The Illinois Non-Withholding Wage Deduction Order is a legal document issued by the state of Illinois that orders an employer to deduct wages from an employee’s paycheck and send it to a designated payee. This process is commonly used to satisfy court-ordered financial obligations such as child support, alimony, and debts owed to creditors. The employer is responsible for collecting, deducting, and submitting the money. There are three types of Illinois Non-Withholding Wage Deduction Orders: Income Withholding for Support, Income Withholding for Debt Collection, and Income Withholding for Federal Debt Collection. An Income Withholding for Support Order is used to collect unpaid child support or alimony payments. An Income Withholding for Debt Collection Order is used to collect payments on a debt owed to a creditor. An Income Withholding for Federal Debt Collection Order is used to collect payments on a debt owed to the federal government.

Illinois Non-Withholding Wage Deduction Order

Description

Key Concepts & Definitions

Non Withholding Wage Deduction Order: A legal directive, typically issued by a court or government agency, requiring an employer to deduct a specific amount from an employee's wages for reasons other than usual federal and state tax withholdings. This can include debt repayments, child support, alimony, or other financial obligations.

Step-by-Step Guide

- Receive the Order: Employers must first receive a wage deduction order from a court or authorized body.

- Review the Order: Verify the authenticity and specifics of the order, checking the amount to be deducted and the duration of the deductions.

- Notify the Employee: Inform the employee in writing about the order, providing them a copy and explaining the deductions and their rights.

- Begin Deductions: Start deducting from the employee's next paycheck as dictated by the order.

- Remit Payments: Forward the deducted amounts to the designated party or agency indicated in the order.

- Maintain Records: Keep detailed records of all deductions and transmissions for legal compliance and future reference.

Risk Analysis

- Legal Compliance: Failing to comply with a non withholding wage deduction order can result in significant penalties, including fines and legal sanctions against the employer.

- Employee Relations: Mishandling the communication or the amount of wage deductions can strain employer-employee relationships.

- Administrative Burden: Managing wage deduction orders requires meticulous record-keeping and coordination, which can be resource-intensive.

FAQ

- What types of debts can result in a non withholding wage deduction order? Debts such as unpaid taxes, child support, alimony, or student loans can typically lead to such orders.

- How much of an employee's wage can be legally deducted? This often depends on the type of debt and state laws, but generally, there are limits to avoid undue hardship to the employee.

- Can an employee contest a wage deduction order? Yes, employees generally have the right to contest the order, usually by filing a response with the issuing court.

