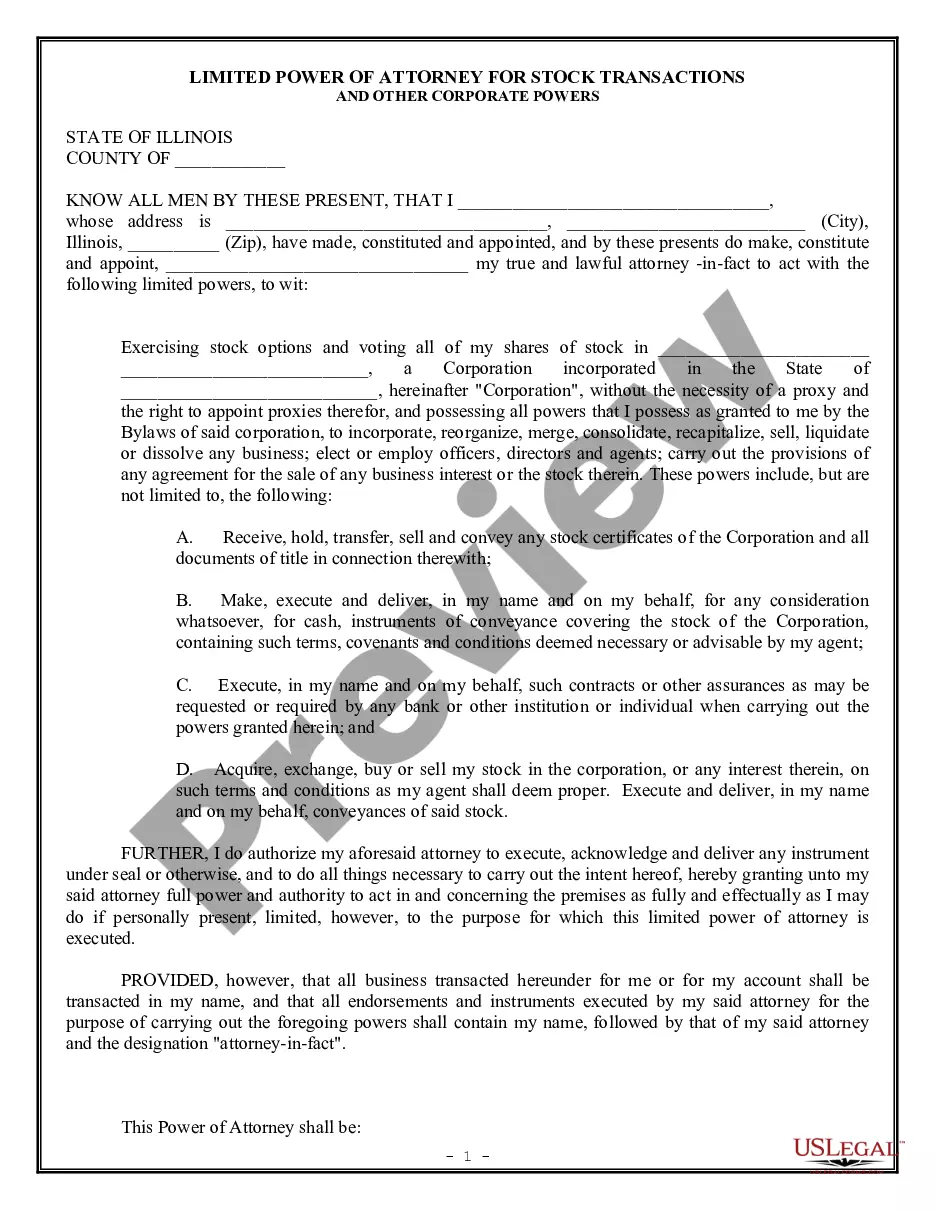

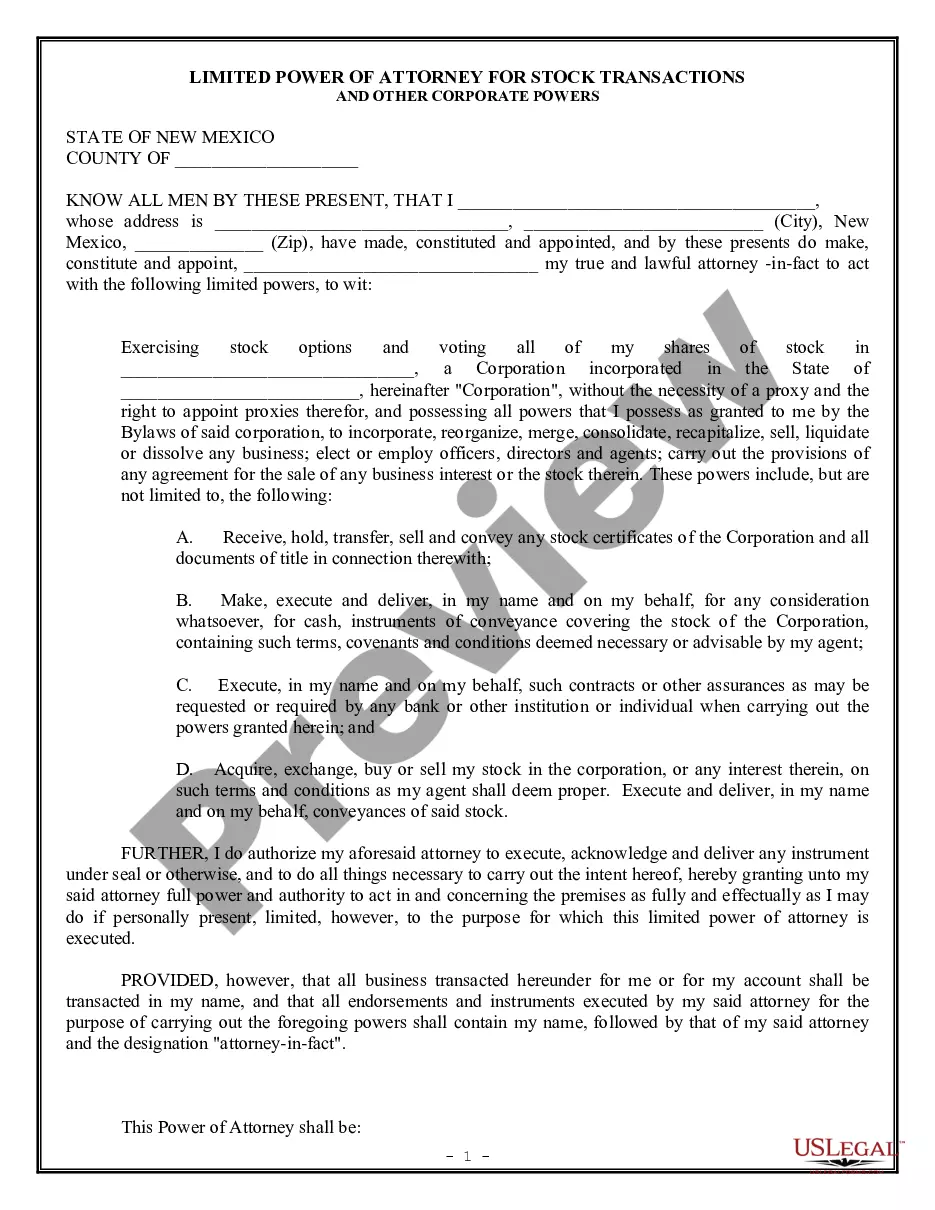

