The Illinois 2015 Cook County Agricultural Questionnaire is a survey administered by the Cook County Department of Agriculture and Animal Control designed to collect data on the agricultural activities in Cook County, Illinois. The survey is used to measure the impact of agricultural production and its economic contributions to the region. The questionnaire covers topics such as acreage and production of crops, livestock, and poultry; farm equipment and facilities; and the economic and environmental impacts of agriculture in the area. It also includes questions on farm management and marketing practices, labor and employment, and farm technology and conservation practices. There are two versions of the questionnaire: one for general farms and one for specialty farms. The general farm version is tailored for livestock, poultry, and crop production, while the specialty farm version is tailored to specialty crop production.

Illinois 2015 Cook County agricultural Questionnare

Description

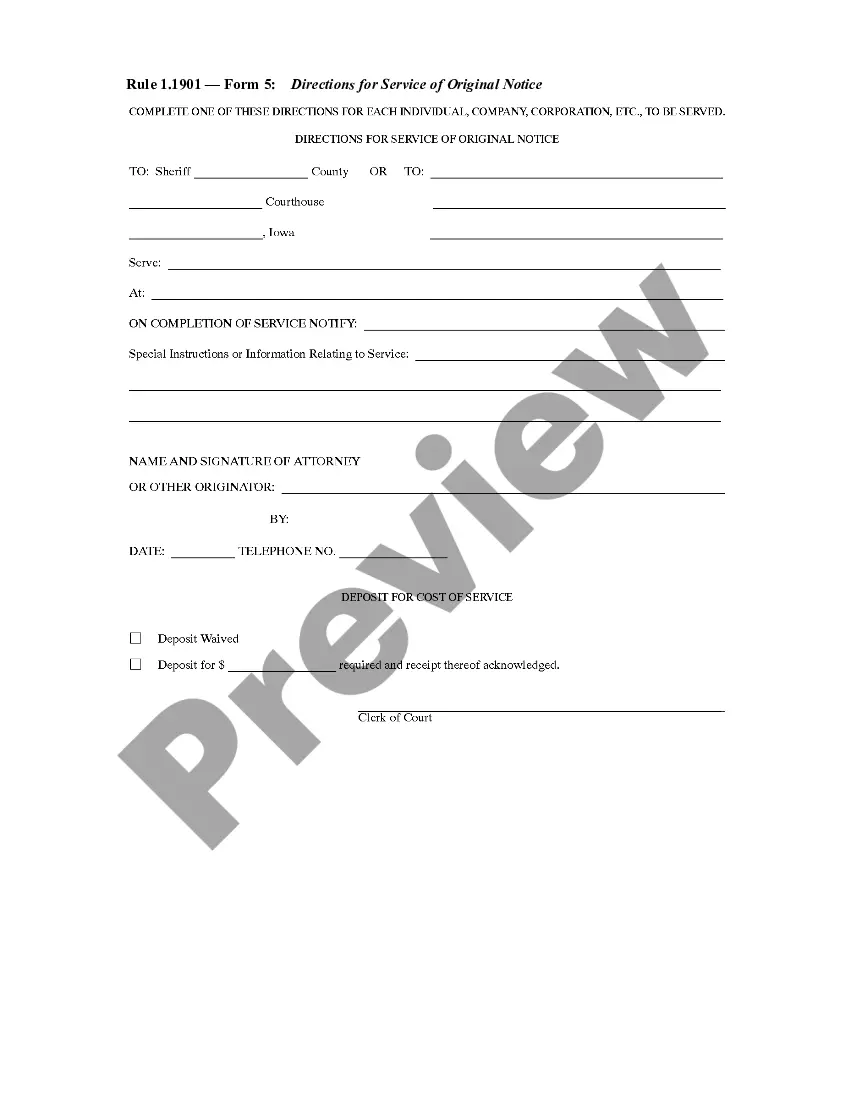

How to fill out Illinois 2015 Cook County Agricultural Questionnare?

How much time and resources do you normally spend on composing official documentation? There’s a greater way to get such forms than hiring legal specialists or wasting hours searching the web for an appropriate template. US Legal Forms is the premier online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Illinois 2015 Cook County agricultural Questionnare.

To acquire and complete a suitable Illinois 2015 Cook County agricultural Questionnare template, adhere to these simple instructions:

- Look through the form content to ensure it complies with your state laws. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, find a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Illinois 2015 Cook County agricultural Questionnare. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally safe for that.

- Download your Illinois 2015 Cook County agricultural Questionnare on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

For residential property owners, the assessed value equals 10% of the fair market value of the home. For most commercial property owners, the assessed value is 25% of the fair market value.

The Senior Exemption property tax savings each year is $8,000 in Equalized Assessed Value (EAV).

Eligible senior citizens automatically receive a reduction of at least $2,000 in the EAV of their homes. Over time, this program may result in taxes changing minimally or sometimes decreasing as surrounding properties continue to rise in assessed value.

Class 6b. Designed to encourage industrial development throughout Cook County by offering a real estate tax incentive for the development of new industrial facilities, the rehabilitation of existing industrial structures, and the industrial reutilization of abandoned buildings.

Do I have to apply every year? No. Once you apply, the Homeowner Exemption will renew automatically in subsequent years as long as your residency remains the same.

Frequently Asked Questions $100,0002022 Estimated Fair Market Value-$8,0002022 Senior Exemption$21,1602022 Adjusted Equalized Assessed ValueX.082022 Tax Rate (example; your tax rate could vary)$1,692.80Estimated Tax Bill in dollar amount4 more rows

Senior Citizens Real Estate Tax Deferral Program allows persons 65 years of age and older, who have a total household income of less than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments on their principal residences.

The amount of the exemption is the difference between your base year EAV and your current year EAV. In Cook County, the amount of the exemption is the difference between your base year EAV and your current year EAV or $2,000 whichever is greater.