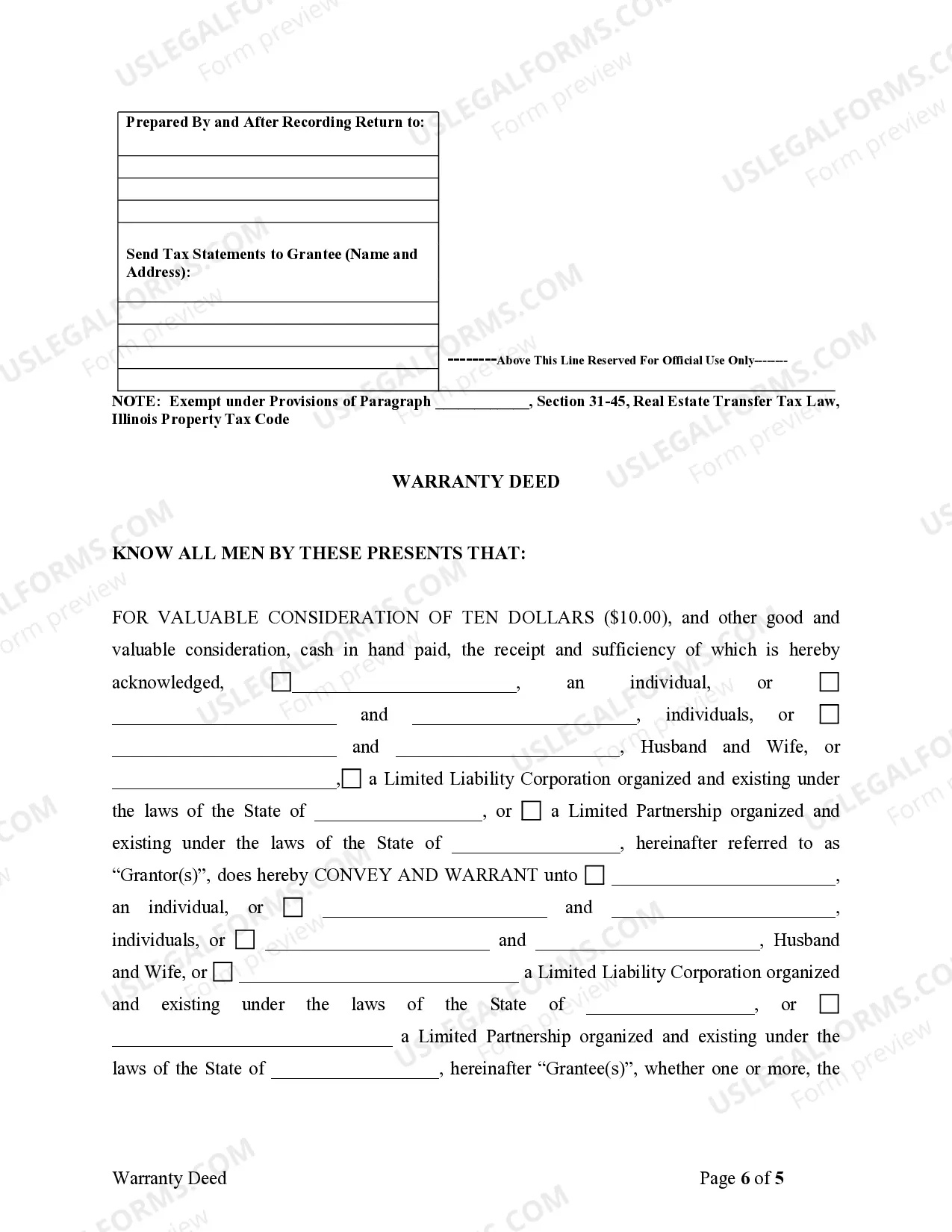

Illinois Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee

Description Limited Partnership Llc

How to fill out Deed Partnership Sample?

