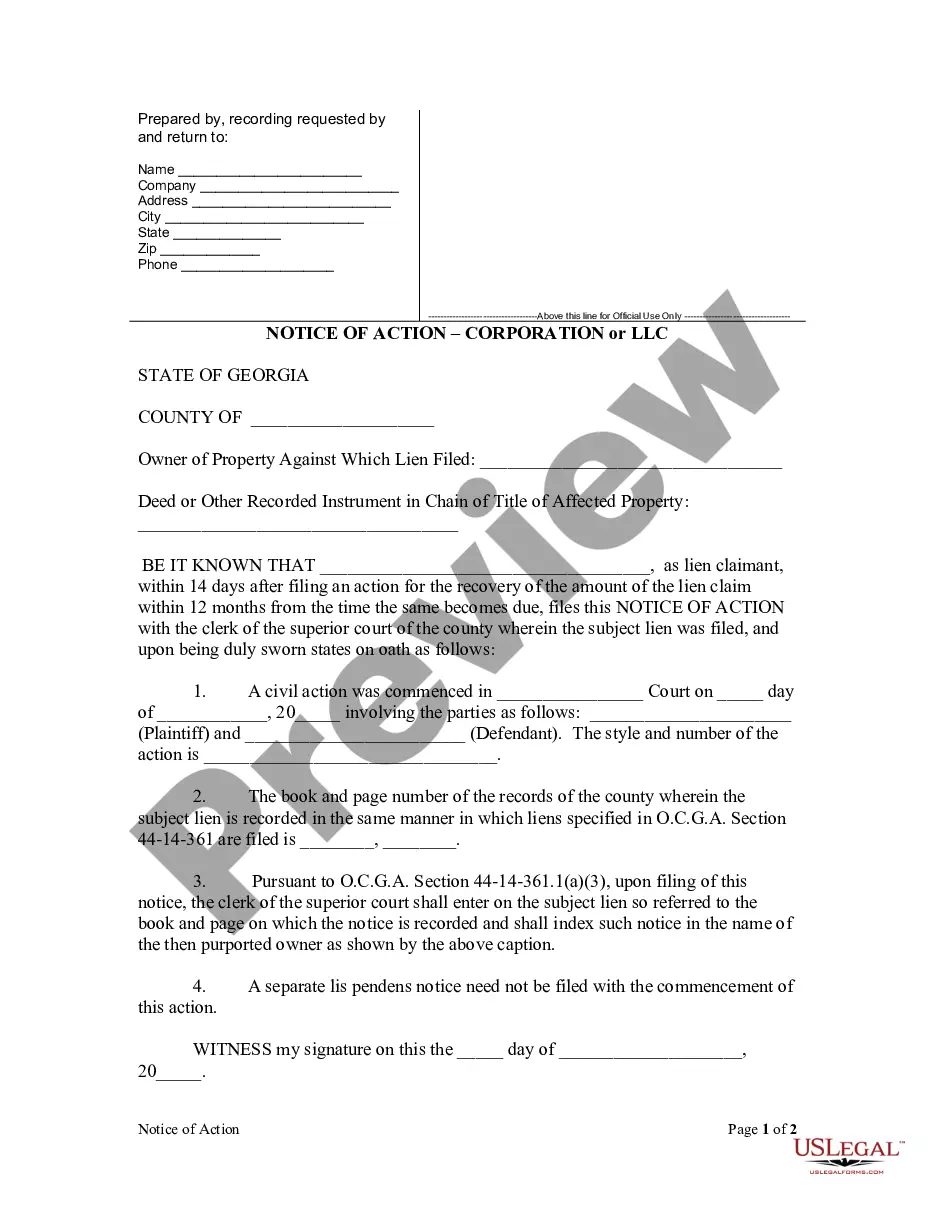

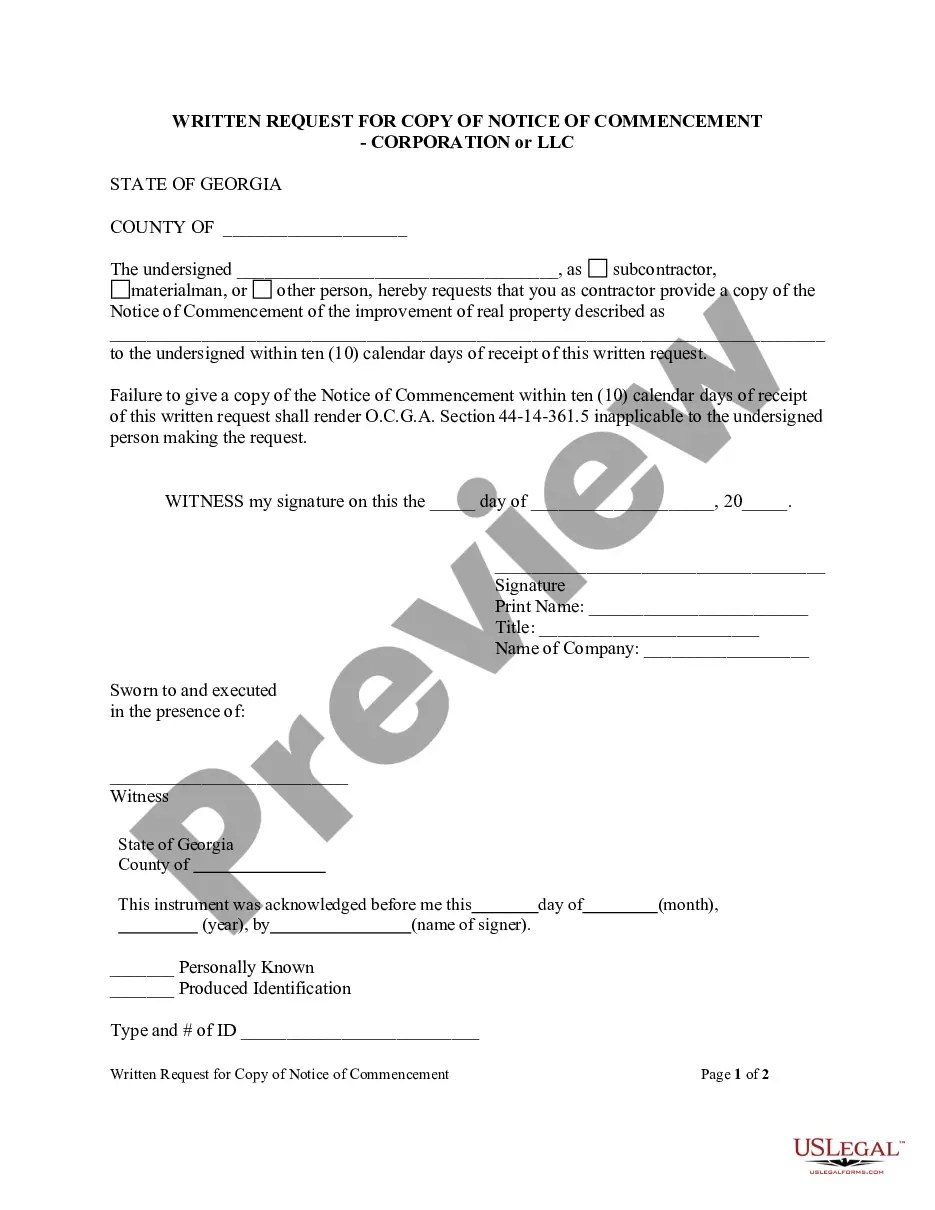

An Illinois Order/Lien With Employer is a type of lien created by the Illinois Department of Revenue when a taxpayer fails to pay their taxes. This lien is placed on the taxpayer's wages and other assets, and requires the taxpayer's employer to withhold a portion of their wages to satisfy the outstanding tax debt. The employer is then responsible for submitting these withheld amounts to the Department of Revenue. There are three types of Illinois Order/Lien With Employer: Wage Garnishment, Bank Account Levy, and Tax Levy. Wage Garnishment requires employers to withhold a certain percentage of an employee's wages until the debt is paid in full, whereas Bank Account Levy allows the Department of Revenue to seize funds from the taxpayer's bank account. Lastly, Tax Levy grants the Department of Revenue the authority to seize a taxpayer's other assets, such as vehicles, real estate, and other personal property.

Illinois Order/Lien With Employer

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Order/Lien With Employer?

How much duration and resources do you typically allocate for drafting formal documents.

There’s a superior alternative to acquiring such forms than engaging legal professionals or squandering hours searching online for a suitable template.

Another advantage of our service is that you can access previously acquired documents safely stored in your profile under the My documents tab. Retrieve them anytime and re-complete your paperwork as often as necessary.

Conserve time and energy preparing legal documents with US Legal Forms, one of the most reliable online services. Join us today!

- Examine the form content to confirm it aligns with your state legislation. To do this, review the form description or utilize the Preview option.

- If your legal template does not satisfy your needs, locate another one using the search tab at the top of the page.

- If you already possess an account with us, Log In and retrieve the Illinois Order/Lien With Employer. Otherwise, continue to the subsequent steps.

