The Illinois Notice of Motion For Wage Deduction Exemption Hearing is a legal document that is used to inform a court that an employee is seeking exemption from wage deductions. The notice sets out the employee’s grounds for the exemption request and is typically filed in the Circuit Court of the county where the employee works. This document is typically used when an employee believes that the amount of deductions taken from their wages is in violation of the Illinois Wage Deduction Act. The types of Illinois Notice of Motion For Wage Deduction Exemption Hearing include: 1. Notice of Motion for Exemption From Deduction For Child Support 2. Notice of Motion for Exemption From Deduction For Alimony 3. Notice of Motion for Exemption From Deduction For Garnishment 4. Notice of Motion for Exemption From Deduction For Tax Liens 5. Notice of Motion for Exemption From Deduction For Bankruptcy 6. Notice of Motion for Exemption From Deduction For Student Loan Payments.

Illinois Notice of Motion For Wage Deduction Exemption Hearing

Description

How to fill out Illinois Notice Of Motion For Wage Deduction Exemption Hearing?

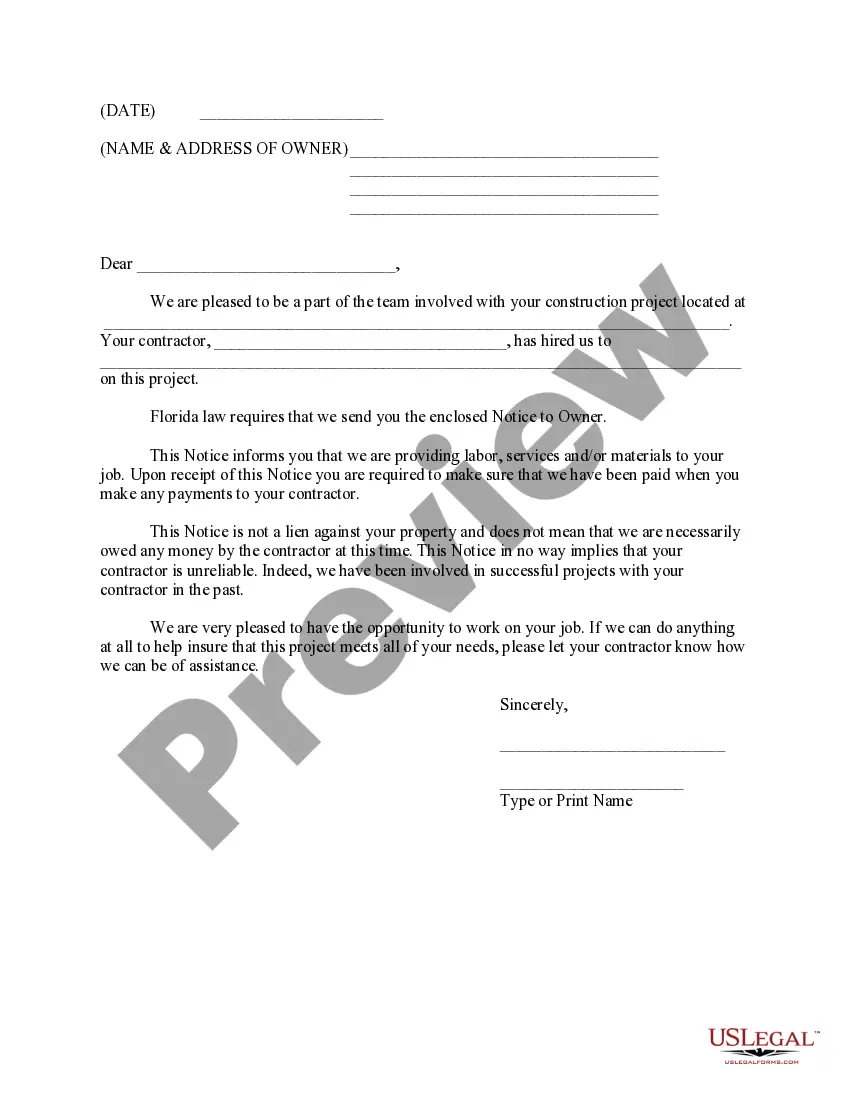

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state laws and are verified by our experts. So if you need to prepare Illinois Notice of Motion For Wage Deduction Exemption Hearing, our service is the best place to download it.