Among numerous paid and free examples that you can find on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they’re skilled enough to take care of what you need them to. Always keep calm and make use of US Legal Forms! Locate Illinois Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee templates created by skilled lawyers and prevent the high-priced and time-consuming process of looking for an attorney and then paying them to write a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you are trying to find. You'll also be able to access your previously downloaded templates in the My Forms menu.

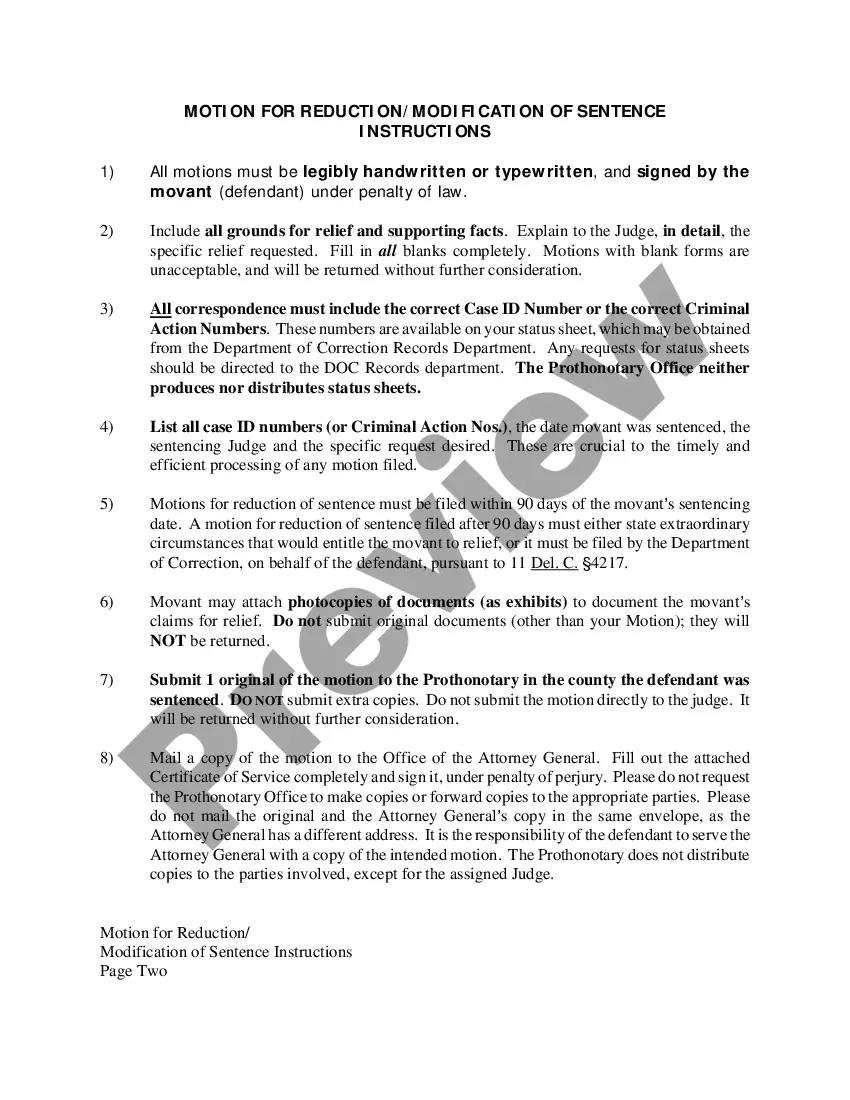

If you are utilizing our service for the first time, follow the instructions listed below to get your Illinois Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee with ease:

- Make certain that the file you discover is valid in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing process or find another example utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you’ve signed up and bought your subscription, you can use your Illinois Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee as many times as you need or for as long as it continues to be valid in your state. Revise it with your favorite offline or online editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Deed Partnership Form Form popularity

Deed Partnership Agreement Other Form Names

Deed Partnership Pdf FAQ

No, in most states, the Grantee is not required to sign the Quitclaim Deed. However, some counties do require that the Quitclaim Deed be signed by the Grantee in addition to the Grantor.

