The Illinois Homeowner Exemption Waiver (to remove the exemption) is a document used to waive the homeowner exemption on a property tax bill. This waiver is necessary for those who are no longer eligible for the homeowner exemption due to changes in ownership or occupancy of the property. This document must be filed with the county assessor in order to remove the exemption from the property. There are two types of Illinois Homeowner Exemption Waiver (to remove the exemption): the Standard Waiver and the Senior Exemption Waiver (for seniors over age 65). The Standard Waiver is used to waive the exemptions on a residence that has been owned for fewer than two years, or has been occupied by a new owner. The Senior Exemption Waiver is used to waive the exemptions on a residence owned and occupied by a senior over the age of 65. Both waivers must be signed and filed with the county assessor within 30 days of the change in ownership or occupancy in order to be valid.

Illinois Homeowner Exemption Waiver (to remove the exemption)

Description

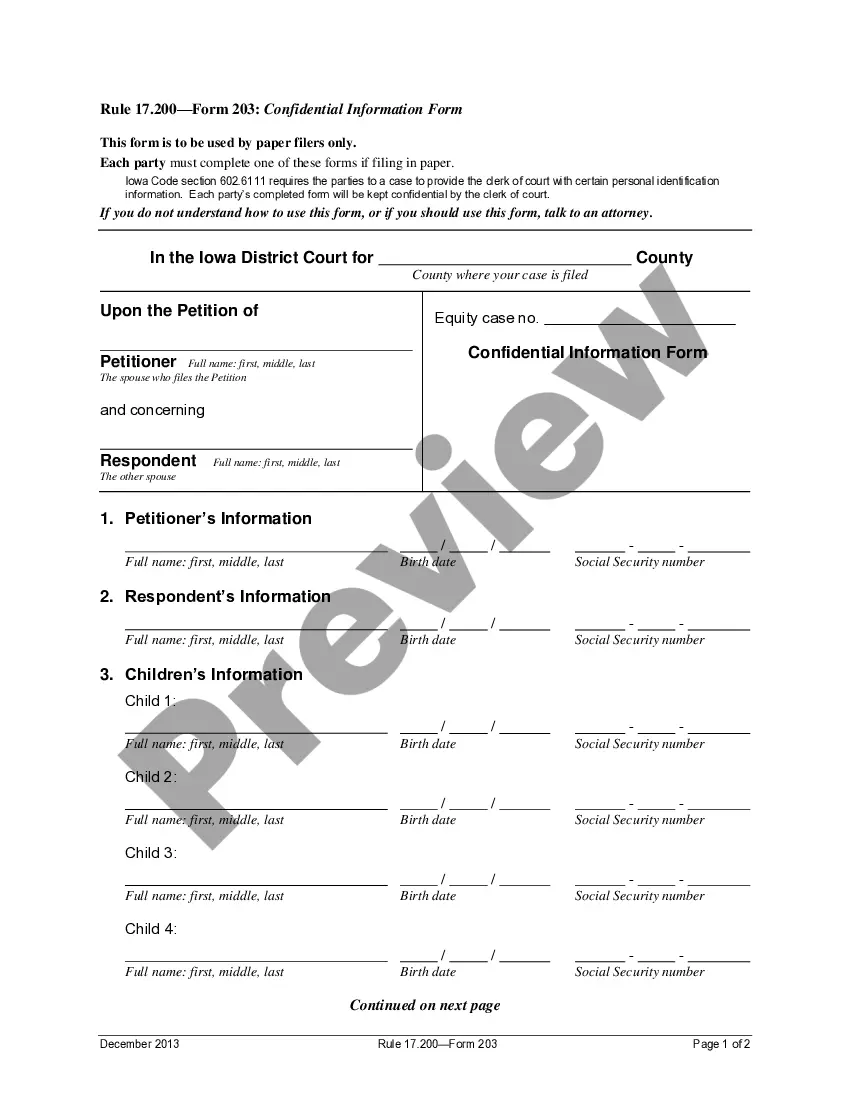

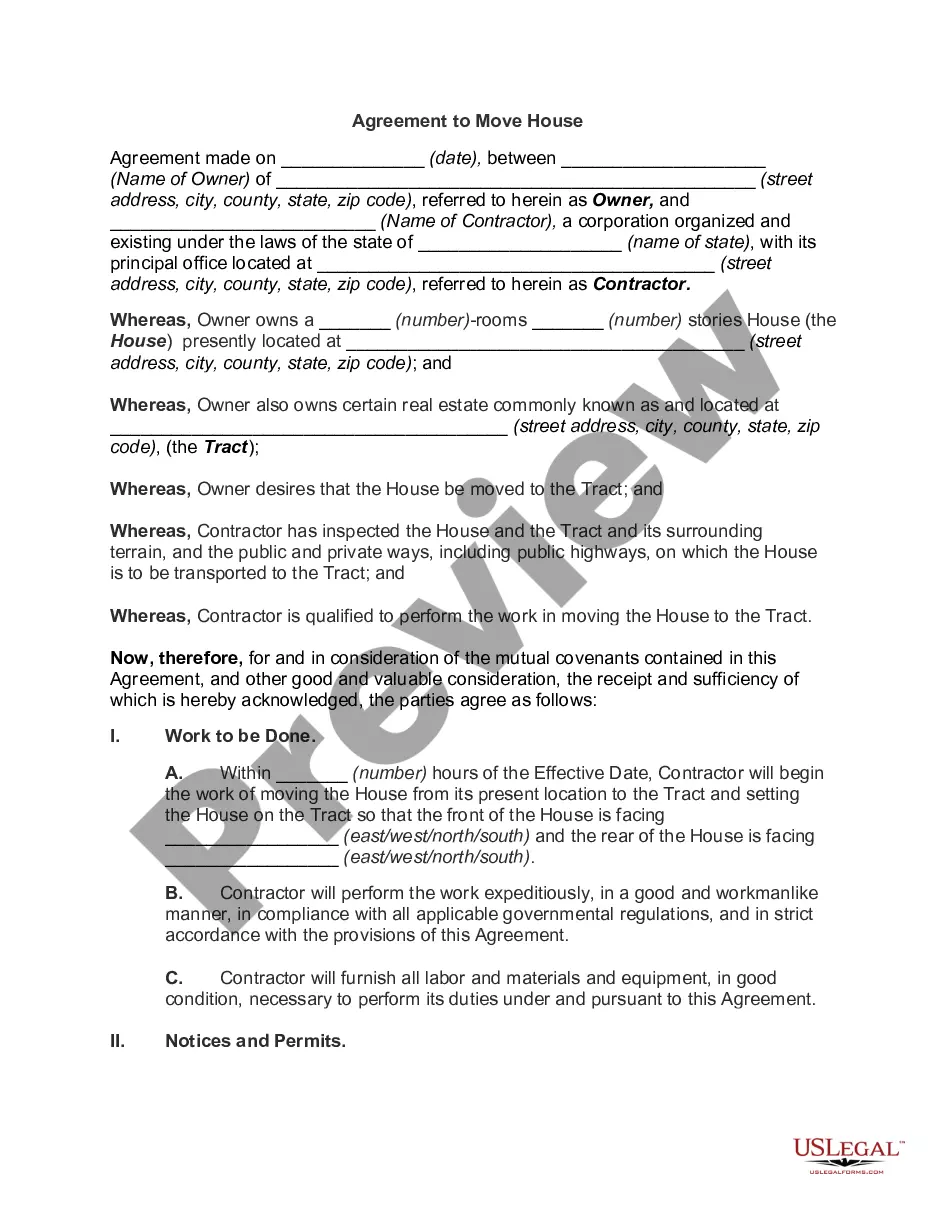

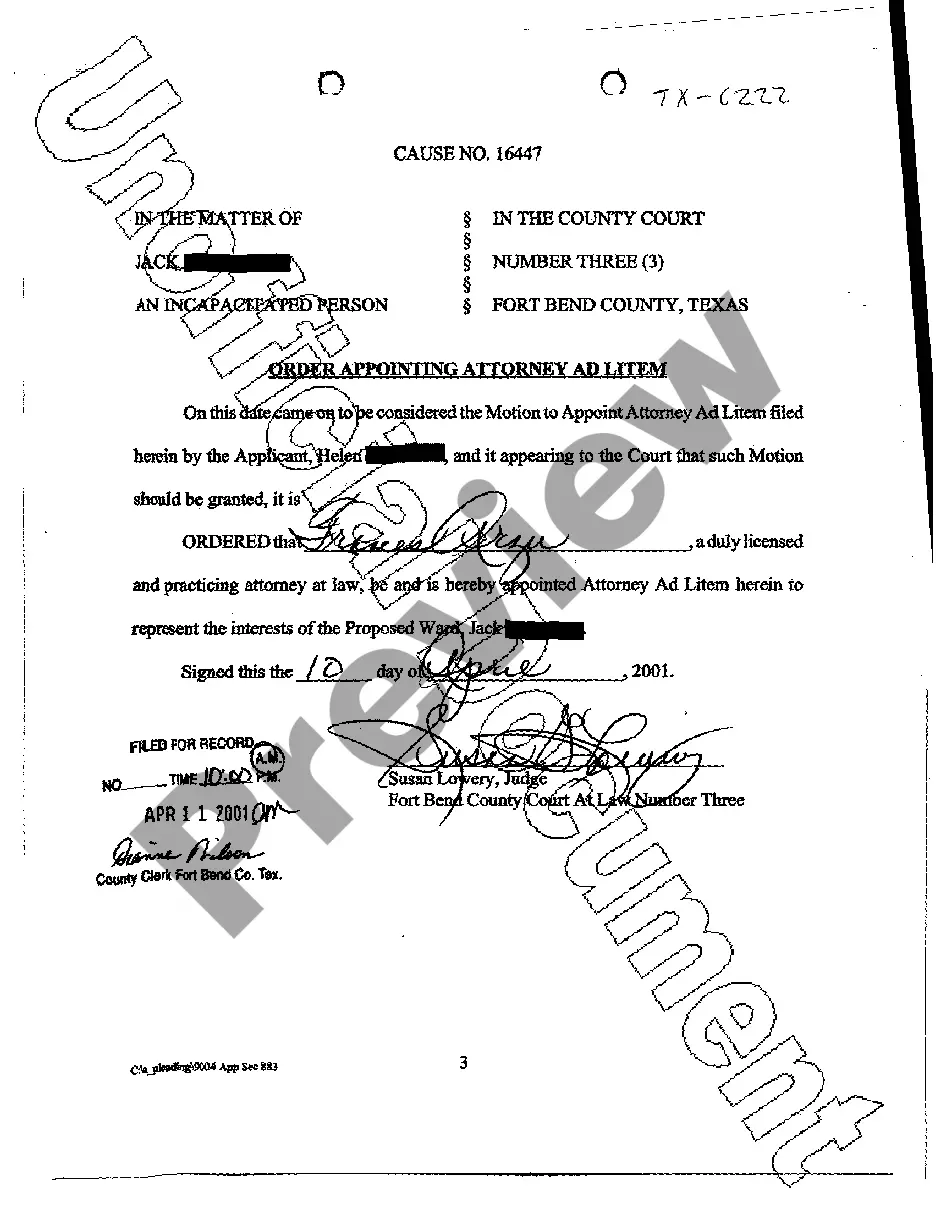

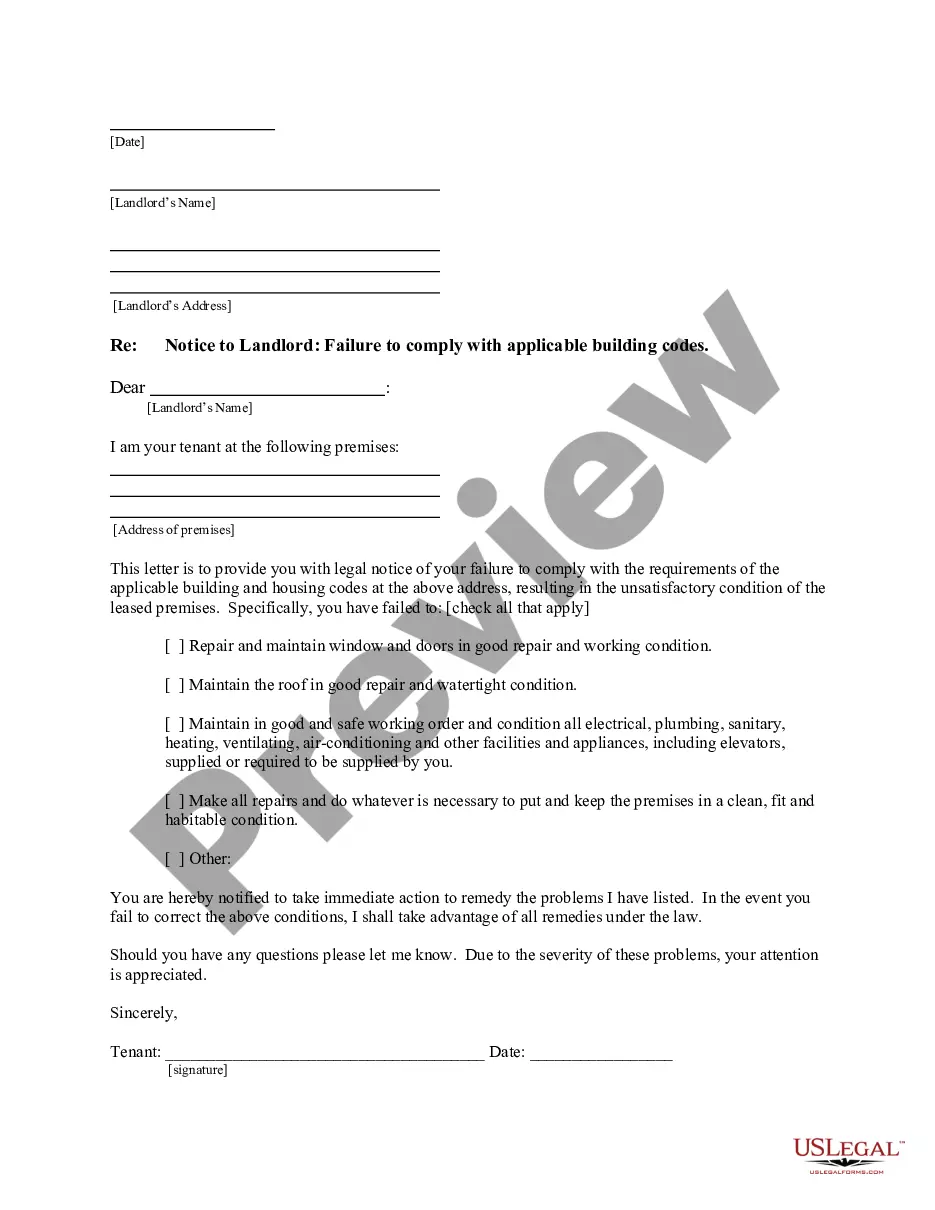

How to fill out Illinois Homeowner Exemption Waiver (to Remove The Exemption)?

How much time and resources do you normally spend on drafting formal paperwork? There’s a better opportunity to get such forms than hiring legal experts or wasting hours searching the web for a proper blank. US Legal Forms is the leading online library that provides professionally drafted and verified state-specific legal documents for any purpose, including the Illinois Homeowner Exemption Waiver (to remove the exemption).

To get and prepare an appropriate Illinois Homeowner Exemption Waiver (to remove the exemption) blank, adhere to these easy steps:

- Examine the form content to make sure it complies with your state laws. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your requirements, find a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Illinois Homeowner Exemption Waiver (to remove the exemption). Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally reliable for that.