Obtaining your Illinois Notice of Motion For Wage Deduction Exemption Hearing from our catalog is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they locate the correct template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick instruction for you:

- Document compliance verification. You should attentively review the content of the form you want and check whether it satisfies your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find an appropriate blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Illinois Notice of Motion For Wage Deduction Exemption Hearing and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

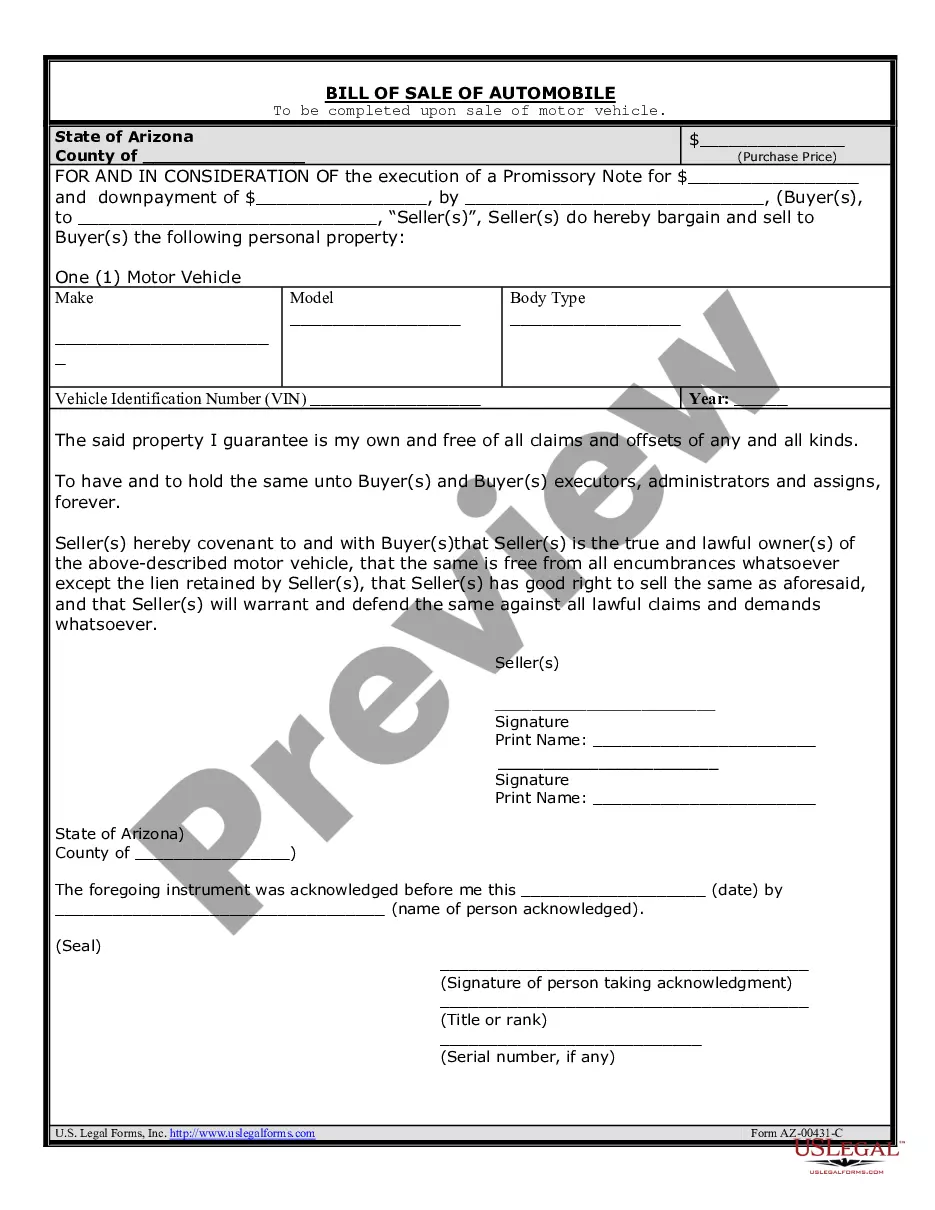

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

Respondent should deduct each pay period 15% of Defendant's non-exempt gross wages. If Defendant's disposable earnings are less than 45 times the greater of the state or federal minimum wage, no deductions may occur. All wages withheld shall be turned over to Plaintiff or Plaintiff's attorney on a monthly basis.