A warranty deed can be revoked. In most situations, the person signing the deed needs the cooperation of the person who received the deed to revoke it.If the deed was prepared for a property transfer as part of a typical sale, though, you probably will have to take legal action to revoke the deed.

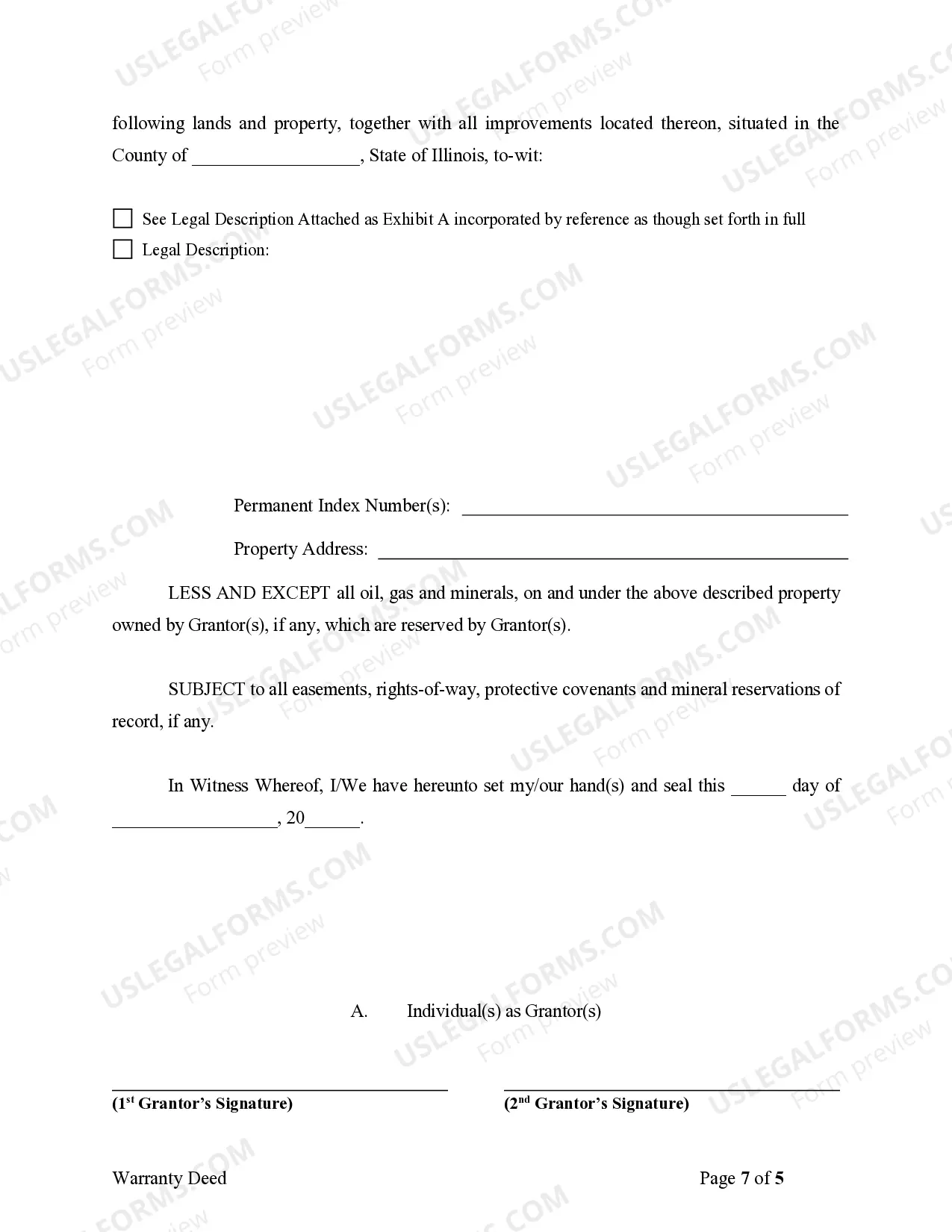

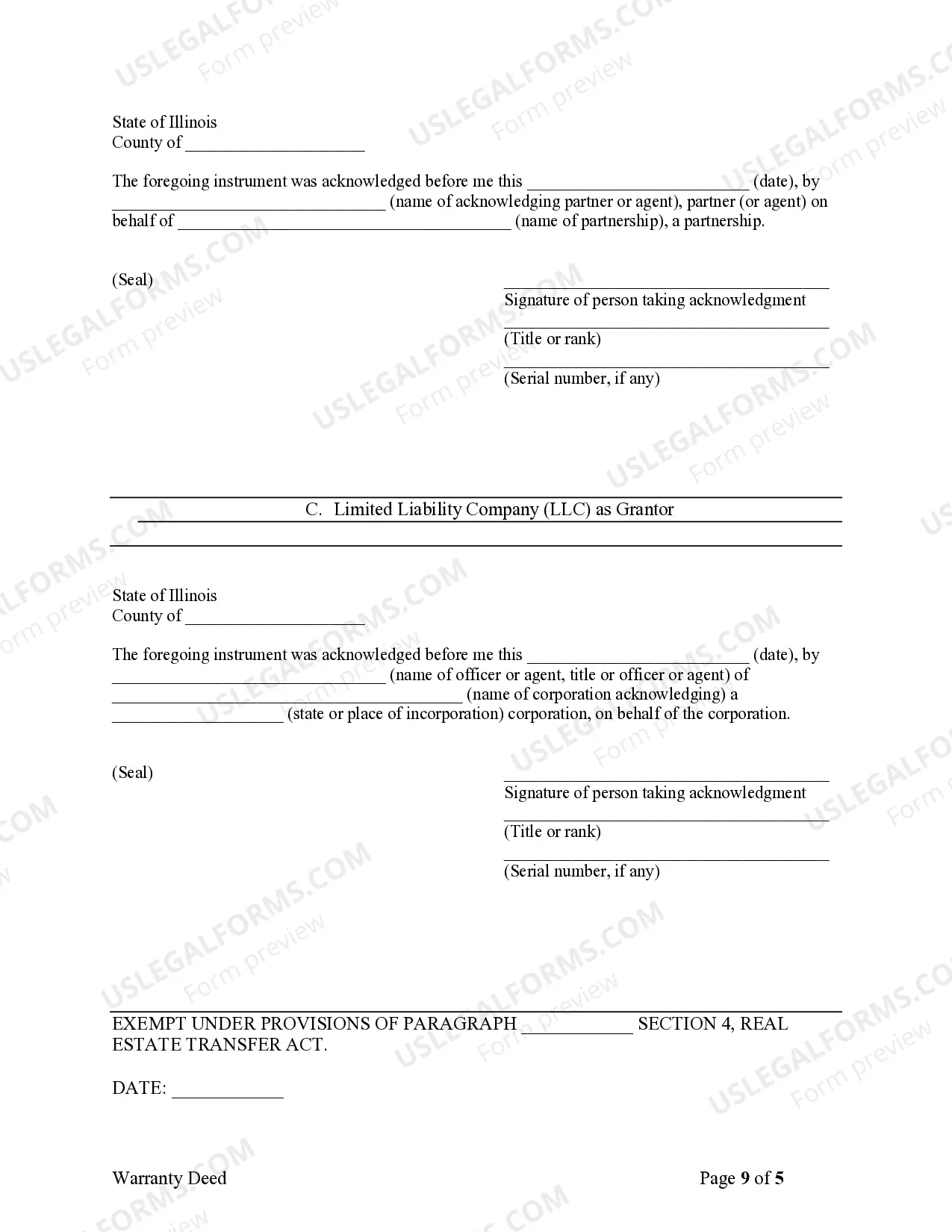

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

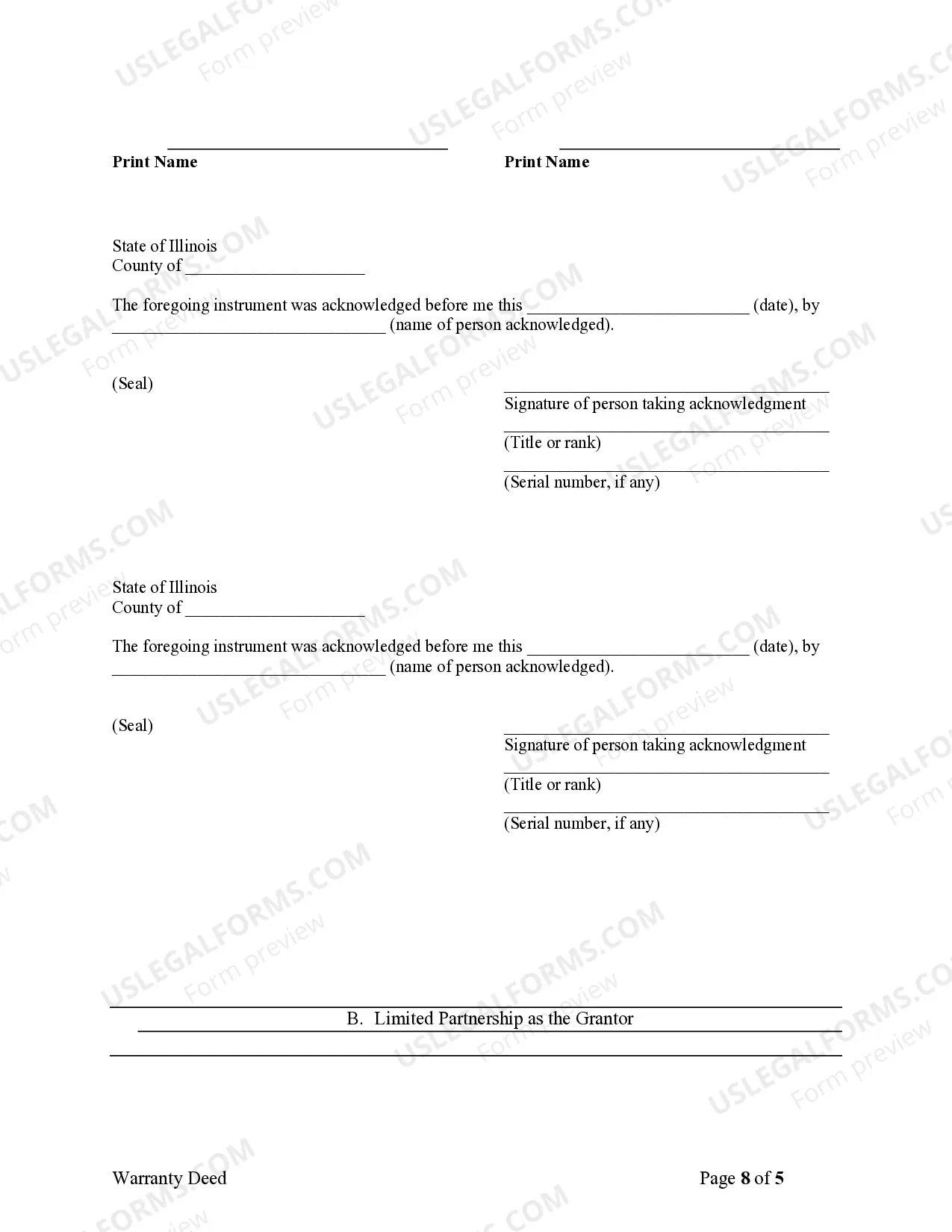

Grantor's signature: The grantor must sign the deed for it to be valid. Usually, if more than one person owns a property, all the owners must sign. In some states a husband or wife who own property by themselves may have to have the spouse also sign the deed even though the spouse does not have title to the property.

The two parties involved in a warranty deed are the seller or owner, also known as the grantor, and the buyer or the grantee. Either party can be an individual or a business, and are often strangers to each other.

The General Warranty Deed A general warranty deed provides the highest level of protection for the buyer because it includes significant covenants or warranties conveyed by the grantor to the grantee.

No, California does not require that the Grantee sign a warranty deed. However, some states and counties require that the deed be signed by the Grantee in addition to the Grantor.