- Click Buy now once you identify the correct document. Choose the subscription plan that best fits your requirements to access our full library service.

- Establish an account and settle your subscription fee. You can complete the transaction using your credit card or via PayPal - our service is entirely secure for this.

- Download your Illinois Order/Lien With Employer on your device and finish it on a printed hard copy or digitally.

Form popularity

FAQ

What can you do to protect your subrogation rights? Section 5(b) of the Illinois Workers' Compensation Act (820 ILCS 305/5(b)) allows an Employer, or its Representative, to recover 75% of the compensation paid to an injured worker, less its pro rata share of costs. These are routinely referred to as ?5(b) rights.?

Under section 8(a) of the Illinois Workers' Compensation Act, the employer is permitted to pay medical expenses at a lower amount negotiated and paid by a third-party insurance carrier, rather than the stipulated fee schedule amounts. ing to Section 8(a):

If the employee refuses to submit himself to examination or unnecessarily obstructs the same, his right to compensation payment shall be temporarily suspended until such examinations shall have taken place, and no compensation shall be payable under this act for such period.

Sec. 5-301. Automotive parts recyclers, scrap processors, repairers and rebuilders must be licensed.

Because employees are barred from holding employers liable for the costs of their injuries, workers' compensation is the exclusive remedy available to them. This is the exclusive remedy principle. An example would be when two construction workers are performing a job for their employer.

Injured workers are able to sue their employer if the employer intentionally caused them harm. For example, if the employer assaults the worker during an argument, the injured worker may be able to sue the employer. Illinois does not allow workers to sue an employer based on gross negligence.

As a general rule, an Illinois employee who is injured during a regular commute to or from work is not covered by workers' compensation for that injury. This is called the going-and-coming rule. The idea is that the employer has no control over what happens during that trip.