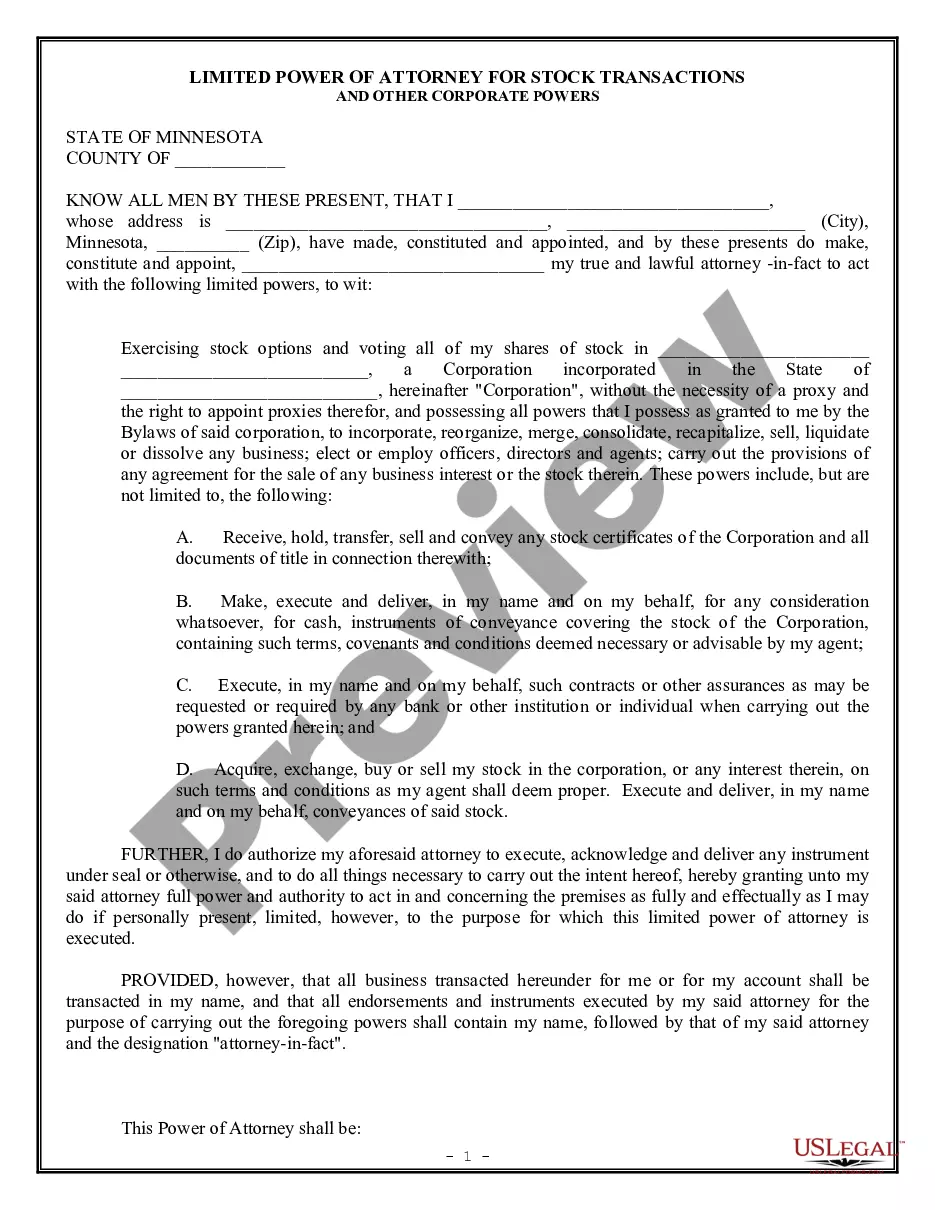

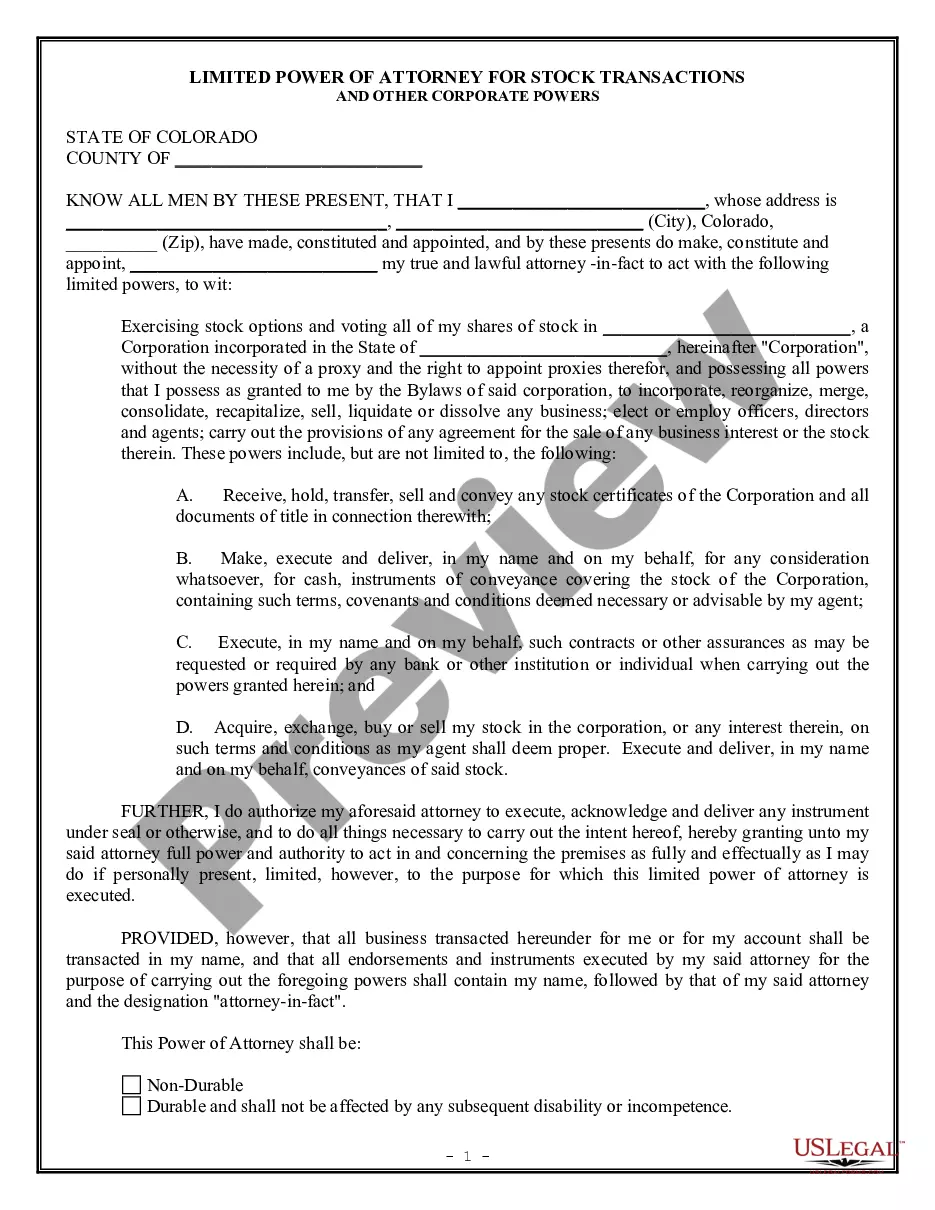

Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers

Description Stock Powers Form

How to fill out Illinois Attorney Form?