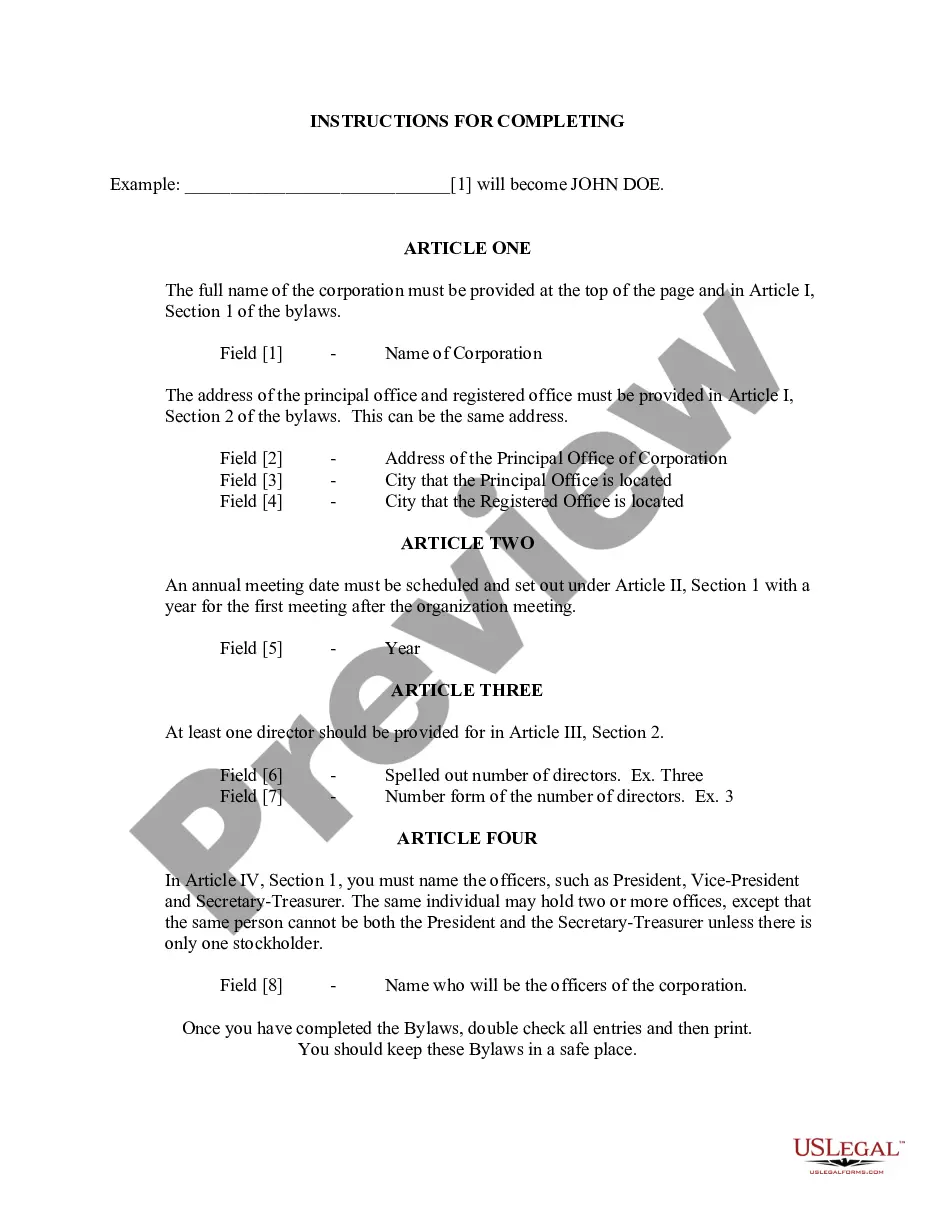

How to fill out Illinois Non-Withholding Wage Deduction Order?

How much duration and resources do you frequently utilize on formulating official documents.

There’s a superior alternative to obtaining such forms than recruiting legal experts or squandering hours searching the internet for a suitable template.

Create an account and settle your subscription fee. You can make a payment with your credit card or via PayPal - our service is completely secure for that.

Download your Illinois Non-Withholding Wage Deduction Order on your device and finalize it on a printed hard copy or digitally.

- US Legal Forms is the top online repository that offers expertly crafted and validated state-specific legal paperwork for any intention, like the Illinois Non-Withholding Wage Deduction Order.

- To obtain and prepare a suitable Illinois Non-Withholding Wage Deduction Order template, follow these straightforward guidelines.

- Review the form content to confirm it aligns with your state regulations. To do this, check the form details or utilize the Preview option.

- If your legal template doesn’t fulfill your needs, find another one using the search bar at the top of the page.

- If you are already registered with our service, Log In and download the Illinois Non-Withholding Wage Deduction Order. Otherwise, proceed to the following steps.

- Click Buy now once you identify the appropriate template. Select the subscription plan that suits you best to access our library’s full capabilities.

Form popularity

FAQ

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

If the employer and employee cannot agree, the employer cannot make deductions without complying with Section 9 of the Act.

In the Illinois law books, the wage deduction law is located at 735 ILCS 5/12-801 through 735 ILCS 5/12-819. In a wage deduction proceeding, you serve a Summons on the Respondent/Respondent's Employer. The summons requires the employer to deduct money from the Respondent's pay and hold it for instructions from a judge.

Wage Garnishment in Illinois In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.

Respondent should deduct each pay period 15% of Defendant's non-exempt gross wages. If Defendant's disposable earnings are less than 45 times the greater of the state or federal minimum wage, no deductions may occur. All wages withheld shall be turned over to Plaintiff or Plaintiff's attorney on a monthly basis.

The document is called a Wage Deduction Affidavit. The creditor states their belief that the debtor's employer owes the creditor wages. In that affidavit, the creditor must certify that, before filing the affidavit, he mailed a wage deduction notice, explained below, to the debtor at the debtor's last known address.