illinois Department of Employment Security called What Every Worker

There are several ways you can be disqualified from receiving unemployment benefits in Illinois: You quit your job without good cause. You were fired due to misconduct connected to your work.You were fired because you committed a felony or a work-related theft.

SEVERANCE IS NOT CONSIDERED WAGES FOR ILLINOIS UNEMPLOYMENT PURPOSES!: What comes as a surprise to many clients is that, in Illinois, severance is not considered wages by the Illinois Department of Employment Security (IDES). Rather, severance is considered by the IDES to be a gift for past services.

You are allowed to get both severance pay and unemployment. Illinois considers severance pay as money you receive for work you did during the time you were employed. Since your severance pay is not considered income, it will not usually affect your unemployment benefits.

Some of the most common reasons for disqualification from receipt of benefits are: Quitting a job voluntarily without good cause connected with work. Being discharged/fired from work for just cause. Refusing an offer of suitable work for which the claimant is reasonably suited.