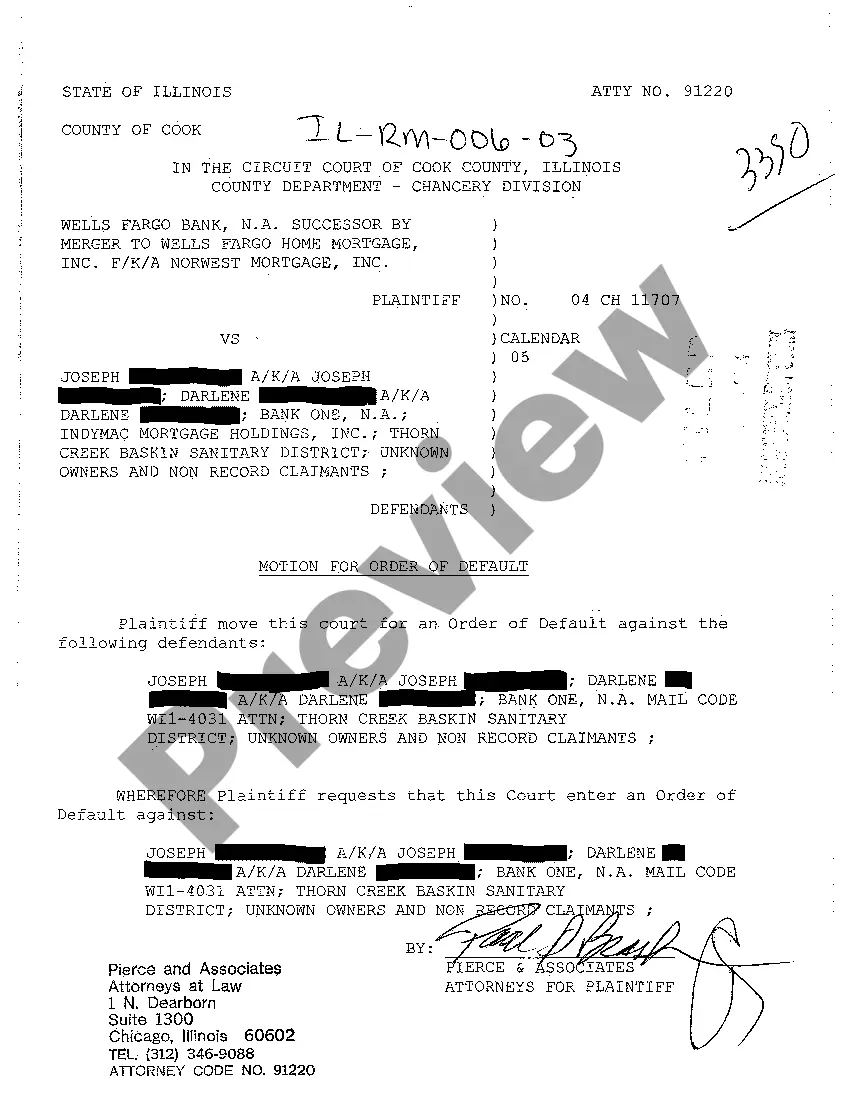

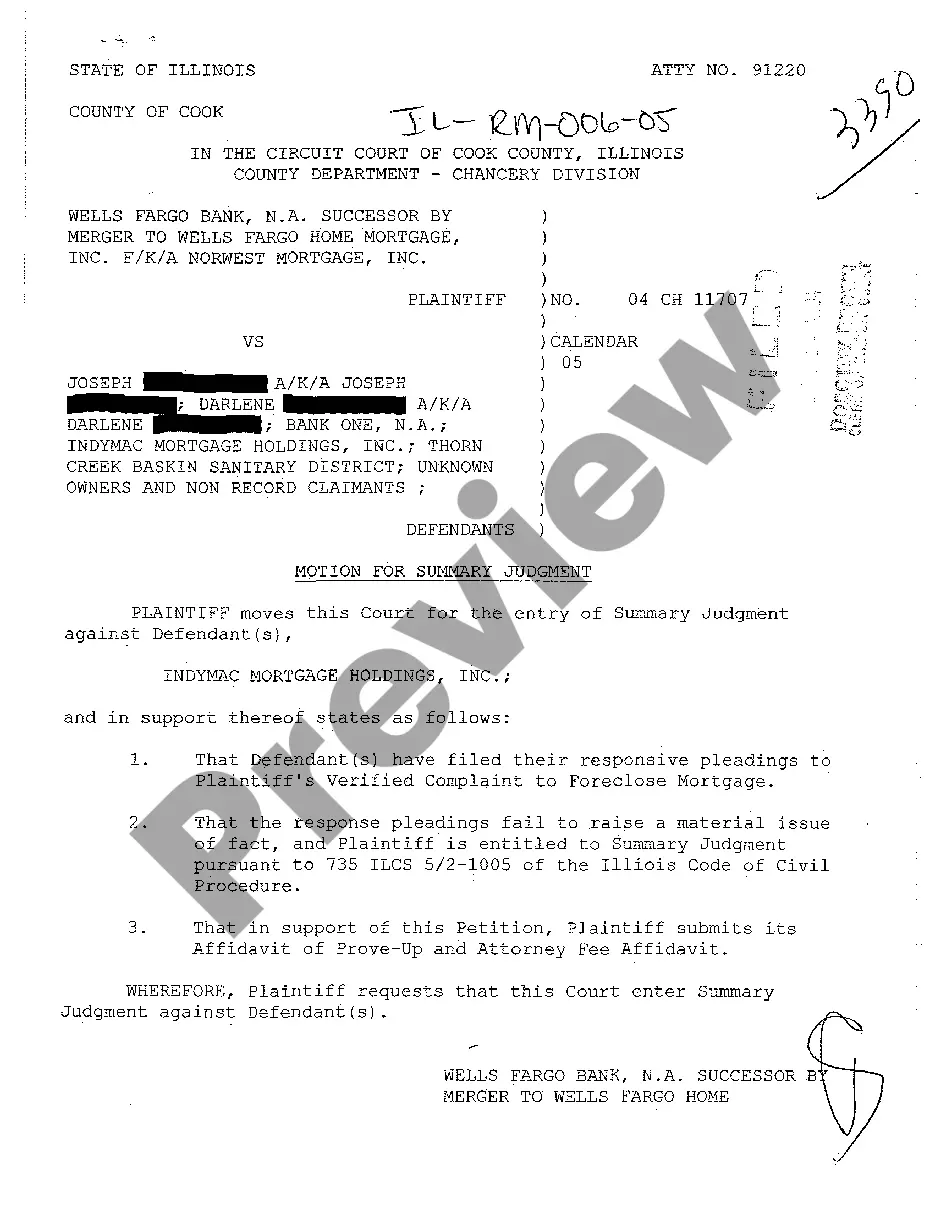

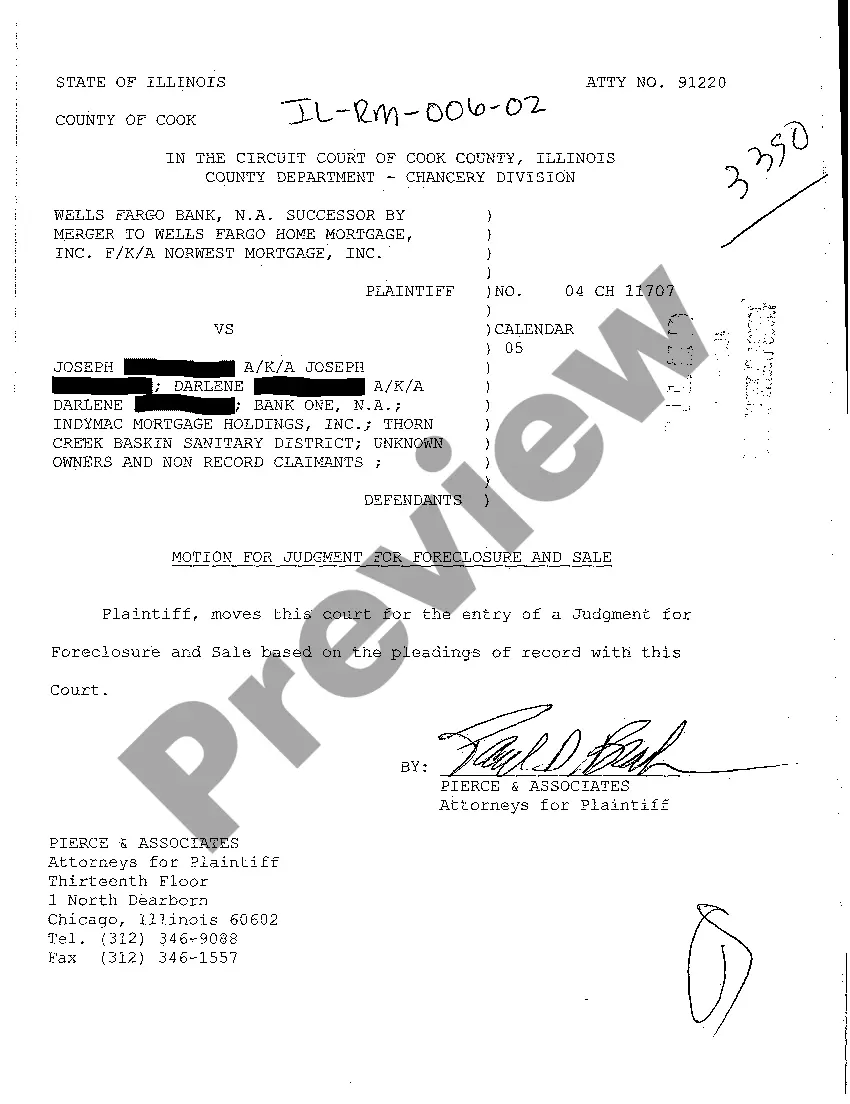

Illinois Motion For Judgment For Foreclosure And Sale

Description

How to fill out Illinois Motion For Judgment For Foreclosure And Sale?

