Illinois is a great place to do business due to its competitive business environment, abundant resources, and central location. Its industrial and commercial appeal is driven by its diverse and skilled workforce, favorable tax incentives, and strong transportation infrastructure. In terms of industrial appeal, Illinois is home to a number of large industrial centers, such as Chicago, Rockford, and Peoria, which provide access to a variety of manufacturing and industrial businesses. The state also offers competitive tax incentives, including a generous research and development tax credit, as well as a property tax freeze for businesses investing in new equipment. Illinois is also a major hub for transportation, with access to multiple interstate highways, railroads, and international airports. In terms of commercial appeal, Illinois offers a wide array of retail and service businesses throughout the state. Chicago is a major metropolitan center for retail, financial services, and leisure activities, while smaller cities such as Bloomington, Champaign, and Rockford offer plenty of options for businesses looking to expand or start up. Additionally, the state has a number of tech-friendly tech hubs, including the Chicago metropolitan area and the University of Illinois-Urbana Champaign campus. Overall, Illinois has a variety of industrial and commercial appeal that makes it an attractive place to do business. With its skilled workforce, favorable tax incentives, and robust transportation infrastructure, the state is a great option for businesses of all sizes.

Illinois Industrial/Commercial appeal

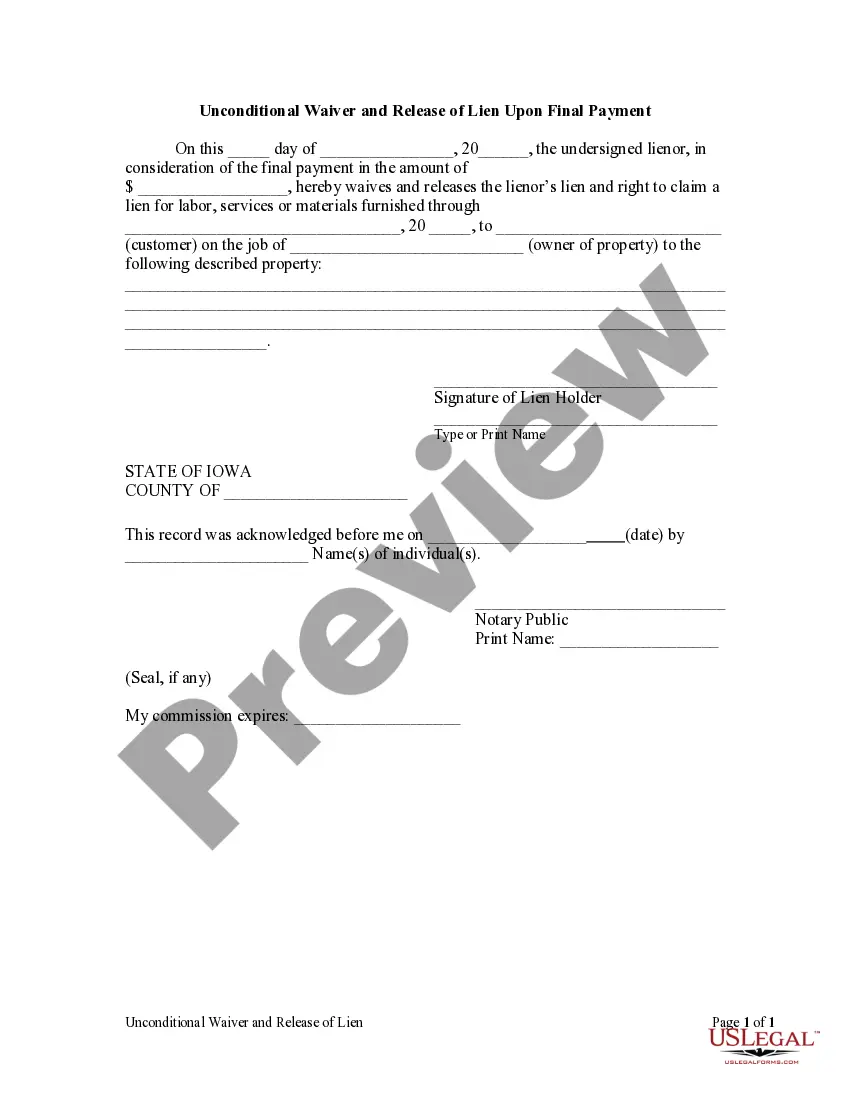

Description

How to fill out Illinois Industrial/Commercial Appeal?

Managing official paperwork necessitates focus, precision, and utilizing well-prepared templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Illinois Industrial/Commercial appeal template from our collection, you can trust it aligns with federal and state laws.

Utilizing our service is simple and swift. To acquire the necessary documents, all you require is an account with an active subscription. Here’s a brief guide for you to obtain your Illinois Industrial/Commercial appeal within minutes.

All documents are designed for multiple uses, like the Illinois Industrial/Commercial appeal you view on this page. If you require them in the future, you can fill them out without additional payment - simply access the My documents tab in your profile and complete your document whenever you need it. Experience US Legal Forms and complete your business and personal paperwork promptly and in full legal adherence!

- Ensure to carefully review the form content and its alignment with general and legal standards by previewing it or examining its description.

- Search for a different official template if the one you accessed does not fit your circumstances or state laws (the tab for that is located at the upper page corner).

- Sign in to your account and download the Illinois Industrial/Commercial appeal in the format you require. If it's your initial interaction with our website, click Purchase now to proceed.

- Establish an account, select your subscription option, and pay with your credit card or PayPal account.

- Decide in which format you wish to save your document and click Download. Print the template or incorporate it into a professional PDF editor for electronic preparation.

Form popularity

FAQ

Please complete these and deliver or mail an original Board of Review Complaint Form or you may file an appeal online, Appeal forms can be picked up at any B.O.R. office or you may download a blank copy or by calling 312-603-5542 to have a form mailed to you.

In Cook County, taxpayers can file an appeal with the County Assessor or the County Board of Review. Call these offices and ask for the date for filing an appeal in your township: The County Assessor's Taxpayer Assistance Department (312) 443-7550. The Board of Review (312) 443-5542.

You may file with any appeal agency as often as you feel necessary to achieve a fair tax adjustment on any given year, not just in the first triennial reassessment year. Appeal reviewers may take as long as 3 to 5 months to finalize a decision on your tax complaint, but your tax savings can last as long as 3 years.

Typically, you have 30 days to file an appeal after receiving your reassessment notice. The last date to file an appeal for that year is printed on your notice. If you miss your appeal period in your reassessment year, you may appeal the following year when your township is open for appeals.

In Cook County, taxpayers can file an appeal with the County Assessor or the County Board of Review. Call these offices and ask for the date for filing an appeal in your township: The County Assessor's Taxpayer Assistance Department (312) 443-7550. The Board of Review (312) 443-5542.

When can I file an appeal? Property owners can file an appeal when the Board of Review opens their township for appeal each year.

When can I file an appeal? Property owners can file an appeal when the Board of Review opens their township for appeal each year. Property owners can also pre-register through the online appeals portal . The Board of Review opens townships for appeals after the Assessor has assessed each property in the township.

In order to appeal an assessment an individual must file an application in the Assessor's Office to appear before the Board of Assessment Appeals. Applications must be received on or before February 20th of each year. Meetings normally are held during the month of March.