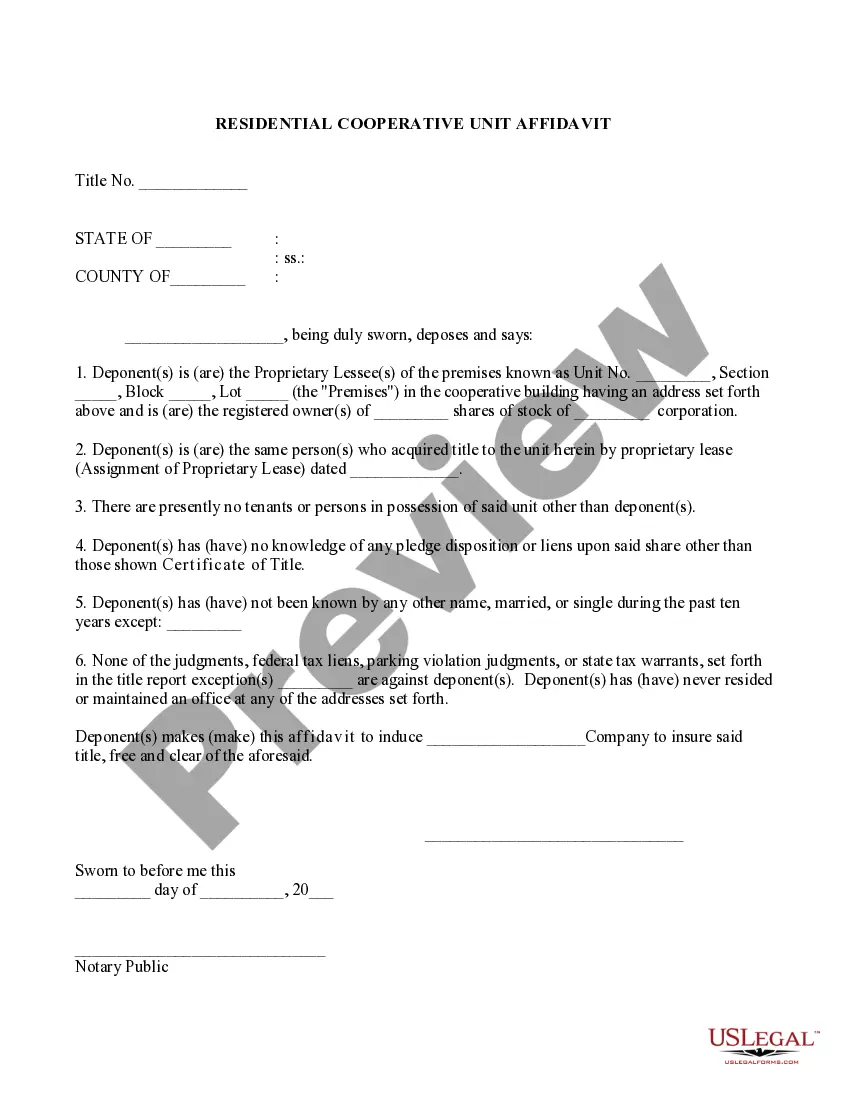

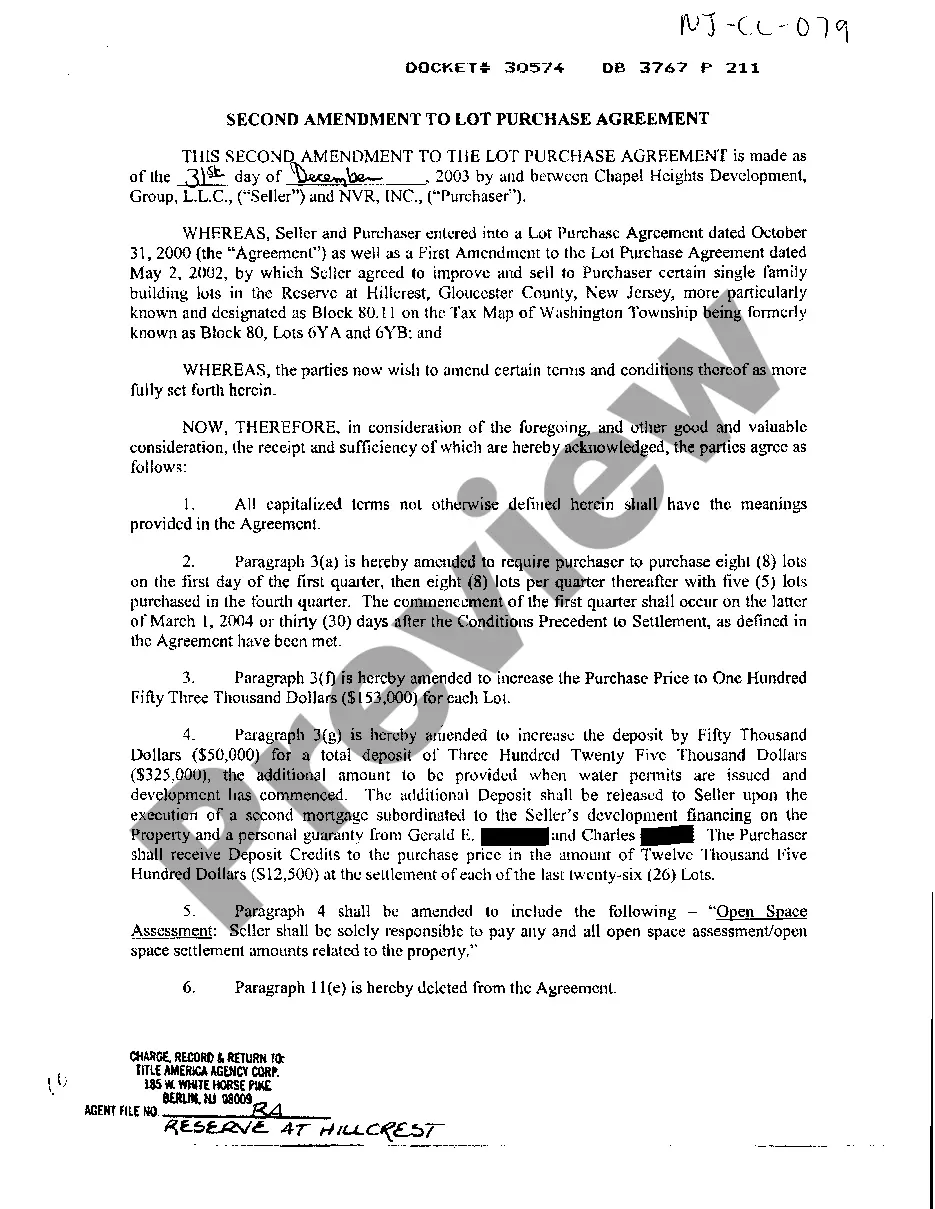

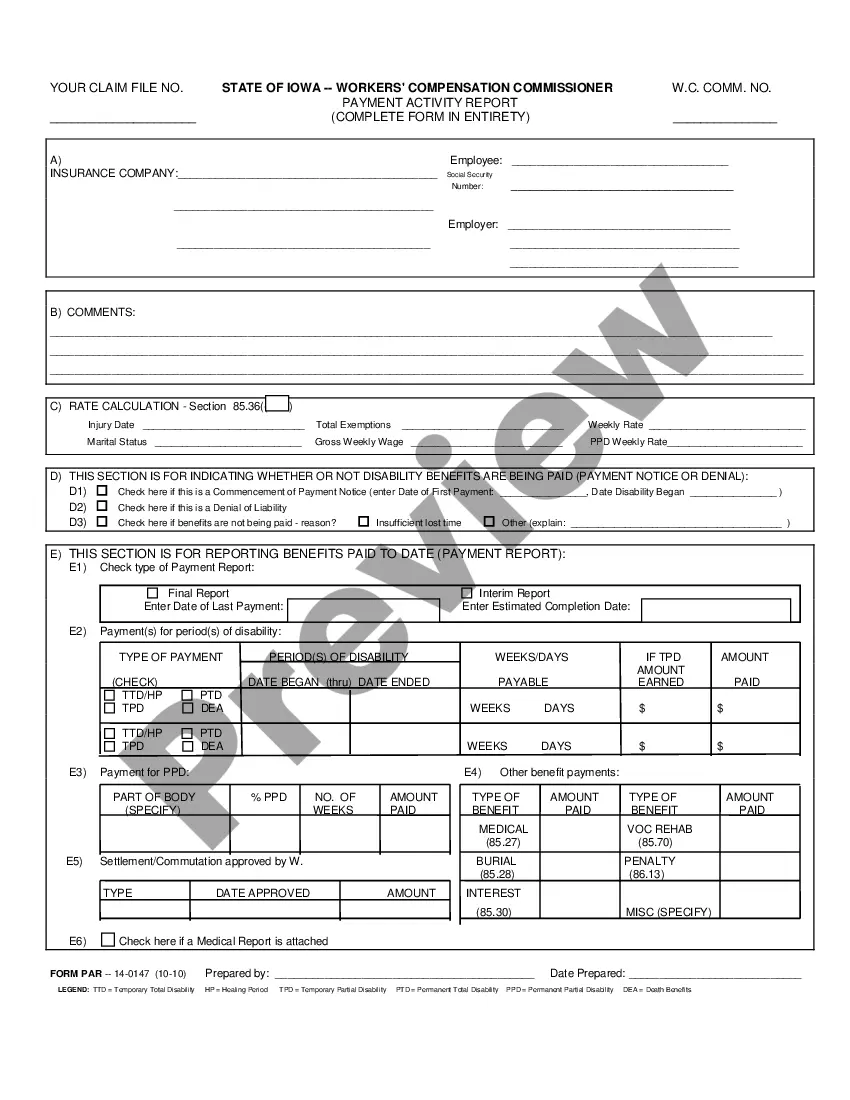

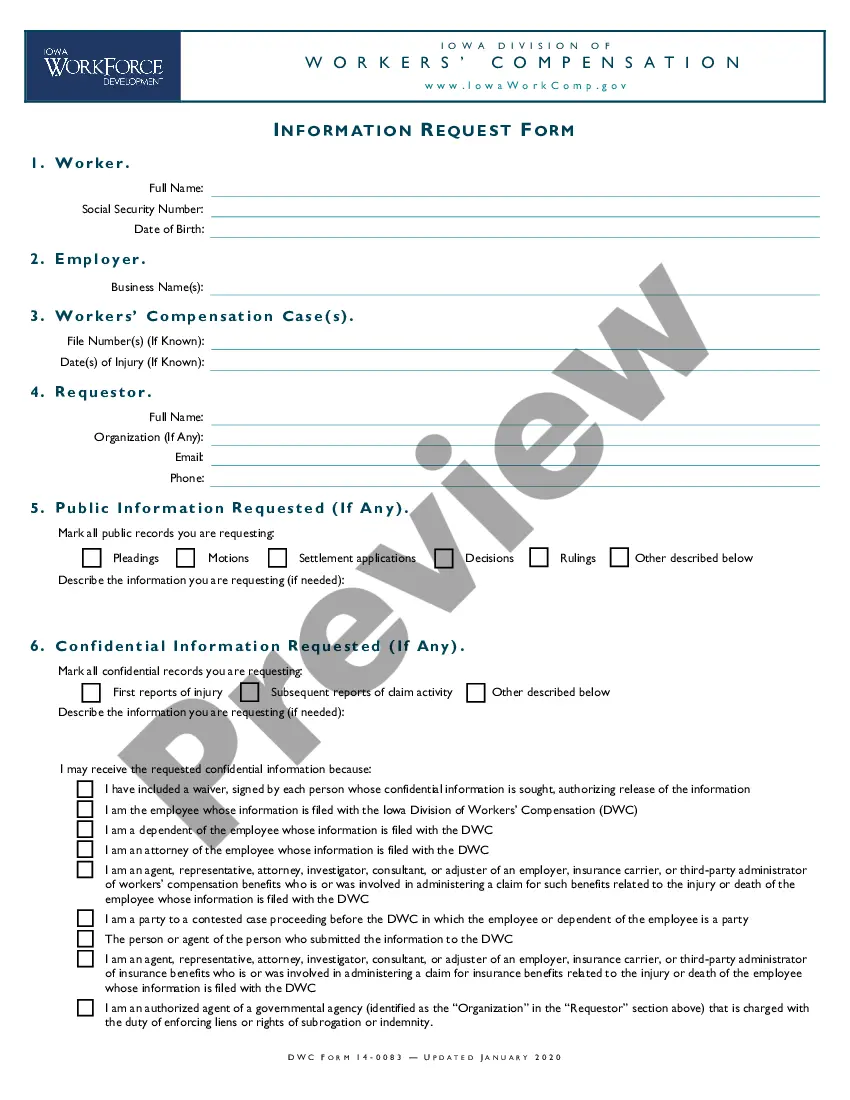

Illinois Condo/COOP appeal is a process used by Illinois condominium and cooperative owners to challenge the decisions of their respective boards of directors. This legal process allows owners to dispute decisions related to assessments, maintenance fees, special assessments, rules, regulations, and other matters related to the management of the property. There are three types of Illinois Condo/COOP Appeal: Administrative Review Appeal, Judicial Review Appeal, and Declaratory Judgement Appeal. Administrative Review Appeal is a process that allows owners to appeal decisions made by their respective condo/coop board of directors to the Illinois Department of Financial and Professional Regulation (ID FPR). This type of appeal must be filed within 28 days of the board's decision. Judicial Review Appeal is a process that allows owners to appeal decisions made by their respective condo/coop board of directors to the Circuit Court of the county where the property is located. This type of appeal must be filed within 35 days of the board's decision. Declaratory Judgement Appeal is a process that allows