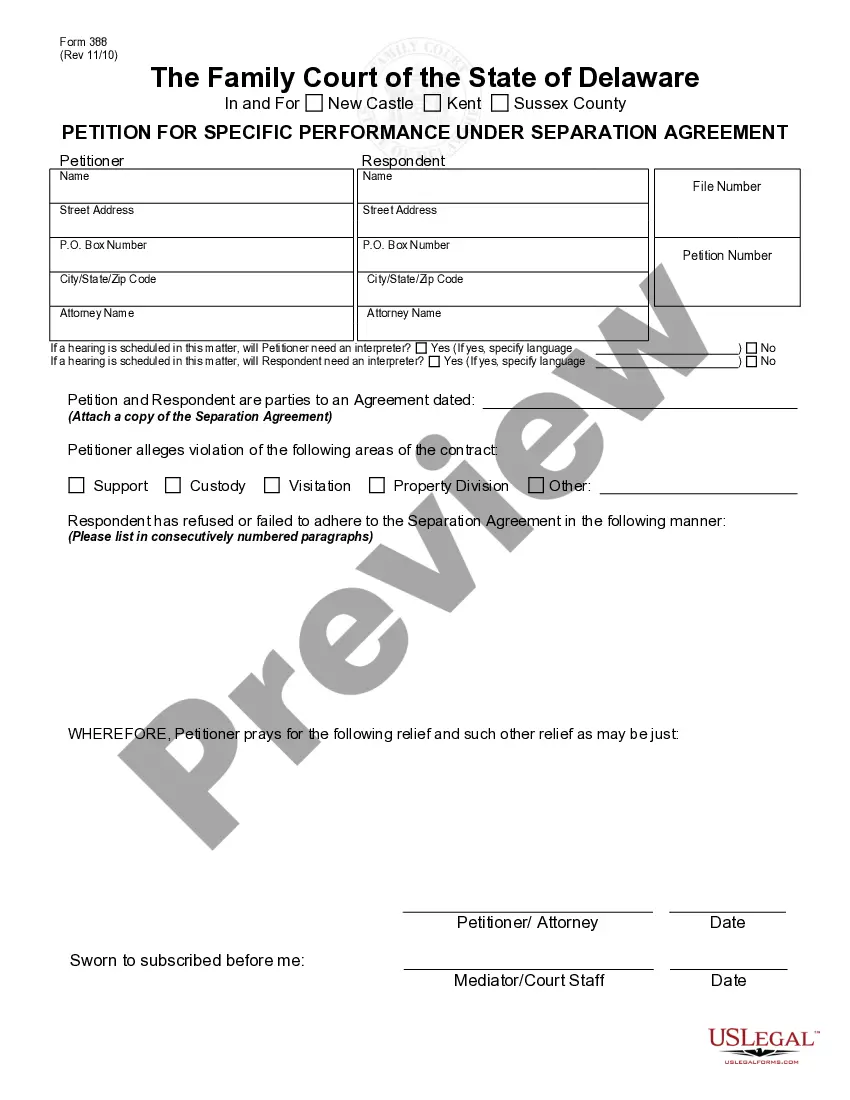

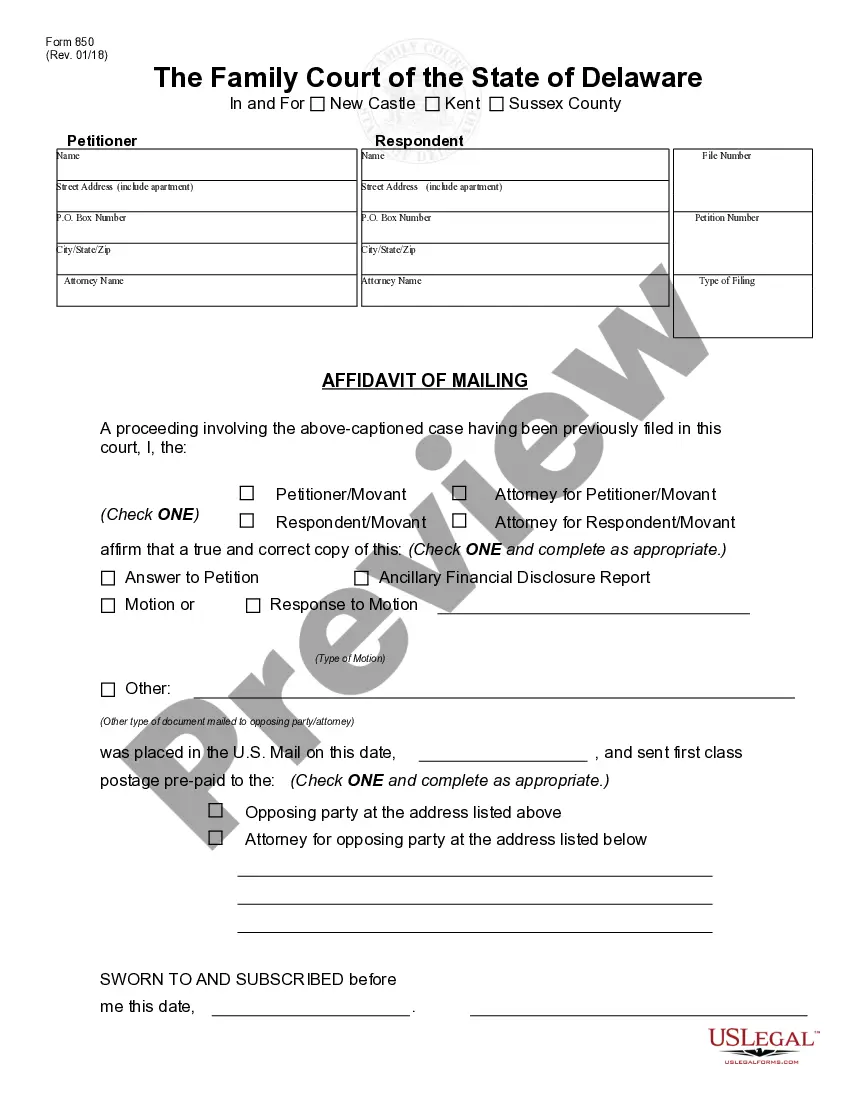

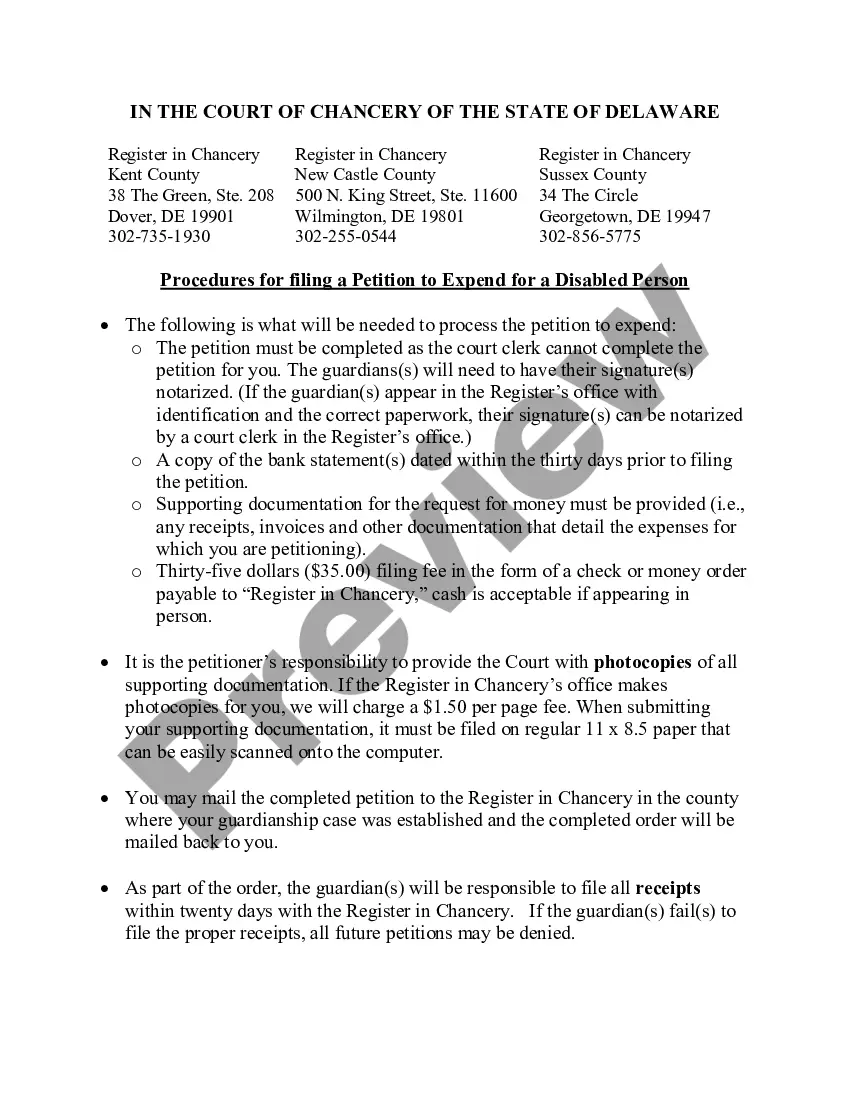

Searching for Illinois Motion For Judgment For Foreclosure And Sale samples and filling them out can be rather challenging.

To conserve significant amounts of time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your state with just a few clicks.

Our legal professionals draft every document, allowing you simply to complete them. It is incredibly straightforward.

Select your payment plan on the pricing page and create your account. Choose whether you want to pay by card or by PayPal. Save the document in your preferred file format. You can print the Illinois Motion For Judgment For Foreclosure And Sale template or complete it using any online editor. There's no need to worry about making mistakes, as your template can be used, submitted, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the template.

- Your saved templates are stored in My documents and are available at all times for future use.

- If you haven't registered yet, you need to sign up.

- Review our comprehensive instructions on how to obtain the Illinois Motion For Judgment For Foreclosure And Sale example in just a few minutes.