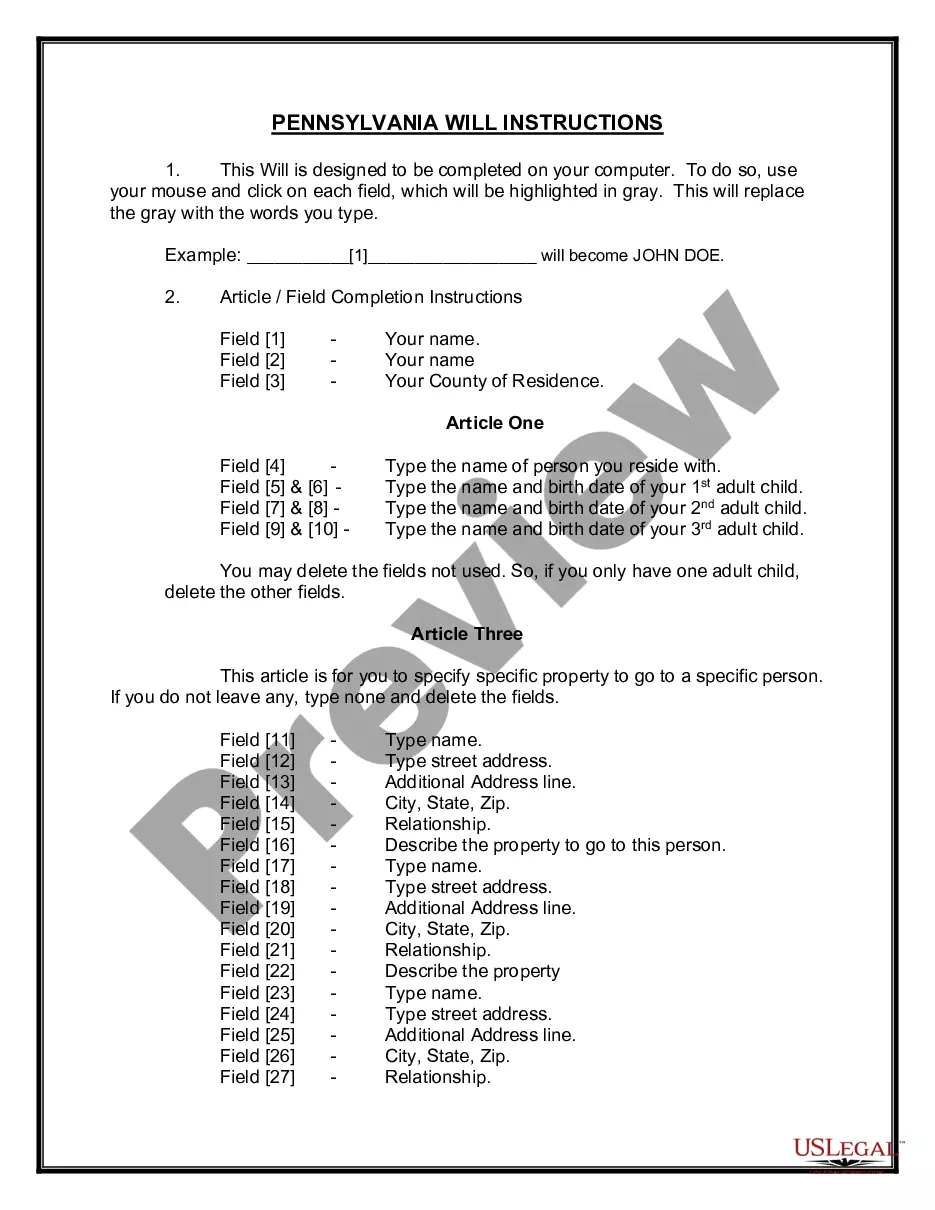

In search of Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers sample and filling out them could be a challenge. To save time, costs and effort, use US Legal Forms and find the appropriate example specially for your state within a couple of clicks. Our lawyers draft each and every document, so you just have to fill them out. It truly is so simple.

Log in to your account and return to the form's web page and save the document. All your saved templates are kept in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you need to register.

Take a look at our thorough instructions on how to get your Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers form in a couple of minutes:

- To get an eligible form, check out its applicability for your state.

- Look at the sample making use of the Preview function (if it’s offered).

- If there's a description, read through it to learn the details.

- Click Buy Now if you identified what you're seeking.

- Pick your plan on the pricing page and make your account.

- Select you want to pay out by a card or by PayPal.

- Download the sample in the favored format.

You can print the Illinois Limited Power of Attorney for Stock Transactions and Corporate Powers form or fill it out using any web-based editor. No need to concern yourself with making typos because your template may be utilized and sent, and printed out as often as you wish. Check out US Legal Forms and get access to over 85,000 state-specific legal and tax documents.