owners to essentially sue their respective condo/coop board of directors. This type of appeal allows owners to seek a court order that declares a certain action or inaction of the board to be unlawful or valid. This type of appeal must be filed within 2 years of the board's decision.

Illinois Condo/COOP appeal

Description

How to fill out Illinois Condo/COOP Appeal?

US Legal Forms is the simplest and most economical method to discover appropriate formal templates.

It boasts the largest online library of business and personal legal documents created and validated by lawyers.

Here, you can locate printable and fillable forms that adhere to federal and state regulations - just like your Illinois Condo/COOP appeal.

Review the form description or preview the document to ensure you’ve found the one that fulfills your needs, or find another one using the search tab above.

Select Buy now when you’re confident of its suitability with all the specifications, and pick your preferred subscription plan.

- Acquiring your template requires only a few straightforward steps.

- Users with an existing account and an active subscription only need to Log In to the site and download the file onto their device.

- Later, they can access it from their profile in the My documents section.

- And here’s how to acquire a properly created Illinois Condo/COOP appeal if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

Section 27 of the Illinois Condominium Property Act outlines the rights and responsibilities of condo owners and associations in Illinois. This section addresses dispute resolution procedures, including the process for appealing decisions made by the board. Understanding this section can significantly help in your Illinois Condo/COOP appeal by giving you insights into your rights as an owner.

The Cook County Board of Review fairly and impartially reviews the assessments of all property within Cook County to the extent authorized by the Property Tax Code, corrects all assessments which should be corrected, raises, lowers, and/or directs the Cook County Assessor to change, correct, alter, or modify

Please complete these and deliver or mail an original Board of Review Complaint Form or you may file an appeal online, Appeal forms can be picked up at any B.O.R. office or you may download a blank copy or by calling 312-603-5542 to have a form mailed to you.

Typically, you have 30 days to file an appeal after receiving your reassessment notice. The last date to file an appeal for that year is printed on your notice. If you miss your appeal period in your reassessment year, you may appeal the following year when your township is open for appeals.

When can I file an appeal? Property owners can file an appeal when the Board of Review opens their township for appeal each year. Property owners can also pre-register through the online appeals portal . The Board of Review opens townships for appeals after the Assessor has assessed each property in the township.

In Cook County, taxpayers can file an appeal with the County Assessor or the County Board of Review. Call these offices and ask for the date for filing an appeal in your township: The County Assessor's Taxpayer Assistance Department (312) 443-7550. The Board of Review (312) 443-5542.

Typically, you have 30 days to file an appeal after receiving your reassessment notice. The last date to file an appeal for that year is printed on your notice. If you miss your appeal period in your reassessment year, you may appeal the following year when your township is open for appeals.

Illinois law provides the Certificate of Error procedure to allow the Cook County Assessor to apply changes to a property tax bill that has already been issued. It is a way to make a correction after the assessment for that tax year is finalized.