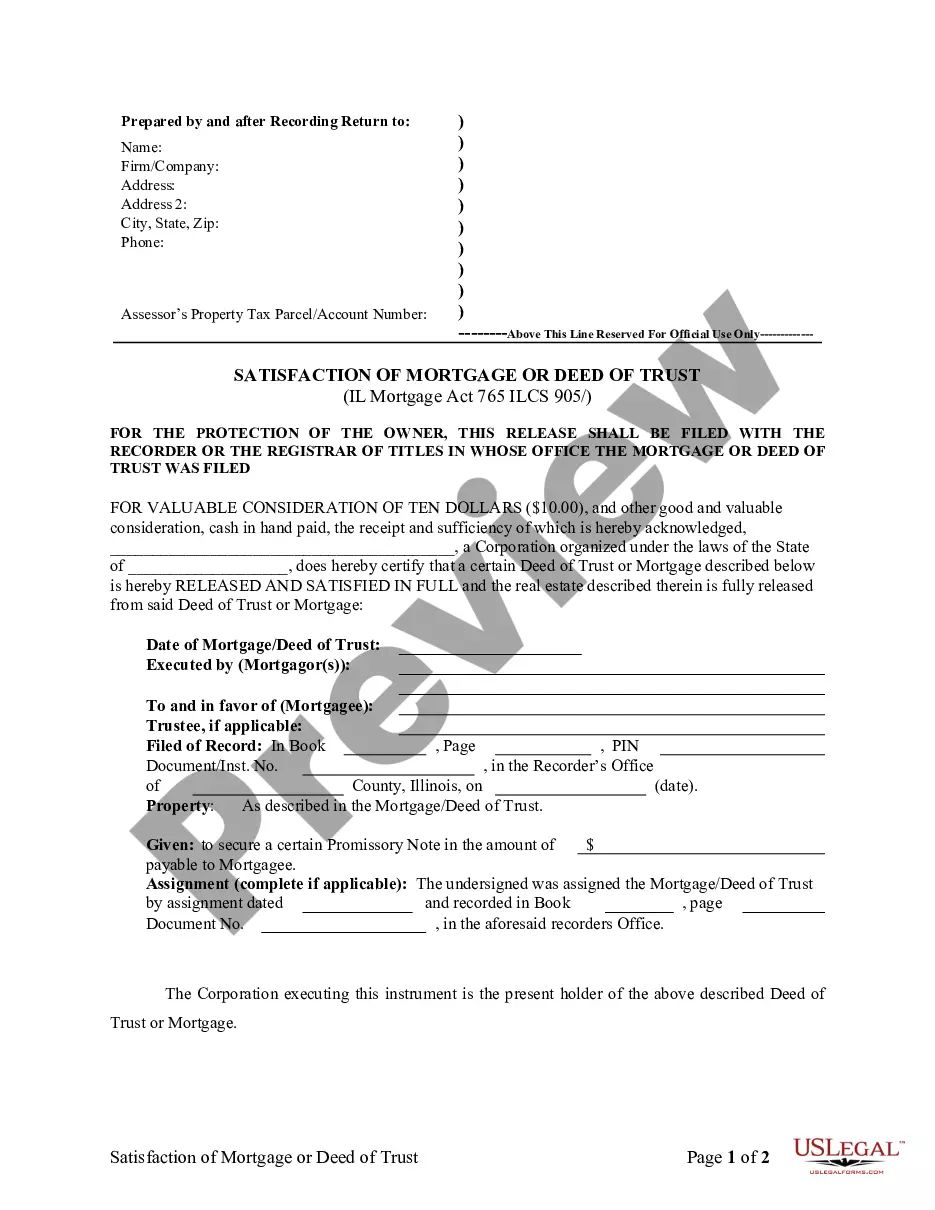

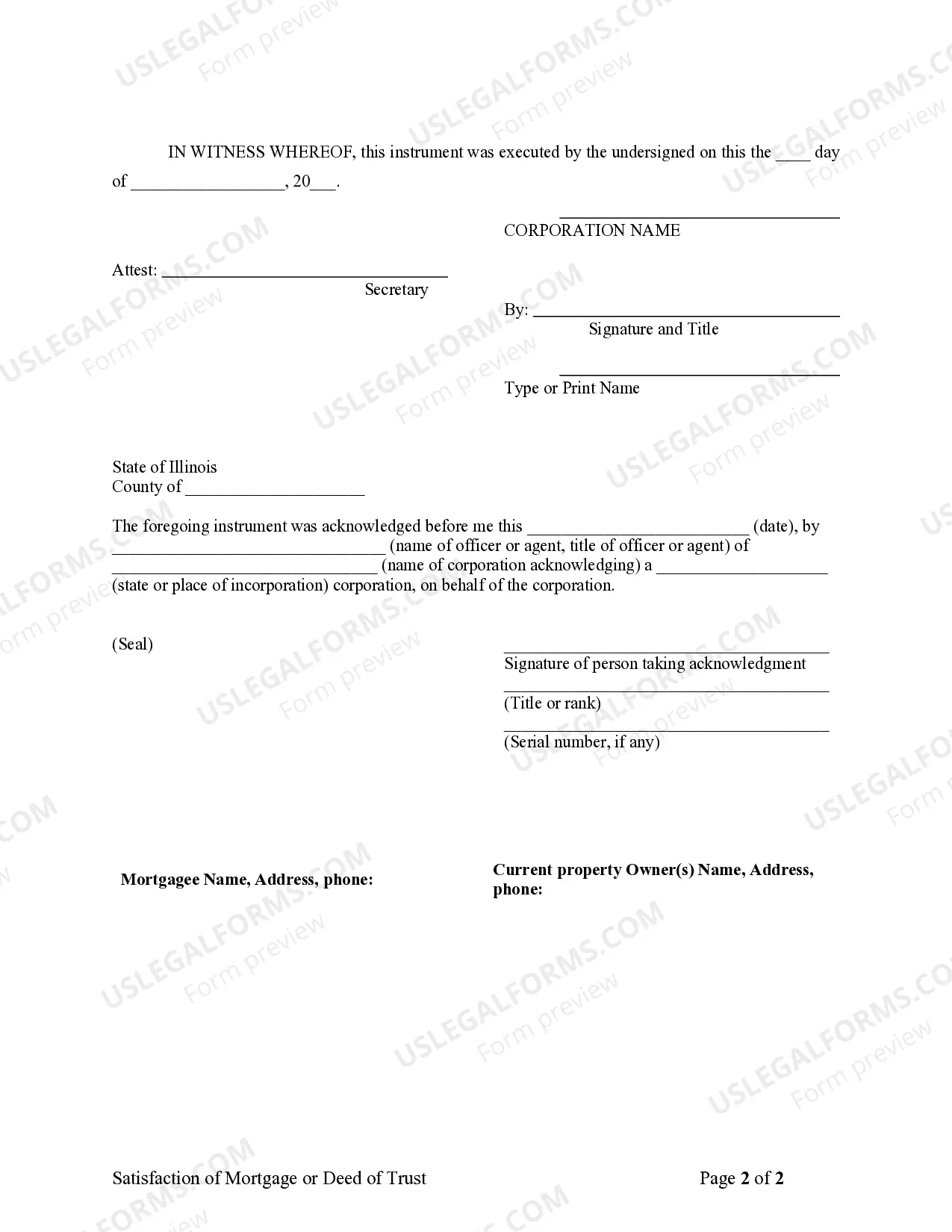

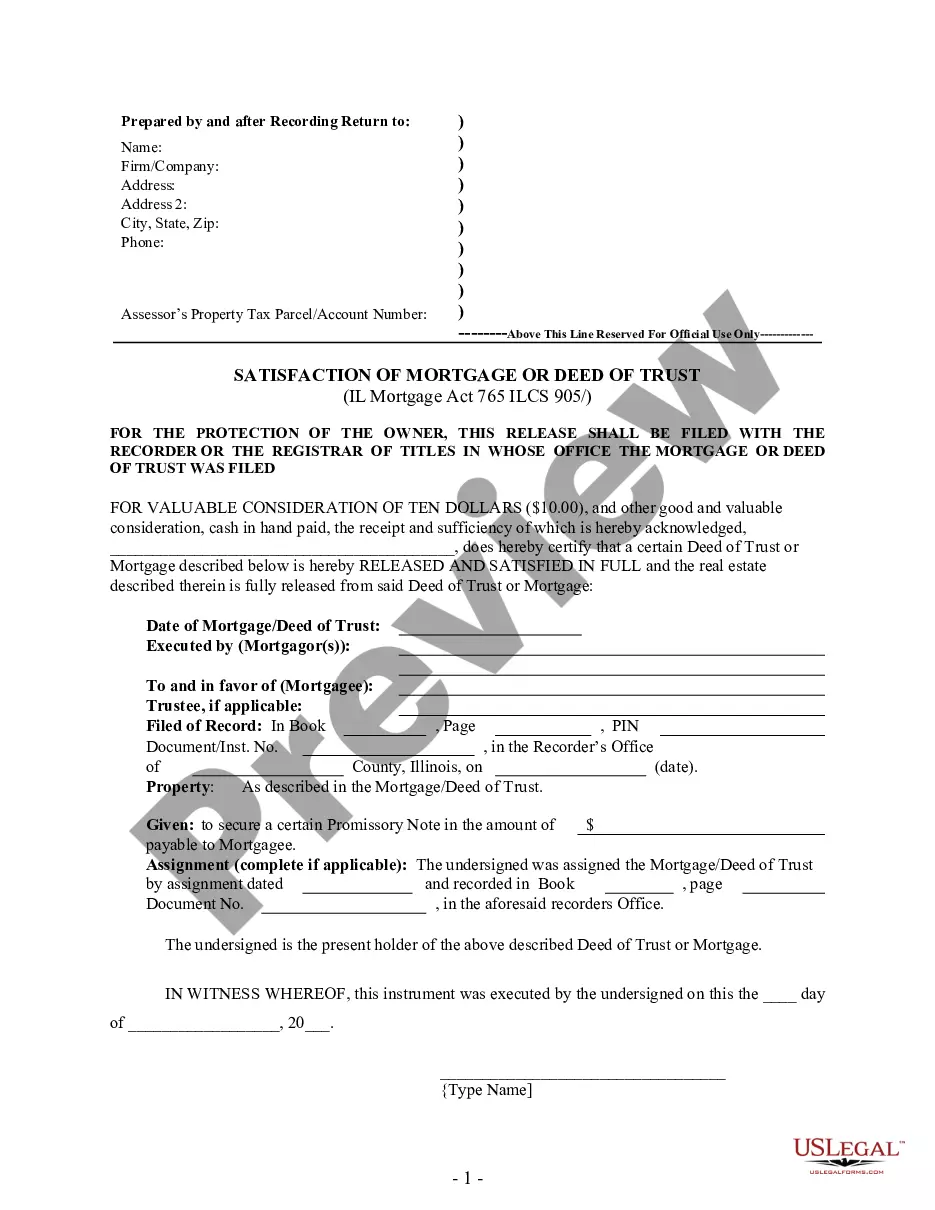

Illinois Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Illinois Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

In search of Illinois Satisfaction, Release or Cancellation of Mortgage by Corporation forms and completing them can be quite a problem. In order to save time, costs and effort, use US Legal Forms and find the correct sample specifically for your state in a few clicks. Our lawyers draw up each and every document, so you just have to fill them out. It truly is that simple.

Log in to your account and return to the form's web page and download the sample. Your downloaded samples are saved in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you should sign up.

Look at our comprehensive recommendations concerning how to get the Illinois Satisfaction, Release or Cancellation of Mortgage by Corporation template in a couple of minutes:

- To get an entitled example, check out its applicability for your state.

- Check out the example making use of the Preview function (if it’s accessible).

- If there's a description, go through it to know the details.

- Click Buy Now if you found what you're trying to find.

- Choose your plan on the pricing page and make an account.

- Choose you want to pay out by a card or by PayPal.

- Download the form in the favored format.

You can print out the Illinois Satisfaction, Release or Cancellation of Mortgage by Corporation template or fill it out using any online editor. No need to worry about making typos because your form may be employed and sent away, and published as often as you want. Check out US Legal Forms and access to above 85,000 state-specific legal and tax documents.

Form popularity

FAQ

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

When a borrower prepays their mortgage or makes the final mortgage payment, a satisfaction of mortgage document must be prepared, signed, and filed by the financial institution in ownership of the mortgage. The satisfaction of mortgage document is created by a lending institution and their legal counsel.

If you have cleared a debt, a mortgage satisfaction document will give you clear title to real property. In other words, mortgage satisfaction is a document that results in release or discharge of a mortgage lien, and indicates that a borrower has cleared his/her debt.

Key Takeaways. A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.