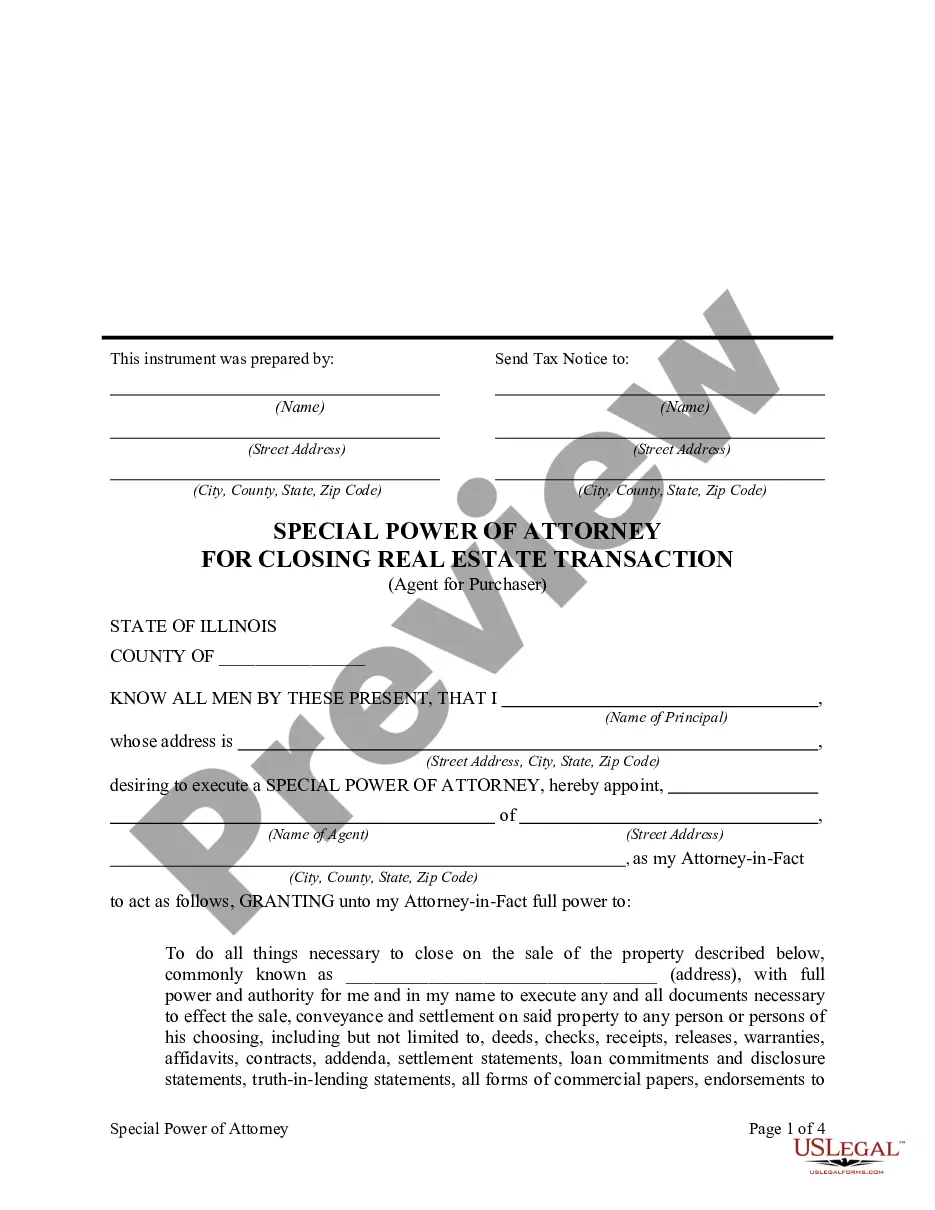

Illinois Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Description

How to fill out Illinois Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Trying to find Illinois Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser templates and completing them could be a problem. To save time, costs and effort, use US Legal Forms and find the correct sample specifically for your state within a couple of clicks. Our lawyers draw up each and every document, so you just need to fill them out. It is really that simple.

Log in to your account and come back to the form's web page and save the sample. All your saved samples are saved in My Forms and therefore are accessible at all times for further use later. If you haven’t subscribed yet, you should sign up.

Look at our detailed recommendations regarding how to get the Illinois Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser form in a couple of minutes:

- To get an qualified form, check out its validity for your state.

- Have a look at the example making use of the Preview option (if it’s offered).

- If there's a description, go through it to understand the important points.

- Click on Buy Now button if you found what you're seeking.

- Select your plan on the pricing page and create your account.

- Choose you would like to pay by way of a card or by PayPal.

- Download the form in the favored format.

