Illinois PLLC Notices and Resolutions

Description

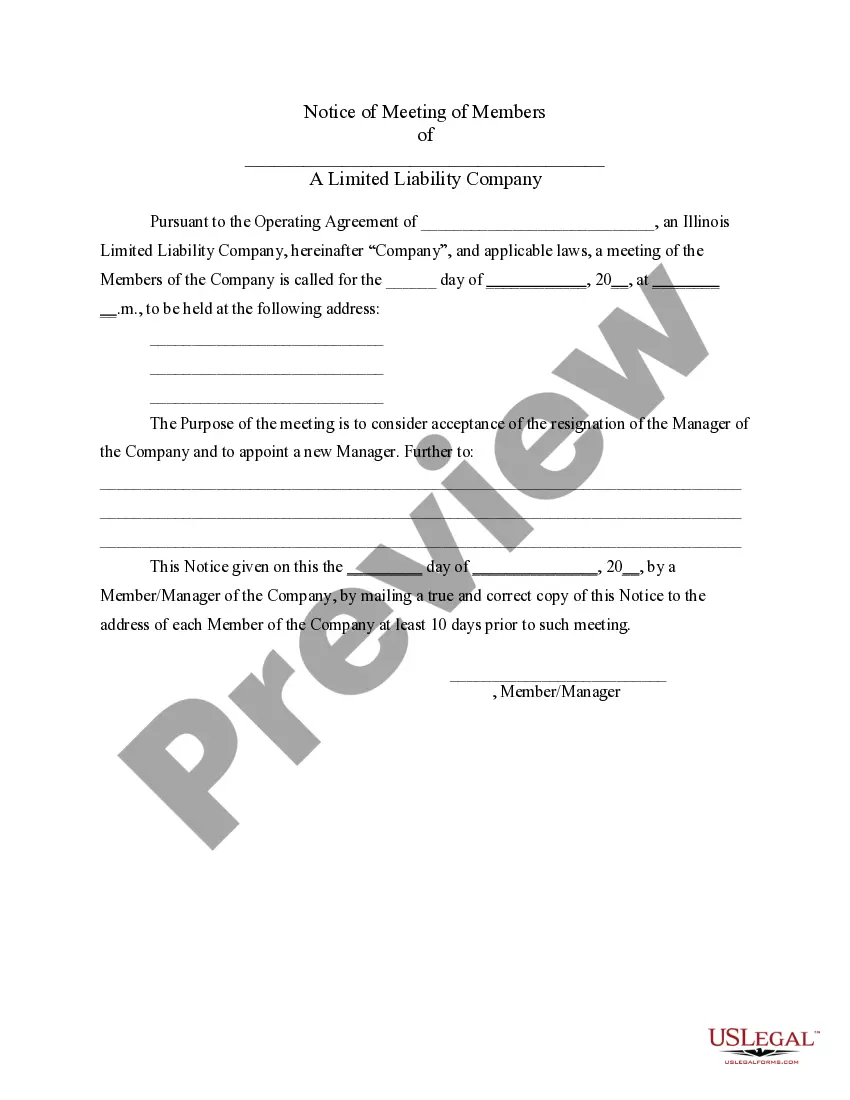

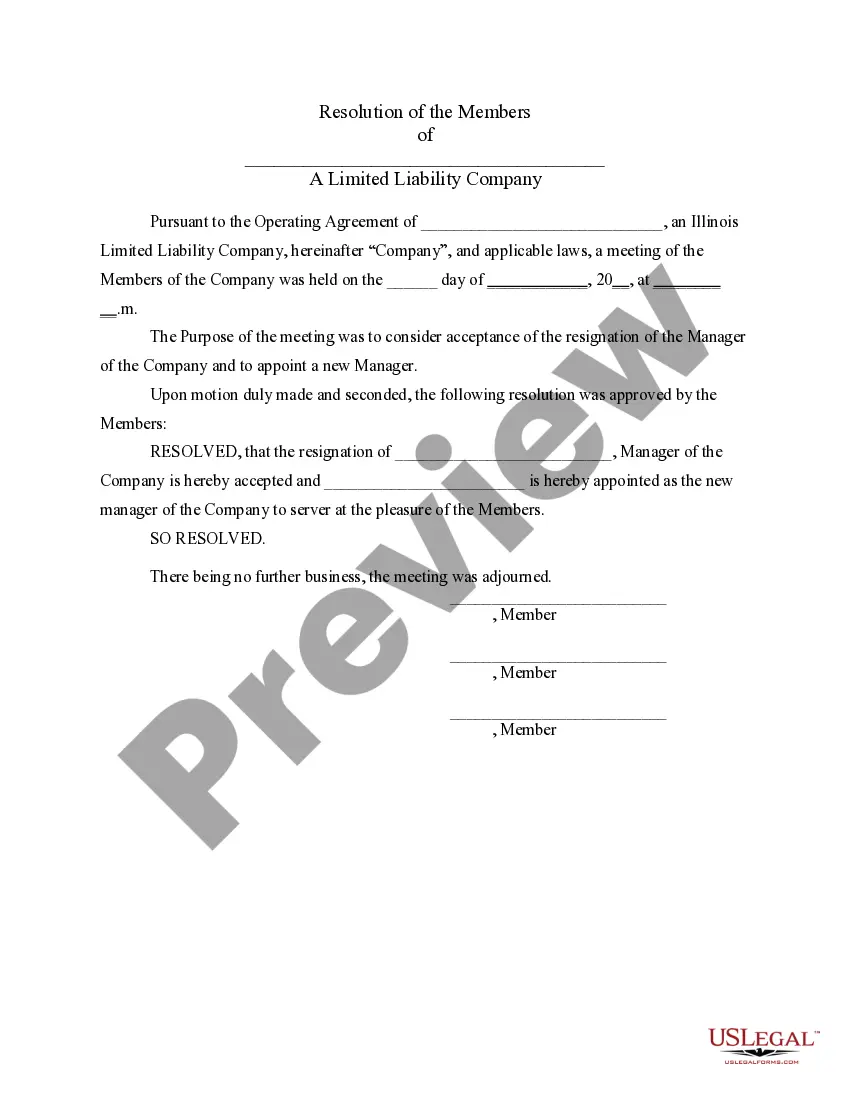

How to fill out Illinois PLLC Notices And Resolutions?

Looking for Illinois PLLC Notices and Resolutions forms and completing them might be a problem. To save lots of time, costs and energy, use US Legal Forms and find the right example specially for your state within a few clicks. Our attorneys draw up each and every document, so you just need to fill them out. It really is that easy.

Log in to your account and come back to the form's page and download the sample. All of your saved examples are kept in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you have to sign up.

Have a look at our thorough instructions concerning how to get the Illinois PLLC Notices and Resolutions template in a few minutes:

- To get an eligible sample, check its applicability for your state.

