Illinois Garnishment Summons To Confirm Conditional Judgment (Non-Wage) is a legal document issued by a court in the state of Illinois that is used to order a debtor to pay a creditor the money owed on a debt. This document is typically issued when the debtor fails to meet the payment terms of a court-ordered judgment. In order to collect the money owed, the creditor must file a garnishment summons with the court. The summons will require the debtor to appear before the court and provide proof that the debt has been paid in full or that the debtor has made arrangements to pay the debt in installments. If the debtor fails to appear or fails to provide proof of payment, the court can order the issuance of a garnishment order against the debtor's assets or wages. There are two types of Illinois Garnishment Summons To Confirm Conditional Judgment (Non-Wage): Wage Garnishment and Non-Wage Garnishment. Wage Garnishment is a legal process where the debtor’s employer is ordered to deduct a certain amount from the debtor’s wages and forward it to the creditor. Non-Wage Garnishment requires a court order for the creditor to levy the debtor’s property or assets, such as bank accounts, vehicles, or personal property.

Illinois Garnishment Summons To Confirm Conditional Judgment (Non-Wage)

Description

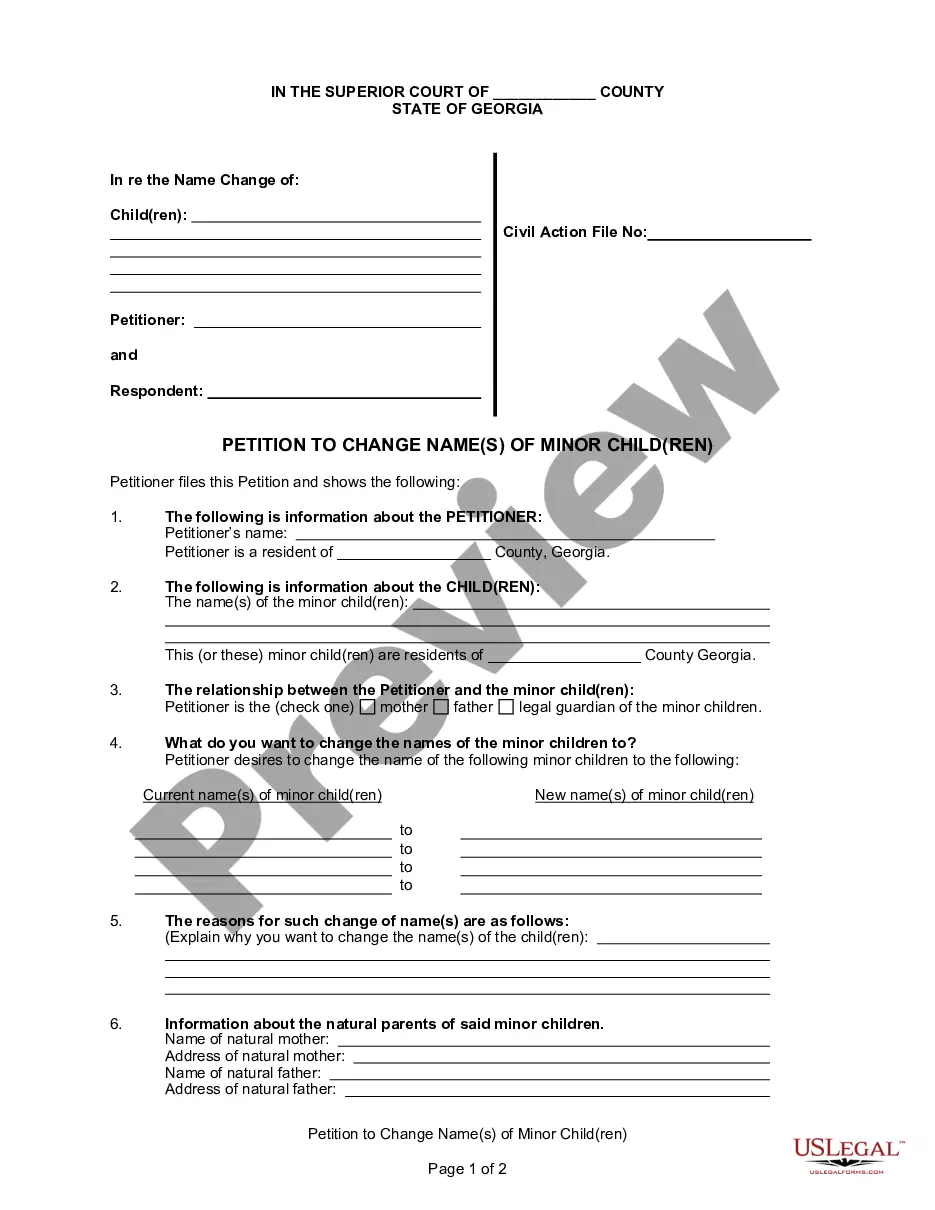

How to fill out Illinois Garnishment Summons To Confirm Conditional Judgment (Non-Wage)?

How much time and resources do you typically allocate to creating official documentation.

There’s a more effective way to obtain such forms than employing legal professionals or spending hours searching online for an appropriate template.

Another benefit of our library is that you can retrieve previously downloaded documents that you securely store in your profile under the My documents tab. Access them anytime and redo your paperwork as often as you need.

Streamline the process of preparing formal documentation with US Legal Forms, a highly trusted online service. Sign up today!

- Browse the form content to ensure it aligns with your state regulations. To do this, review the form description or utilize the Preview option.

- If your legal template does not fulfill your needs, look for another one using the search tab located at the top of the page.

- If you are already a member of our service, Log In and download the Illinois Garnishment Summons To Confirm Conditional Judgment (Non-Wage). Otherwise, follow the next steps.

- Click Buy now when you locate the appropriate blank. Choose the subscription plan that best fits your requirements to access the complete features of our library.

- Create an account and pay for your subscription. You can complete the payment with your credit card or through PayPal - our service is entirely secure for that.

- Download your Illinois Garnishment Summons To Confirm Conditional Judgment (Non-Wage) onto your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

A summons after conditional judgment in Illinois is issued to notify you of actions taken to enforce the judgment. This summons often comes with an Illinois Garnishment Summons To Confirm Conditional Judgment (Non-Wage), indicating that a creditor intends to collect the owed amount from your assets. It is essential to respond promptly and understand your rights to avoid further legal action. Platforms like US Legal Forms provide useful resources for dealing with these situations.

Employment income is usually not exempt under Illinois law, but other kinds of income are exempt from wage deductions. Some examples of exempt income include Social Security and other income from the federal government, workers' compensation benefits, unemployment benefits, and government assistance, to name a few.

Non-wage garnishment is the judgment creditor's attachment, after judgment, of the judgment debtor's property, other than wages, which is in the possession, custody or control of third parties. Example: A creditor files a non-wage garnishment to attach funds your client has deposited in the local bank.

The most the employer can hold out for you is 15% of the debtor's gross income before taxes or deductions. However, the withholding can't leave the debtor with less than 45 times the state minimum wage as weekly take-home pay.

Wage Garnishment in Illinois In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.

The written objection should include: the case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. a detailed explanation of your reasons for challenging the garnishment. a request for a hearing if the court has not already set a hearing date.

Conditional judgment. (a) When any person summoned as garnishee fails to appear and answer as required by Part 7 of Article XII of this Act, the court may enter a conditional judgment against the garnishee for the amount due upon the judgment against the judgment debtor.

Illinois allows wage garnishment and account levies. The Illinois statute of limitations on credit card debt is five years. Consult with an attorney to learn more about your rights and liabilities.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.