You can print the Illinois Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser form or fill it out utilizing any web-based editor. No need to worry about making typos because your form can be applied and sent away, and published as many times as you wish. Check out US Legal Forms and get access to more than 85,000 state-specific legal and tax documents.

Form popularity

FAQ

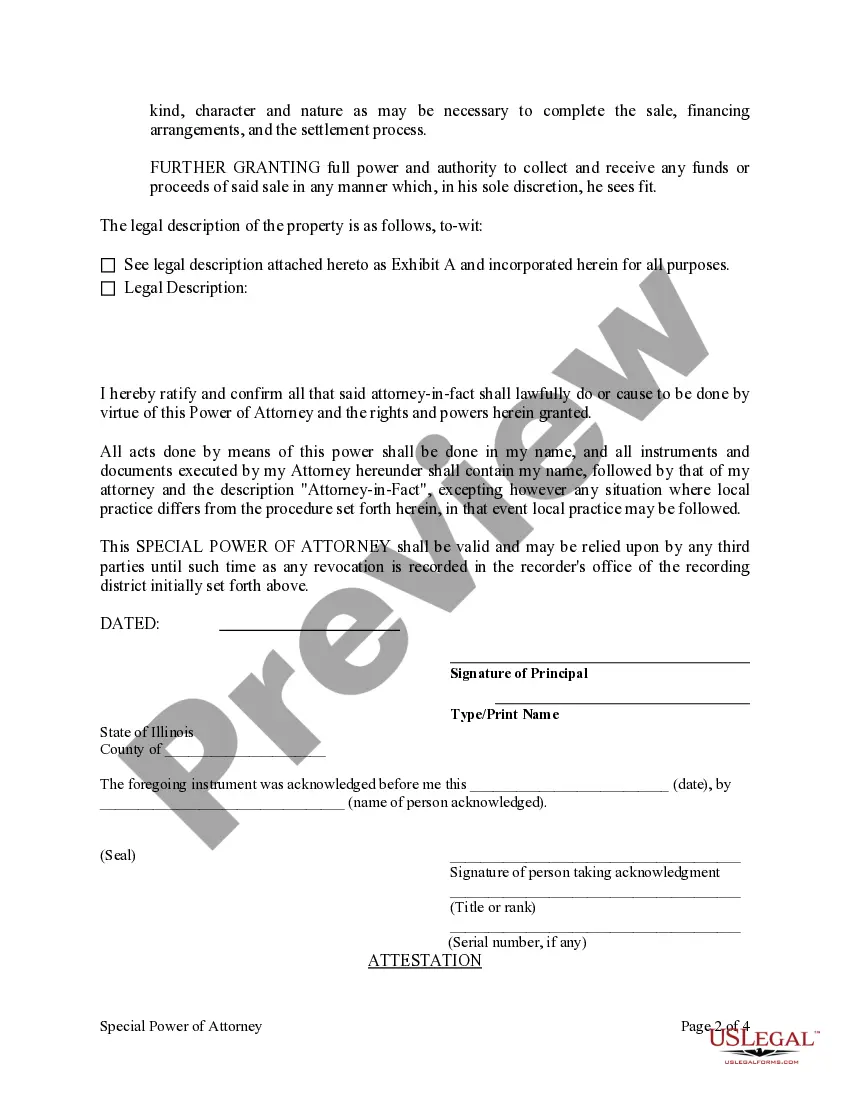

A power of attorney letter bestows the Agent with powers to act over various transactions. Generally, the main elements in an example of power of attorney letter include: Your name, address, and signature as the principal.The name, address, and signature of the person who witnesses the signing.

Finally, the power of attorney document requires the principal's notarized signature and at least one witness to be effective. Please note, according to Section 3-3.6 of the Illinois Power of Attorney Act, the requirement of at least one witness's signature applies to agencies created after June 9, 2000.

Hence, rights in immovable property are vested only when a sale deed or deed of conveyance is registered between the parties.Sale of property has various implications such as capital gains tax on the seller and payment of stamp duty on the document of transfer.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

Hence, rights in immovable property are vested only when a sale deed or deed of conveyance is registered between the parties.Sale of property has various implications such as capital gains tax on the seller and payment of stamp duty on the document of transfer.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

Draft the Power of Attorney for NRIs, print on a plain paper and sign it. Go to the Indian Embassy or Consulate in that country and get it stamped and sealed from the embassy.

Name, signature, and address of the principal. Name, signature, and address of the agent. Properties and activities under the authority of the agent. Date of effect and termination of authority. Compensation to services of the agent.

You can draft a durable power of attorney by writing out or typing the document, which should include the date, your full name, and speech that clearly identifies the document as a durable power of attorney that applies even in the case of your incapacitation.