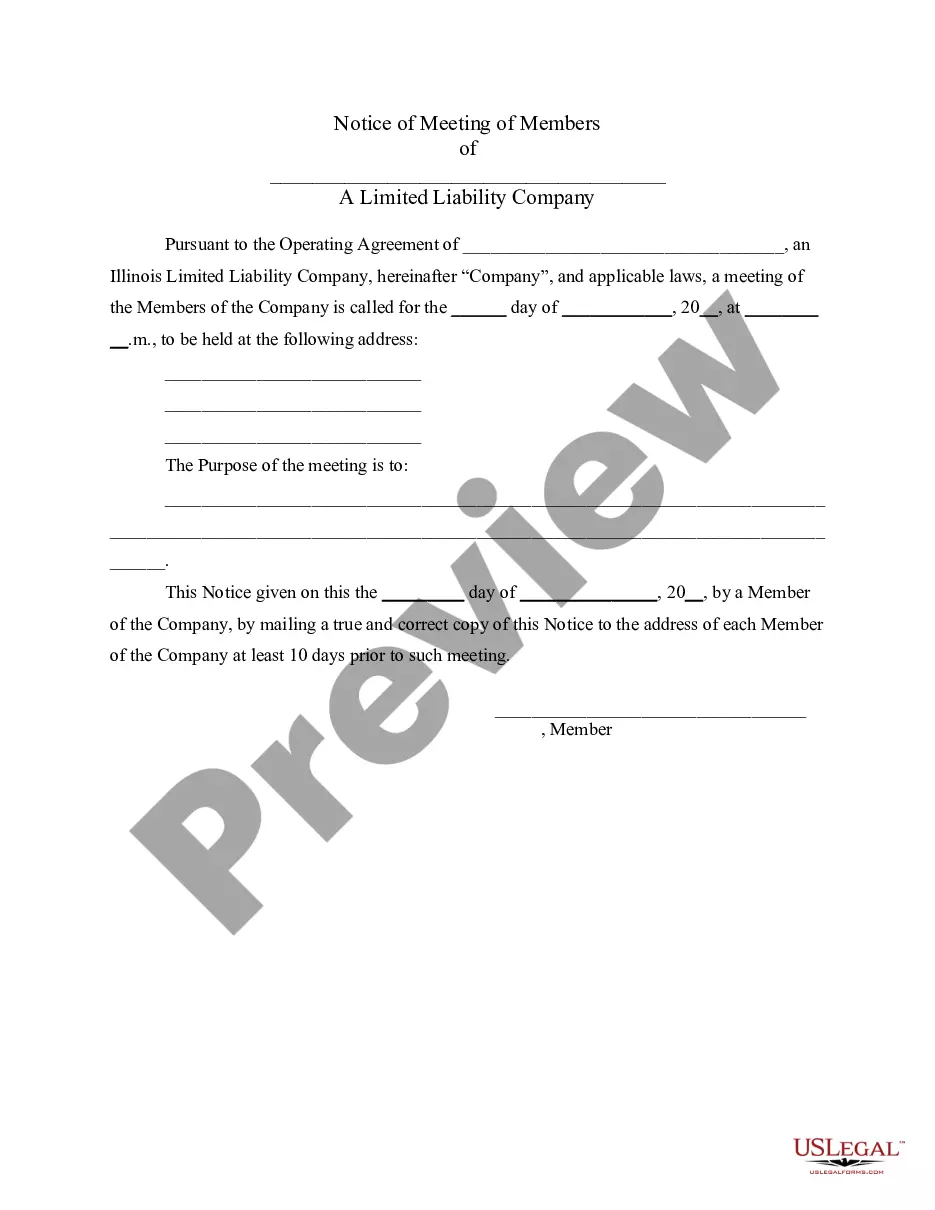

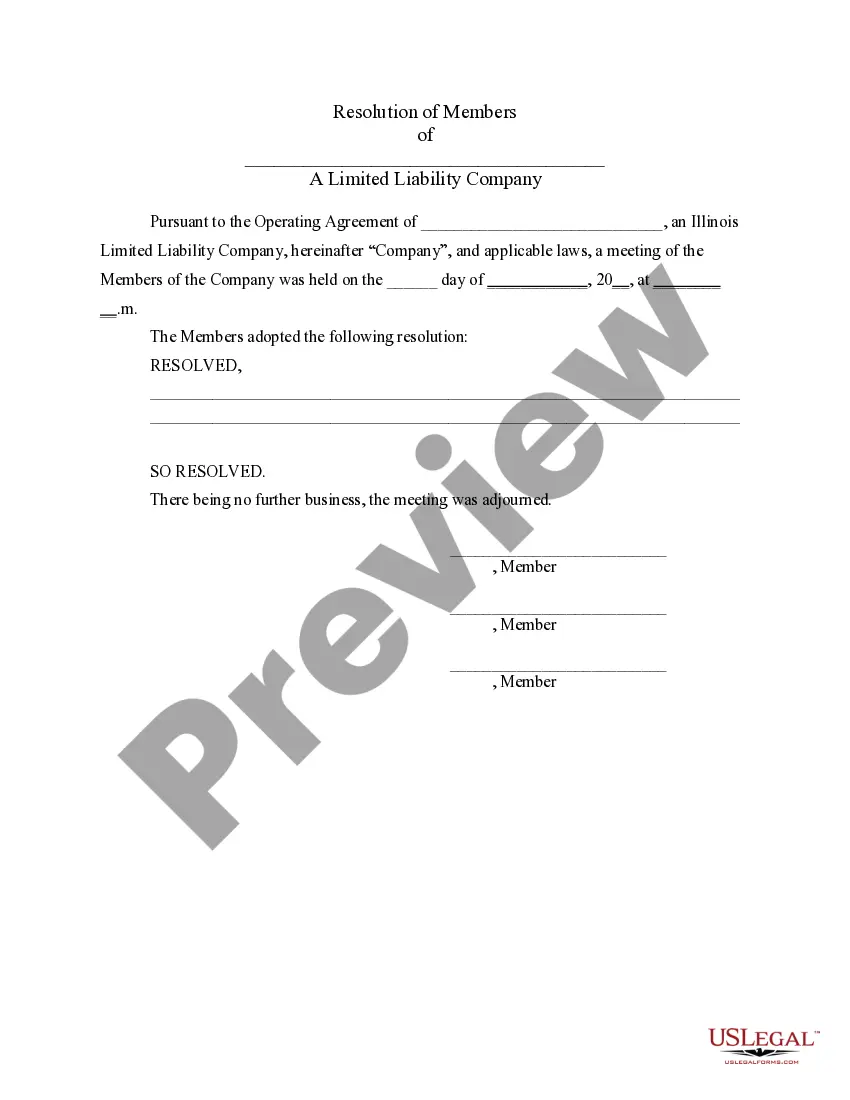

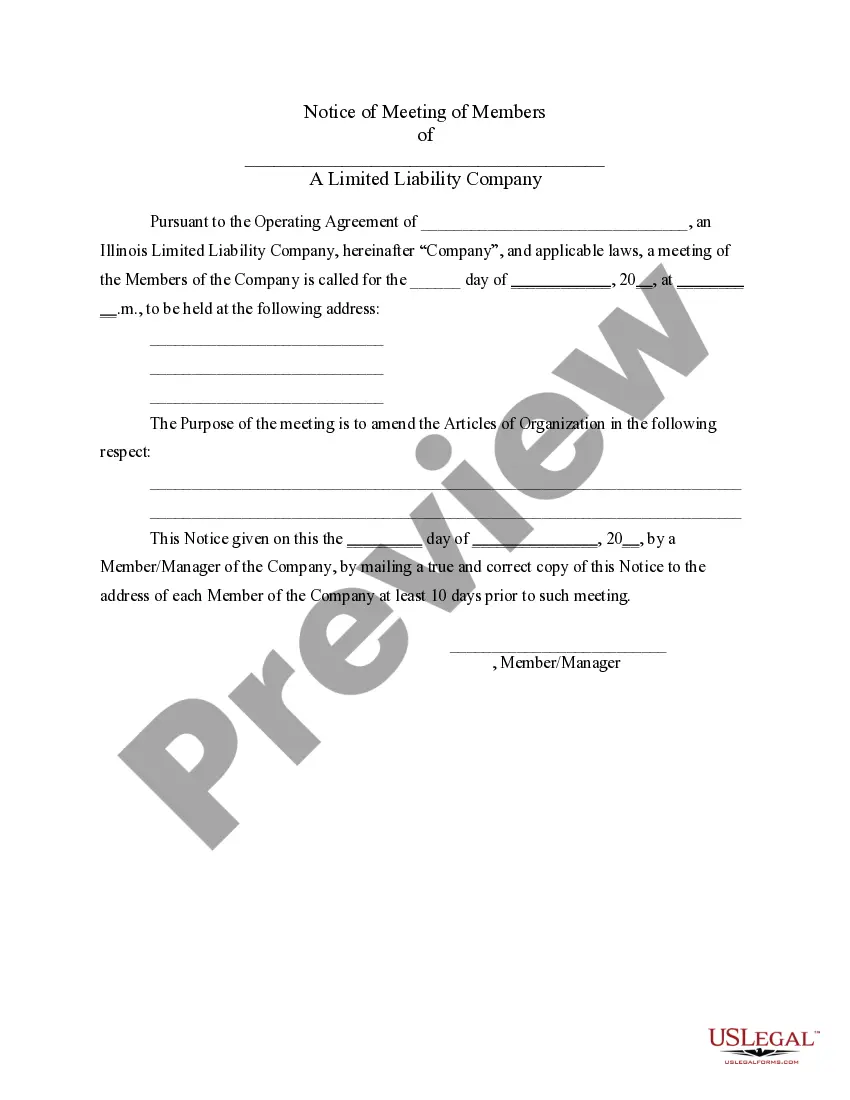

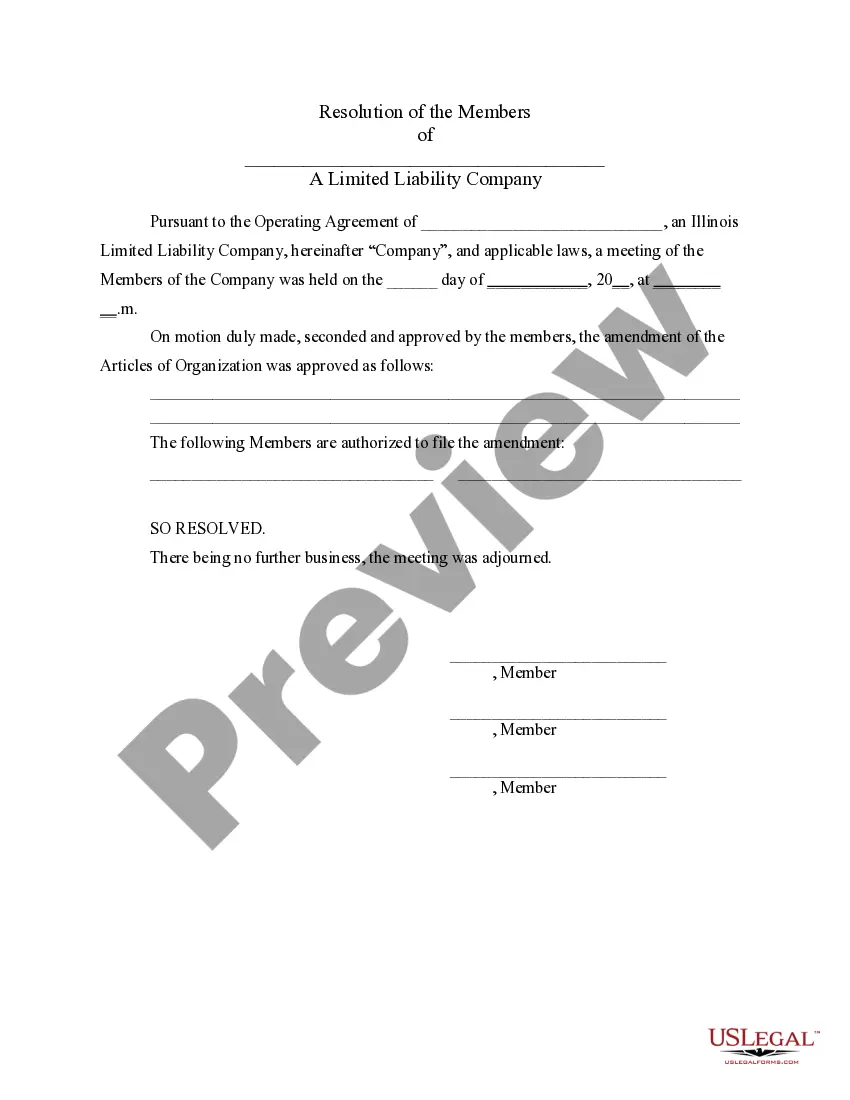

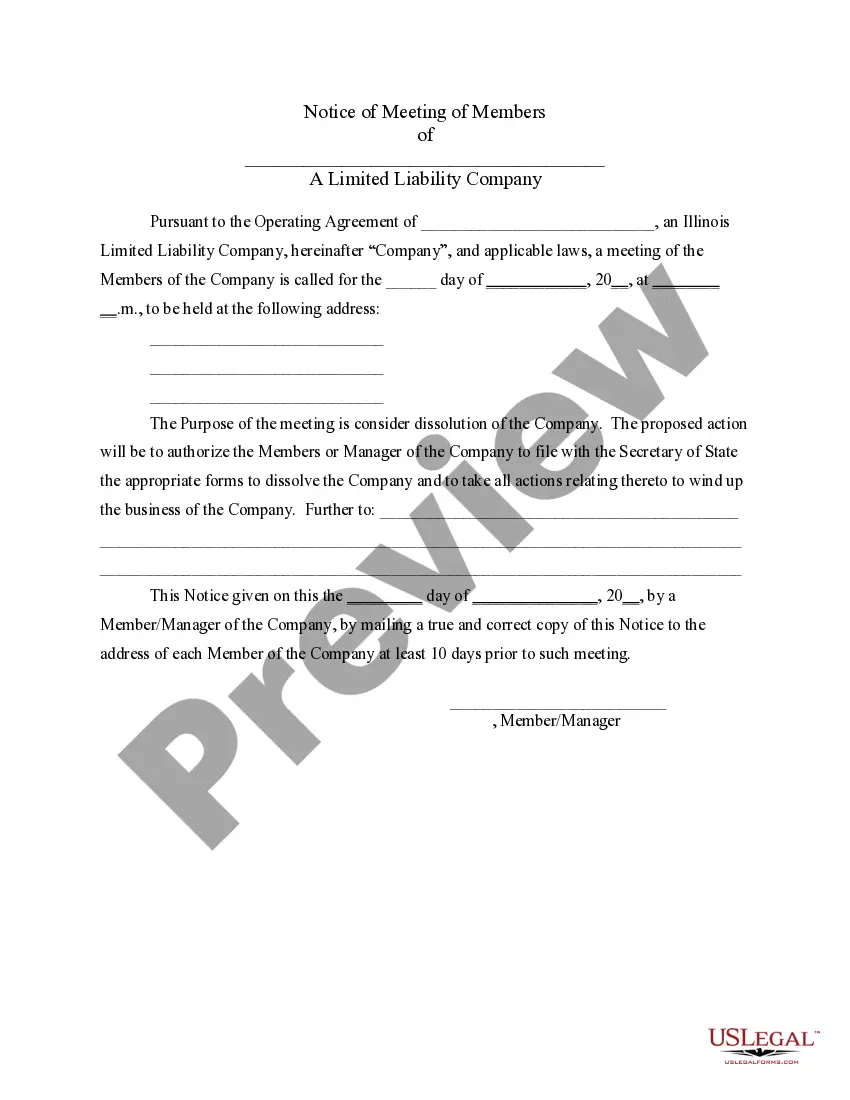

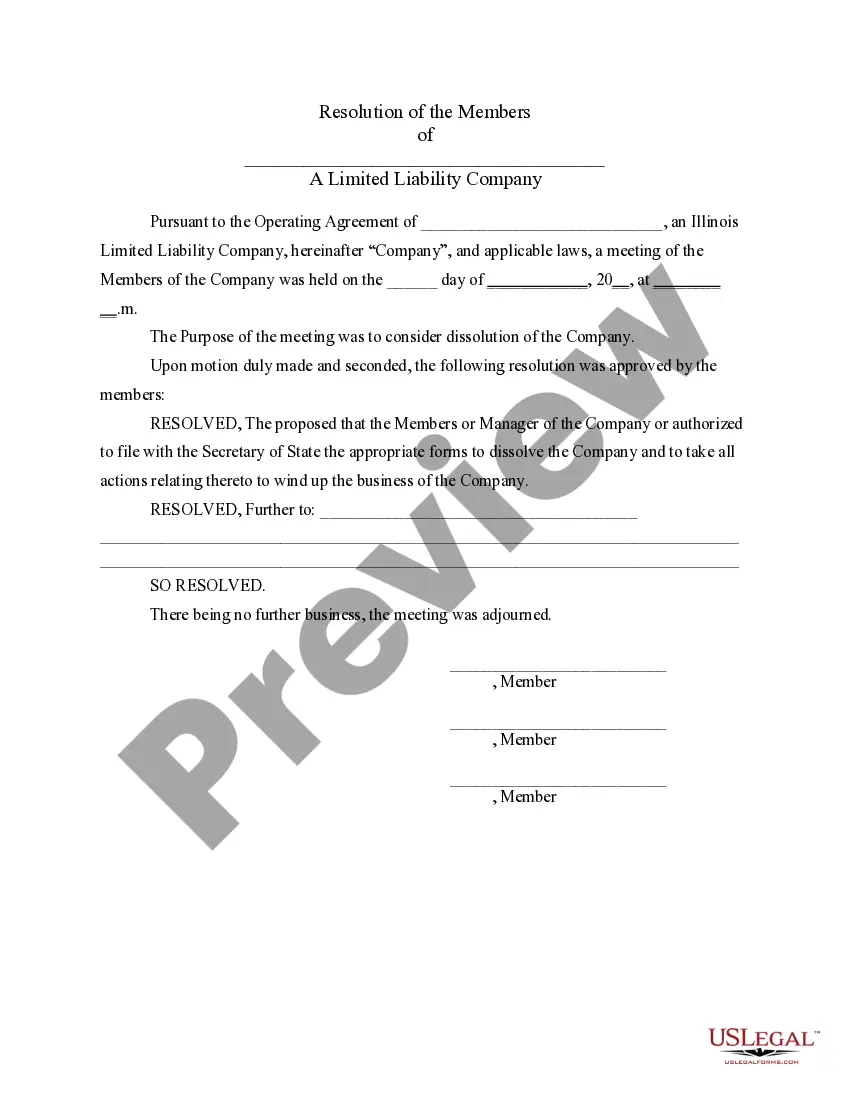

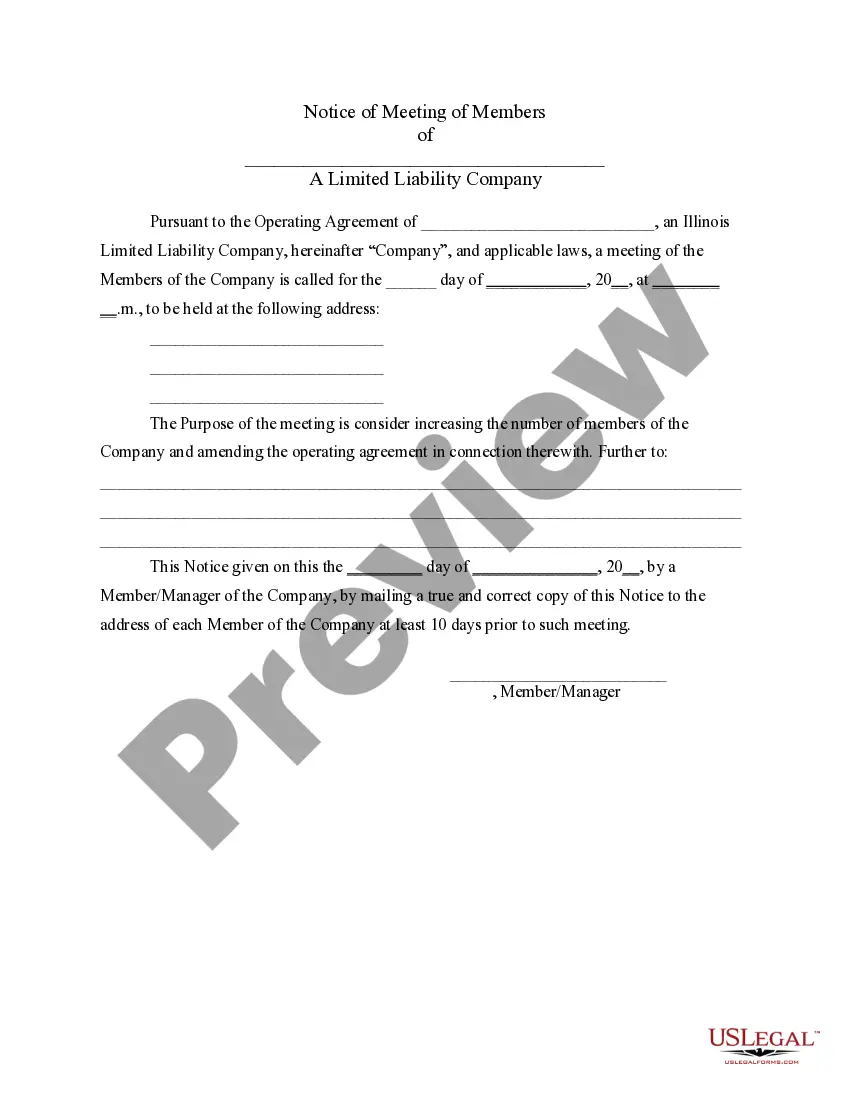

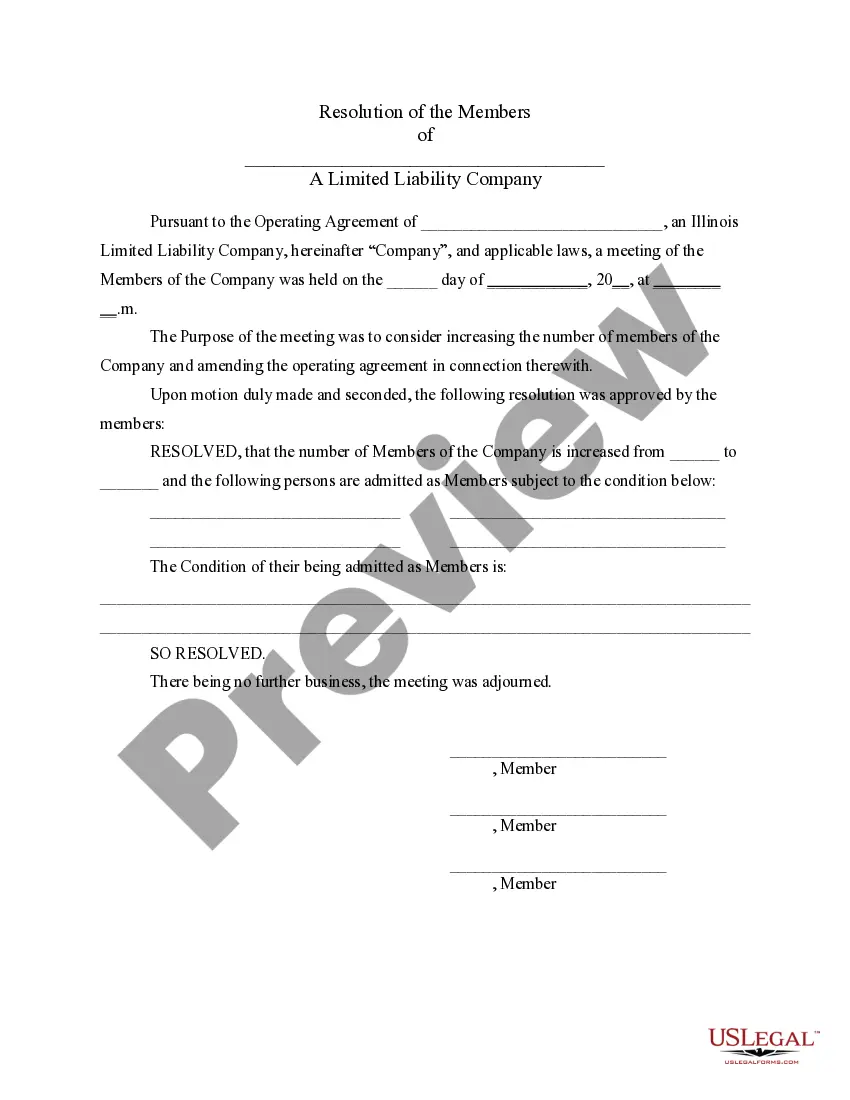

- Take a look at the sample utilizing the Preview function (if it’s accessible).