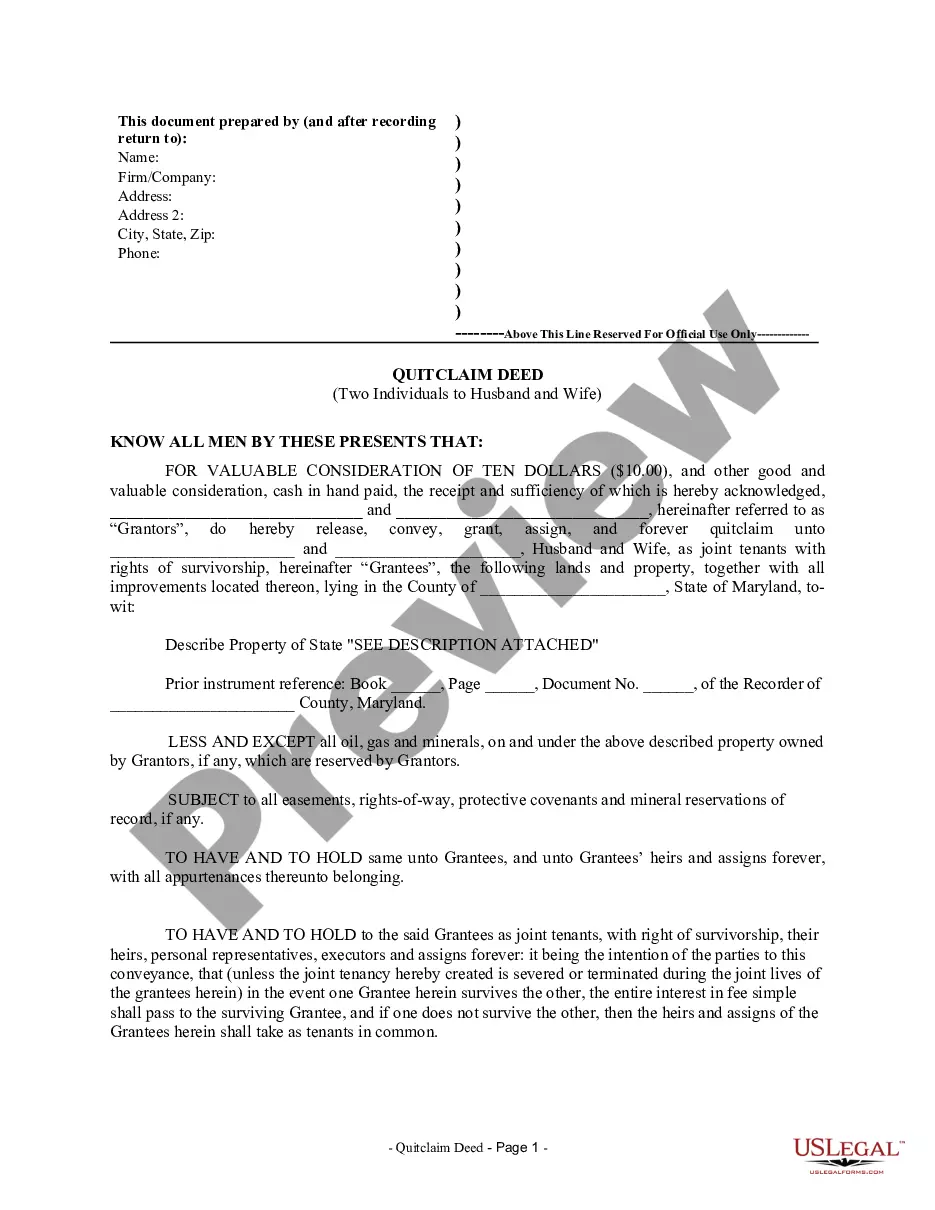

The document is called a Wage Deduction Affidavit. The creditor states their belief that the debtor's employer owes the creditor wages. In that affidavit, the creditor must certify that, before filing the affidavit, he mailed a wage deduction notice, explained below, to the debtor at the debtor's last known address.

The Wage Deduction Notice tells the Respondent you are trying to do a wage garnishment, and tells them they have the right to protect their exempt wages. It also tells the Respondent the ?return date.? The return date is the deadline for the Employer to answer the Wage Deduction Summons.

If the employer and employee cannot agree, the employer cannot make deductions without complying with Section 9 of the Act.

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

In non-wage garnishments, 735 ILCS 5/12-701 requires the judgment creditor, or other person, to file an affidavit stating that the affiant believes the garnishee is indebted to the judgment debtor or has property of the judgment debtor. Failure to file such affidavit invalidates the garnishment.