- Download your Illinois Homeowner Exemption Waiver (to remove the exemption) on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trusted web services. Join us now!

Form popularity

FAQ

The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills.

A total household income of $75,000 or less is limited to a 7% annual percentage increase in EAV or a total household income of over $75,000 to $100,000 is limited to a 10% annual percentage increase in EAV. The minimum limit is the same amount calculated for the GHE with no maximum limit amount for the exemption.

The Home Improvement Exemption allows a homeowner to add improvements to their home that add to its value (for example, by increasing the building's square footage, or repairing after structural flood damage) without being taxed on up to $75,000 of the added value for up to four years. No application is required.

Taxpayers whose primary residence is a single-family home, townhouse, condominium, co-op or apartment building (up to six units) are eligible. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question.

You can get your property taxes lowered by proving that your house is worth less than the assessor says it is. To do this, you have to appeal to your local board of review. You can find contact information for your local board of review on the Illinois Property Tax Appeal Board website.

Taxpayers are only entitled to one homestead exemption on their primary residence for any given tax year. If you received a notice of discovery for your primary residence, please contact the Assessor's Office if you have not already done so.

Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1957 or prior) and own and occupy their property as their principal place of residence. Once this exemption is applied, the Assessor's Office automatically renews it for you each year.

Properties of religious, charitable, and educational organizations, as well as units of federal, state and local governments, are eligible for exemption from property taxes to the extent provided by law.