- To obtain a valid template, verify its eligibility for your state.

- Examine the template using the Preview option (if available).

- If there's an explanation, read it to understand the details.

- Click Buy Now if you have found what you are looking for.

Form popularity

FAQ

To motion to set aside a judgment in Illinois, you file a petition with the court that issued the original judgment. You must show valid reasons for the request, such as new evidence or insufficient notice. Engaging with the Illinois Motion For Judgment For Foreclosure And Sale can provide insights into the specific legal requirements involved. It’s advisable to seek legal guidance during this process.

Generally, the deficiency amount is the difference between the home's fair market value and the total mortgage debt. But Illinois law prohibits a deficiency judgment unless the borrower agrees to remain liable by signing an agreement at the same time as the deed in lieu.

When You Have to Leave After an Illinois Foreclosure Sale The foreclosed homeowner can remain in the home for 30 days after the court confirms the sale.

Foreclosure proceedings begin with a complaint filed by the lender. The borrower is served a copy of the complaint and a summons, along with a notice of his or her rights during foreclosure. In most cases, the borrower has 30 days to file a response. Failure to respond will result in a default judgment for the lender.

If the court grants summary judgment in favor of the bank, typically after a hearing, the bank wins the case, and your home will be sold at a foreclosure sale.order the foreclosure sale, or. dismiss the case, usually without prejudice. (Without prejudice means the bank can refile the foreclosure.)

Subject to a few limited exceptions, you have 7 months from the date you are served to pay off your loan in full, either by refinancing the loan or by selling the house or by other means. This is called your right to redeem, and the 7-month period is called the redemption period.

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can.

The process, known as "statutory redemption," allows mortgagors (homeowners) a limited amount of time, often one year, to reclaim (or redeem) the property if they are able to pay what the property sold for at the foreclosure sale.

To get the deficiency judgment, the bank has to file an application with the court within three months of the foreclosure sale. The judge will then hold a fair value hearing to determine the property's value.