1. An Heirship Affidavit

2. A General Power of Attorney effective immediately

3. A Revocation of Power of Attorney

4. Statutory Declaration - Living Will

5. A Personal Planning Information and Document Inventory Worksheet

Illinois Newly Widowed Individuals Package

Description

How to fill out Illinois Newly Widowed Individuals Package?

Looking for Illinois Newly Widowed Individuals Package forms and completing them can be quite a problem. In order to save time, costs and energy, use US Legal Forms and find the correct template specially for your state in just a couple of clicks. Our lawyers draw up every document, so you simply need to fill them out. It truly is so easy.

Log in to your account and return to the form's web page and save the document. All of your downloaded examples are saved in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you need to register.

Look at our thorough recommendations on how to get your Illinois Newly Widowed Individuals Package template in a couple of minutes:

- To get an eligible form, check out its applicability for your state.

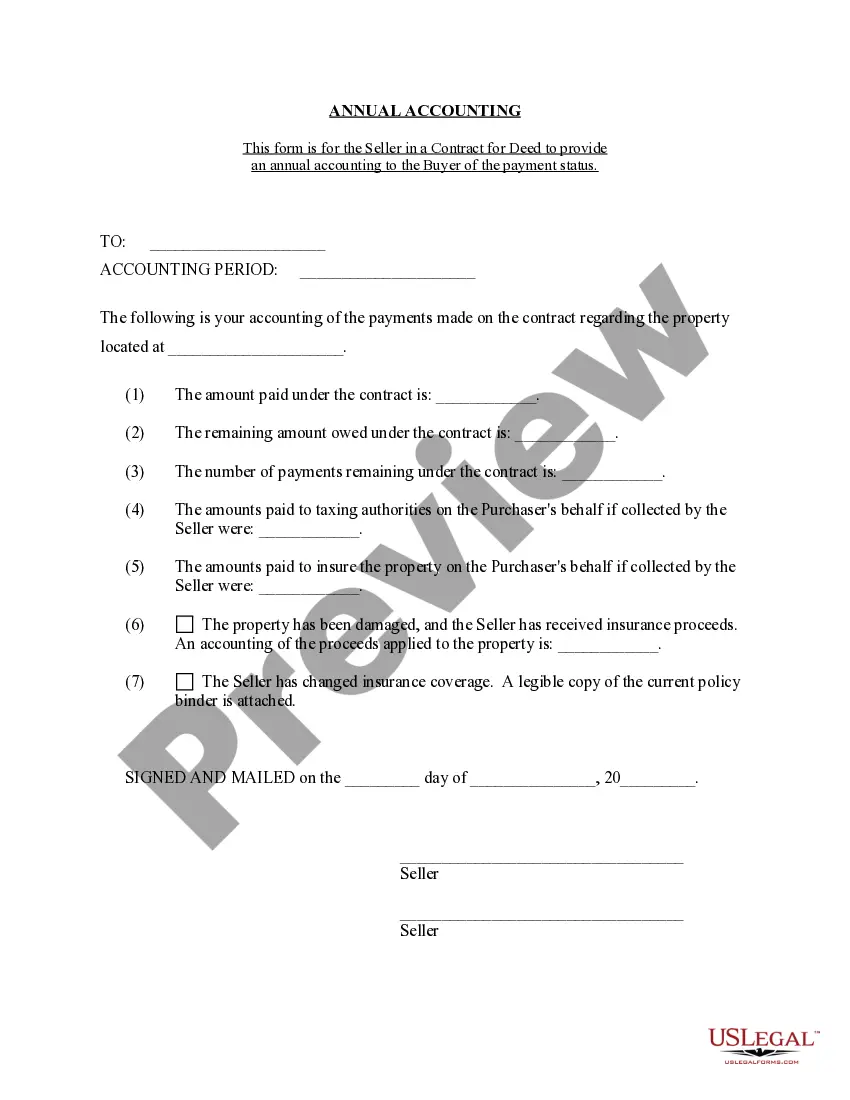

- Take a look at the sample making use of the Preview option (if it’s accessible).

- If there's a description, go through it to understand the specifics.

- Click on Buy Now button if you identified what you're searching for.

- Select your plan on the pricing page and create an account.

- Choose you would like to pay by a card or by PayPal.

- Save the file in the favored format.

Now you can print out the Illinois Newly Widowed Individuals Package template or fill it out utilizing any web-based editor. Don’t concern yourself with making typos because your sample can be utilized and sent, and printed as many times as you want. Check out US Legal Forms and access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 50 if they are disabled provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

A surviving spouse can collect 100 percent of the late spouse's benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

Widows can claim benefits at any time between 60 and their survivor full retirement age.

There are two kinds of benefits that loved ones left behind may be entitled to receive after the death of a spouse. These are: Widowed parent's allowance. Bereavement allowance and bereavement payment.

These are examples of the benefits that survivors may receive: Widow or widower, full retirement age or older 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 full retirement age 71½ to 99 percent of the deceased worker's basic amount.

For Your Widow Or WidowerWidows and widowers can receive: Reduced benefits as early as age 60 or full benefits at full retirement age or older. If widows or widowers qualify for retirement benefits on their own record, they can switch to their own retirement benefit as early as age 62.

Widow Or Widower Receive full benefits at full retirement age for survivors or reduced benefits as early as age 60.Begin receiving benefits as early as age 50 if you are disabled and the disability started before or within seven years of the worker's death.

Employees may also be eligible to receive Medicare benefits through a deceased spouse if that spouse had earned 40 credits prior to their death and they were married to them at the time of the spouse's death.

Be at least age 60. Be the widow or widower of a fully insured worker. Meet the marriage duration requirement. Be unmarried, unless the marriage can be disregarded.