- If there's a description, read through it to learn the details.

- Click on Buy Now button if you found what you're looking for.

- Choose your plan on the pricing page and create an account.

- Pick how you would like to pay by way of a credit card or by PayPal.

- Save the file in the preferred format.

You can print the Illinois PLLC Notices and Resolutions form or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your form may be utilized and sent away, and published as often as you would like. Check out US Legal Forms and get access to around 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

Step One) Choose a PLLC Name. Step Two) Designate a Registered Agent. Step Three) File Formation Documents with the State. Step Four) Create an Operating Agreement. Step Five) Handle Taxation Requirements. Step Six) Obtain Business Licenses and Permits.

Prepare an Operating Agreement An LLC operating agreement is not required in Illinois, but is highly advisable. This is an internal document that establishes how your LLC will be run.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

To form an Illinois LLC you will need to file the Articles of Organization with the Illinois Secretary of State, which costs $150. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Illinois limited liability company.

How much does it cost to form an LLC in Illinois? The Illinois Secretary of State charges $150 to file the Articles of Organization. You can reserve your LLC name with the Illinois Secretary of State for $25.

In most cases, business owners can amend the articles of organization of an LLC to change to a PLLC. For example, the state of Arizona requires that a company complete a form to amend its articles of organization and change the name of the company from LLC to PLLC.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.