Il Attorney Powers Form popularity

Illinois Attorney Powers Other Form Names

Power Stock Form Sample FAQ

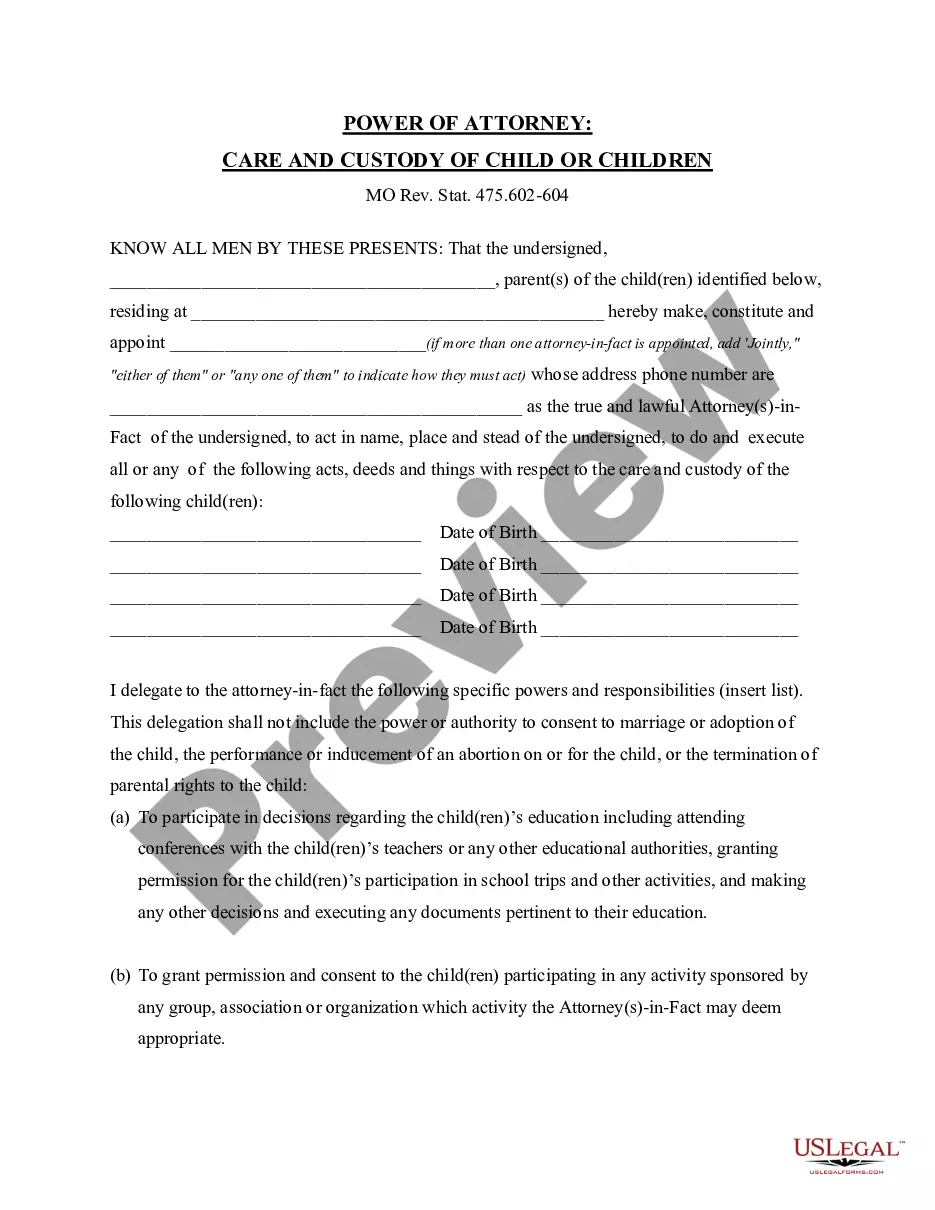

Having joint power of attorney between two siblings is also an option families can explore. James Gillis, an estate planning attorney at Offit Kurman, explained: A principal could appoint two or more agents.

You cannot have more than one Agent acting at the same time. In Illinois, if you want to name more than one Agent, you must make one of them your primary Agent. If that Agent dies or can't make decisions for you, then your second Agent (the Successor Agent) would act for you.

Technically you can have as many attorneys as you like but it is common to appoint between one and four attorneys. It's advisable not to have too many attorneys, as it can cause issues if lots of people are trying to act on your behalf at once.

The person you give the power of attorney to is the agent and you are the principal. The agent is usually a spouse, a close friend, or a trusted relative. The document does not have to be notarized.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

You can choose one or more people to be your attorney. If you appoint more than one, you must decide whether they'll make decisions separately or together.

An Enduring Power of Attorney may not be effective outside Alberta.An Alternate Attorney is a person named in a Power of Attorney to act if another Attorney cannot act. More than one EPA can be valid at the same time. For example, you might have different documents for different purposes.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

If you do not have a power of attorney for health care, your family and your doctors will make health care decisions for you.